The Fed May Not be the Only Ones Waiting Until After the Election

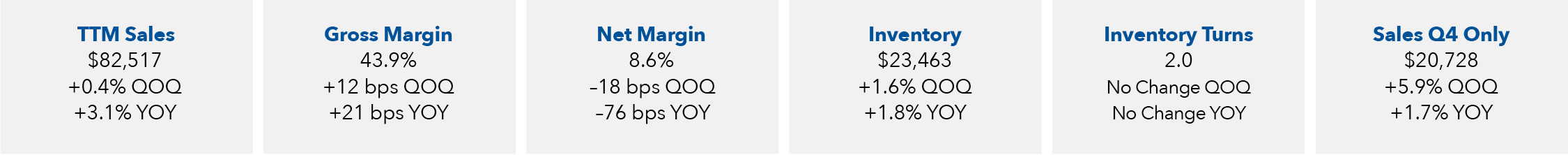

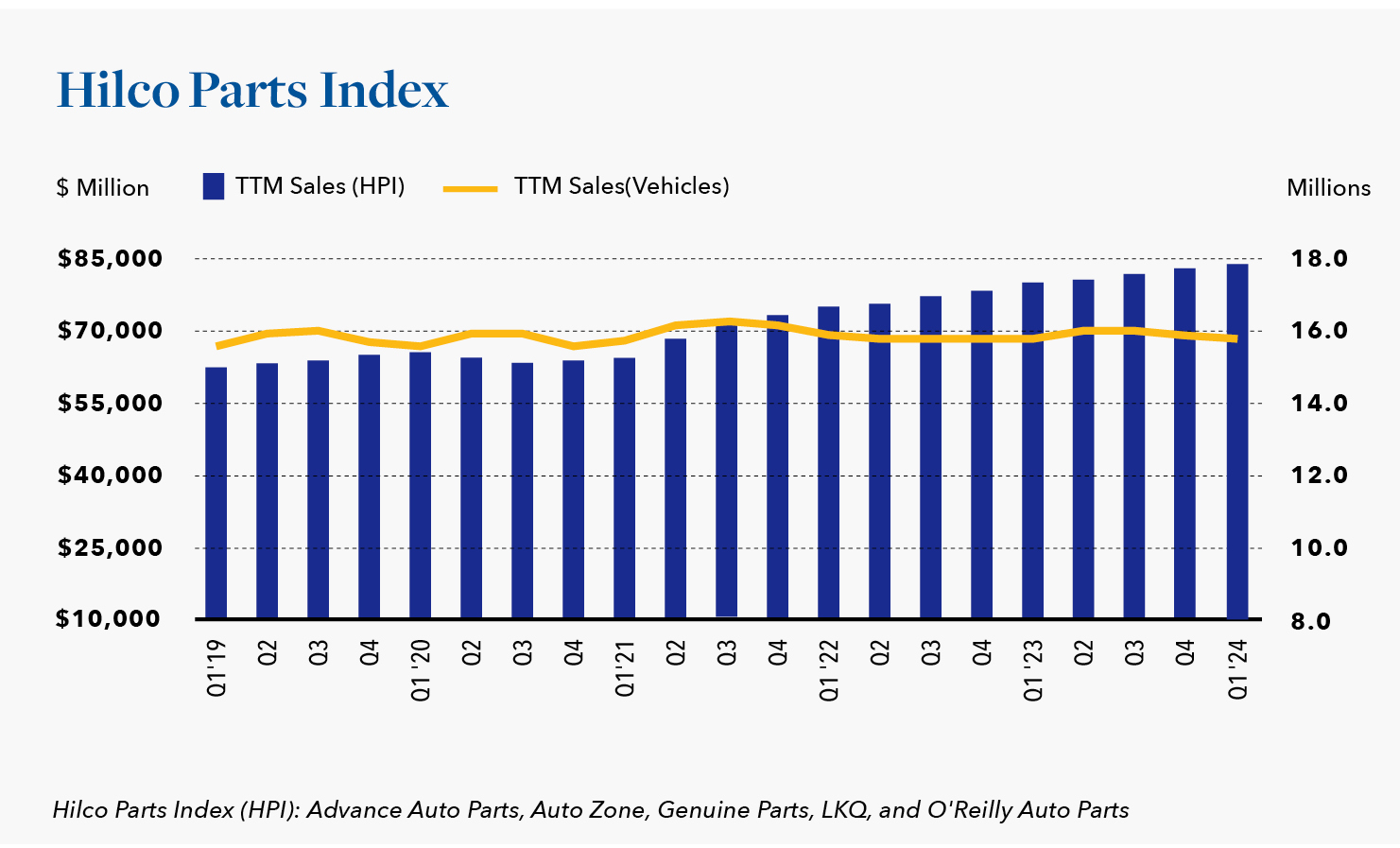

June 13, 2024 – The trailing twelve-month (TTM) sales for the five public companies in the Hilco Parts Index (HPI or the Index) were $82.5 billion through the first quarter of 2024. Compared to the TTM sales ending with the first quarter of 2023, that is an increase of 3.1%, not much different than the reported rate of inflation. According to the latest data available from the Bureau of Labor Statistics, the consumer price index (CPI) rose 3.3% year-over-year, while the Personal Consumption Expenditures Price Index reported by the Bureau of Economic Analysis increased 2.7%. The latter is the preferred rate of the Federal Reserve (Fed), but either way, the rate of inflation remains above the Fed’s 2 percent target for inflation. At the June 12 meeting of the Federal Open Market Committee (FOMC), in response to reluctantly high inflation and a persistently tight labor market, the Federal Reserve signaled it was no longer considering three rate cuts in 2024. There are only two more meetings of the FOMC before the November presidential election, and, at this point, it is highly unlikely the Fed will make any rate changes prior the election.

For now, at least, the Federal Funds rate will remain in the 5.25% – 5.50% range, the highest in 23 years, and a range that is considered restrictive to economic activity. As a result, the average interest rate on a loan for a new vehicle was 6.73% during the first quarter of 2024 and 11.91% on a loan for a used vehicle. High loan rates are at the top of the list of concerns of most car dealers, and one of the reasons the seasonally adjusted annual rate of new car sales has struggled to reach 16 million vehicles this year. However, in the automotive replacement parts market, high interest rates are not necessarily bad. When faced with the increasing cost of vehicle ownership that comes with high interest rates, consumers tend to increase their investment (i.e., maintenance) in their existing vehicles as opposed to buying a new one. To this point, sales for auto parts stores that have been open for at least 12 months (i.e., same-store sales) only increased about one percentage point. If not for the above-average performance from O’Reilly Auto Parts, same-store sales would have been closer to zero. At that level, sales of auto parts are not keeping up with inflation, a sign of a certain amount of “wait and see” behavior.

During prior earnings calls, HPI executives have steadfastly denied any evidence that consumers have been deferring maintenance or trading down to lower price points. However, there was a distinct change in the tone of these calls for the first quarter. Sales of merchandise items (e.g., car care) are generally down as our sales of more traditional maintenance items like brake repairs. It appears fewer cars are being brought in for tire checks, which means fewer cars are being subject to a “free” 50-point safety inspection. The decrease in the North American replacement tire market is born out of the reported financial results for most major tire manufacturers. There were a variety of explanations given, but there is no mistake that sales of replacement parts, tires included, were flat in the first quarter. It sounds a bit cliché, but the Feds may not be the only ones waiting until after the November presidential election to make a decision.