Changing the Tire in 2022

In this article we take a look at the changing tire industry and how the impact of ever-changing tariffs prior to the arrival of the pandemic and a precipitous drop in the number of miles driven during its height in 2020 have now been further exacerbated by reduced production output, increased raw material pricing, shipping delays and higher import costs.

THE PAST

Not that long ago, U.S. car owners could drop in at any one of 900+ Sears Auto Centers to obtain replacement tires on their popular Pontiac and Saturn vehicles. The Pontiac most likely received a Tier One tire (OEM brands such as Goodyear, Michelin and Bridgestone that were on the vehicle when purchased), while the Saturn may have received a Tier Two (secondary brand such as Goodyear’s Kelly) or Tier Three (private label Sear’s branded) tire. One of the words widely used within the tire industry over the years has been “Tier.” Companies and product lines were historically categorized as either Tier One, Tier Two, or Tier Three, etc. to describe where different tire brands might fall across a broad marketplace spectrum. OEM tires including anchor brands such as Bridgestone, Michelin, Continental, and Goodyear, have typically been considered Tier One, the category holding the greatest market share across both the U.S. and Canada. These flagship brands of the world’s four largest tire manufacturers enjoyed backing by the industry’s largest advertising spends, generally commanded the highest prices, and typically have been considered the “best” tires in terms of the “good-betterbest” selling strategy widely utilized across the industry.

THE PRESENT

Fast forward to 2022. All Sears auto centers have closed, GM’s Pontiac and Saturn brands are defunct, and the tiered tire nomenclature is generally no longer used as a result of a much broader range of manufacturers now offered on OEM vehicles as well as imported replacement tires.

Thus “changing the tire” in 2022 is a significantly different prospect in today’s market and impacts a large segment of the industry, including passenger and light trucks. The largest subset of the tire market is replacement tires, or those tires purchased to replace a vehicle’s OEM tires due to wear or puncture. According to IHS Markit, the average age of vehicles on the road in the U.S. topped 12 years for the first time in history, up from 11.9 in 2020 to 12.1 in 2021. Older tires with many miles driven, equate to the need for a greater number of replacement tires overall. This ongoing trend, during which we have seen vehicles stay on the road longer, reflects both the increased durability of automobiles as well as their higher cost of replacement in today’s market.

