Chassis Market Update Q4 2022: Production Ramp-Up Should Soon Ease Capacity Issues

In this end-of-year chassis market update, we provide a brief primer, discuss current developments, and note critical observations to assist assetbased lenders in better understanding and assisting borrowers within their portfolios who are involved in, or reliant upon, the industry and its resources.

INDUSTRY SYNOPSIS

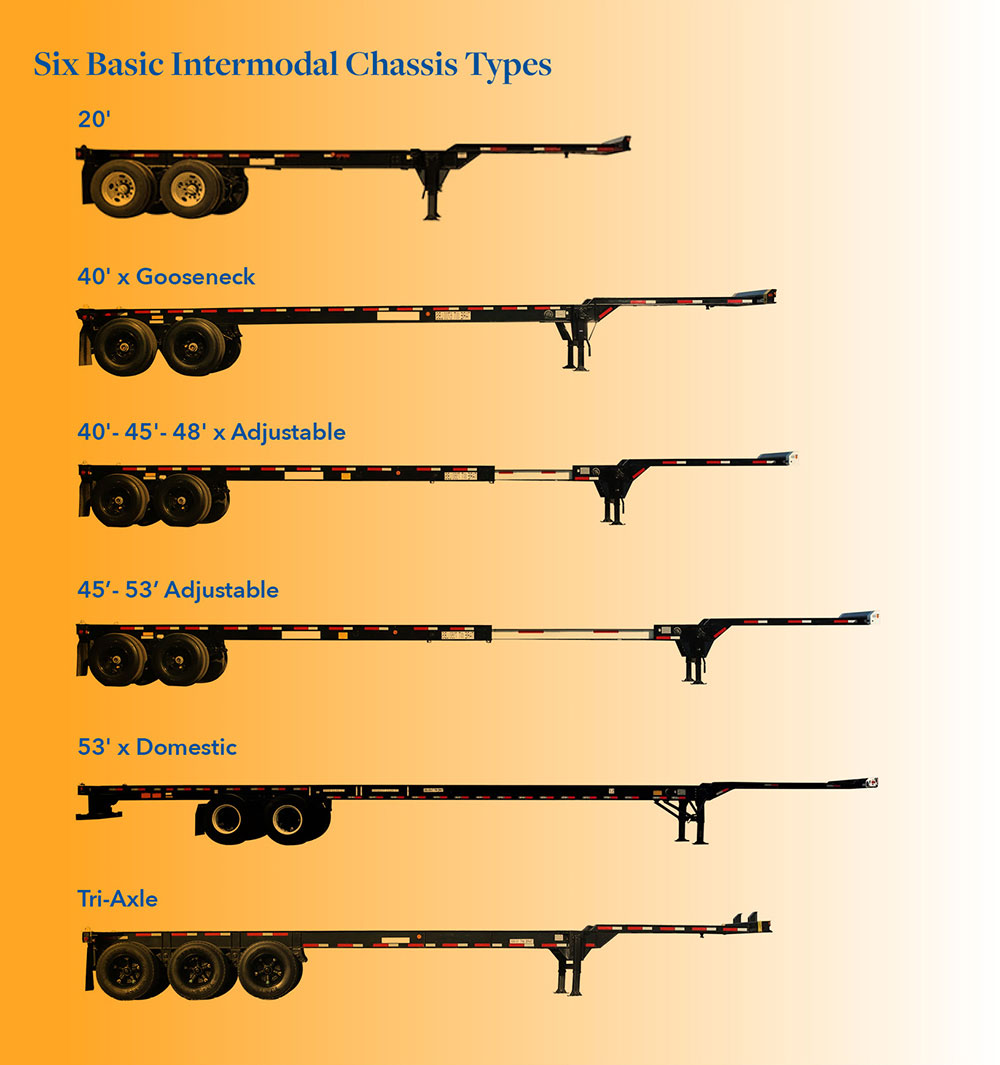

Chassis are special trailers or undercarriages that feature steel frames, tires, brakes and lighting systems, and are used in the transport of ocean containers over the road by truck. Two federal agencies, the Federal Motor Carrier Safety Administration (FMCSA) and the Federal Maritime Commission (FMC) regulate the industry.

