Challenges and Opportunities in the World of Consumer Connected Products for the Asset-Based Lender

This article examines the state of the consumer connected products, or internet of things, market; and explores challenges and opportunities for secured lenders in the space.

INTRODUCTION

Unless you have been living under a rock for the past several years, you have probably noticed that an ever-increasing range of consumer products offer (or require) a Wi-Fi connection and an app to use to their full potential, or, in many cases, to use at all. Products as diverse as automobiles, health monitors, fitness equipment, home security systems, thermostats, home appliances, baby monitors, watches, coffee mugs, and light bulbs now offer integrated internet connectivity. These products generally come paired with a smartphone app or other digital platform specifically designed to monitor and control the product.

According to Amazon Web Services:

The term IoT, or Internet of Things, refers to the collective network of connected devices and the technology that facilitates communication between devices and the cloud, as well as between the devices themselves.

A typical IoT system works through the real-time collection and exchange of data. An IoT system has three components:

Smart Devices

This is a device, like a television, security camera, or exercise equipment that has been given computing capabilities. It collects data from its environment, user inputs, or usage patterns and communicates data over the internet to and from its IoT application.

IoT Application

An IoT application is a collection of services and software that integrates data received from various IoT devices. It uses machine learning or artificial intelligence (AI) technology to analyze this data and make informed decisions. These decisions are communicated back to the IoT device and the IoT device then responds intelligently to inputs.

A Graphical User Interface

The IoT device or fleet of devices can be managed through a graphical user interface. Common examples include a mobile application or website that can be used to register and control smart devices.

