2022 Has Been a Near-Perfect Economic Storm but Partly Sunny Skies May Be in the Forecast

This article discusses recent developments in the retail industry, our expectations for 2023, and presents suggested steps that can be taken by retail operators given these factors.

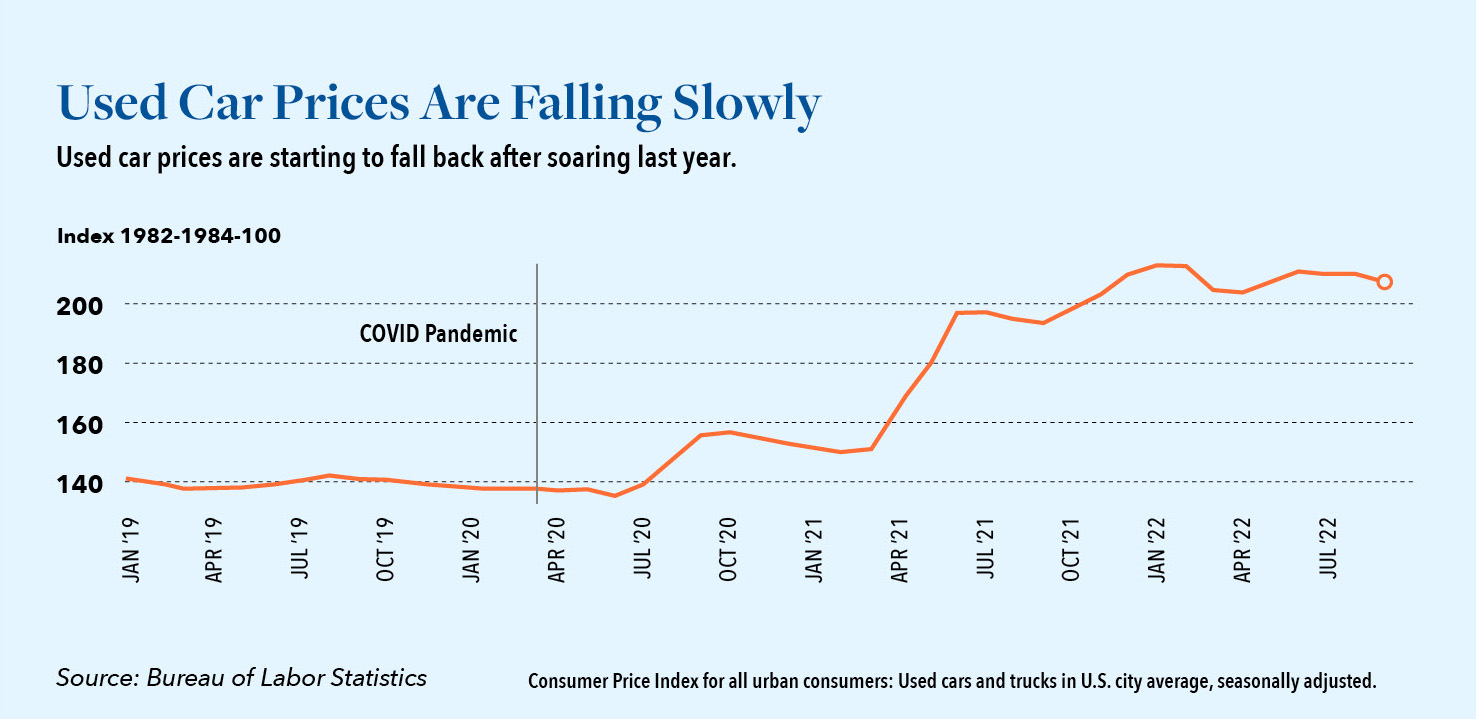

Early 2022 was characterized by a high level of consumer demand, still relatively reasonable fuel prices and continued low interest rates. This continued to drive a continued high level of demand for consumer goods and renewed spending on experiences such as vacations and events, which had been largely inaccessible to consumers from early 2020 through most of 2021. Meanwhile, supply chain constraints persisting from the impacts of COVID continued to limit production and associated supply across multiple industries, further inflating prices beyond 2021. One of the most visible examples of these impacts was the automotive industry, where a trickle of new car production met by high demand also resulted in accelerated used car inventory depletion despite higher than normal prices.