Six basic chassis types are used in the transport of containers.

THE CRITICAL INDUSTRY ISSUE:

BACKLOG

Ports and Rail around the country are facing significant backlogs, in large part due to a current chassis shortfall.

Costs and usage associated with chassis have escalated to unprecedented heights since the start of the pandemic. According to the U.S. Department of Transportation, much of the issue began with cumulative tariffs that totaled 221% and were not repealed in the second quarter of 2021. With the start of COVID, the US economy saw import demands exceed prior record amounts for goods shipped particularly through Asia.

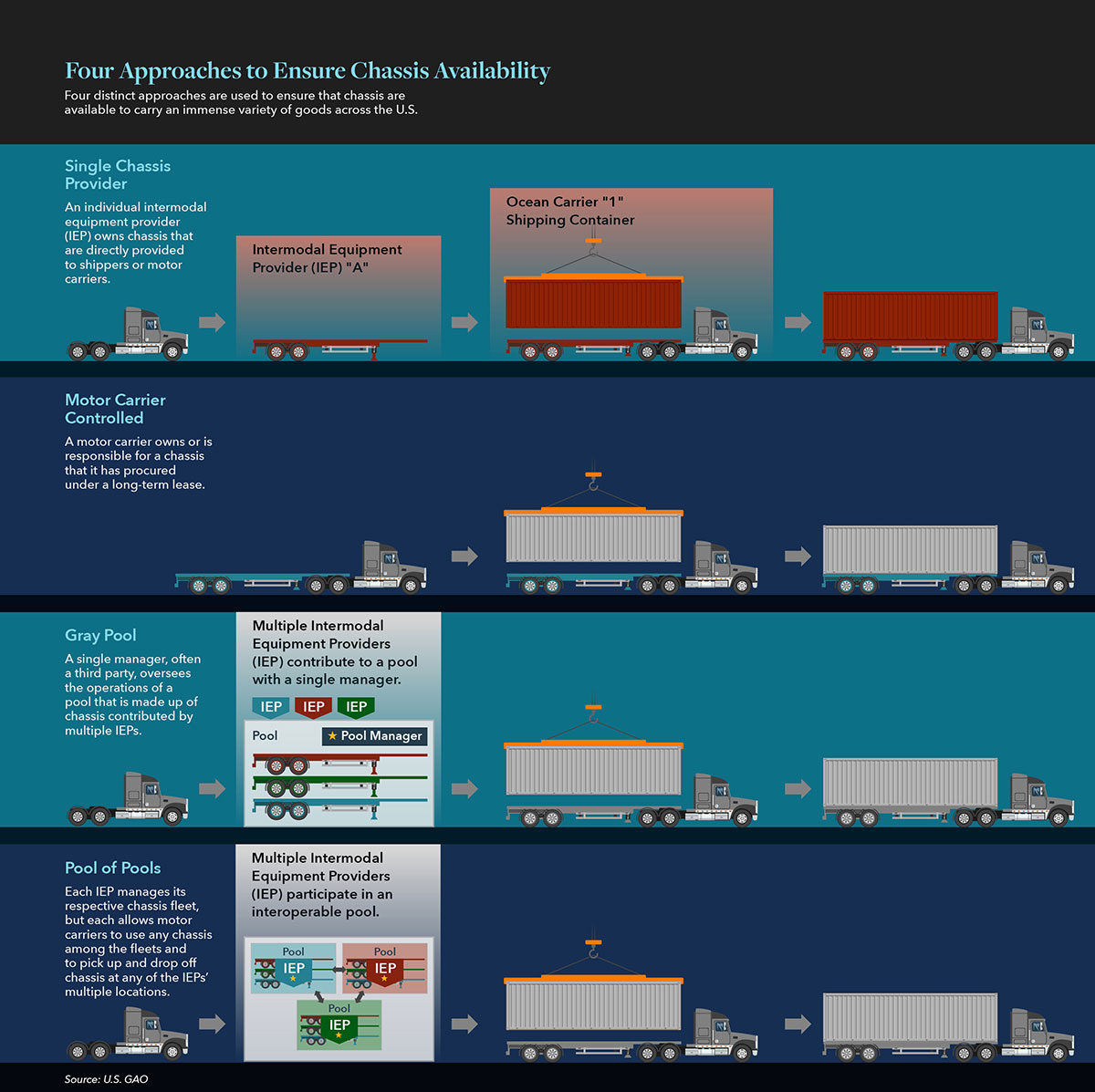

Consequentially, intermodal Equipment Providers (IEP’s) including TRAC-Flexi- DCLI and others have been receiving 20-30% fewer new chassis than they truly require to operate effectively.

Additionally, in the U.S., ocean container chassis are generally designed to accommodate specific container sizes (40’, 20’, 45’) and have two axles. Due to the lower national gross vehicle weight standards which are imposed here, these are generally somewhat lighter in weight than chassis utilized in most other countries. Additionally, most ocean container chassis cannot accommodate 53’ domestic intermodal containers. The latter largely serve the rail-based intermodal container transportation market.

