Effectively Navigating the Cannabis Real Estate Market in 2023

In this article, we address important considerations for those involved in acquiring, selling or leasing real estate associated with the evolving U.S. cannabis market.

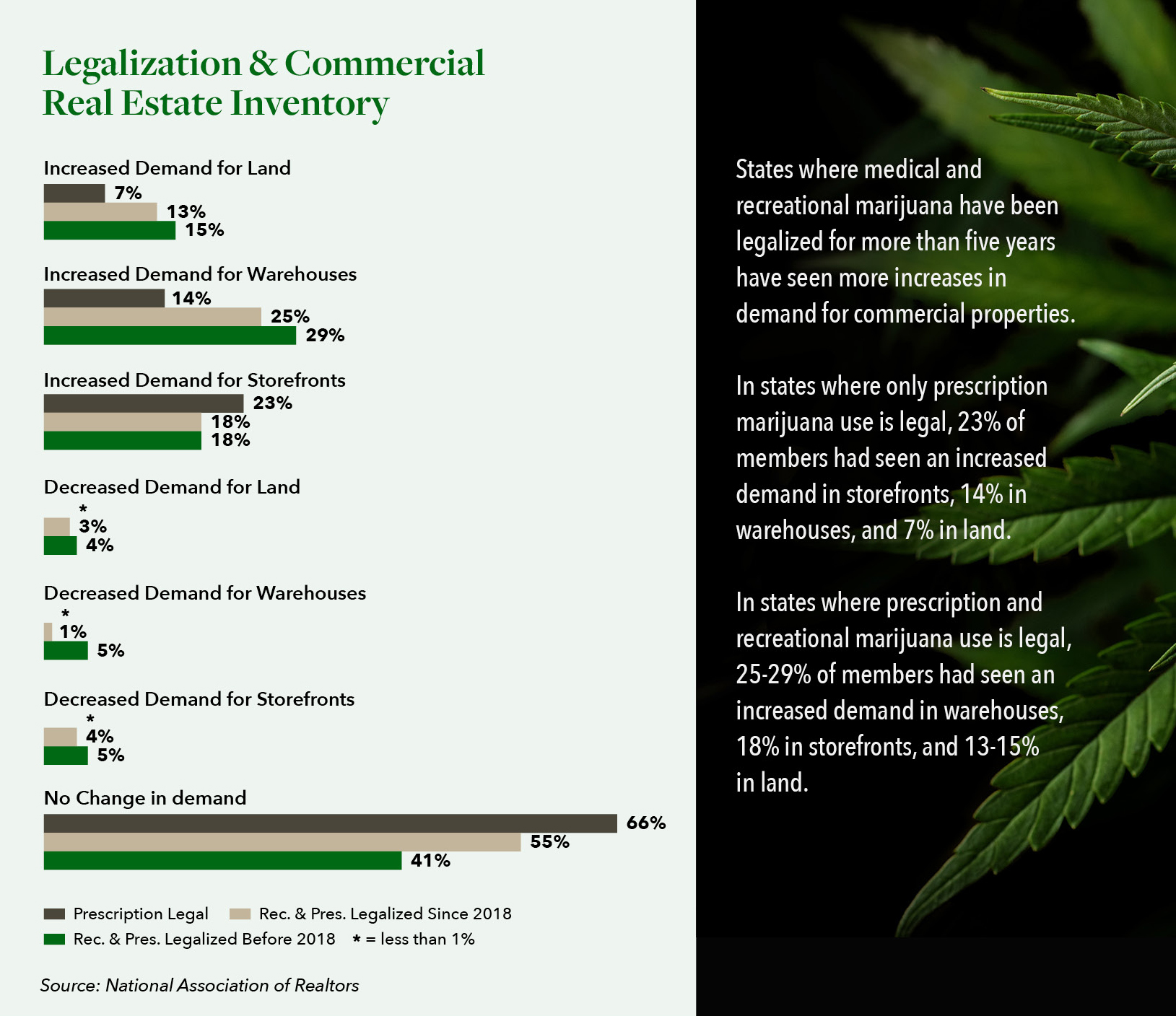

The U.S. cannabis real estate market has experienced growth and transformation as legalization and decriminalization of cannabis for medical and recreational use has expanded. Importantly, there are a variety of important considerations that the investment community, developers, and others involved and interested in the market should be aware of right now.

Primary among these is the importance of recognizing and addressing the nuances associated with the geographic application of regulatory requirements on the industry and its participants. Based on proximity and cross-border competition, in certain markets it is critical to look at both the U.S. and Canada and how the legal and regulatory frameworks surrounding cannabis differ and impact business for operators in the two countries’ impacted states and provinces. Being thoroughly familiar with local and nearby competitive market regulations, zoning laws and licensing requirements is critical for both real estate developers and investors to ensure compliance and avoid costly and time consuming legal roadblocks. These considerations should also extend to sustainability and environmental impact. Cannabis cultivation, for example, requires significant resources, including energy and water. Sustainable practices and energy-efficient infrastructure can help reduce the environmental impact of cannabis operations and, without question, will continue to be increasingly important to both regulators and communities across the country in the coming years.