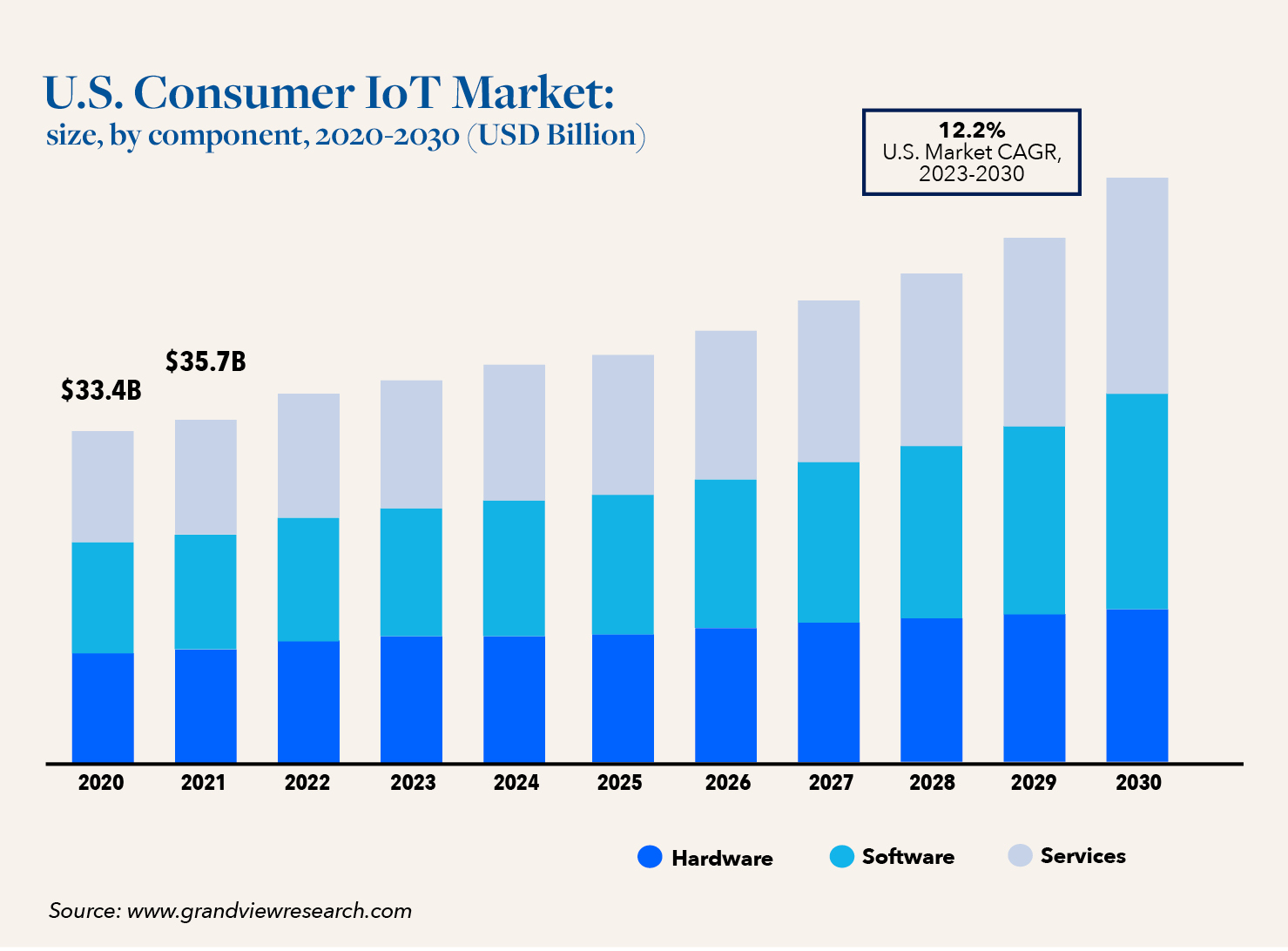

According to Grand View Research, Inc., with a 12.2% forecasted U.S. CAGR from 2023 through 2030 for the consumer IoT market, and an estimated global revenue of $555.92 billion by 2030, the explosive growth in connected products is only expected to continue.

