Global Supply Chain Update Q1 ‘24

This article is our latest installment in a regular review of key developments across all facets of the global supply chain.

SUPPLY MARKET INDICES

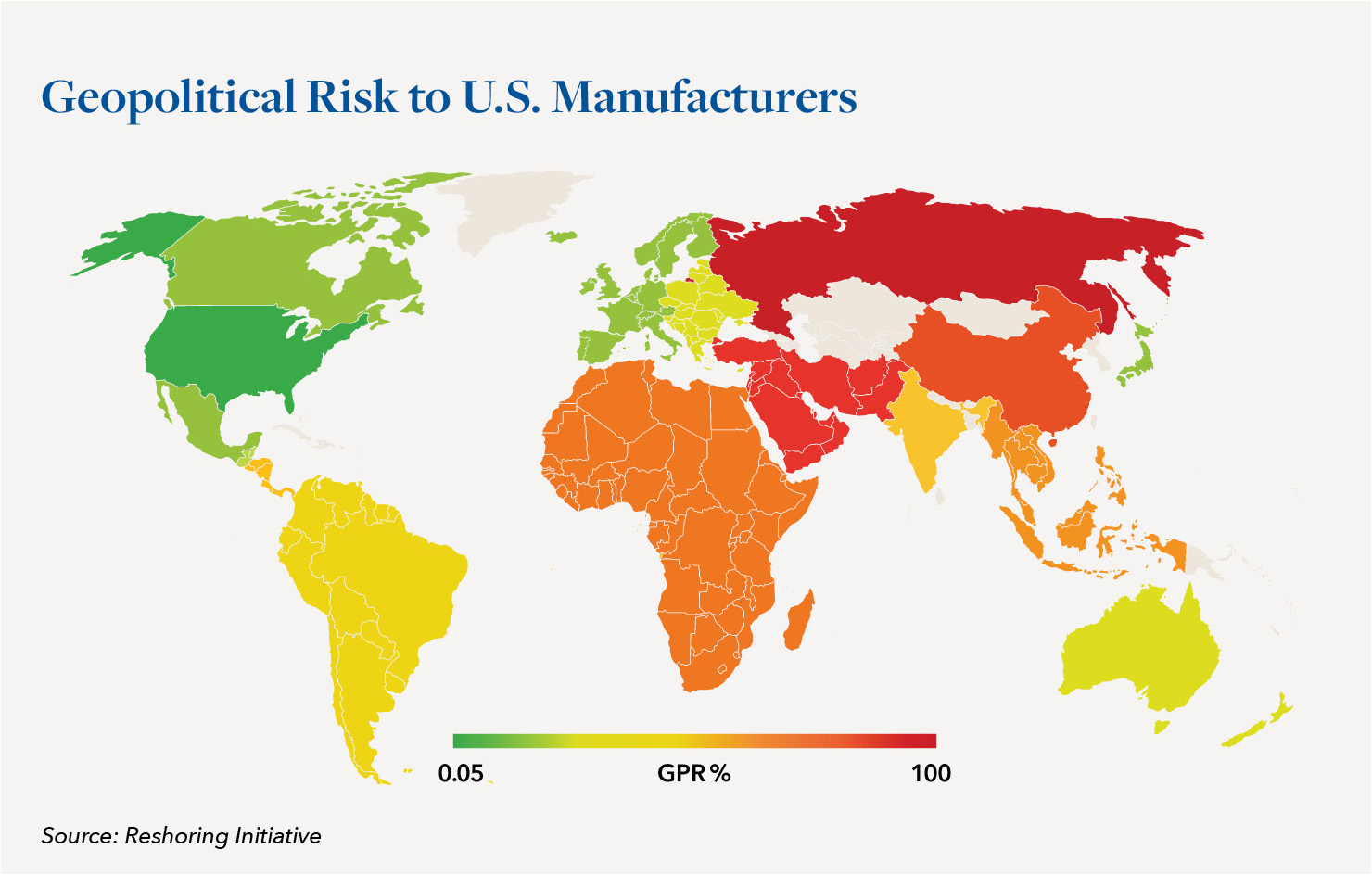

The move to re-shore or near-shore operations has accelerated in recent years to support greater supply chain resiliency. A recent study by the (US) Reshoring Initiative found that geopolitical disruptions are driving companies to reevaluate their supply chain priorities. COVID shutdowns, the wars in Ukraine and Gaza and increasing tension over the Taiwan situation illustrate that it is well past time for companies to evaluate reshoring and nearshoring as insurance against potentially catastrophic disruptions.

