Effective Asset Disposition Remains a Critical Need for Stressed European Steel & Non-Ferrous Plant Operators

In this European Manufacturing update article, we discuss the continued prevalence of high energy costs and the resulting output decreases that have caused European steel companies to close their factories at a rate of approximately five times greater than what is currently occurring in the U.S.

Last summer we provided an update on the evolving industrial/energy dynamic that was taking place in Europe and how the monthly energy costs to power European industrial facilities had increased to nearly as much as what they had previously been for an entire year of service. Unfortunately, we must report that these conditions have not eased and we expect that more large steel, chemical and other plants will be closing through the spring, summer and perhaps the fall months of this year. To prevent this, many are actively investing in operational changes to reduce the amount of energy/gas they are consuming. These shifts include, but are not limited to, eliminating certain product production, retooling plants outside of Europe and shifting production to those locations, and downsizing exiting European facilities and production to achieve lower overall energy unitization.

Beyond these steps by manufacturers themselves, many of the emergency measures and policies implemented at the governmental level to ease the burden on the manufacturing sector have been largely unsuccessful. This has been exacerbated by the pressures of weak domestic demand and further amplified by the growing popularity and low cost of steel imports from Asia as well as the continued need for countries including Germany, France and Italy to source energy from locations other than Russia — largely now via the U.S. and Middle East. While Liquified Natural Gas (LNG) would seem to present a reasonable option under these conditions, the cost to ship and convert it for use is high, limiting the practicality of doing so in the majority of instances.

In addition to unsustainable energy costs, industrial manufacturers in the EU also face a mounting backlash associated with both natural resource consumption and the pollution generated as a byproduct of their production. In some cases, they are even being told by prevailing government bodies to close down plants when they are unable to meet requirements. We expect to see more smaller plants closing this year and even some of the larger corporations may decide to close smaller plants on a case-by-case basis as a result.

