Framing Lumber Prices Decline, Inventories Rise in Rapid 2022 Inflationary Environment

In this article, we take a look at the impact that various factors including supply chain easing, record inflation and the Fed’s actions to curb that trend are having on forestry markets and how the industry is reacting.

Last summer, just over a year into the COVID-19 crisis, Hilco published an article focused largely around the topic of the transformation of the home to both living quarters and workplace, and how the trend of moving to more expansive housing in more affordable or appealing locations would likely help to fuel the housing boom for some time to come. Slightly over a year later, with mask mandates removed, supply chain constraints easing and more people returning to the office, we revisit the market to see how things have evolved.

Still bolstered by wallets made flush by their lack of spending and stimulus through the pandemic period, consumer home improvement and relocation momentum remained strong through much of 2021 but began to slow notably as inflationary pressure mounted at the end of the year and into spring 2022. With astronomical prices on everything from groceries to gasoline now tapping out those savings, consumers are pulling back on everything from dining out to planned home remodeling projects. Across the country, many of those still contemplating a move to capitalize on better weather or market affordability are having to postpone their dreams, as the largest interest rate increases in modern history are making new mortgages largely unaffordable in comparison to the record low rates many secured over the past two years.

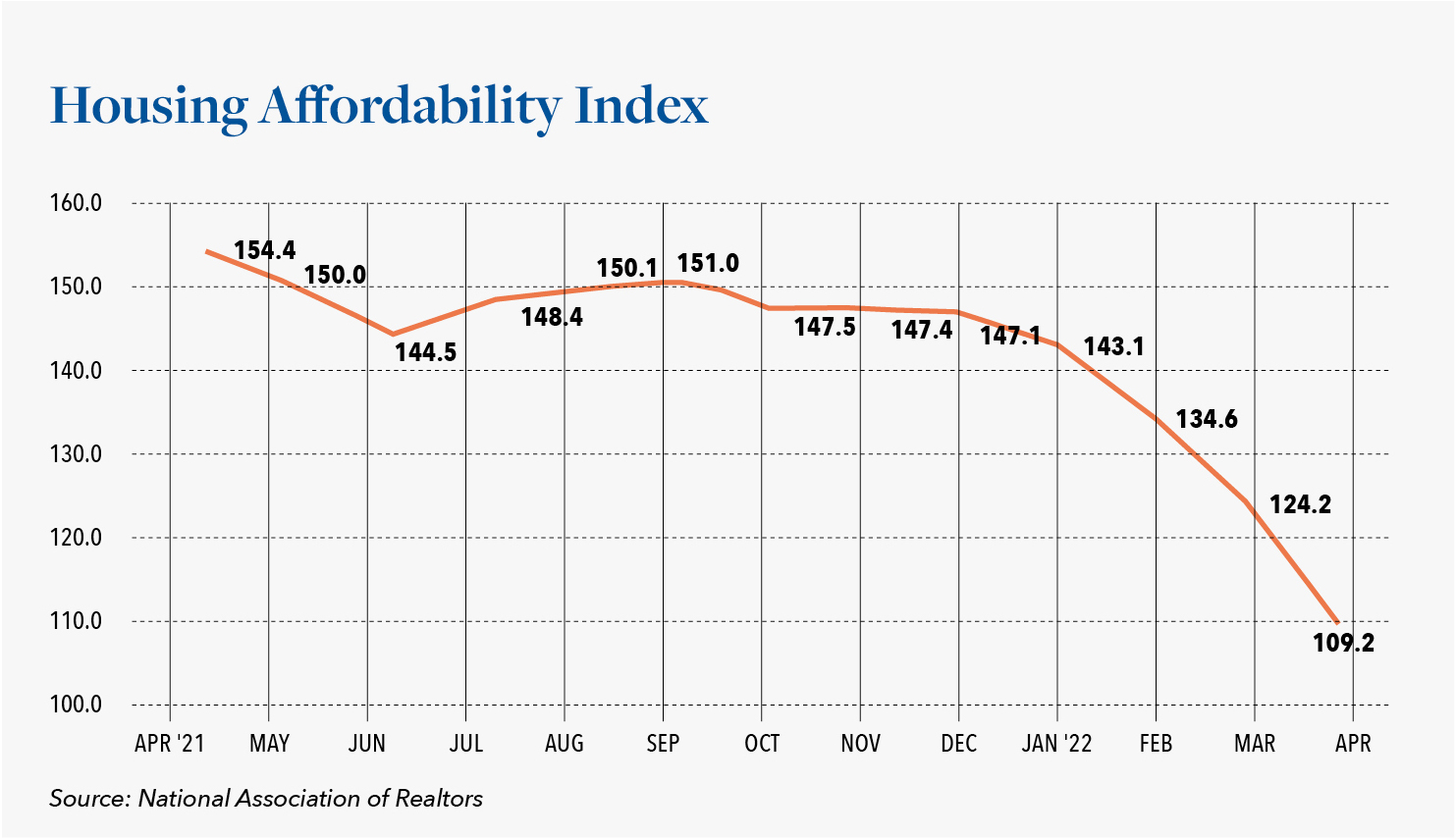

According to the National Association of Realtors, surging home prices and mortgage rates have cut housing affordability in the U.S. by 29% over the last year, the most significant year-overyear affordability decline on record. During roughly the same span, 30-year mortgage rates increased from just over 3% to levels now approaching 6%. The Fed’s actions have also sent the stock market plummeting, resulting in its worst, first half-year performance since 1970. As Chris Zaccarelli, chief investment officer for Independent Advisor Alliance explained to CNBC during the last week of June, “Right now we are at an inflection point in the economy, where actual spending and economic activity is still positive, however, consumer confidence and financial conditions (especially interest rates) are indicating a slowdown ahead.”