Another issue that has presented itself is the increase in shipping companies holding onto chassis longer than they had in the pre-COVID period. Through conversations with chassis providers, Hilco Valuation Services has learned that the prior average of a 5-day hold has now increased to an average of nearly 9 to 10 days, and in some cases even longer. As this notable increase in time held has persisted, it is now requiring a costly doubling of the number of chassis in a fleet to accurately compensate.

TAKING ACTION

In response to widespread supply chain disruption, the U.S. Department of Transportation (USDOT) developed a comprehensive Freight and Logistics Supply Chain Assessment and the Biden administration has created a Supply Chain Disruptions Task Force of key stakeholders representing ports, labor, the trucking industry, and affected businesses. A Special Ports Envoy was also appointed to help advance short term actions.

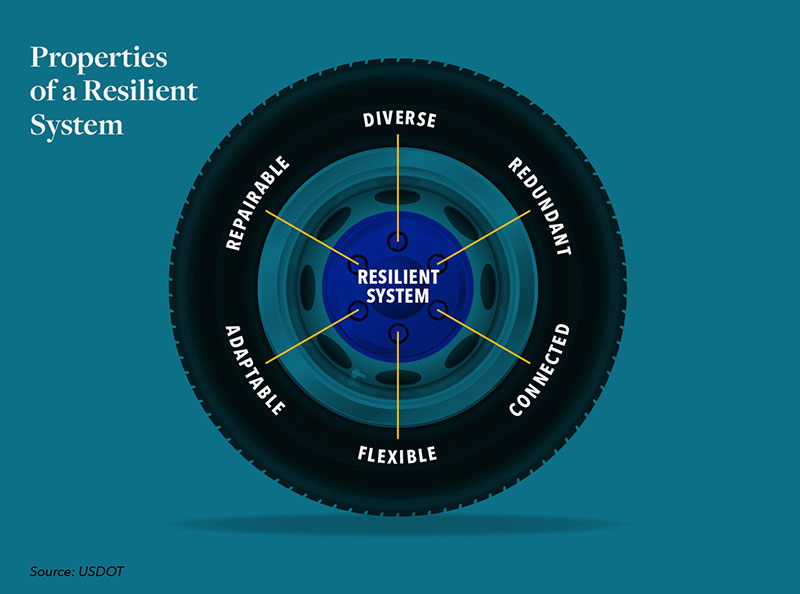

The USDOT’s February 2022 Supply Chain Assessment of the Transportation Industrial Base: Freight and Logistics sites the importance of implementing a “Resilient System” for freight in the U.S., one which can:

1. Demonstrate responsive and flexible operations, such as an ability to reroute supply chains quickly and add capacity where needed in response to surges in demand.

2. Have infrastructure capable of maintaining performance and security, and resisting damage under stress and, when damaged, be able to be repaired quickly.