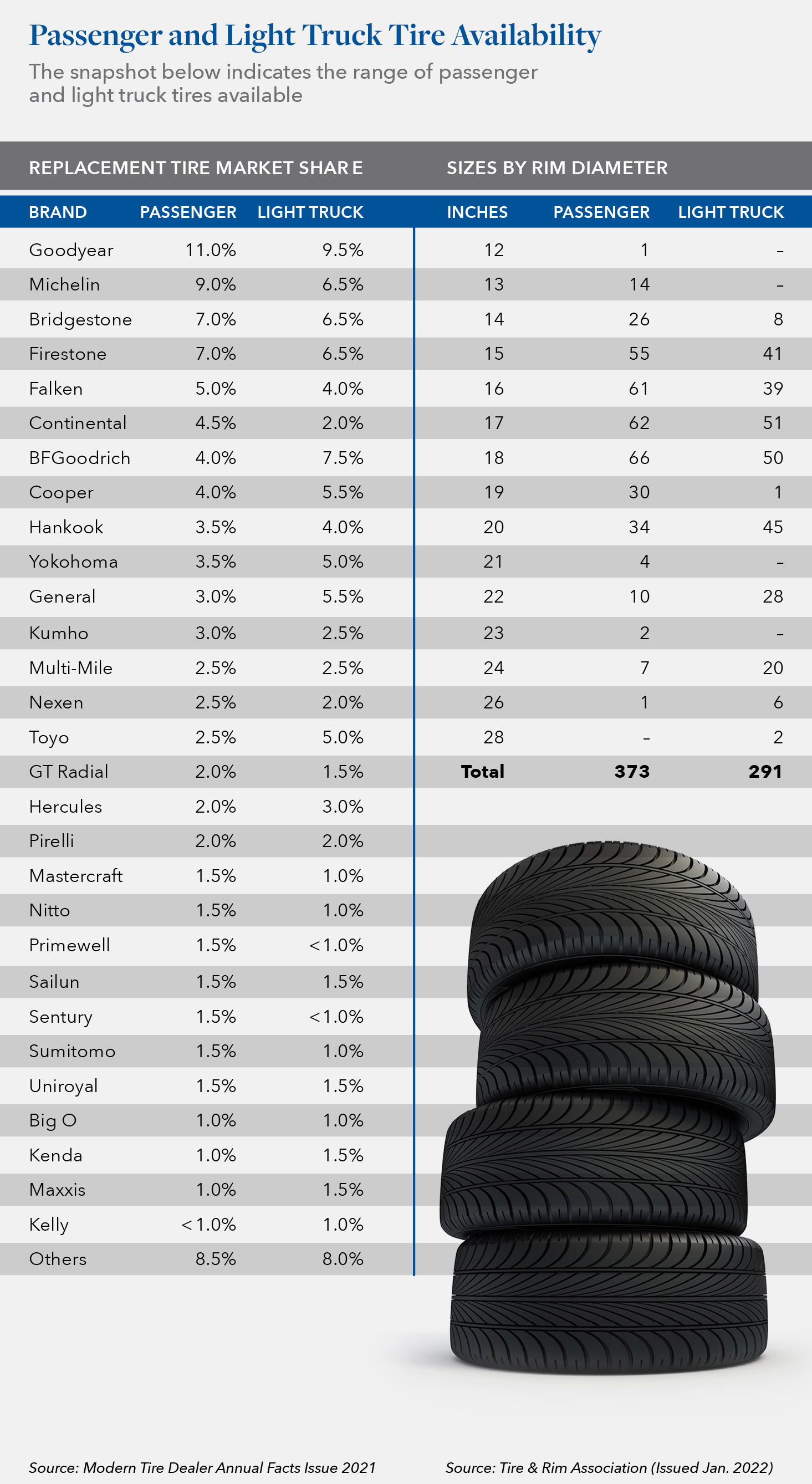

While the number of replacement tires needed to sustain those older vehicles has increased, it follows that, to some degree, the number of new tires has been impacted in the opposite direction. Furthermore, in addition to the more crowded U.S. market referenced earlier, tire manufacturers now find themselves operating in an intensely competitive international marketplace with diverse needs and specifications that make production more complex and costly. This, in turn, trickles down to distributors, who also now must carry an increasing variety of tire sizes and labels to meet the expanding needs of understaffed and overly scheduled installers. These factors, combined with an active merger and acquisition environment which is consolidating industry players at each level, makes the tire industry a highly intricate landscape right now, not just for those along the supply chain, but also for asset-based lenders who must navigate how to best support their tire portfolio companies and limit their own downside risk during this crisis period.

