The Energy Market’s Rollercoaster Ride Continues

In this article we take a look at developments in the energy market with an eye on rising energy prices, the factors responsible, and the cascading impacts being felt by an already slowed supply chain amid the daunting

prospect of a prolonged war in Ukraine.

The energy market has been chaotic since Covid 19 arose in March of 2020, languishing with oil futures dropping into a rare negative (causing production cutbacks which have been slow to recover) immediately thereafter and languishing for a better part of the remainder of 2020. Post-election, oil prices rose steadily and were as high as $117 a barrel as of the end of May 2022, some of the causes and effects of which will be further discussed below.

THE RUSSIA SITUATION

Since the February 24th invasion of Ukraine by Russia, the world oil market has been thrown into turmoil. Crude oil futures have been collared at between $100 and $120 barrel since the invasion. Russia is the world’s third largest oil producer after the U.S. and Saudi Arabia. Russia heretofore had supplied 8% of all oil exports to the U.S. globally and its exports were 7.8 million barrels a day with 2 to 3 million of those typically exported to the U.S.

Immediately after the invasion, however, the U.S. and many other countries banned oil imports from Russia. Europe, less oil self-sufficient than the U.S., hesitated in instituting those bans. Previously, Russia had supplied 3.1 million barrels a day of crude, condensate and feedstocks along with 1.3 million in refined products to the European market.

However due to increased global pressure, the EU at the end of May agreed to sanctions covering 90% of the previous Russian oil imports. There are exemptions however for oil delivered via pipelines which made up 1/3 of oil exports. Hungary has exempted itself due to its landlocked position. The country gets 65% of its oil and 85% of its gas from Russia. The Czech Republic and Slovakia are temporarily exempt from the ban as well, continuing to receive even larger portions of oil and gas from Russia.

Assuming they remain in place, these export bans will cause Russian production to decline very significantly and pose a major financial hardship due to the importance of oil to Russia vis a vis foreign remittance. It should be noted that prior to the war in Ukraine and these steps, the EU collectively relied on Russia for 23% of its oil imports.

The likely outcome of this situation is that Russia will increase its exports to China, India and Turkey. In turn, these countries will likely buy less from the Middle East, and that oil will now find its way to Europe.

DOMESTIC IMPACT

Domestically, pricing for oil and its gasoline and diesel derivatives increased throughout 2021 and has now increased more substantially in 2022. The national average of one gallon of gas was $3.18 on 6/14/21 and $5.10 on 6/13/22, an increase of 60%.

Though most of us pay particular attention to gasoline prices, what should be of more concern are diesel prices. Diesel averaged $3.28 per gallon on 6/14/21 and reached $5.71 on 6/13/22 (with prices even higher in coastal and other select markets), an increase of 74%. While the price had increased prior to the Ukraine war, it rose precipitously thereafter in part due to greater demand in Europe for diesel to replace Russian fuel. European cars typically are more diesel engine-driven than those in the U.S. Another reason for the notable increase? Electrical generation also started using diesel as a substitute for natural gas. The impact of higher diesel prices is particularly notable in the Northeast which is more dependent on imported fuel due to closure of a number of refineries.

So why is this so important? Diesel powers more than cars, as it is the workhorse of fossil fuels. Diesel powers the tractors of farmers, the trucks that haul long distance and local deliveries of raw materials to finished goods.

Diesel fuels milk deliveries, Amazon deliveries, and the locomotives of railroads that haul containers, coal, autos, chemicals, lumber and passengers. It fuels the ships that traverse the globe hauling everything from timber to toys and Toyotas. Higher diesel prices, therefore, mean higher prices for just about everything we consume, as illustrated by recent comments from companies such as toymaker Mattel to retailer Target, which cite fuel costs for prices increases and margin compression.

Accordingly, we can expect that almost all areas of the supply chain have, and will continue to experience, cost increases due to higher diesel prices. Longer term implications are not known but could potentially range from less acreage being farmed to the withdrawal from the market of independent truckers who are less able to pass on fuel costs than fleet operators.

Not surprisingly, the stock of diesel on hand amounted to 103 million barrels at the end of May 2022 as compared to a normal storage level of about 220 million barrels. Exports of U.S. diesel to Latin America and Europe now stand at a record 1.5 million barrels a day. These exports involve a less complex blend than required by U.S. regulators and are commanding a high price at the present time, with the current USD price in Germany at $8.22 gallon.