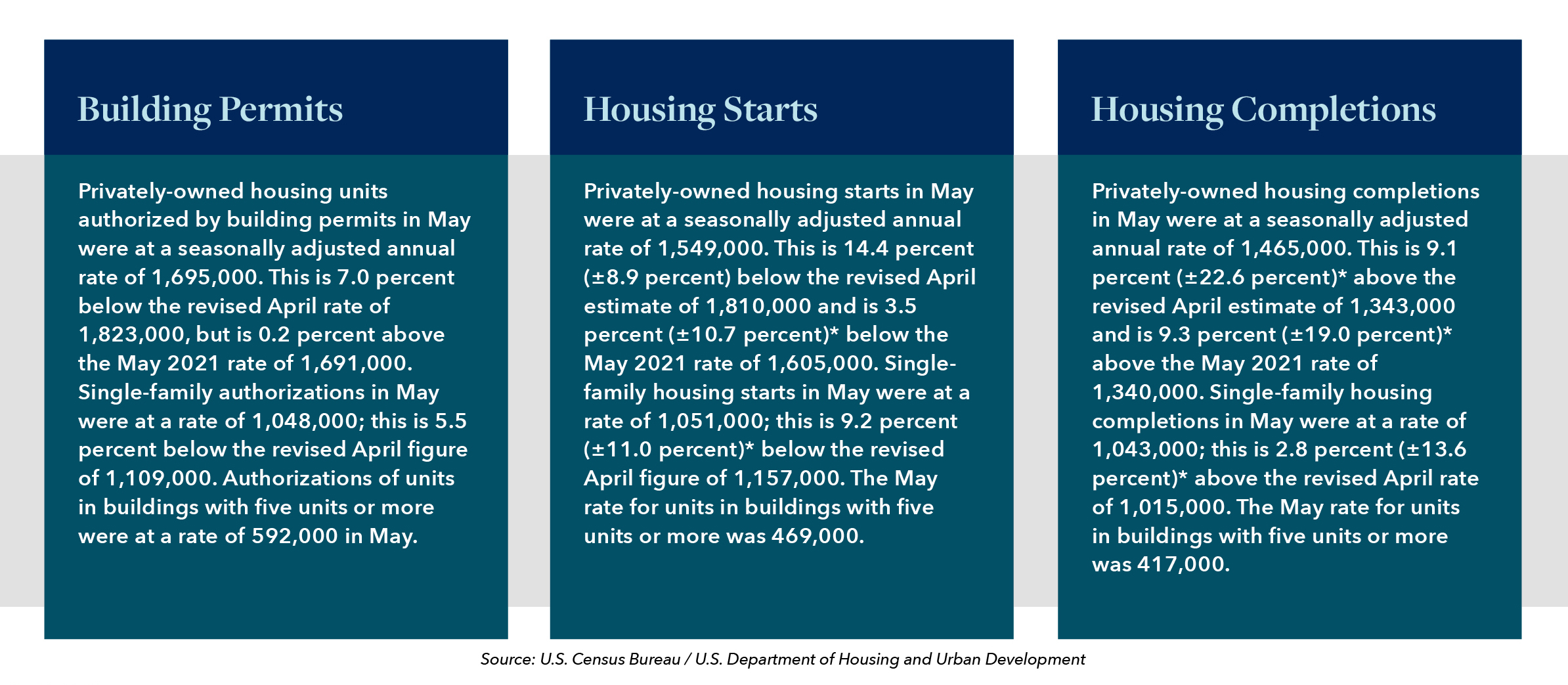

Not surprisingly, alongside these trends, housing starts have declined month over month during the past six-month period. While homebuilders are working off a good backlog of inventory put into production many months ago, demand for lumber could weaken just as more mills are coming online to ease capacity issues late this year or early next. Future demand for lumber will be highly dependent upon where interest rates go from here. If rates hold in this range, we could expect to see the still plentiful housing inventory in markets such as Tennessee, Georgia and Texas dwindle as some consumers with greater levels of financial resilience relocate for lifestyle benefits. If, however, we see rates surpass the 7%+ range, we would expect to see the market negatively impacted across the board. Even with a potentially softer market, however, lumber prices have a long way to fall to reach pre-pandemic levels.

Ensuring a continued supply of lumber requires the requisite labor to log the forest, truck the logs to the mills and process it for market consumption. While labor remains in short supply across the lumber and numerous other global industries, a weakening of the economy and dwindling stimulus can likely be expected to drive more workers back to earn a daily wage in industries including lumber. The question is, will producers need them in the short-term?