NOTABLE DEVELOPMENTS ACROSS THE INDUSTRY

Manufacturers

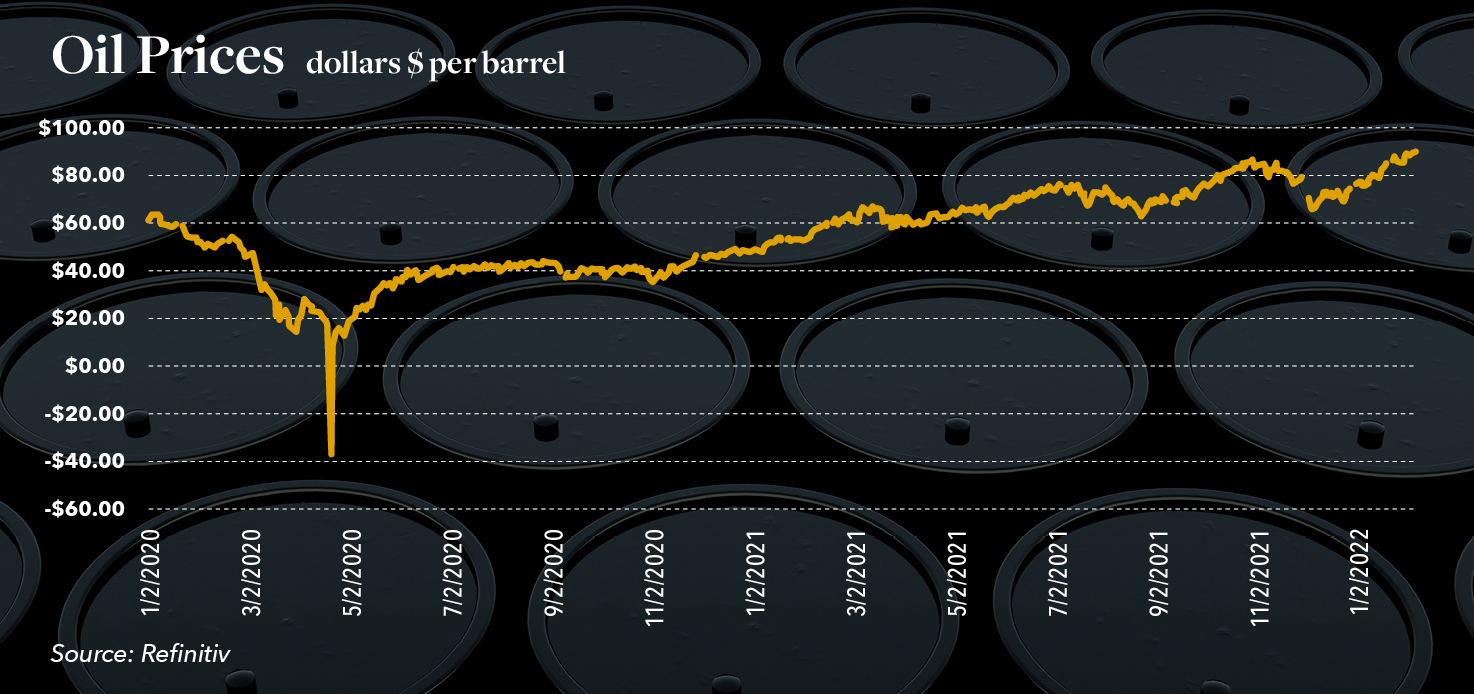

In 2020, production by U.S.-based tire makers fell by double-digits in all key categories, reflecting the weeks and even months of suspended manufacturing at most U.S. tire plants during March, April, and May. For passenger tires, production was at the lowest output since 1955. During 2021, as vehicle OEMs continued to incur supply issues, including the lack of computer chips, manufacturers, and importers announced a dizzying number of price increases, stating reasons including about two-thirds of raw materials costs are influenced by oil prices, with natural rubber, butadiene, carbon black, and synthetic prices rising steadily. Well documented port congestion, shipping delays, increased freighter demand, and other factors contributed to 40’ container freight costs for imported tires and raw materials to increase by over $10,000. We also saw European Brent Spot prices rise 59.9% from $57.77 a barrel in January 2020 to $92.35 in January 2022.

The impacts have been evident. Case in point: In early April of this year, leading manufacturer Michelin North America, Inc., announced its sixth price increase in about a year. The company cited “Market dynamics” as the rationale. As the announcements were made, competitive manufacturers and importers also raised prices to a varying degree and timing from Michelin’s.

The U.S. Tire Manufacturers Association (USTMA) is the national trade association for tire manufacturers that produce tires in the U.S. Thirteen member companies operate 57 tire-related manufacturing facilities in 17 states and generate more than $27 billion in annual sales. On March 1, 2022, USTMA reported that total U.S. shipments for 2021 were 335.2 million units. In March 2021, the USTMA had a modest prediction of 315.7 million units for 2021 after experiencing historically low results of 303.2 million units in 2020, off from 332.7 million units in 2019. Compared to 2021, 2022 replacement passenger and light truck tire shipments are projected to increase +0.9% to 226.8 million units and decrease -0.3% to 38.5 million units, respectively.

In June 2021, The Goodyear Tire & Rubber Company completed the acquisition of Cooper Tire & Rubber Company, two of the leading tire manufacturing companies in the U.S. At the time of acquisition, Cooper was the fifth largest tire manufacturer in North America and 13th in the world operating in 15 countries with $2.5 billion of annual sales of replacement tires produced in 10 facilities with 19 distribution centers. The combined entity reported 2021 sales of $17.5 billion.

Importers (Tires & Raw Materials)

Tariffs and duties have had a significant effect on the U.S. tire market in recent years. The Trump Administration’s additional 25% tariff on various goods from China, including tires, rubber, and rubber chemicals, took effect in May 2019. In November 2020, the U.S. Department of Commerce announced evidence that tiremakers and tire exporters in Vietnam benefited from government subsidies during 2019. As a result, consumer tires imported to the U.S. from Vietnam were assessed with Countervailing Duties (CVD). The rates of the subsidies for the two largest passenger car radial (PCR) producers are Kumho Tire Co. Ltd. at 10.08%, and Sailun Co. Ltd. at 6.23%. During May 2021, the USDC further announced that passenger and light truck tire importers from South Korea, Taiwan, Thailand, and Vietnam would be assessed antidumping duties between 13.25% and 98.44% (varying by company). The International Trade Commission (ITC) confirmed these rates as of June 2021.