REFINERY ISSUES

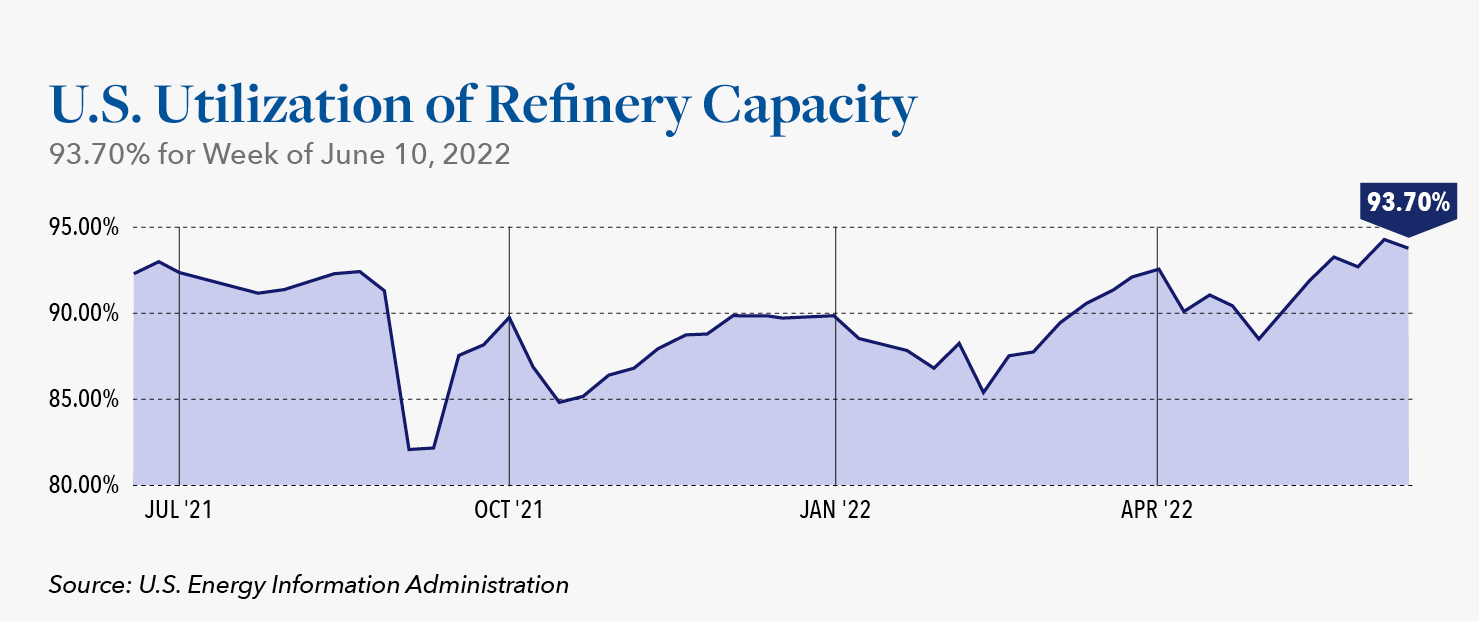

While global issues can be a contributor to rising energy prices, it is important to also look inward to the domestic refinery situation as well. There are just 124 refineries operating in the U.S. today, down from 250 in 1980 and from 139 in 2016, according to the U.S. Energy Information Agency. In the Northeast, the largest population center, there are just 7 operating refineries, down from 27 in 1982.

Additionally, the push for greener energy had led some refineries to be encouraged to shift to bio diesel, a product of soybean oil. This product, while greener, is slightly less efficient than petroleum-based diesel, is more subject to weather issues, and is costlier.