The Reshoring Initiative study found that the main drivers for reshoring were geopolitical risk exposure, cited by 48 percent of respondents; supply-chain resilience, 34 percent; closer management and oversight, 33 percent; tariffs and freight costs, 27 percent; proximity to customers and domestic markets, 22 percent; and brand image, 21 percent. The Geopolitical Rick (GPR) Index is calculated based on the number of negative geopolitical news reports for that country compared to a base year. US Companies should make a concerted effort to avoid suppliers in those countries deemed to be high risk.

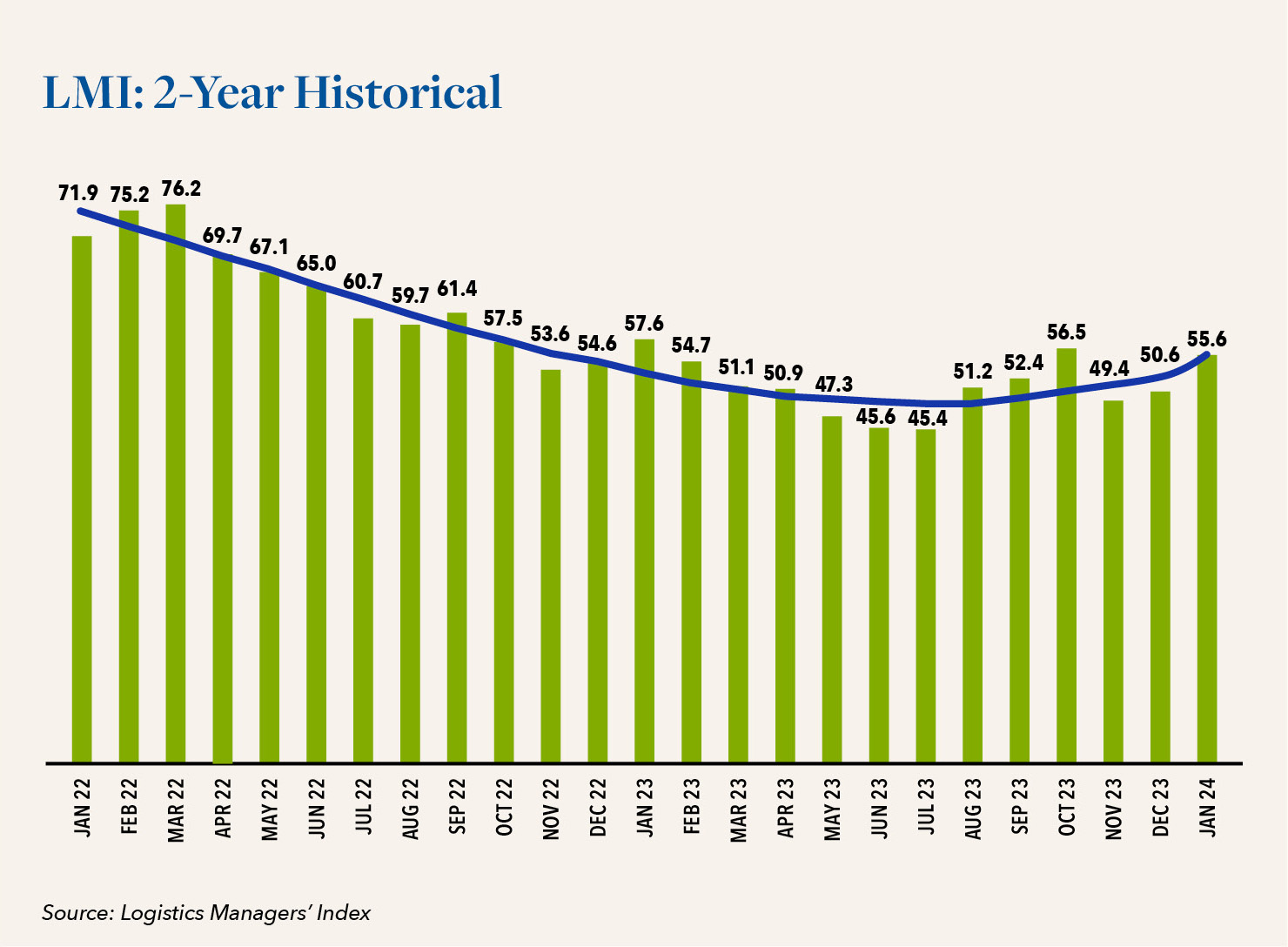

Another gauge worth examining here is the Logistics Managers’ Index (LMI), a broad measure on the health of the industries that manage the storage and movement of goods. This score is a combination of eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices. The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding.

