A Mattress Industry Primer for Asset Based Lenders

The mattress industry is an ever evolving space in terms of both the competitive landscape and product offerings. Historically dominated by a few major players, more recent disruptors include bed in a box/bag entrants, some of which have a physical showroom presence, as well as drop ship/pure play ecommerce companies.

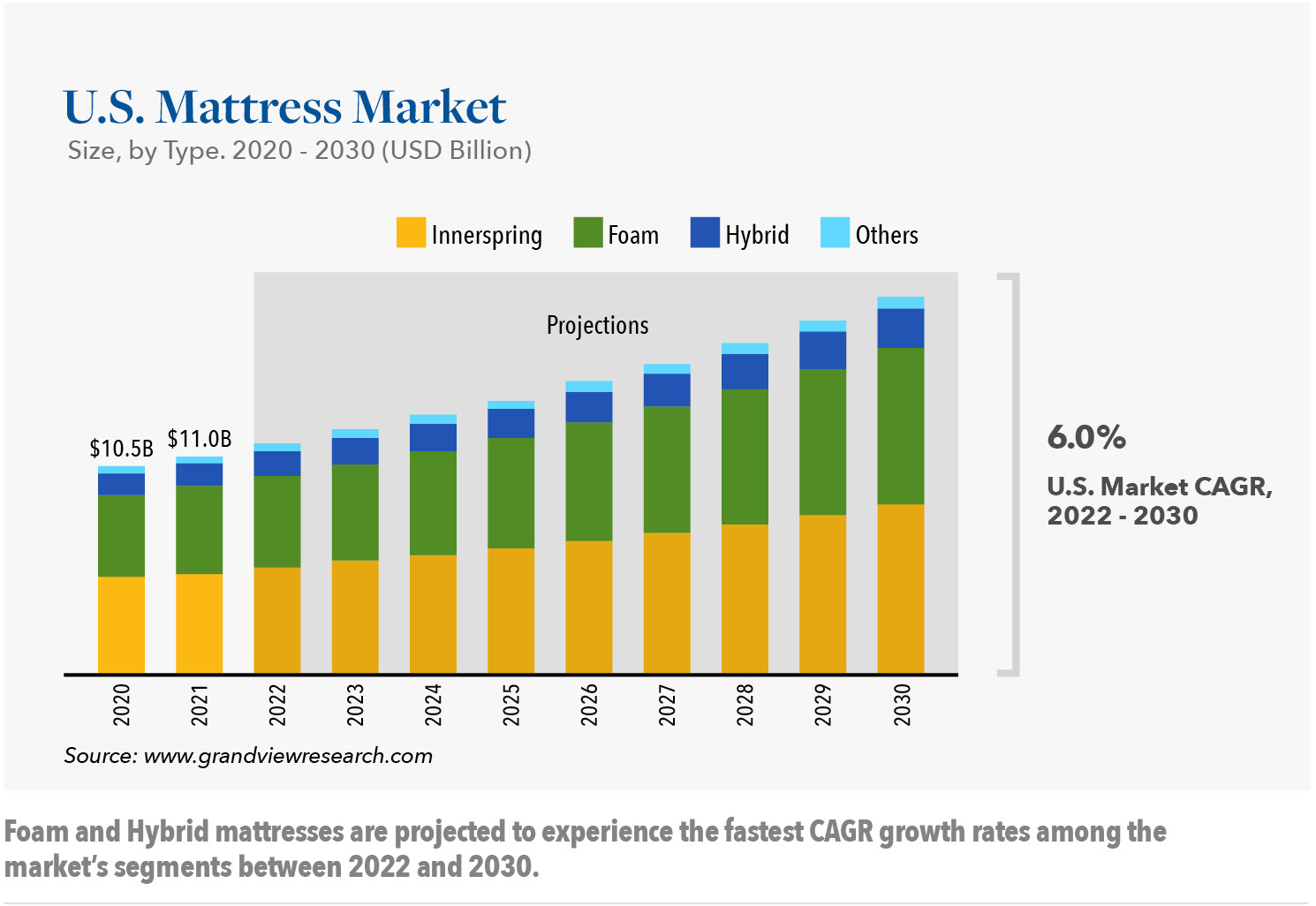

From a product standpoint, inner spring mattresses ruled the market until 1991, when Tempur-Pedic, Inc. first introduced products featuring memory foam in the U.S. Hybrid models (a combination of spring and foam) are a newer concept that has been gaining traction among users. Beyond mattresses, additional complimentary offerings in this space include items such as pillows, protectors, frames and bases, sheets, duvets, and other sleep-related accessories.

During the early stages of the pandemic, the mattress industry benefited from a concentration of consumer spending for in-home purchases as well as a higher rate of individuals moving into new homes. There was also a direct correlation between the timing of stimulus payments and the purchase of large-ticket items such as mattresses. Given more recent macroeconomic conditions, many such consumer purchases have become more sales event-driven and, at the same time, there has also been a shift toward more spending of discretionary dollars in areas such as international travel. This, of course, has been to the detriment of hard goods. Additionally, rising interest rates unfavorably affected mattress companies from a credit borrowing standpoint, as well as the expense tied to customer financing promotions, which is very common in this industry.