Anticipation of coming interest rate increases and a new level of work-from anywhere flexibility being realized, and acted upon, by working individuals and families also led to a prolific level of home sales at record high prices in desirable relocation areas such Florida, Arizona and Tennessee. Prices were boosted in part by the continued high cost of construction materials, including lumber and a shortage of labor up and down the supply chain. Many consumers also scrambled to locate vehicles for purchase or lease in order to lock in lower monthly payment rates, only to find their local dealerships had tacked on innocuous “COVID-19” and “Vehicle Acquisition” fees, in some cases adding thousands of dollars to a vehicle’s price.

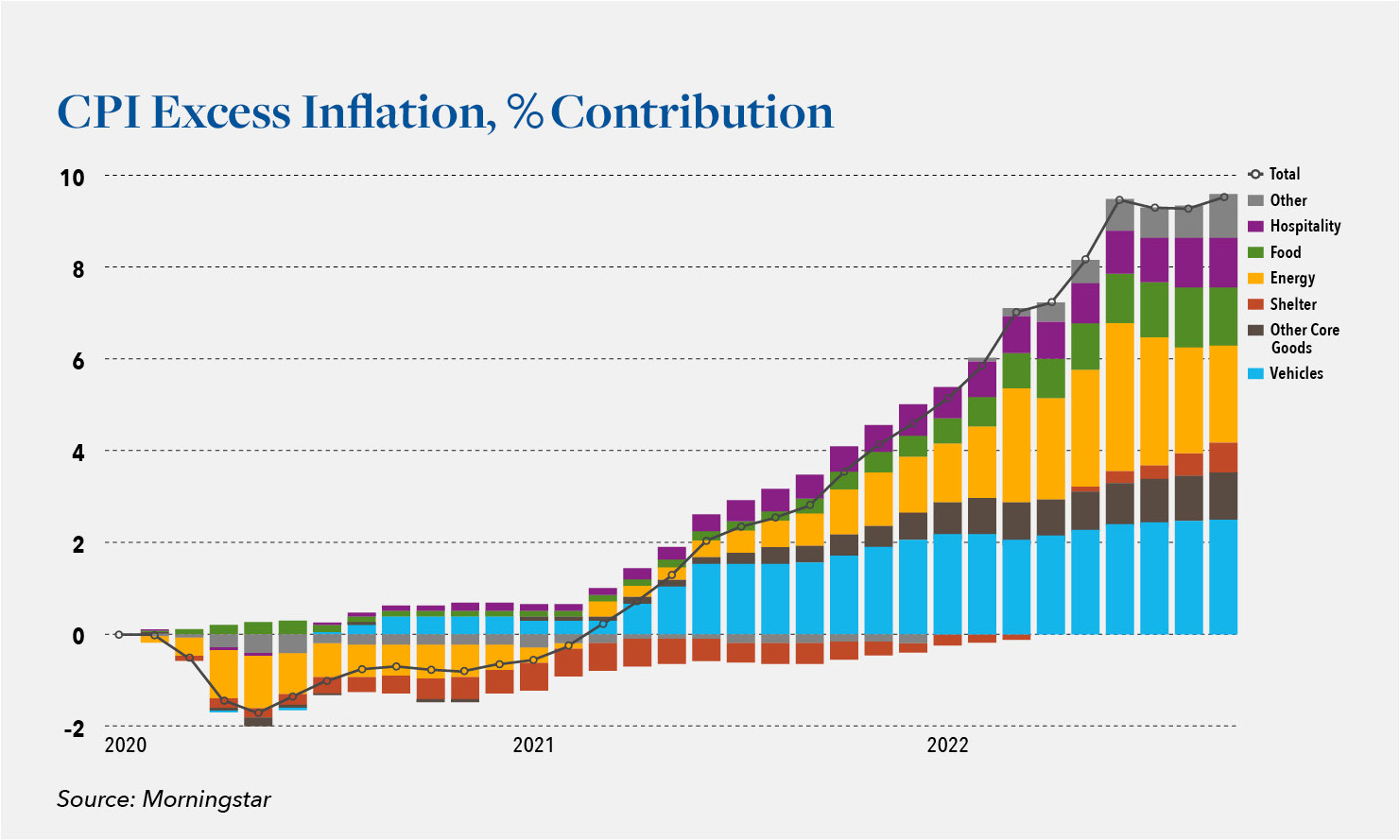

Once the Fed took decisive action to attempt to stem inflation toward the end of Q1 2022, the game started to change. Rates surged from near 3% to close to 7%. Fuel prices driven by OPEC actions rose sharply adding to consumer road and air travel costs. These have remained elevated but with some relief. Across durable and nondurable goods, consumers witnessed prices skyrocket on virtually everything from milk and perishables to appliances and furniture. While these have since receded somewhat over the course of this year, service prices — including rents and medical services — have risen quickly to meet them.

So what’s on tap for 2023?

While inflation in the short term continues to be a daunting factor, we do not expect this to lead to what might be termed a classic “recession” in the year ahead. Why this partly sunny forecast? For starters, despite economic headwinds, unemployment remains historically low and there are millions of open jobs across the country and consumer spending remains strong. We also continue to see wage inflation and available capital — albeit more expensive capital.

So what can we expect?

Partly sunny by its very nature also means partly cloudy, and it is true that inflation is not going away anytime soon. Most notably, this is due to the fact that the government printed money at unprecedented levels. We saw similar inflation in the 1970s when President Nixon removed us from the gold standard. Afterall, transitory inflation — as Federal Reserve Chairman Powell initially referred to it — should recede once the variables causing the inflation