Emerging Trends in the Mobility Market

As a follow up to our recent article on the evolving perils of auto supplier obsolescence, Hilco Global will be exploring a range of timely topics pertaining to the broader mobility market in the coming months.

As we continue to track evolving developments, experts from across our platform of companies will contribute their observations to this effort, providing more in-depth insights on the various challenges and opportunities being presented to a wide range of market participants across this expanding landscape. This introductory article provides an overview of some of the areas we will be addressing in greater detail throughout the series.

THE MARKET

The mobility market is evolving at an ever-rapid pace. Beyond innovative new EV manufacturers challenging the offerings and business models of long- dominant ICE OEMs, a number of other factors are shaping the future of how people will be transported from one location to another in the years ahead and how that time in motion will be spent by those individuals.

Technology, including the ability to collect greater amounts of data, is being paired with sophisticated and powerful analytics tools to provide greater insight into customers, their habits and potential opportunities. As part of their expressed long-term commitment to an EV future, OEMs are ramping up their recruitment efforts, seeking individuals with these and other skills atypical of previous hiring profiles. They are looking to partner with or acquire start- up and well-established businesses that complement and augment their own capabilities, to enable an accelerated ramp-up in these areas in order to remain competitive.

A FUTURE OF COLLABORATION

Across the supply chain, new and longstanding participants in the mobility ecosystem are finding themselves challenged by a need to forge or maintain a meaningful place in this new order. This is requiring substantial investment in new assets, research and capabilities and a commitment to new levels of collaboration — not a trait typically associated with many legacy businesses, particularly those with longstanding automotive industry roots.

The lure of collaboration is compelling, however, when examined objectively. The investments and evolved platforms of others, including those who were once fierce competitors, can be turned to notable advantage when these businesses become collaborators via partnership, joint venture or other formalized agreements. R&D can be accelerated while the cost of those investments can be simultaneously defrayed to minimize downside risk. CAPEX associated with sizable infrastructure needs can also be shared. Overall, we are seeing more of these types of relationships along with consolidation, which is empowering scale-up and the potential for enhanced outcomes across the market.