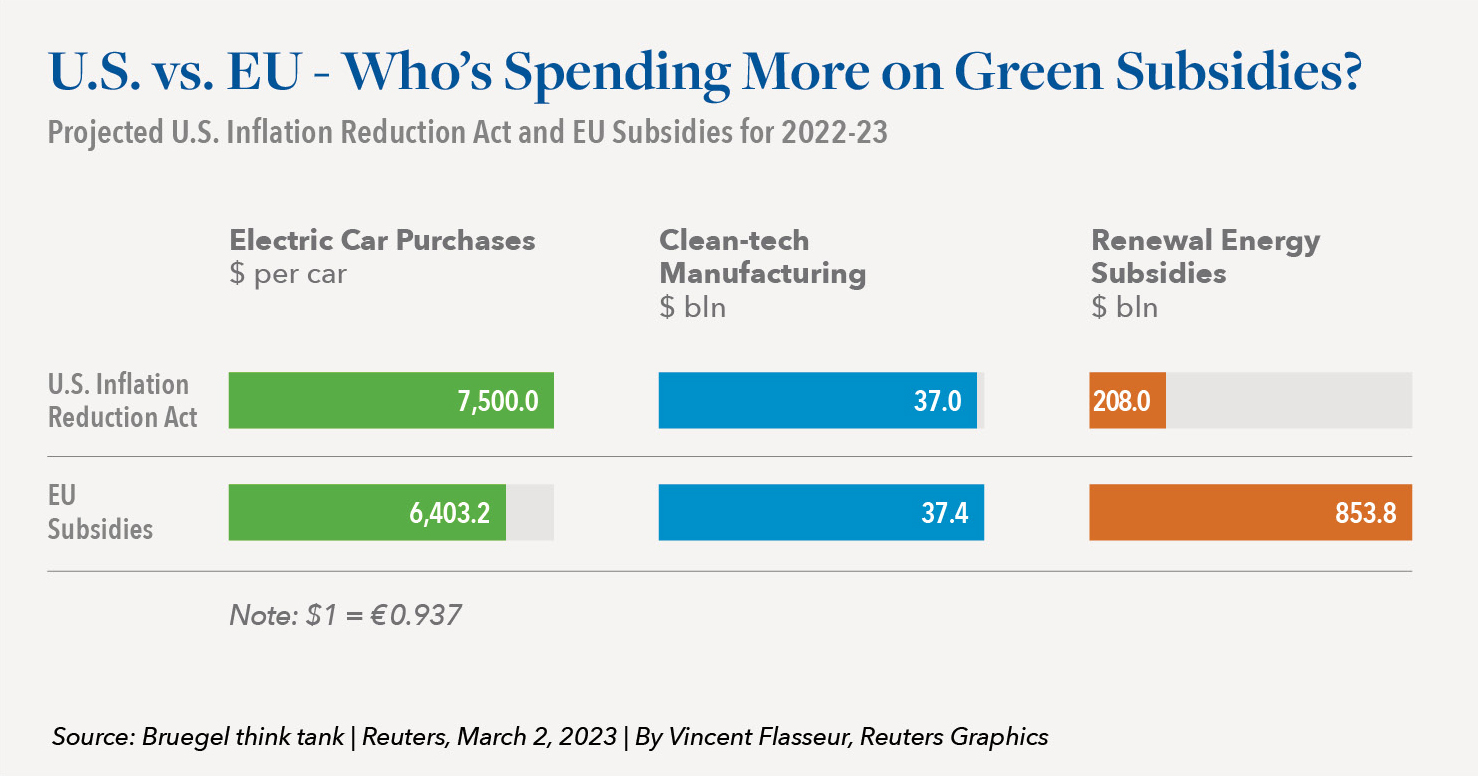

Overall these rules and regulations, are leading to an increasingly pervasive attitude of deindustrialization. For example, we are seeing companies such as Dupont, a relatively new name in Europe, experiencing difficulties operating in this highly charged environment and deciding to shift production back to the U.S., Asia and North Africa where their own, or other partners’ plants are able to accommodate that capacity. Seamless pipe manufacturer, Vallourec, for example has completely withdrawn from the European market, instead deciding to manufacture exclusively in the U.S. Additionally, we are seeing the semiconductor and automotive industries receiving incentives from the U.S. to open or expand plants there. This is creating a compelling case for relocation among those facing high regulatory costs and impacts throughout Europe.

Importantly, some EU countries are now providing substantial subsidies to assist steel manufacturers in areas such as shifting from blast furnaces to electric arc furnaces, which are more efficient and can be less harmful to the environment. Doing so requires making steel in a different way, most typically using hydrogen vs. coal. ArcelorMittal and Thyssenkrupp Steel, for example, have received significant subsidies specifically for use in easing the cost burden associated with converting those plants for this shift in production method. The subsidies are in many cases substantial, equating to roughly 50 percent of the total investment required to undertake conversion.

If there is a positive to this story right now, it is that while worldwide steel prices have ticked marginally lower in recent months, they have not been impacted significantly by the developments cited above. That said, based on our longstanding reputation throughout Europe and successful efforts on behalf of companies such as Thyssenkrupp and others during 2023, we are being approached on a weekly basis in 2024 by companies with industrial asset disposition needs that are being driven by the current environment.

Over the past three years, Hilco Industrial Acquisitions has sold more than 200,000 tons of equipment. Our experienced project management and sales teams continue to handle highly diverse and complex engagements across a wide range of industries and markets around the world, leveraging a proprietary database to track and benchmark the sale price of machinery and equipment across virtually every industry and sector. Our dual ISO Certification (ISO 9001 and ISO 45001) ensures essential quality and safety delivery for our clients. Additionally, we invest our own capital to acquire assets upfront and project manage deals directly, with a focus on private treaty sales to industry-specific end users vs. auctions to sell acquired assets.

Because we already know your industry, speak your language and understand your challenges, we can ensure a level of accuracy, efficiency and delivery of maximum monetization value for you and your organization that others cannot. With this in mind, if your company or a company within your investment portfolio is currently involved in steps toward a Steel or Non-Ferrous plant closure, or is embarking on any other type of transaction involving disposition of industrial plants or their assets, we encourage you to reach out to our experienced team to discuss how we can assist. We are here to help.