EXPLORATION, PRODUCTION AND OIL FIELD SERVICES

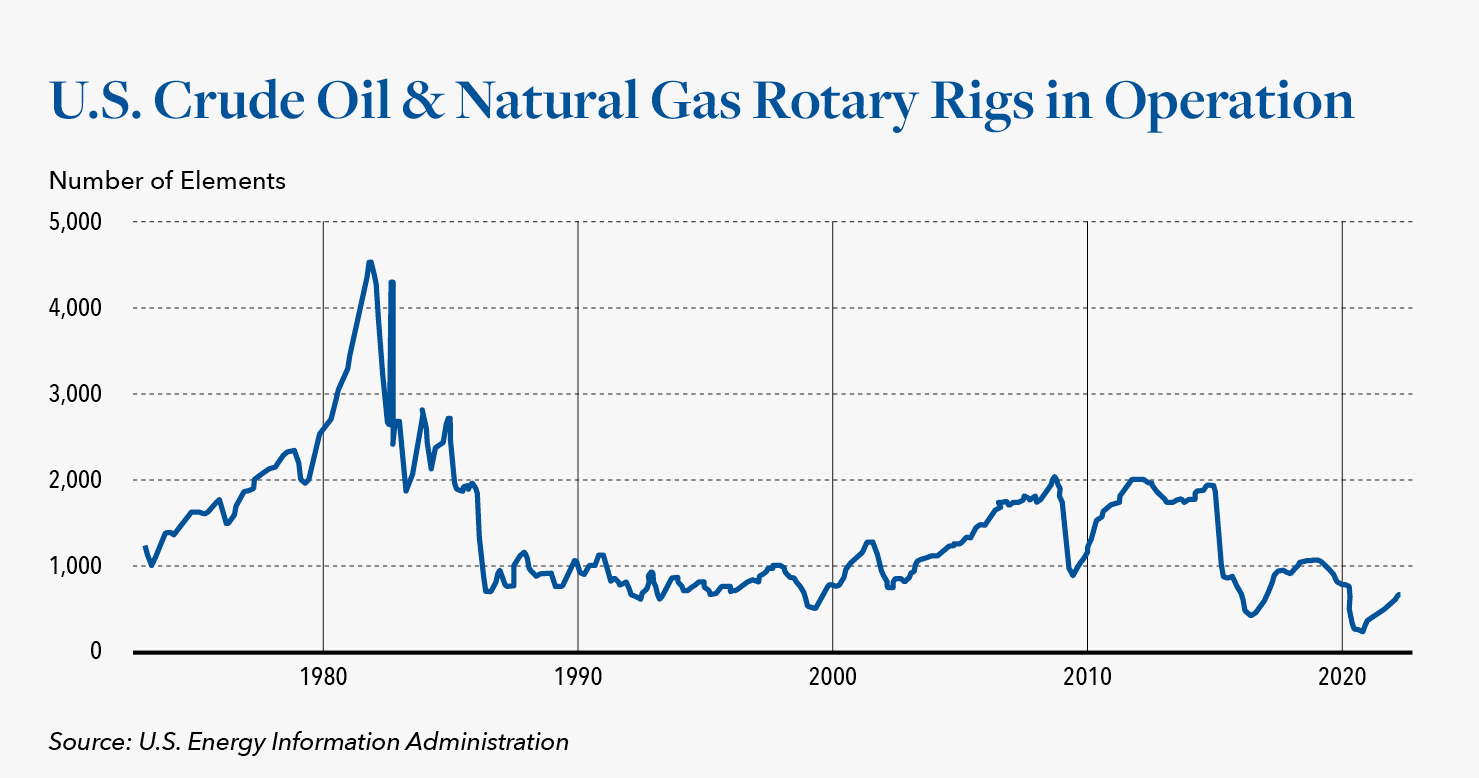

The COVID-19 pandemic has brought lasting effects to both the global and domestic energy markets, especially in the exploration, production and oil field services sector. The rig count, the predominant measurement of domestic activity, reached a high of 1609 rigs in October of 2014 as shale plays and fracking both reached a frenzy. Adjusting for rig efficiencies requiring fewer rigs along with energy price moderation, the rig count ranged much lower, from 350 to 850 between 2016 and early 2020. When the reality of the pandemic set in, rig count (along with oil prices as previously mentioned) dropped precipitously and reached a low of 244 active rigs in August of 2020. During that time, many Oil Field Service companies were reorganizing or liquidating through bankruptcies and there were quite a few mergers and acquisitions. Capital was tight, so underutilized equipment was either sold or cannibalized for parts to keep working assets running. Large amounts of older assets were sold or scrapped at that time as well.

The year-over-year rig count for the period June 2021 to June 2022 stands at 740, up 57% or 270 rigs. It should be noted that 356 rigs are operating in Texas and another 110 in New Mexico. Together, these account for 63% of all U.S. rigs. The vast majority of these are located in the Permian Basin and other nearby regions.

One might actually expect an even higher rig count given the current energy supply demand environment. Numerous factors, however, have hampered further production efforts. Following the pandemic-induced oil price collapse in 2020, the market exhibited an enhanced bust of what has been a cyclical boom or bust industry. Pandemic related lockdowns, closures and greatly reduced travel obliterated the demand for diesel, gasoline and jet fuel, causing oil futures to briefly turn negative. This, in turn, resulted in a storage crisis with those across the industry unable or hard-pressed to find available tanks or alternate storage space at any cost. Massive layoffs ensued in oil producing areas across all levels of employment. Just as people had chosen to migrate to these areas in boom time, they now chose to exit during the downturn, looking for opportunities elsewhere. As those individuals departed, their unique and valuable skillsets were lost to the area as well, putting the prospect of a quick future industry re-start across these areas at risk.