As indicated in the chart below, the rate of expansion had been slowing in 2022 from its peak and through 1H23 but has started increase in pace in 2H23 which indicates tightening capacity and increased pricing. Pre-Covid levels showed the LMI in the 55 range which is the current level followed by a dramatic increase to scores around 75 which reflected a logistics industry with very restricted capacity.

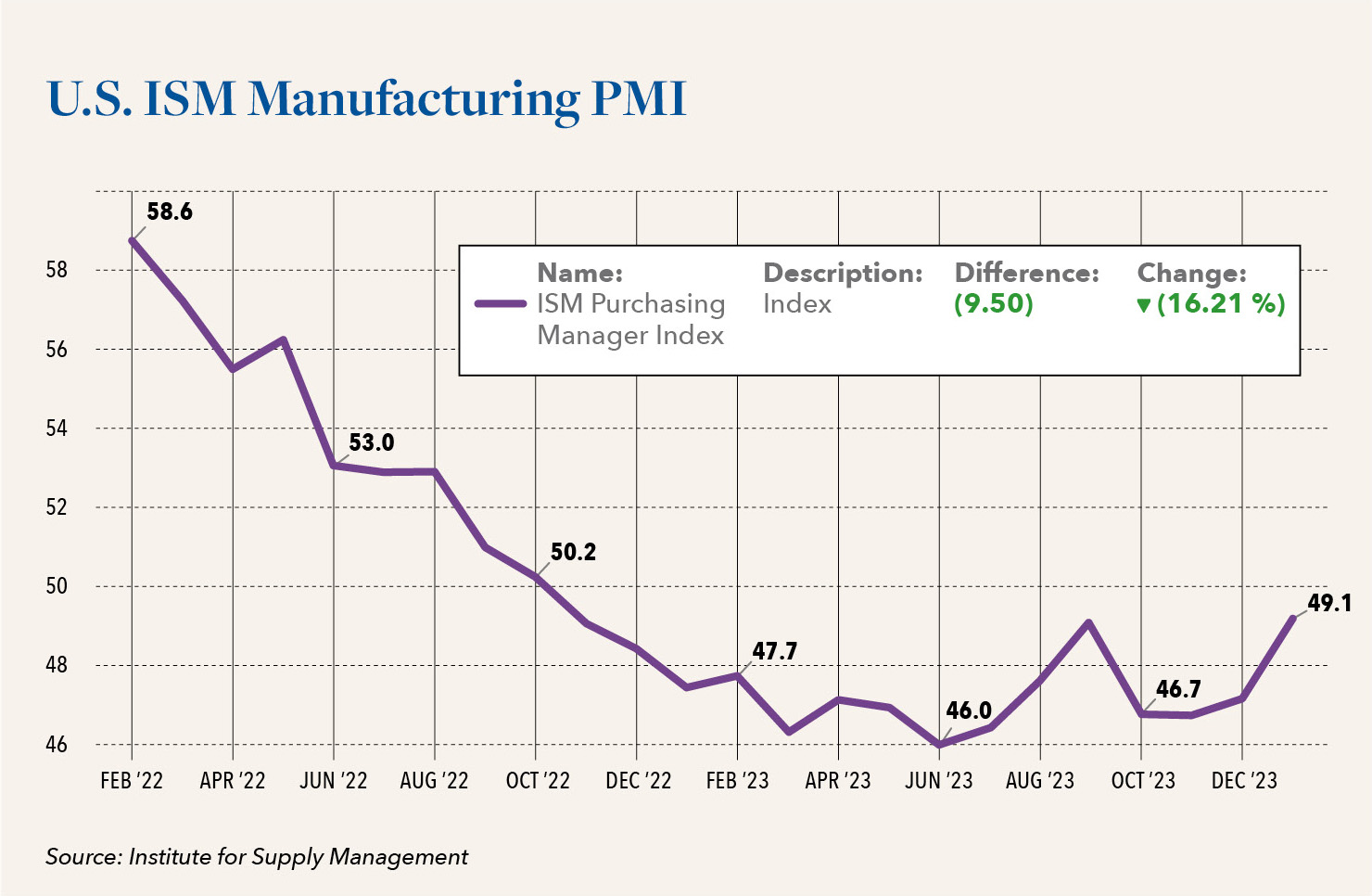

A third source of measurement, the ISM Purchasing Manager Index (PMI) is shown below which is calculated based on industry surveys on whether key supply chain parameters are expanding or contracting where >50 indicates an expansion.

The U.S. ISM PMI remained fairly flat during 2023, generally indicating stable pricing. January of 2024 showed a 2.5-point increase and the forecast for February is expected to be much the same driven by recent increases in metals, plastics, packaging, and other commodities.

Dun & Bradstreet recently released its Q1 2024 Global Business Optimism Insights report, which indicates a downturn in global supply chain continuity due to geopolitical tensions, trade disputes and climate-related disruptions in maritime trade causing both higher delivery costs and delayed delivery times. The report also indicates that businesses — having endured multiple challenges such as the pandemic, conflicts, and monetary tightening — are now adopting a growth mindset, as reflected in the overall optimism index. Key takeaways when comparing Q1 ‘24 results with those of Q4 ‘23 are:

- The Global Business Optimism Index increased by 6.6% indicating that businesses in advanced economies now feel more confident about their ability to absorb geopolitical and policy shocks, and are focusing more on growth opportunities.

- The Global Business Financial Confidence Index increased by 10.1% in addition, liquidity is expected to increase across firms of all sizes and businesses are more optimistic about their competitive positioning, particularly large firms with greater resources employed in liquidity risk management.