3. Demonstrate a high degree of connectivity to enable the shifting of supply chains to alternative routes or modes.

As the USDOT explains, “Building the resilience of the nation’s supply chains requires Federal leadership to coordinate efforts across a wide range of freight and logistics stakeholders, including coordination among and between the public and private sectors to ensure efficient freight transportation flows for both emergency response and economic recovery activities.”

TRACKING RELEVANT FACTS & FIGURES

Our team at Hilco Valuation Services actively follows developments in the industry, and has noted the following:

1. While China International Intermodal Marine Containers (CIMC) had supplied up to 90% of the industry’s needs for many years, the 221% tariff imposed in the second quarter of 2021 has effectively pulled them out of the US Market.

2. Overall US chassis fleet utilization is currently thought to be hovering at approximately 90%.

3. Average US street dwell is 10.8 days for 40’ chassis.

4. CIMC/CIE is still active, utilizing US based parts, and has now doubled capacity at their two manufacturing plants.

5. Large scale US chassis providers including DCLI, Flexi-Van, TRAC Intermodal and others have seen cost increases that have effectively doubled the cost of a new chassis.

a. These increases are passed down to the chassis end users.

b. An uptick in chassis production from other US-based trailer manufacturers is expected.

6. Under-investment in chassis fleets leading up to COVID is contributing factor to the shortage issue.

a. Older chassis required significant investment to be made road legal.

b. Refurbishment, however, has now peaked, due to shortages of available new chassis.

Additionally, we are seeing both old and new players activating production lines to (re)enter the chassis market.

a. Hyundai-Translead (Mexico): annual capacity unknown

b. Panus (Thailand): 12k annual capacity

c. Randon (Brazil): Purchased NJ based Hercules Chassis annual capacity unknown

d. Dorsey: 12,900 chassis produced for private fleet. Annual capacity unknown

e. Stoughton: 22,000 annual capacity

OUTLOOK

Chassis shortages which began in 2020, have continued throughout 2022, particularly in inland U.S. cities such as Chicago, Memphis, Cleveland and Columbus, Ohio. While current overall chassis market annual production capacity is estimated as of 9/2022 to be 50-90,000, 55,000 is likely a realistic total production number this year. It is positive to note that, according to the US railroads and chassis lessors, most domestic chassis providers now seem to believe there will be enough 53-foot chassis injected into the market during the 2023 calendar year to overcome the existing supply shortage.

In keeping with our thinking from our previous chassis article from mid-year 2021, and based upon ongoing feedback from the market, some of which we have shared above, Hilco anticipates that there will be significant new and used chassis purchase volume throughout the balance of 2022 and into 2023 as providers strive to position pooled and other fleets capable of flexing to meet the needs of both existing and new customers.

Our Valuations team has seen record levels of engagement by providers, their lenders and our partners who rely upon our expertise and appraisal accuracy as part of their work in the industry. If you are an ABL with chassis industry exposure in your portfolio, the current environment demands that you maintain a comprehensive understanding of the operational components and current market challenges of those businesses.

With this in mind, we encourage you to reach out to our team today to learn more about fleet valuation, disposition, acquisition, and other nuanced considerations specific to this volatile period. We are here to help!

Hilco Global is one of the world’s largest and most diversified business asset appraisers, valuation advisors, and monetization experts. A trusted resource to companies, their lenders and professional services advisors, Hilco Valuation Services provides value opinions across virtually every asset category. Our extensive experience in valuing and monetizing chassis assets is unsurpassed in the industry, with our valuation and M&E teams working closely together to deliver maximum accuracy and efficiency on behalf of our clients. With a dedicated team focusing on truck, trailer and chassis fleets, we have performed valuations on well over 1 million assets across transportation and logistics, covering $2 billion in deployed capital. Hilco’s track record in the liquidation of fleet assets for maximum valuation based on its understanding of realistic value and real challenges to an actual orderly liquidation process, is highly regarded across the industry. Hilco Valuation Services has the ability to affirm asset values via proprietary market data and direct worldwide asset disposition and acquisition experiences. Access to this real-time information, in contrast with the aged data relied upon by others, ensures our clients more reliable valuations, which is crucial when financial and strategic decisions are being made.