There are multiple areas of consideration that Hilco recommends the lender understand and monitor when it comes to new credit evaluation and existing collateral monitoring. These factors will influence the disposition strategy and recovery values in an appraisal report.

Sizing and SKU Count

Mattress sizing is generally consistent between companies and commonly includes Twin, Twin XL, Full, Queen, King, and California King. From a sales perspective, the Queen mattress has remained the most popular size for many years, oftentimes followed by the King size. Twin size is typically more popular than both Full size and California King. Hilco recommends that the lender monitor historical sales concentration by size and how it correlates to on-hand inventory by size to identify any potential imbalances that may exist. Beyond mattresses, the sizing of corresponding bedding accessories (e.g., sheets, duvets, and foundations) should also be monitored.

In addition to sizing, there are often varying price points and firmness levels (e.g. soft, medium, firm) by brand. Beyond mattresses, product such as pillows will have a standard and king size, as well as different lofts and firmness levels. For multi-brand companies, these product variations are further multiplied by the number of brands offered. Collectively, these factors can quickly build a company’s SKU base; the individual SKU performance should be monitored by the lender to identify any areas of underperformance.

Bed to Frame/Base Ratios

Bed frames and bases are potential add-on items, but the attachment rate is not a 1:1 ratio. These items are also size dependent. The challenge with these product types is that once the mattress inventory on hand is depleted in a liquidation, any remaining bed frames and box springs/foundations would present significant challenges to sell through, as these items are not an independent customer traffic driver. Accordingly, the levels of these items should be monitored for imbalances.

Product Turnover

Mattresses sourced domestically are procured by retailers on a just-In-time basis. This, in turn, drives rapid turnover rates for the mattress category. Traditional mattresses are generally domestically produced due to their large physical size, which makes them container transit inefficient. Bed in box varieties maximize cube space and are more often an imported product. Therefore, bed in box imported mattresses will have a longer lead time and lower overall turnover rate unless the product is drop-shipped from an international vendor direct to end consumers. While mattress inventory turns quickly, corresponding mattress accessory items tend to be imported and slower moving. This, coupled with the fact that accessories are add-on items as opposed to the primary purchase, creates added risk in a liquidation, particularly for the residual accessories on hand after the mattress inventory is sold off; this drives greater discounting for accessories. In addition to the recovery percentage, the liquidator will also isolate historical sales between mattress and non-mattress inventory when determining the expected multiplier for a sale due to the aforenoted operating metric differences. The need-based nature of the mattress and its long replacement cycle (consumers replace mattresses every 10 years, on average) will also challenge the multiplier. The average order value of a mattress is significantly different as compared to a non-mattress item and units per transaction tend to be one unit for mattress, but multiple units for non-mattress items. These factors also influence multiplier and recovery assumptions.

Anti-Dumping Policy

“Dumping” occurs when a product is sold into the U.S. at a price point that is far below comparable market pricing. This is a practice by manufacturers in various countries done to gain market share and price out domestic competition. The seller may be compensated by the local government in this process. To counteract this strategy, the U.S. imposed duties on product imported by countries determined to be participating in this pricing practice. China was an initial target of these actions, followed later by countries such as Cambodia, Malaysia, Indonesia, Vietnam, Serbia, Turkey, and Thailand. The imposed duties are paid by the importer and can reach over 100% in certain instances. As expected, the addition of a material duty to a product affects the overall procurement cost and consequently the decision-making criteria of the buyer. As duties are imposed, the buyer may begin to search out alternate suppliers in other regions. For borrowers importing product, the lender should monitor the country of origin, any applicable duties imposed and changes in those duties, and any transitions to alternate vendors located in other parts of the world.

Delivery

Flat-packed mattresses are large and difficult for a consumer to cash and carry. Therefore, home delivery is a common practice in the industry. Due to competitive pressures, some mattresses may come with a free delivery option along with the removal of an old mattress, while in other instances companies may use customer delivery as a profit center. In either scenario, delivery adds incremental cost to the seller. Free threshold and white glove, third-party delivery service options are now common across the industry, but bed in a box has allowed more customers the ability to cash and carry product home as the boxes are designed to fit in most mid-to-larger sized vehicles. The lender should be aware that because the market has set an expectation of rapid delivery to customers, there is a potential need to maintain inventory at multiple DCs depending on the company’s geographic sales footprint. In a liquidation scenario, delivery is considered essential and the costs related to the delivery are incorporated into the liquidation expense structure of the appraisal.