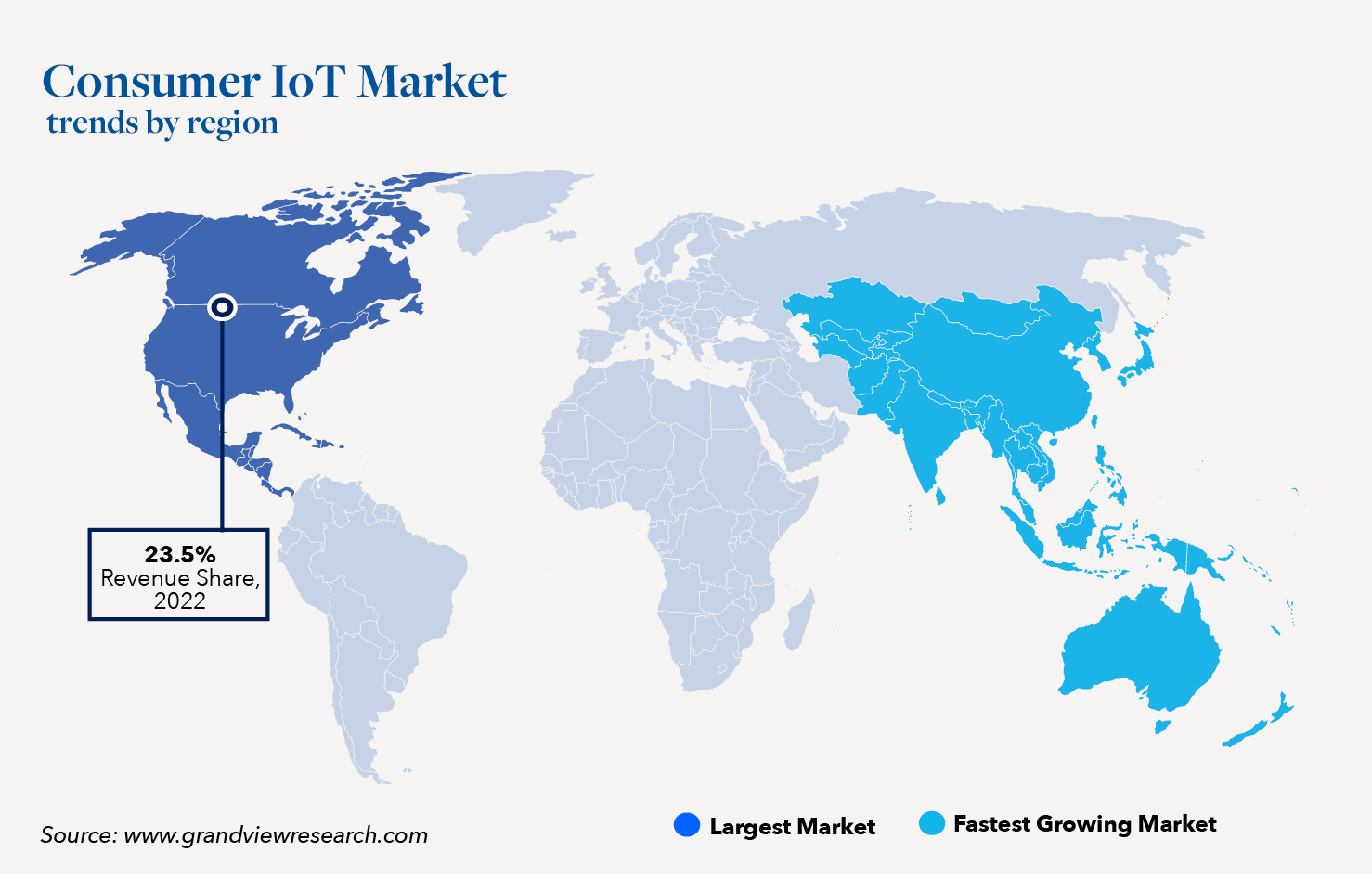

North America accounted for the largest share of the consumer IoT market in 2022, representing 23.5% of overall revenue, and is expected to grow significantly during the forecast period. This is due to increased product demand, especially for fitness tracking devices, in the region.

Many different products and business models fall under the connected, or IoT, umbrella. Some products, such as certain connected fitness equipment, require a paid monthly subscription to access their proprietary digital platform, and lose much of their functionality without an active internet connection and paid subscription. Other products, such as home appliances, smart coffee mugs, and other simpler devices, offer free apps with a handful of interesting features but are usable as standalone products (with no internet connection) without a significant loss of functionality.

For some companies, their subscription digital platforms generate significantly more revenue and profitability than actual sales of their products, and as a result, these companies operate on a vastly different business model and operating expense structure than traditional consumer products companies. Hilco has even seen some companies choose to sell connected products at a loss or “break-even” level to create a subscription stream of cash flows. Manufacturers can also use the “connected” feature of their devices as an opportunity to build relationships with and collect data from their customers while not needing to provide any additional services or content.

ENTER THE ASSET-BASED LENDER

With the growth and diversification of connected products in recent years, Hilco has seen an increase in inquiries for both valuations and liquidation proposals related to connected products businesses as asset-based lenders seek to provide financing to, or exit, these frequently fast-growing companies. Although, at first glance, these connected consumer products may seem similar to their non-connected counterparts, it is important to develop a deep understanding of the specific company and products as well as related platforms and IP (intellectual property) to understand the implications for secured lenders.

In terms of inventory valuation and potential inventory liquidation recoveries, it is critical for secured lenders to think about the inventory and the IP as related elements in a cohesive asset disposition strategy. The value of connected products in a liquidation will likely hinge on whether the digital platform will continue to be supported uninterrupted during and after a liquidation. Any discontinuity in the availability of an app or digital platform that is critical to using a connected product would be expected to have a severe impact on the marketability of that product, regardless of whether the company sells directly to consumers or via wholesale distribution to retailers.

A thorough analysis is required to anticipate the outcome for the company’s IP, particularly the digital platform, in a liquidation, which in turn impacts the inventory disposition strategy. The more dependent the functionality of the product is on the digital platform, the more critical the continuity of the platform is to support inventory values in a sale, and the more inventory recoveries would be impaired by a lack of digital platform availability.