- The Global Business Investment Confidence Index rose 10.7% This reading reflects a high absolute level of optimism and a growing consensus that major central banks in advanced economies have reached a peak in the current interest rate hike cycle.

- The Global Supply Chain Continuity Index fell sharply by 6.3% with suppliers’ delivery time and delivery cost indices both deteriorating. Executives also report that climate-induced disruptions and trade disputes are contributing to decreased optimism. This index declined equally for both advanced and emerging economies, with each receding 6% from the last quarter.

SUPPLY CHAIN RESILIENCY

There is a distinct methodology for companies to pursue creating a more resilient supply chain. According to Adhish Luitel, Senior Analyst leading the Supply Chain Management & Logistics Research practice at ABI Research, “Managing day-to-day as well as looking out for things that could happen five or 10 years from now, that’s key,” He emphasizes that a company’s supply chain must evolve and improve over time to meet continuously changing conditions and minimize risk based on disruptive events. His strategies on optimizing a supply chain to create contingency plans are as follows:

- Increase supply chain visibility

- Increase inventory levels

- Create flexible production and automation

- Diversify suppliers

- Use data analytics

- Conduct supply chain audit

- Improve supplier relations

- Keep an eye on market trends

TECHNOLOGY

At present, there are many versions of what everyone is calling “AI” out there. The version that most of you have probably read about recently is called generative AI (GenAI). These are algorithms used to generate new content, including video, charts and graphs, code, pictures and text. Best-in-class companies are using AI to support fundamental supply chain processes are discussed in the Jan 2024 issue of PYMNTS. One example is, Dollar General is using artificial intelligence to optimize its fresh produce buying to improve their purchasing decisions and boost efficiency. And back in November, grocery giant Albertsons announced the rollout of AI-powered solutions from food supply chain technology company Afresh to improve decision-making around its meat and seafood inventory.