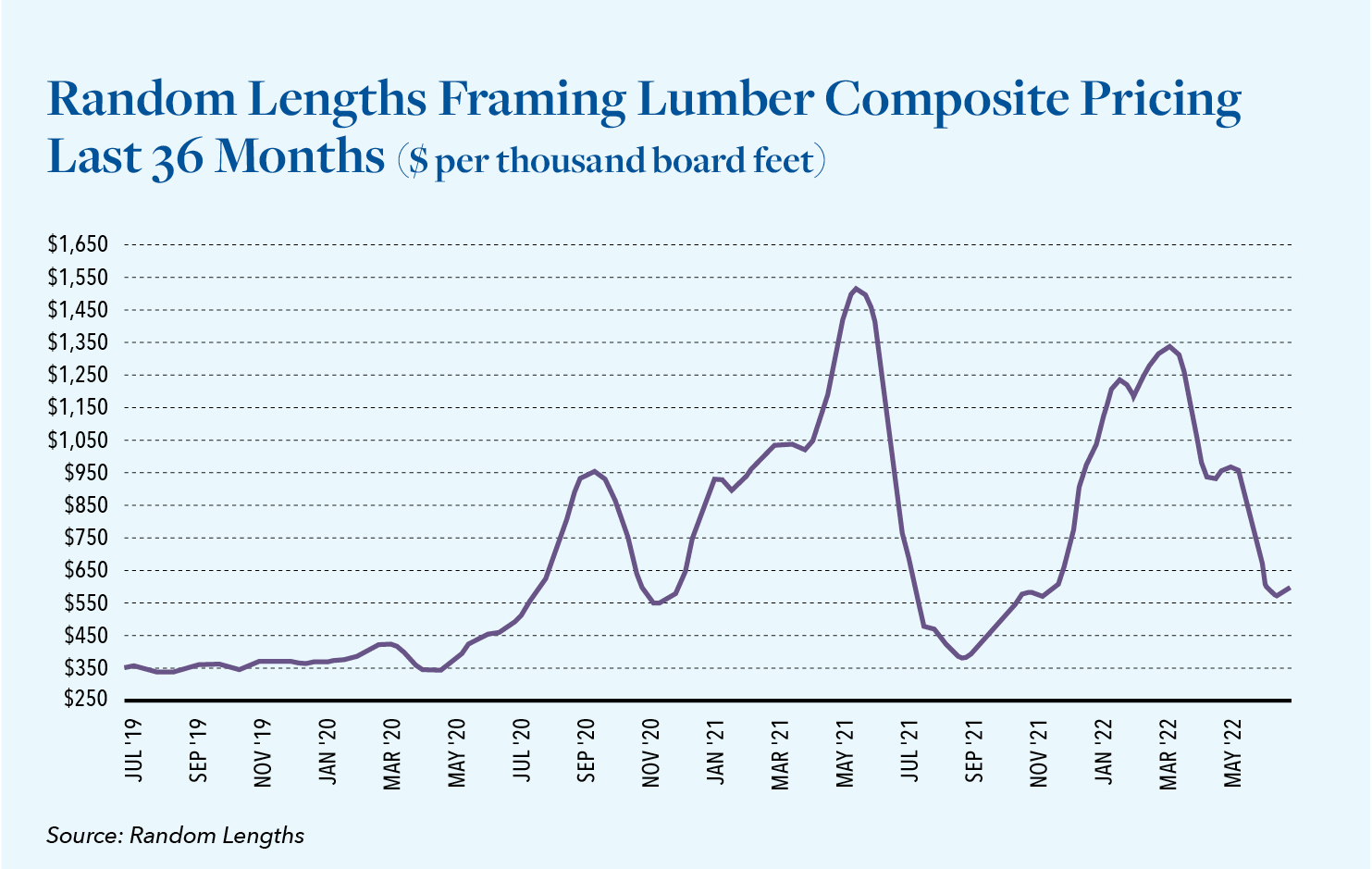

Lumber prices fell 7% in early June, hitting a new 2022 low of $604.50 per thousand board feet. This reflects a consistent decline that has tracked closely with the rising interest rates mentioned earlier and the corresponding cooling of the housing market in recent weeks. With prices down by more than 45% year-to-date, and even more from their 2021 highs, these declines should help to somewhat ease inflationary pressures in the housing market by reducing the overall cost to build.

This is also resulting in increased lumber inventory levels at saw mills and home improvement centers, where professional builders shop. In the absence of a rapid turn-around in demand, we can expect to see a continued downward pricing trend in the months ahead. Random Lengths recently reported that lumber buyers have slowed down their ordering and sawmills are beginning to trim their prices as this inventory builds. We have also just seen one of the world’s biggest lumber producers, Canfor, indicate that it will be extending a reduction in production schedules as it attempts to adjust for the ongoing supply gut. On its most recent earnings call, Canfor CEO Don Kayne said, “The global supply chain crisis has had a significant impact to Canfor and Canfor Pulp in recent quarters. This has resulted in operational downtime with our sawmills in Western Canada currently running on a reduced schedule to manage excess inventories at our mills.” The company expects those supply chain issues to last for at least the next several months.

In terms of paper related products, the second half of 2021 through the present period has brought a reversal on consumer packaged goods such as toilet tissue and paper towels. As discussed in our previous update, there was significant stockpiling of these products but this has been followed by right-sizing. As a result, we are now seeing somewhat weakened demand over the past 8 months for many end products. This includes boxes, which are actually flat to down in 2022, largely due to online shopping trends which turned negative in Q1 2022 vs. Q1 2021 as consumers eager to partake in the trips and events they missed during COVID restricted periods chose to spend their earnings and savings on those experiences rather than making product purchases requiring containers for shipment.