The potential upside of this situation is that, for connected products companies with recurring paid subscription app revenue, existing content libraries, patents, or other IP, the company’s IP can also be a significant source of value that can potentially be included in the collateral base for asset-based lending. An IP valuation can provide insights into the likely disposition strategy and potential buyers for IP in a liquidation. From an inventory valuation perspective, if there is significant value in the continuity of the digital platform, it may make more sense to value the inventory on an FMV (Fair Market Value) basis rather than (or in addition to) an NOLV (Net Orderly Liquidation Value) basis, as a buyer of the IP would likely see value in purchasing the inventory as well, and the inventory may have very limited liquidation value without continuity of the digital platform.

RECOMMENDED DUE DILIGENCE DISCUSSION TOPICS AND LENDING RECOMMENDATIONS

- Product Functionality with and without Connectivity: It is key to understand how the products function with the related digital platform, and what their functionality is without the digital platform and/or an internet connection. Connected products run the gamut from retaining almost 100% functionality without the related app to a total loss of functionality without the related app. It is also worth noting that, within a company’s product portfolio, different products may fall in different places across this spectrum.

- Inventory Obsolescence: Connected products companies tend to introduce new generations of products often as technology advances. When a new-generation product is introduced, the marketability of the previous-generation product is challenged, as consumers prefer the newest generation of a particular product. Lenders should review the company’s current inventory for prior-generation units and discuss the company’s approach to managing and disposing of prior-generation products when new products are introduced.

- Nature of Digital Platform: Some key questions related to the digital platform include:

- Is a paid subscription required to use the digital platform, or is it free to customers? A paid subscription model represents a recurring revenue stream that may have significant value, while a free app represents an ongoing expense and may not have material value to a potential buyer.

- Is the product compatible with any third-party apps or platforms, or is it strictly compatible with a proprietary platform operated by the company? Connected products that are compatible with third-party apps would be expected to retain more value in the event of discontinuation of proprietary software than products that are only compatible with proprietary software.

- Does the digital platform require ongoing production of fresh content to keep the user base engaged, such as live or recorded workout classes? Or is it simply an interface to control a product like a smart washing machine or thermostat? Continued production of content represents an additional ongoing cost for a potential IP buyer.

- Has a library of media or other content been created to serve the subscriber base? Even on a standalone basis, the library might have value.

- To what extent is it possible to identify operating expenses within the company’s profit and loss statement related to the development, maintenance, and marketing of the digital platform versus expenses related to design, sourcing, marketing and sales, and fulfillment of physical products? These details are especially important in developing an accurate valuation.

- Digital Platform Performance: Companies should provide key metrics, including total users, total daily engagements, analytics around customer retention and turnover rates, how often various cohorts of customers are accessing the platform, and what specific features or app functions generate the most customer interaction. Monitoring the performance of the digital platform on an ongoing basis can provide an indicator of future inventory sales performance and overall brand health.

- Digital Platform Security: A major concern among consumers related to connected products is security, as many early connected products were shown to be vulnerable to hackers, who, in some cases, could gain access to other devices on consumers’ home networks through specific connected products. Lenders should review the product security features of prospective borrowers to ensure they are following best practices in marketing secure products.

- Digital Platform Continuity: Lenders should plan to put in place a process to gain control of the digital platform in the event of a default, in order to ensure uninterrupted provision of service to the customer base. Any interruption, even temporary, could have a negative impact on marketability of inventory and recurring revenue streams related to the IP.

CLOSING THOUGHTS

Due to the unique interplay of IP, inventory functionality, and resultant asset valuations in the connected products space, it is critical for lenders to develop a coherent conception of the disposition strategy related to IP and inventory. Hilco has extensive knowledge and experience in inventory and IP valuations and has performed numerous concurrent inventory and IP valuations in the connected products space that provide our clients with a consistent and fully thought-out disposition strategy and valuation for these related assets.