Overall, we are seeing businesses increasingly turning to AI to boost efficiency. For instance, research highlighted in the “Understanding the Future of Generative AI” edition of the “Generative AI Tracker®” revealed that around 40% of executives said there is an urgent necessity to adopt generative AI, and 84% of business leaders said generative AI’s impact on the workforce will be positive. Gartner surveyed 127 supply chain leaders in November 2023 on their plans to utilize GenAI within their function for 2024. An astonishing two-thirds of respondents plan to, or are already in the process of, implementing the technology, with just 2% of respondents having no plans to do so over the next year. The survey also showed that supply chain leaders are backing up their implementation plans with significant budget allocations. Supply chain leaders will allocate 5.8% of their budgets to the technology, as well as incremental employee spend to deploy GenAI. 65% of respondents said they will hire dedicated staff and experts to help deploy the technology in 2024. These investments will not only reduce manual work and allow departments to spend less time on tasks that can be consolidated or automated, but will also reduce spending, help streamline processes and better ensure that organizations meet employee and stakeholder needs while increasing profitability.

TRANSPORTATION

The disruptions being caused by the Red Sea crisis are extending delivery times from Asia to Europe and increasing costs dramatically. In its Jan 2024 issue, Freight Waves tries to quell some of this mild panic, referencing comments from transportation consultancy firm, Drewry Shipping Consultants, suggesting that the global market is so heavily oversupplied right now that it can handle these types of disruptions. According to Philip Damas, head of Drewry’s Supply Chain Advisors practice, the huge jump in spot rates following the Houthi attacks was partly related to timing. Red Sea diversions happened to coincide with a period of high demand as importers sought to load cargoes prior to the February Chinese New Year holiday break.

In the Jan 2024 issue of Supply and Demand Chain Executive, the view is for a stable US freight market in 2024. The publication observes that after three years of impacts from the pandemic and major external forces disrupting the freight market, 2024 may be the first-time carriers will get a sense of what the new normal will look like. Retailers are re-stocking inventories again, potential interest rate cuts could mean better access to capital, and consumer demand could be less volatile if inflation keeps cooling. While we will likely continue to see overall contraction of the freight market, For US related transportation costs, it appears likely that 2024 will be less volatile, leading to greater predictability across freight and inventory planning.

WAREHOUSING

The Jan 2024 issue of Supply Chain Digest points out that the U.S. warehouse vacancy rate edged over 5% in Q4 ’23, its highest level since the start of the pandemic. Despite the rise in vacancy rates overall, asking rents for warehouse space inched higher, to $9.79 per square foot (psf) per year, up 20% YoY. In its outlook for 2024. Cushman & Wakefield expects vacancy to inch up further, as the construction pipeline continues to deliver new product throughout the country, while demand moderates further. The national vacancy rate should peak at just over 6% in 2024 before re-tightening.

GLOBAL SOURCING

In an Oct 2023 publication, Gartner indicates that Procurement leaders have been slow to address Forced Labor compliance in their global supply chains. This survey found that 71% of sustainable procurement leaders consider addressing modern slavery risk a key priority, but just half report making effective progress on the issue. “Modern slavery is a risk to almost all supply chains,” said Laura Rainier, Senior Director, Analyst in Gartner’s supply chain practice. “It’s also one of the most challenging risks CPOs have to address; rooting out the practice requires visibility into multiple tiers of suppliers and a willingness to address issues in areas of the supply chain that traditional due diligence processes often fail to reach.”

Addressing forced and child labor has certainly never been a simple mission, but it is one which is now intensifying, particularly in the apparel industry, where over 15% of clothing items sold in the U.S. are affected according to the Jan 2024 Supply Chain Executive issue. The U.S.’ Uyghur Forced Labor Protection Act (UFLPA) and Canada’s Modern Slavery Act are designed to address the exploitation of China’s minority Uyghur population by prohibiting any goods produced in Xinjiang’s Autonomous Region. These acts compel companies and brands, many of which rely on China’s vast cotton supplies for manufacturing, to provide clear evidence that no forced labor was utilized in production.

FINAL THOUGHT

The impact of these global supply chain dynamics on a company’s ability to profitably provide dependable products and services to their customers is significant. A proactive approach that injects resiliency and carefully adopts appropriate technology into the supply chain is vital for sustained success. If you have clients or are aware of companies that may be struggling with supply chain issues, Hilco Performance Solutions can help. Leveraging a highly tenured team of cross-functional experts in the areas of operations, supply chain, people, mergers & acquisitions and commercial strategy, the Hilco Performance Solutions team advises clients toward meeting these and other challenges. We can perform diagnostics and assessments quickly and inexpensively and from that develop a curated menu of potential advisory work to resolve a company’s specific challenges. Feel free to contact us.