Distributors

In recent years, we have seen various steps taken by both manufacturers and wholesalers/distributors across the industry to address the ongoing challenges associated with competition and profitability. Among those most notable have been:

1) The formation of Tirehub, a joint venture of Goodyear and Bridgestone – the number 2 and 3 tire producers respectively behind Michelin. Established just ahead of the pandemic to more effectively control and ensure continued distribution of their tires in the U.S., the move resulted in the pair removing their brands from the largest U.S. distributor, American Tire Distributors, Inc.

2) One of the largest independent tire wholesalers in the country, U.S. Autoforce acquired Treadmaxx Tire Distributors in October 2021, then purchased Max Finkelstein, Inc in January 2022. These moves added 14 Treadmaxx distribution centers across the south/southeast and 13 Max Finkelstein distribution centers on the Eastern seaboard and in the Northeast, to the company’s capabilities during a highly competitive period.

Retailers

Following significant reductions related to the COVID-19 pandemic in 2020, vehicle traffic has returned to more normal levels, with remote working still impacting those numbers to some degree. The U.S. Department of Transportation (USDOT) stated that cumulative travel on all roads through August 2020 versus 2019 decreased by 15.3%, or 332.5 billion vehicle miles. Although the tire industry was deemed “essential,” it was still affected by the pandemic; many installers operated on reduced hours or had periods of complete store closures. Consumer driving behaviors changed as many employers allowed office staff to work from home. USDOT data indicates that cumulative travel on all roads travel for all of 2021 versus 2020 increased 325.2 billion vehicle miles, or 11.2%, to 3228.8 billion vehicle miles, while the month of January 2022 increased by 4.1% over January 2021. Of note on the retail side in terms of consolidation, Percheron Capital entered the industry in April 2021 by acquiring 20 Big Brand Tire & Service (Big Brand) retail locations in California. Under the Big Brand umbrella, acquisitions in the fourth quarter of 2021 created the eighth-largest retailchain in the U.S. with West Coast purchases of American Tire Depot (101 outlets), Integrity Tire (13), Purcell Tire and Service Centers (11), Tire World (6), Community Tire Pros & Auto Care (6), C&R Tire & Automotive (5) and S&S Tire Auto Service Center (3). Additionally, at the end of 2021, Reinalt- Thomas Corporation DBA Discount Tire Company (DTC), a leading retailer with nearly 1,100 stores across 36 states, acquired Tire Rack Inc., the largest direct-to-consumer online retailer in the U.S. Tire Rack has 11 distribution centers totaling 2.7 million square feet of warehousing capacity.

CONCLUSIONS

The continued presence of tariffs, persisting shipping delays, and a series of price increases, are all having a significant effect on the U.S. tire market. In addition to changing duties, the tire industry is affected by higher raw material and tire costs attributed to the pandemic’s influence on container shortages, port activity (both loading and unloading), higher ocean freight costs, and extended transit times. Rising oil prices are affecting the price paid at the pump and the highest inflation rates in decades may dampen the appetite for consumers to drive and possibly delay vehicle maintenance including replacement tires.

Given the current environment, we urge lenders with exposure to the tire industry, and in particular distributor exposure, to closely monitor inventory levels, product mix and aging. With the number of tire sizes and the quantity of brands growing tremendously in recent years, the need to maintain extensive stock has increased and we have seen instances of distributors with disproportionate inventories of less desirable, aged merchandise. The bestselling tires may already have been sold. In addition to ensuring that borrowing bases are adjusted accordingly for such occurrences, lenders should also be mindful of the impact that surging steel and oil prices continue to have on those involved in the production, distribution and sale of tires.

Hilco Valuation Services has significant, validated expertise in the tiremarketplace, including production, importation, distribution, and retail installation. Leveraging our deep industry knowledge, we have delivered valuations on dozens of Companies in the U.S. and Canada over the past five years. As one of the world’s largest and most diversified business asset appraisers and valuation advisors, we serve as a trusted resource to companies, lenders, and professional service advisors, providing value opinions across virtually every asset category. Hilco Valuation Services has the ability to affirm asset values via proprietary market data and direct worldwide asset disposition and acquisition experiences. Access to this real-time information, in contrast with the aged data relied upon by others, ensures clients of more reliable valuations, which is crucial when financial and strategic decisions are being made.