Financing

Common within the mattress and the furniture industries is the use of various financing programs, including popular multi-year, interest-free, and rent-to-own options. Furniture retailers, which benefit from large total transaction sizes compared to mattress specialty retailers, historically encouraged buyers toward longer-term financing options. The higher price point of the product fuels the need for these types of offers. Retailers may tweak the terms of their programs by increasing the minimum purchase requirement to finance or changing the number of years for financing to offset these costs. The lender should monitor whether the liability related to these programs is held internally or by third parties and should assess the monetary effect on the company from the cost of such programs, particularly in the current elevated interest rate environment. Customer use of these programs should also be monitored, including whether that use has increased in the current economic environment and if the credit criteria conditions of the financing companies (e.g., credit score, approval rate, approved credit amount, and overall customer default rate) have been affected by the current economy. Without a financing option in a sale scenario, the liquidator would need to provide incremental discounting incentives to entice customers to purchase.

Sales Commissions

Sales associates at mattress and furniture retailers may work on a commission basis. While commission structure will vary from company to company, it may account for a material portion of payroll related costs. Commissions may also vary by product, achieved margin, or sales. Continuation of the sales associate commission program(s) in place, and the associated expense, are considered within the appraisal analysis. Depending on the company’s commission payment plan, which may be influenced by potential return activity, the timing of the payment for an earned commission to an employee may be delayed by a few weeks. During this gap period, there is an unpaid commission liability for the company. The need to retain key sales associates during a GOB or store closing sale is critical and therefore the lender should consider any unpaid commission liability. Daily customer count is typically low, but a mattress retailer is viewed as a destination thereby positively influencing conversion rates. Mattress purchases therefore require an increased level of sales associate engagement.

Seasonality

Unlike retailers in other industries, a customer’s need for a mattress is not significantly correlated to a specific time of year. Spring through fall may experience a slight uptick in need due to a higher level of customers that are moving; however, this sales demand is not pronounced. What does drive fluctuation in customer buying behavior are sale events that are popular in the industry and often center on holiday timeframes (i.e., Memorial Day and Presidents’ Day). Additionally, retailers will often offer promotions such as “King for a Queen” and “Free Adjustable Base,” which are effective in driving traffic. Because sales seasonality is expected to play a limited factor in a liquidation, the typical mattress inventory appraisal is based on a single selling recovery scenario.

Commodity Markets

The first cost for mattresses and adjustable bases is influenced by commodity markets. Changes in steel prices influence spring mattresses as well as adjustable bases, while foam mattresses are affected by changes in oil prices.

Competitive Market

The industry faces a high degree of competition across both brick and mortar and online. The bed in a box segment has gained numerous new competitors, including low-cost importers. There has also been consolidation within the industry. In May 2023, Tempur Sealy International, Inc. signed a definitive agreement to acquire Mattress Firm in a cash and stock transaction valued at approximately $4.0 billion. The transaction is expected to close in the second half of 2024, subject to the satisfaction of customary closing conditions (e.g., applicable regulatory approvals). Other noteworthy events this year have included Serta Simmons Bedding, LLC filing for Chapter 11 bankruptcy in January and 60-year-old Klaussner Furniture Industries, Inc. shuttering its operations in August.

Floor Models And Preowned Inventory

The lender should understand the borrower’s approach to floor models, including whether these mattresses are part of inventory or are recorded as an expense. If the floor model mattresses are part of inventory, the lender should understand whether the mattresses are costed at the same rate as a first quality good. Often OEMs will sell floor models into the retail sector at 50% off the historical wholesale selling price. Therefore, the cost basis will not be the same for a retailer’s floor models versus its first quality mattresses. Given the industry’s extended return window offering (one hundred days is a common mattress return window), these companies are subject to customer returns that need to be carefully inspected and sanitized when deemed saleable. Any pre-owned product available for sale has to be identified to the customer as such. Certain mattress companies will donate/destroy floor models and returns, while others choose to sell these products. In cases where these products are to be sold, metrics, such as achieved margin, should be closely monitored and the amount of return inventory on hand should be understood. This includes bifurcating evaluated versus quarantined returned inventory for inspection, as well as quantifying the associated costs to sanitize product and the expected timeframe for making pre-owned product available for sale. The timing of floor resets and new model introductions should also be understood.

Macroeconomic Factors

Key macroeconomic factors that influence the mattress industry include gross domestic product trends, new housing starts, existing homes sales, and the Case-Shiller Price Index for housing. Key life events such as getting married, moving to new and larger homes, raising children, and even divorce can influence mattress purchasing behavior. Accordingly, the lender should monitor the current housing market, including changes in new and existing home sales activity. Interest rate activity should also be monitored based on the fact that consumer financing is common for mattress purchases due to their high price point.

At Hilco Valuation Services, we are currently engaged in multiple valuations and are having informative conversations with our industry contacts and partners across the mattress industry on a regular basis. Whether you are working with a prospective mattress industry borrower or have current industry exposure within your portfolio, the more you understand about those businesses, the better. This is particularly relevant in the current, uncertain climate. As information on a borrower is gathered, we recommend that lenders share these details with Hilco or the selected appraiser prior to a formal valuation engagement. Doing so will facilitate a more efficient and effective process in areas such as initial recovery guidance and general report setup recommendations. To learn more, we encourage you to reach out to our team at Hilco Valuation Services today. We are here to help!