Aftermarket Replacement Parts, a Counter Cyclical Industry

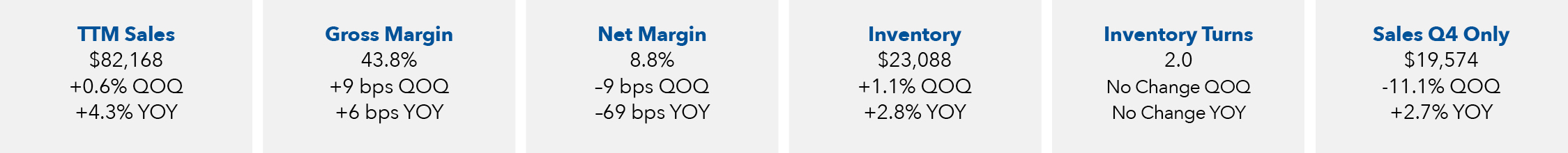

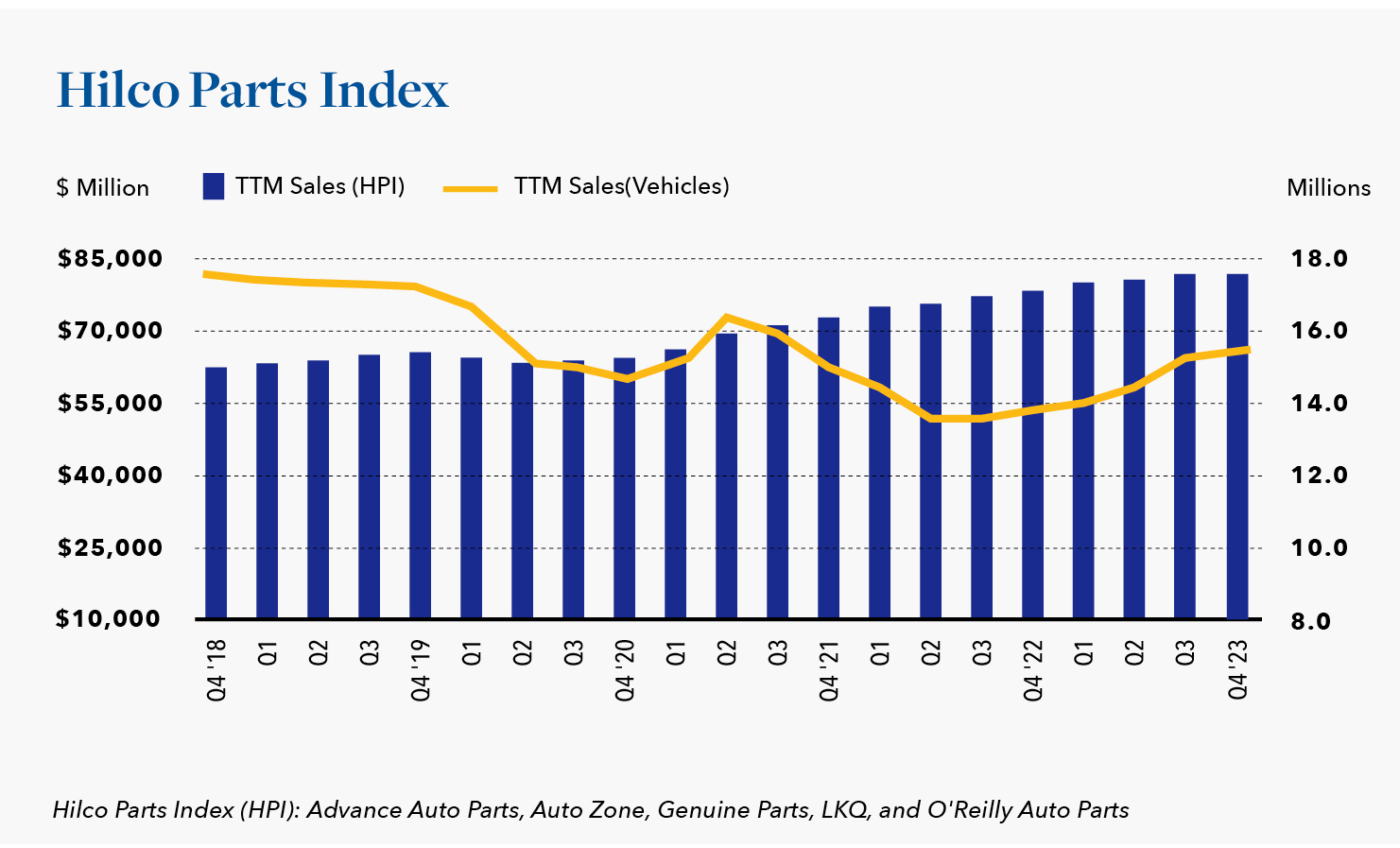

March 26, 2024 – The Hilco Parts Index (HPI or the Index) is a graph of the trailing twelve month (TTM) sales for five of the largest retailers of replacement parts for light-duty vehicles. Typically, the accompanying chart maps the Index against the industry’s inventory turns which are reliably 2.0, quarter after quarter. For a change, this month the Index (the blue bars) is being charted against the trailing twelve month sales of new light-duty vehicles (the unpredictable heavy grey line). Light-duty vehicles (LDVs) being an industry term for data sets that include pickup trucks, vans, and sport utility vehicles, as well as automobiles.

The 2019 calendar year marked the end of a five-year run of annual sales in excess of 17 million vehicles and the beginning of a five year period that can be described as an epic “roller coaster ride.” The pandemic that first gripped the global economy in 2019 tightened its grip in the U.S. in the first quarter of 2020 and the sale of LDV’s, like most other products, went into a free-fall for several months before it mounted a promising recovery at the outset of 2021. The recovery in LDV sales was short-lived as the pandemic shock uncovered fatal weaknesses in the global supply chain, particularly the production of semi-conductors. The contraction this time was not as severe as the first but it lasted longer, and sales slumped deeper than the first shock. The LDV market bottomed mid-2022 and has been recovering at a slow, steady, sustainable rate since.

Using the Hilco Parts Index as its proxy, compare the reaction of the replacement parts market to the violent reaction of the LDV market just described. When LDV sales plummeted in 2020 in response to the global pandemic, the dip in replacement parts (HPI) is barely perceptible. When the LDV market skidded for a second time in 2021 after a brief recovery, the impact on replacement parts (HPI) is even less perceptible. This disconnect between the two segments of