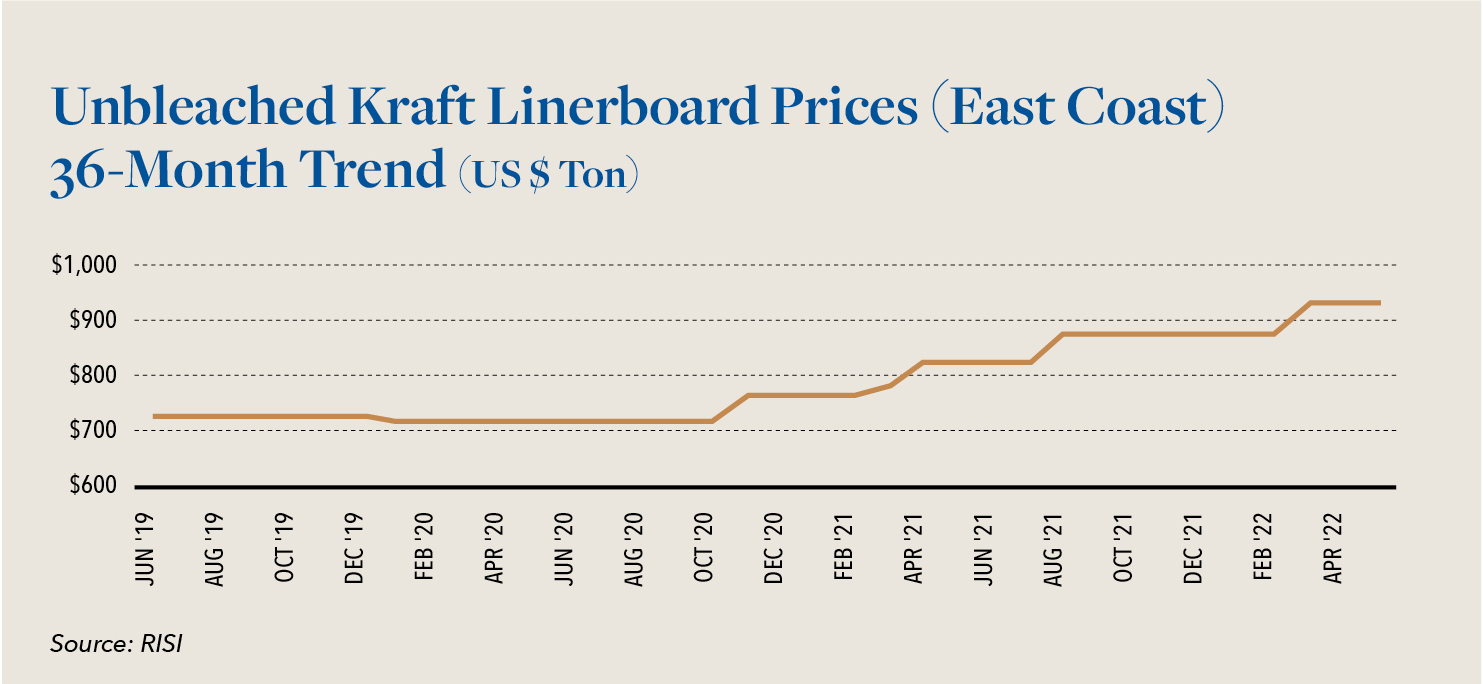

This, in turn, is starting to weigh on containerboard prices but we have still seen price increases there based on cost-push continued inflationary pressure on chemicals, freight, raw materials and labor.

Short- to mid-term lumber market performance remains a concern, although on a global basis, the forestry and logging market is expected to grow from just under $9 billion in 2022 to over $1.3 billion in 2026 at a CAGR of 11.5%. With the construction industry estimated to contribute some 25% of global greenhouse gas emissions, green construction continues to become more and more appealing. Construction using wood also produces very little waste. These and other factors are helping to boost the popularity of lumber and its frequency of use in both domestic and global projects ranging from residential to commercial use.

Hilco is working closely with numerous industry leaders, providing valuation, advisory and other guidance during this period of market volatility. Asset based lenders with questions or concerns pertaining to exposure within their portfolio are encouraged to reach out to our team for added perspective or to address a specific need for information or guidance. We are here to help.

Framing Lumber prices have fallen significantly from their highs of nearly $1,350 per thousand board feet earlier in 2022 to a level now under $650.

Prices for Unbleached Kraft Linerboard have increased steadily during 2022 to levels now over $900 p/ton.

Hilco Valuation Services is the leader in valuation for the forestry and lumber industry, having delivered more than 500 forestry and lumber appraisals, with asset values ranging from $500 thousand to $1 billion. As one of the world’s largest and most diversified business asset appraisers and valuation advisors, we serve as a trusted resource to companies, lenders and professional service advisors, providing value opinions across virtually every asset category. Hilco Valuation Services has the ability to affirm asset values via proprietary market data and direct worldwide asset disposition and acquisition experiences. Access to this real-time information, in contrast with the aged data relied upon by others, ensures clients of more reliable valuations, which is crucial when financial and strategic decisions are being made.