Auction Theory and Its Application to the Monetization of Business Assets

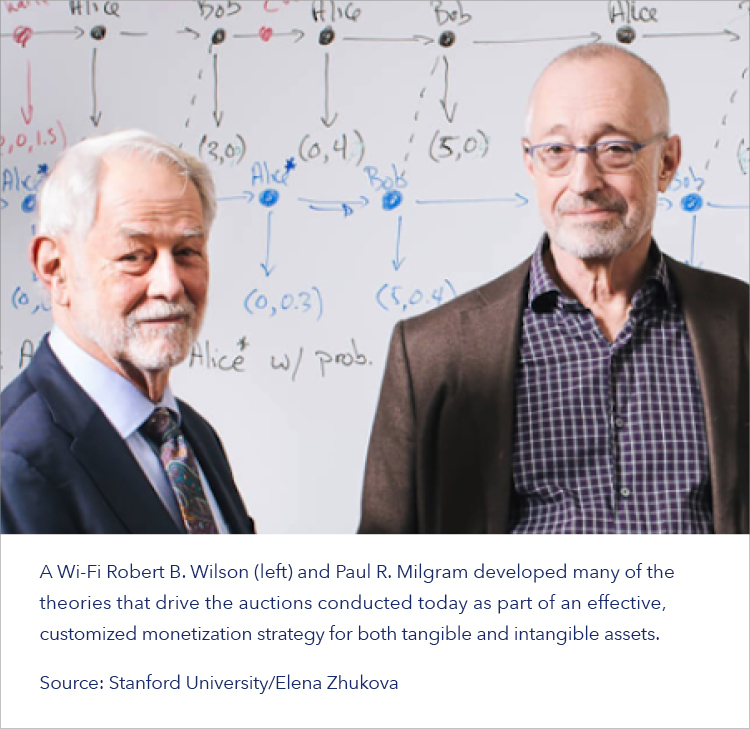

This past fall, Stanford University economists Robert B. Wilson and Paul R. Milgrom were awarded the 2020 Nobel Prize for Economics based upon their contributions for improvements to auction theory and inventions of new auction formats. According to the prize committee, “Their discoveries have benefitted sellers, buyers and taxpayers around the world.” Impressively, each began their efforts in fundamental theory, and were able to advance their work to a level of real world application.

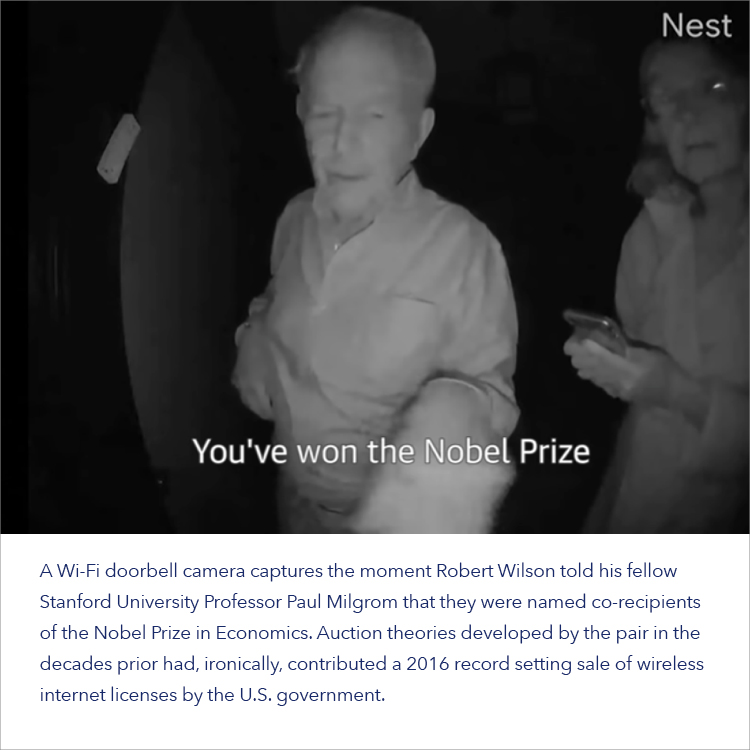

I was sitting in my home when the story about the pair’s selection for the prestigious award came on the news. Given my profession, the fact that I just happened be tuned to the station at the precise time it aired was quite a coincidence. The report featured footage of Mr. Wilson ringing Mr. Milgrom’s Wi-Fi video doorbell in the middle of the night to inform him that they had each been awarded the Nobel. I found this ironic, particularly when you consider that a learned scholar of this stature should realize recognition of a life’s work in such an unexpected and pedestrian manner, let alone from one’s own “partner in crime” under cover of darkness. After all, when the pair began to explore the intricacies of auction theory decades ago, the closest thing to a video doorbell was found only on the pages of a comic book and the technologies that enabled the transmission of the doorbell’s Wi-Fi signal to Mr. Milgrom’s phone that night, were likely not yet on the drawing board.

If not for the fact that I manage business development in Mexico for one of the world’s most recognized and accomplished asset monetization firms, which began its existence over 30 years ago with an emphasis on business auctions at around the same time Wilson and Milgrom’s theories first achieved some of their most noteworthy impacts in real world application, I might have just gone about my day and not given the story another thought. Inspired, however, by my chosen profession to conduct a little research of my own, I soon discovered just how apropos the involvement of that internet-driven doorbell was in this particular instance. After a little reading on the subject, I came across a fact that illustrated the full irony of that Wi-Fi doorbell ringing episode. It turns out that one of the most significant accomplishments associated with the decades-long work of the two Nobel Laureates was actually achieved in 2016, when auction design efforts led by Milgrom on behalf of the U.S. Federal Communications Commission (FCC) resulted in the record-setting sale of nearly $20 billion in… wait for it… WIRELESS INTERNET (Wi-Fi) LICENSES!