the industry, new vehicle sales and the sale of replacement parts, is what some economists refer to as the counter cyclical nature of the replacement parts market. The average useful life of a new vehicle is well over 12 years and every year the vehicle remains in service it will generate demand for replacement parts, particularly from year’s five to eight, referred to as the “sweet spot”. According the Department of Transportation, there are nearly 300 million light-duty vehicles currently in operation in the U.S. When LDV sales dropped by 2.5 million vehicles in 2020, it represented a 15% decrease from the prior year. For the the replacement parts market, the loss of 2.5 million vehicles represented less than a 1% decrease from the prior year (2.5 million ÷ 300 million).

Admittedly, this is a gross over simplification of the relationship between the two different segments of the industry (i.e. vehicles sales versus parts sales). There are many other factors besides the underlying size of the U.S. vehicles in operation (VIO) that contribute to the stability of the replacement parts market. Equally important as the VIO is the non-discretionary nature of the sales demand for replacement parts. In fact, the mild dip in replacement parts in 2020 is an indication of how little of the demand for replacement parts is discretionary. In the event of an economic slowdown, purchasing wiper blades can be delayed, or consumers may opt to buy at a lower price point, but most car repairs cannot be delayed for long given how dependent most people are on personal transportation for their livelihood.

About the Index: The Hilco Parts Index is comprised of five publicly traded companies that distribute aftermarket parts, namely Advance Auto Parts (Advance), AutoZone, Genuine Parts (NAPA), LKQ, and O’Reilly Auto Parts (O’Reilly). Advance, AutoZone, NAPA, and O’Reilly are the four traditional parts distributors in North America with strong commercial (do-it-for-me or DIFM) and retail (do-it-yourself or DIY) programs. LKQ is largely a distributor of aftermarket collision-specific parts and recycled (used) parts.