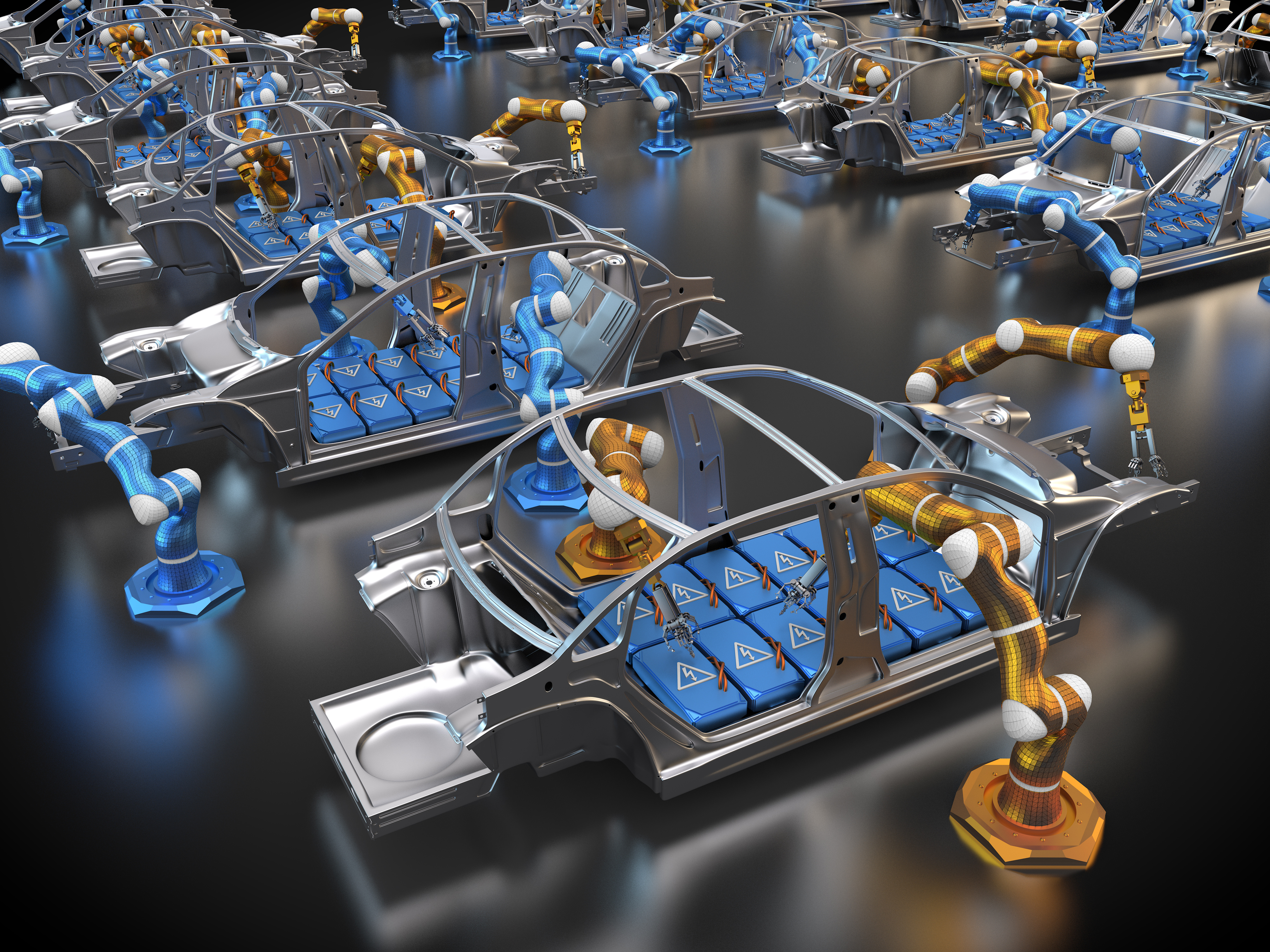

Dramatic expansion is being seen and is expected to further accelerate across numerous non-traditional areas that will define mobility moving forward as well. In addition to EV batteries, charging systems and charging infrastructure, these also include connectivity, entertainment, autonomous and other software, hardware and integration.

The overarching vision, whether for shared or private mobility, is a future of interconnected, guided transportation that leverages enhanced data collection capabilities to deliver a highly customized, efficient and differentiated user experience while within the vehicle. Imagine taking a Peloton class, viewing an immersive theater experience or a taking stroll through a virtual grocery store to purchase dinner for delivery to your home — all as you are whisked to your destination without ever touching the wheel or accelerator. What about custom content and information pushed and presented to you based on onboard AI and predictive analytics features tied to your mobile or other device, smart watch or even an implanted medical device? For OEMs which innovate or collaborate to bring these built-in capabilities to customers, and for stand-alone suppliers providing software as a service and other solutions to the market independently, these represent potentially lucrative and sticky revenue streams with seemingly unlimited expansion potential. In an industry where ICE OEMs have tended to well underperform the market in terms of both shareholder return and enterprise valuation, this could finally present a chance to somewhat level the playing field.

WEATHERING THE CURRENT STORM FOR A POTENTIALLY BRIGHTER TOMORROW

With new passenger vehicle sales down to 14.6mm units in 2020 and 14.9mm units in 2021 from previous sales averages that were above 17mm vehicles from 2015-2019, Tier One automotive parts manufacturers have struggled to remain profitable since the start of the Pandemic, balancing very capital-intensive infrastructures against reduced production volumes. We have now seen this trend extend into the first few months of 2022 with widespread expectation of its continuation through at least the balance of the year.

Dramatic expansion is being seen and is expected to further accelerate across numerous non-traditional areas that will define mobility moving forward as well.

These reduced production levels coupled with inflationary pressures on a multitude of raw materials for many of these manufacturers has resulted in negatively impacted gross margins, reduced inventory turnover, and less inventory against which to amortize expenses. In many cases, this is resulting in negative impacts to inventory net orderly liquidation values (NOLV).