are removed, such as supply chain disruption. Even though ports have become less crowded and container prices have dropped, inflation has not subsided. Indeed, when you combine the prior two years of inflation by month, you will see that the 2 year trend has remained almost flat over the course of the last six months. Moreover, with a shift to onshore more manufacturing both by the U.S., right here in North America, as well as by countries elsewhere around the world, we will continue to experience transitory inflation as companies seek to build new facilities and hire more employees. Compound that with the ongoing retirement of the baby boomers, and we should expect inflation to remain above the Federal Reserve’s 2% annual target for some time.

Stock Outs

These should be anticipated on items ranging from apparel to automobiles. As we transition to a period of deglobalization, the wonderful world of “always in stock” is, sadly, behind us and may never return.

Political Gridlock

Republicans have retaken the house, while Democrats retained the senate in the recent November elections. A divided government translates to low likelihood of any forthcoming government bailouts. Even if government was not divided, printing money partially created this problem and printing more money will only make it worse.

Interest Rate Increases

The Fed is on a mission and has stated its position clearly. By committing to raising rates “forcefully and thoughtfully,” they have put the country on alert that while painful, these incremental steps are necessary and should be expected moving forward. Unfortunately, raising interest rates and time are the only obvious solutions presently available.

We’ll build on thoughts presented here and provide more details on tackling these and other tough challenges currently facing operators in our next Perspectives article early in 2023. In the meantime, if your operation or retailers in your portfolio of companies are facing challenges in these partly sunny/partly cloudy days, we encourage you to reach out to our team at Hilco for a discussion. We are here to help.

Hilco Retail Group offers broad and deep expertise in all retail sectors. Our seasoned professionals deliver a wide range of analytical, advisory, asset monetization, and capital investment solutions to help define and execute client strategic initiatives.