More so than most business types, zoning regulations play a pivotal role in determining where cannabis-related businesses can and do operate. These regulations often dictate the proximity of cannabis facilities to schools, residential areas, and other “sensitive” locations. Identifying suitable properties that meet zoning requirements specific to an area targeted for development is essential for successful real estate ventures within the Cannabis market. Having a solid grasp of the operating impact of such restrictions as well as the overall level of demand and saturation for cannabis products in locations being considered for development/investment is essential, as these can have a significant impact (either positive or negative) on both the value of real estate and the potential for return. Lastly here, it should be noted that public perception of cannabis and those who operate cannabis facilities varies. We advise investors and developers to carefully consider community sentiment when making decisions about locating their own, or leasing to, operators. Listening to and earnestly working with community groups, businesses and individuals can often diffuse and sufficiently address early concerns, while also building trust and open lines of communications that will be important in the future.

While much of the public focus is on the consumer-facing aspects of the cannabis business, the industry functions thanks to work performed at and across numerous types of properties. These include those that house cultivation facilities, processing centers, distribution hubs, research laboratories and, of course, dispensaries. Each of these different property types come with unique infrastructure and security needs and requirements. Each also present opportunities for different types of investment and development. While dispensaries may sit on a sliver of an acre in a metropolitan area, cultivation sites often occupy dozens of acres in rural regions. While this diversity of entry points creates a greater expanse of opportunity, it also necessitates that investors carefully tailor their strategies and funding to properly suit the specific needs costs associated with starting up and running the type of cannabis businesses they aim to support.

Security is a top priority for cannabis businesses due to the nature of the product and the potential risks associated with it. To comply with regulations and safeguard their supply chain, operators need to meet stringent security standards, including video surveillance, access control systems, and alarm systems. The capital and operating costs associated with meeting these requirements and protecting the valuable assets, including but extending beyond finished and unfinished inventory) have often been underestimated during the early years of Cannabis expansion in the U.S. and Canada. Theft of, and damage to, cultivation equipment, laboratory instrumentation and production equipment, can create costly setbacks for businesses with multi-millions dollar investments on the line. Real estate site selection, including thorough diligence pertaining to historic crime trends associated with locations under consideration can serve to limit downside risk in this regard.

The industry has also faced challenges in accessing traditional financing due to continued federal restrictions in the U.S., which to some degree remain the result of a lingering stigma associated with Cannabis. While some small banks will lend against cannabis real estate right now at more reasonable rates, they tend to have minimal bandwidth and are hard to find. Of the financings that are taking place, we’re seeing that most at the present time are private debt fund deals at 16%+ rates. Not surprisingly, with traditional banking sources unavailable, and banking transaction channels highly limited, those entering or expanding across the industry are for the most part turning to alternative funding sources, including private equity, venture capital, and specialized cannabis-focused funds, to secure financing for their real estate projects. In each of these instances, timely and accurate real estate appraisals are essential to the process. Other important considerations and watch out areas for businesses and their lenders based on current laws and requirements include but are by no means limited to the following:

- Because the Cannabis industry remains illegal under federal law, and banks must comply with federal regulations, any party involved in the industry that seeks to secure a leased property with an existing loan on it – particularly from a larger bank – is likely to encounter complications when attempting to do so.

- Although cannabis is legalized in several states, the fact that it remains illegal under federal law means that transporting it across state lines can result in federal criminal prosecution. This presents substantial challenges for cannabis businesses operating in multiple states that are seeking to scale.

- Due to the fact that federal law prohibits the sale as well as the possession and use of cannabis in all its forms, the major payment networks do not allow cannabis purchases using credit cards. This adds complexity for consumers and has the potential to limit sales volume.

It is also important to note that for those currently, or seeking and in a position to, lease their properties to cannabis operators, establishing strong tenant relationships is imperative. Ensuring the success of these relationships starts right at the beginning with comprehensive lease agreements that do not leave any room for misinterpretation or dispute, and a thorough understanding of a leasing business’ specific needs. Identifying and vetting qualified candidates is also essential to ensuring successful leasing outcomes. As with identifying appropriate properties for acquisition or selling properties to Cannabis operators, engagement of an experienced and proven real estate partner that is well versed in the Cannabis industry can contribute to successful leasing outcomes as well as long-lasting, mutually beneficial lessor/lessee partnerships, and profitable exit strategies. With this in mind, we encourage you to reach out to our experienced team to discuss your current needs and challenges. We are here to help.

Hilco Real Estate is the authority on real estate optimization, repositioning and disposition. We advise and execute strategies designed to help clients maximize the value of their real estate through a range of core services including: Real Estate Appraisal, Lease Advisory, Asset Sales, Asset Management, and Capital Deployment. Our team’s cannabis market experience can assist both new and experienced investors to achieve growth and optimize return. Vast knowledge and experience in real estate appraisal sits squarely at the center point of our efforts on behalf of clients in this and other industries, where we provide fee-owned and leasehold valuation services and cost segregation analysis conducted by a seasoned staff of analysts and appraisers. When/where appropriate, our valuations are subjected to a reality test by Hilco Real Estate’s property disposition and acquisition experts, who review and assess valuations as if they were ultimately responsible for marketing the asset or considering its purchase.