This environment also caused temporary and sometimes permanent shutdowns of a wide variety of suppliers to the industry. These ranged from pipe and tube (OCTG) manufacturers, to forging, fitting and valve makers, and sand and frac chemical suppliers. As demand improved when the pandemic related closures and restrictions abated, these energy related suppliers were faced with the same issues as the rest of industrial America. Labor shortages, supply chain issues and inflationary price pressures on both raw materials and purchased finished product continue to linger. Steel pipe and tube was especially limited in supply and it has taken until recently for shuttered pipe and tube mills to reopen domestically. Imports of these items have also been severely impacted by supply chain and logistics issues. Both domestic and foreign suppliers have enacted huge price increases due to higher steel material prices. Currently many domestic producers of tubing, casing and line pipe have customers on allocation. Hot roll steel, the base flat roll product often used as a pipe and tube substrate, was $488 p/ton in end of May 2020. It rose to $1,726 a ton in end of May of 2021 and has since leveled off, dropping to $1,253 a ton end of May 2022. Accordingly, rig contracts aren’t expected to rise 40% into next year.

Historically there had been a huge influx of capital into the new shale areas/fracking that reached a peak back in 2015/16. Money rushed in with hopes of high returns, which in many cases were slow to materialize or never happened. More and more leases and drilling occurred, chewing up investment capital to the point where investors began to demand more return and less exploration. Learning from this, many E&P firms now have restricted exploration activity in favor of those larger returns to attract and satisfy investors. According to Bloomberg, publicly traded oil and independent oil companies are now giving back about a third of their cash flows to investors.

The U.S. is expected to add about 900,000 barrels a day of production over the remainder of the year. However, in 2019 the U.S. produced almost 13 million barrels a day and at present we are at approximately 11.5 million barrels. Whether we get back to that 2019 level depends on many factors, not the least of which is producers’ fears of falling victim to another price drop that is out of their hands.