Ralph Cassady Jr.’s book, Auctions and Auctioneering suggests that the use of early forms of auctions dates back to at least the 5th century B.C. when the Greek historian Herodotus documented the barbaric auctioning of women as potential wives. Auctions were also prevalent across the Roman Empire for use in the liquidation of owned land and goods. In China, Buddhist monks are said to have auctioned the property of their deceased brethren in order to fund the construction of early temples. Auctions in England likely began in the 1500s with the now famous Sotheby’s and Christie’s both established there around the mid 1700s.

Auction theory, itself, is used to inform the design of real world auctions. Considered as an applied branch of economics, it focuses on the behavior of bidders in auction markets and how features of those markets impact predictable outcomes. Auction theory is generally thought to have its roots in an article published in 1961 by the Canadian-American economics professor William Vickrey, but went largely unnoticed until years later when theorists including Wilson and Milgrom became actively involved in their work on the subject.

In the 1970’s, Robert Wilson’s work closely examined the “common value” scenario in which the value of an item being auctioned is generally believed to be the same by the universe of bidders involved, even though those bidders do not, in fact, have full information pertaining to the item’s actual value. He further examined how winning bids in an auction often tend to exceed the true worth of an item. Winning a bid under these conditions is known in auction theory as the “Winner’s Curse,” a term not coined by Wilson but discussed in great depth within his work. Among other topics in his writings, Wilson explained that this very fear of overpayment can result in conservative bidders undervaluing and ultimately being outbid in auctions; a condition which becomes more likely he noted, when bidders have varying private information regarding an items true value.

A decade or so later, in the 1980s, Paul Milgrom’s theories and writings, too, focused on the common and private values that exist as conditions of auction scenarios. In his work, among other things, he looked closely at English and Dutch auctions, explaining that differences between how the two distinct formats are conducted impact the propensity with which overbidding is likely to occur. Specifically, Milgrom, an expert in game theory, found that as more information about an object’s value becomes known in an English auction format – where bidders drop out as prices escalate upward vs. Dutch auctions where prices start high and are bid downward from that point – a bidder’s likelihood of experiencing the “Winners Curse” through overbidding decreased. Furthermore, he concluded that even though this type of overbidding was minimized through the format, higher revenues were in fact derived via auctions of this type as the process itself provided more opportunities for bidders to gain detailed information about an object’s actual value along the way.

When the U.S. government sought a fair, equitable and highly efficient method for allocating radio frequencies in the 1990s, Wilson and Milgrom pooled their collective knowledge to develop a new auction format they dubbed Simultaneous Multi Round Auction (SMRA) in which all items were offered collectively in a group for auction at the same time. Buyers, in turn, were able to bid on any one item or multiple items within a format paralleling the low to high bid format of an English auction and thus minimizing potential for overbidding. This format proved highly successful in monetizing these frequency assets. In fact, an article in the New York Times the following week, authored by noted columnist, journalist, and presidential speechwriter William Safire called it “the greatest auction in history.” After that, SMRA was widely adopted and implemented around the world, achieving great levels of success. In the years that followed, new auction formats were developed based on the foundation of Wilson and Milgrom’s SMRA, with Milgrom, himself, leading development of one such offering to assist the U.S. government in generating maximum return in repurposing radio spectrum from television to wireless broadband. These efforts lead to the development of the innovative Incentive Auction. This new format combined both reverse and forward auction elements to empower the acquisition of spectrum-usage rights on the front end and the sale of that spectrum to interested bidders on the back end, leading to the FCC’s record setting sale of the wireless internet licenses referenced earlier in this article.

At Hilco Global, we are not auction theorists or practicing economists, but we are – among other things – expert auctioneers and true authorities in the strategic monetization of assets spanning virtually every industry, sector and asset class. Headquartered in Mexico City, we provide a full suite of asset valuation services. This includes a significant annual volume of well marketed and highly attended on-site and Internet-based auctions, through which we regularly leverage aspects of the knowledge shared by Wilson, Milgrom and their peers to deliver both unmatched disposition outcomes for our clients and outstanding acquisition opportunities for participating buyers.

This same commitment to excellence is exhibited through our work in private treaty sales and advisory services to private and public sector customers and governmental agencies throughout Mexico. Specific expertise includes master and primary loan and portfolio servicing, valuation and monetization of industrial assets, real estate, agricultural assets, as well as other personal property assets. Like other Hilco Global units providing asset monetization services, Hilco Global Mexico will often purchase assets and inventories to expedite the availability of working capital to help facilitate restructurings, mergers and acquisitions.

Without question, the exhaustive body of work conducted over the years in the development of auction theory and the many innovative auction formats that have been put into practice cannot adequately be recognized in an article of this nature. My intention here has simply been to acknowledge how the contributions of these two scholars (and others both before and after them) have served to shape the way that we at Hilco Global, and our many partners across the industry, conduct business today within the complex world of asset valuation and monetization.

Over the past many months, businesses across almost every industry have been impacted to varying degrees by repercussions stemming from the ongoing global pandemic. Throughout this period, we have continued to work closely with companies to assist them with both the strategic disposition and acquisition of assets and to provide guidance and support to numerous lenders with a diverse range of businesses within their portfolios. Whether you are simply looking for some perspective in the current environment or have a specific time-sensitive need, we encourage you to reach out to our team. We are here to help during this challenging time!