The Rise of Office-to-Residential Conversions and the Role of the Court Appointed Receiver

This article discusses the rising use of TIF funds to enable the conversion of vacant office space in large cities across the U.S. to residential use, and the important role that the receiver plays in both protecting a lender’s interests during this process and helping to facilitate a future sale.

In cities around the country, owners of office buildings, their lenders, and local government authorities have been putting their heads together to determine how best to address the current dilemma– millions of square feet of vacant office space from coast to coast. An unexpected and truly unprecedented exodus from the hallowed hallways of big corporate America was first set in motion by the pandemic lockdowns in spring of 2020 and accelerated through technological innovation and the adaptability of workers.

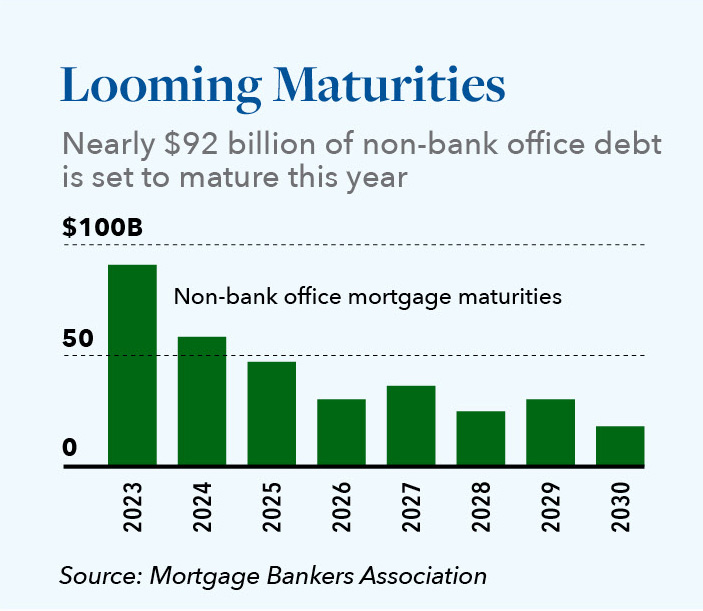

Try as they might, many companies have been unable to entice their employees back into the office. The outcome? The rise of the hybrid and fully remote workforce, accompanied by the highest-ever vacancy rates in urban office space history. The average U.S. office vacancy rate in the first quarter of 2023 was 18.6%. With an estimated $92 billion in office building debt from the non-banking sector coming due in 2023, according to the Mortgage Bankers Association, landlords are defaulting at an alarming rate with many now turning the keys to the property back over to the creditor.

In Chicago, home to the Hilco Real Estate U.S. headquarters and our parent company Hilco Global, the outgoing mayor recently announced an office-to apartment conversion initiative targeting older-generation office towers in the Loop and designed to create an economic model that is being called “inclusive growth.” While providing a potential lifeline to owners of these properties and their lenders, the transformation would also set aside 30% of newly constructed apartments at mandatory affordable rental rates in an effort to address, at least in part, the current shortage of affordable housing in the city’s downtown area.

Similar efforts are also in various stages of proposal and development in other large U.S. cities including Atlanta, Dallas, Los Angeles, New York City, Philadelphia and Washington, D.C., and most share a common attribute. To be economically viable, their success relies heavily upon the use of tax increment financing (TIF) funding dollars to offset the cost of conversion. Without access to those funds, these deals do not pencil, and creditors may find themselves having to write down significant losses on their existing loans.

These conversions are complex and multifaceted, involving the need for experienced professionals who know how to work with city government officials, architecture firms, construction firms as well as provide varying degrees of project management and oversight throughout the application process. If awarded the TIF financing, they also require a team to pay close attention to the ongoing quality management of all aspects of the property, including ongoing communication with current and potential tenants regarding the construction timeline, before, during and after the conversion process is complete, as well as during the conversion and through the dismissal of the receivership.

Performance of these and other related duties fall squarely under the purview of experienced and proven receivers, whose core expertise is to assist creditors in the recovery of funds and help troubled property owners avoid bankruptcy when possible. When receivers take possession of real property, they collect rents, manage or oversee the property’s management, and under certain circumstances will sell the property.

Overall, a receiver’s role replaces the borrower’s in regard to the general operation of the subject property. The receiver and its agents are a neutral arm of the court. As such, on a monthly basis a receiver is required to provide the court with a comprehensive report, documenting its actions and decisions relative to the financials and operations of the property. The receiver’s role also provides for court oversight, ensuring that all interested parties have an opportunity and place to either challenge or support a receiver’s decisions or actions.

A receiver’s powers are outlined in the court order and the receiver normally takes a series of actions including, but not limited to, the following when overseeing the associated property:

- Execution of new leases

- Authority to grant tenant rent relief

- Collection of rents

- Oversight of insurance coverage and bank accounts

- Day-to-day property management or oversight of property management services

- Payment of bills for utilities and contractors

- Repair of deferred maintenance

- Correction of life safety issues

As referenced earlier, under certain conditions the receiver may also direct the sale of the property and there are distinct advantages to doing so. If the subject loan is burdened with a high prepayment penalty, longer term or defeasance, the receiver can sell the property with the assumable loan in place. When a property or note is sold through receivership, the lender is also kept out of the chain of title, thereby reducing its liability for potential construction defects or other issues. The receiver can also be empowered to widely market the property or loan, either selling the property/loan themselves or hiring a knowledgeable third-party broker to help drive the highest possible sales price. In the case of property conversion, and particularly where the use of TIF funds are involved, a receiver’s local knowledge, experience, business and government connections can help deliver superior sale outcomes for lenders.

While their use is clearly on the rise, office-to-residential conversions are just one of many avenues available to distressed office property landlords and their lenders in the current environment. The utilization of a court-appointed receiver in conjunction with any such conversion efforts or other chosen solutions brings with it the solid assurance that collateral is being safeguarded, while also minimizing other risks to both the lender and property. This enables the lender to focus on resolving the loan via the most optimal means available to them in the most expeditious timeframe possible.

Hilco Real Estate is the one of the industry’s most respected and accomplished authorities on real estate repositioning and disposition, advising and executing strategies to help both healthy and distressed clients maximize the value of their real estate assets. Engaging our team for performance of Rents and Profits Receivership, Equity Receivership, Post Judgement Receiverships and Federal & Regulatory Receiverships

has proven successful for a wide range of property owners and their lenders seeking to explore evolutionary ideas in an effort to minimize downside and maximum upside potential. Hilco Real Estate executives bridge the gap between traditional real estate experts and formal business consultants, bringing an understanding of how to evaluate assets, structure a plan of attack, and effectively execute said plan. We encourage you to reach out to us today to discuss how we can help stabilize and add value to borrower properties within your existing office space portfolio through receivership, conversion or other efforts.