NATURAL GAS

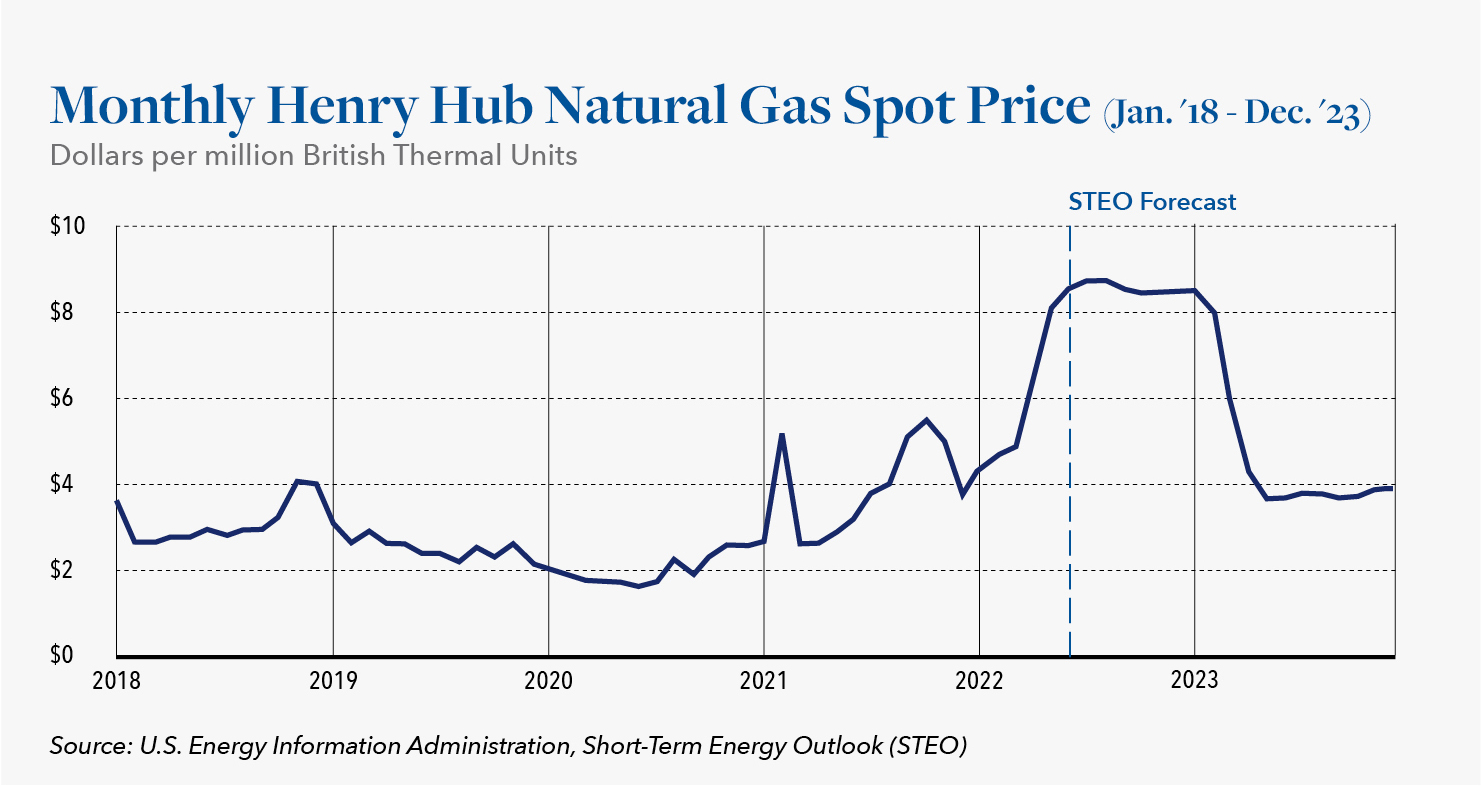

While consumers tend to be less well informed and knowledgeable about natural gas as compared to petroleum and its derivatives, it is an important component of the U.S. and global energy picture. Natural gas prices have now spiked, with the benchmark futures contracts hitting a 13-year high in May and rising above $9 per million British thermal units for a time before settling to the $8.20 – $8.40 range in early June. Various factors are to blame including hotter than expected weather and the increased reliance on natural gas for power generation (given that it has supplanted coal). The events stemming from Russia’s invasion of Ukraine, referenced earlier in this article, have also contributed to this price increase, as Russia is the largest exporter of natural gas and its exports are now greatly limited.

Increased U.S. production of natural gas, particularly in the Marcellus and Utica shale regions, has encouraged greater export levels for LNG (liquified natural gas), with export markets typically yielding better margins than domestic consumption. Additionally, these recent shale gas discoveries have led to storage issues domestically, adding to the attractiveness of exportation. Recently natural gas exporter Venture Global LLC announced a final investment decision, closing on $13.2 billion in financing to construct a 20 million MTPA export facility and related pipeline (Gator Express) in Plaquemines, LA. This is the largest financing transaction in the world thus far in 2022. It is also worth noting that several other LNG export projects are also now under consideration elsewhere by other firms.

Interestingly, however, domestic natural gas prices had a large drop recently. The 16% decrease was the result of a fire and related closure of the Freeport LNG plant at Quintana Island, TX. Prior to the event, this facility had accounted for just 2% of natural gas demand in the U.S. With the plant’s liquefaction capabilities expected to be down for up to 90 days, product that would otherwise be exported is now available on the domestic market, resulting in a domestic oversupply.

CONCLUSIONS

While global energy markets had been spurred on by a more robust economy last year as many COVID-19 impacts diminished, the continuing war in Ukraine and the looming threat of recession here in the U.S. are among the biggest factors creating uncertainty. Energy market pricing for the remainder of 2022 is likely to remain dependent on a number of interrelated domestic and global factors, including those we have touched on here. Clearly higher fuel costs are already impacting nearly every aspect of today’s supply chain from input prices to the cost of delivery. The question at this point is whether the increased cost for gasoline, diesel and natural gas — in combination with the extraordinarily high prices consumers are now paying for everyday goods — will tip the scales toward an economic downturn not only in the U.S., but throughout the world.

Hilco Valuation Services is one of the world’s largest inventory appraisers and valuation advisors, serving as a trusted resource to companies, lenders and professional service advisors across virtually every asset category. We have extensive experience in the energy sector, and have conducted a wide range of monetization engagements involving the appraisal, disposition and acquisition of oil and gas industry assets throughout the U.S. and Canada. Hilco Valuation Services has the ability to affirm asset values via proprietary market data gained via its worldwide client experiences. Access to this real-time information, in contrast with the data relied upon by others, ensures clients of more reliable valuations, which is crucial when financial and strategic decisions are being made.