Additionally, with electric vehicle (EV) sales totaling 487,560 units in 2021, a staggering 89% increase over the 257,872 units sold in 2020, both OEM’s and Tier One parts manufacturers have no real choice but to further invest material amounts of capital to retool production lines and facilities for an EV future. While significant, that one year jump in non-ICE sales still accounts for only a small percentage of the overall new car market. As a result, until significantly higher sales thresholds can be achieved, initial returns from those investments will be nominal and notable downside risk exists. Not surprisingly, we are seeing various approaches from OEMs and suppliers designed to hedge their bets in this evolving market. Among others, these include 1) partitioning of existing business lines into distinct ICE and EV/future mobility-focused entities as well as 2) strategic acquisition of complementary businesses that bring capabilities or technologies to help a company leverage existing business strength while jump-starting efforts toward a longer-term, sustainable strategy.

Will the government funding earmarked for EV charging and related infrastructure be put to quick use to help drive consumer and commercial confidence in the purchase and operation of EV automobiles, commercial and industrial trucks? Or will the use of those infrastructure dollars be largely held back until such time as consumers become more confident in the range of those battery powered vehicles and demonstrate it via their pocketbooks? Like the classic “chicken vs. the egg” scenario, the answer for now still remains anybody’s best guess and heavy investment risk weighs in the balance.

SEIZING OPPORTUNITIES AND RIGHT-SIZING

For automobile and trucking suppliers that are heavily reliant on ICE-related production, a refocus on EV platforms and/or non-automotive applications for their products is necessary moving ahead. While this shift will take time to fully implement, there will undoubtedly be opportunities to take advantage of the displacement of certain parts production and technologies.

It can be expected that aftermarket demand for ICE parts will continue for many years following the end of ICE platform production, as current vehicles which possess lengthy lifespans will remain on the road well into the future. This means that even as active platform production ends, there will be a need to maintain the ability to produce lower levels of certain parts for warranty, replacement and repair purposes. As ICE platforms wind down, there will be less need for large upfront tooling and M&E expenditures, which will allow for increased positive cash flows on those lines. At that point, such cash flows should enable automotive suppliers to fund other lines or high potential projects, while also being attractive to others looking to consolidate production and maximize capacity and utilization during the wind down. While the peak period of positive cash flows may be relatively brief in duration, it should also be well defined with a rather predictable operational and financial outlook. As a result, opportunities will likely exist for a supplier to 1) monetize ICE lines and divest those operations in order to focus on continuing EV operations and, 2) look to add volume to its lines and take advantage of the resulting efficiencies and the positive cash flows. As production demand wanes going through the wind down process, suppliers can correspondingly reduce their workforce and shrink direct and indirect expenses to maximize profitability. Excess M&E can be monetized throughout the process as well.

Suppliers should not overlook the potential opportunities that may arise from discontinuing ICE platforms. Savvy suppliers can take advantage by either divesting production as it winds down or consolidating production to maximize cash flows.

CONCLUSIONS

If your business or a business within your portfolio is involved in the manufacture of legacy combustion engine vehicle components, emerging EVs or the expanding range of products and services being innovated as part of the broader mobility market, we encourage you to thoroughly familiarize yourself with the dynamics of the current market. Doing so can help shed light on the opportunities available to those businesses for remaining or becoming an integral part of the mobility market moving forward. With that in mind, questions you should consider asking today include: Does your business strategy have enough optionality and flexibility built-in? Can your existing manufacturing process and facilities be utilized or retooled to produce components critical to this future? Are there potential partners within or outside the market whose products, expertise or technology could help ensure your business’ future or transformation potential? Is there industrial equipment, a plant, or technology available for purchase that could help jump start that process? Do you hold proprietary patents, licenses or other intellectual property that could be monetized to help acquire technology, tools, or staff in order to secure your position as a valued supplier moving forward?

At Hilco, our Advisory, Valuations, Commercial Industrial, Specialty Capital and other integrated teams have significant experience assisting businesses address the unique challenges associated with transformational periods such as the one the automotive and trucking industry now face as part of the transformation to a true mobility marketplace. If you would like our perspective on your situation, please reach out to us today. We are here to help.

Industry experts from across the Hilco Global platform and Getzler Henrich are contributing to this Mobility article series, including: Tom Boniface (Hilco Valuation & Advisory Platforms), Geoffrey Frankel (Hilco Corporate Finance), Kevin Krakora (Getzler Henrich – Turnaround/ Restructuring), Keith Spacapan (Hilco Valuation Services – Automotive), Ed Zimmerlin (Hilco Valuation Services – Multidisciplinary). For more information, contact Ed Zimmerlin at ezimmerlin@hilcoglobal.com