How a Skilled Servicer Can Recover Maximum Value from a Distressed Sub-Prime Portfolio

In this article, we discuss the rising incidence of sub-prime loan delinquencies, with emphasis on developments and effective remedies associated with auto and other transportation portfolios.

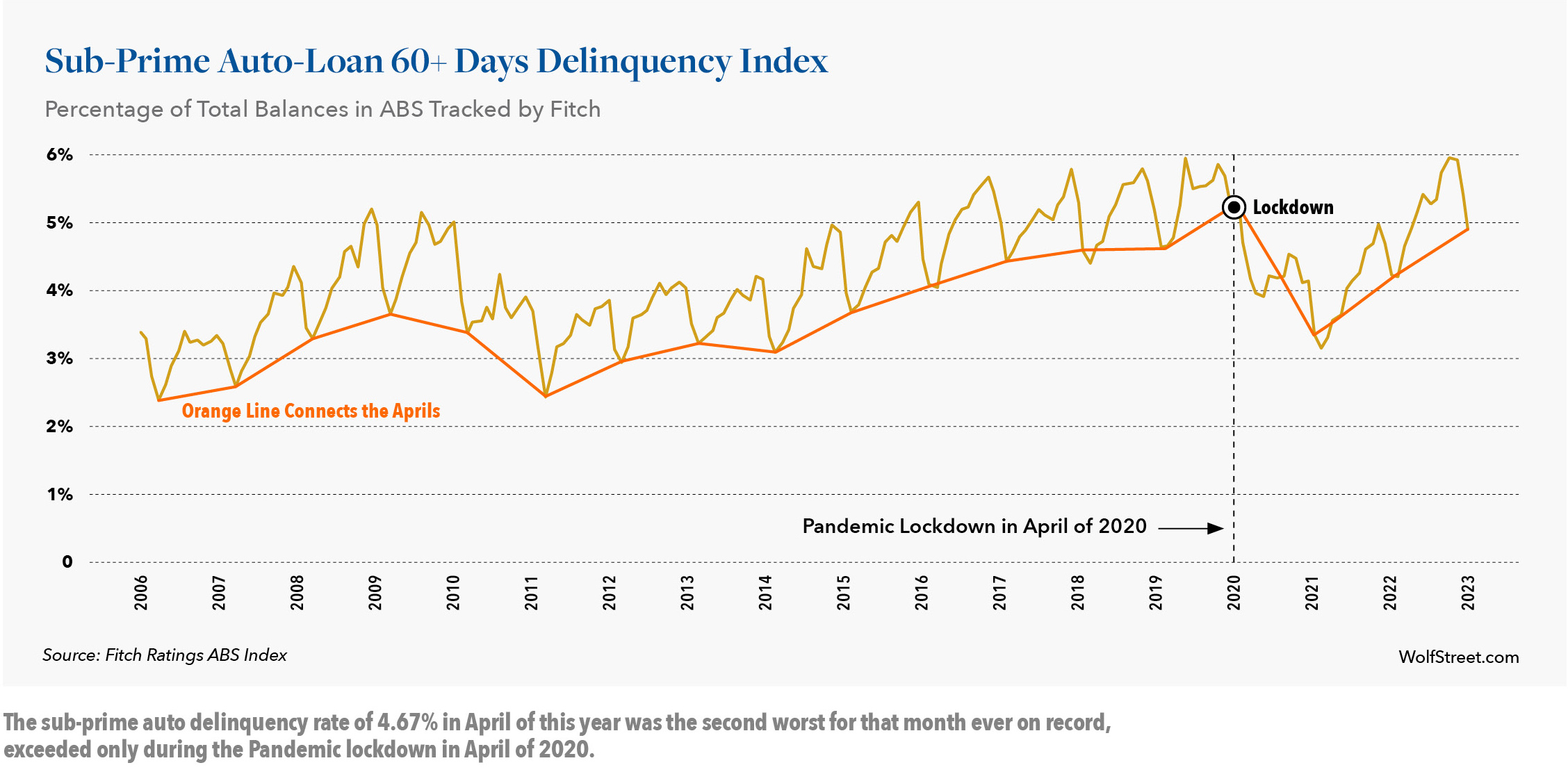

Subprime auto bonds have consistently returned sizable returns to investors over the past several years. Recently, however, growing delinquency rates, the collapse of some high profile used car dealer/loan issuers, and concerns over the stability of many others, have raised alarms across the industry.

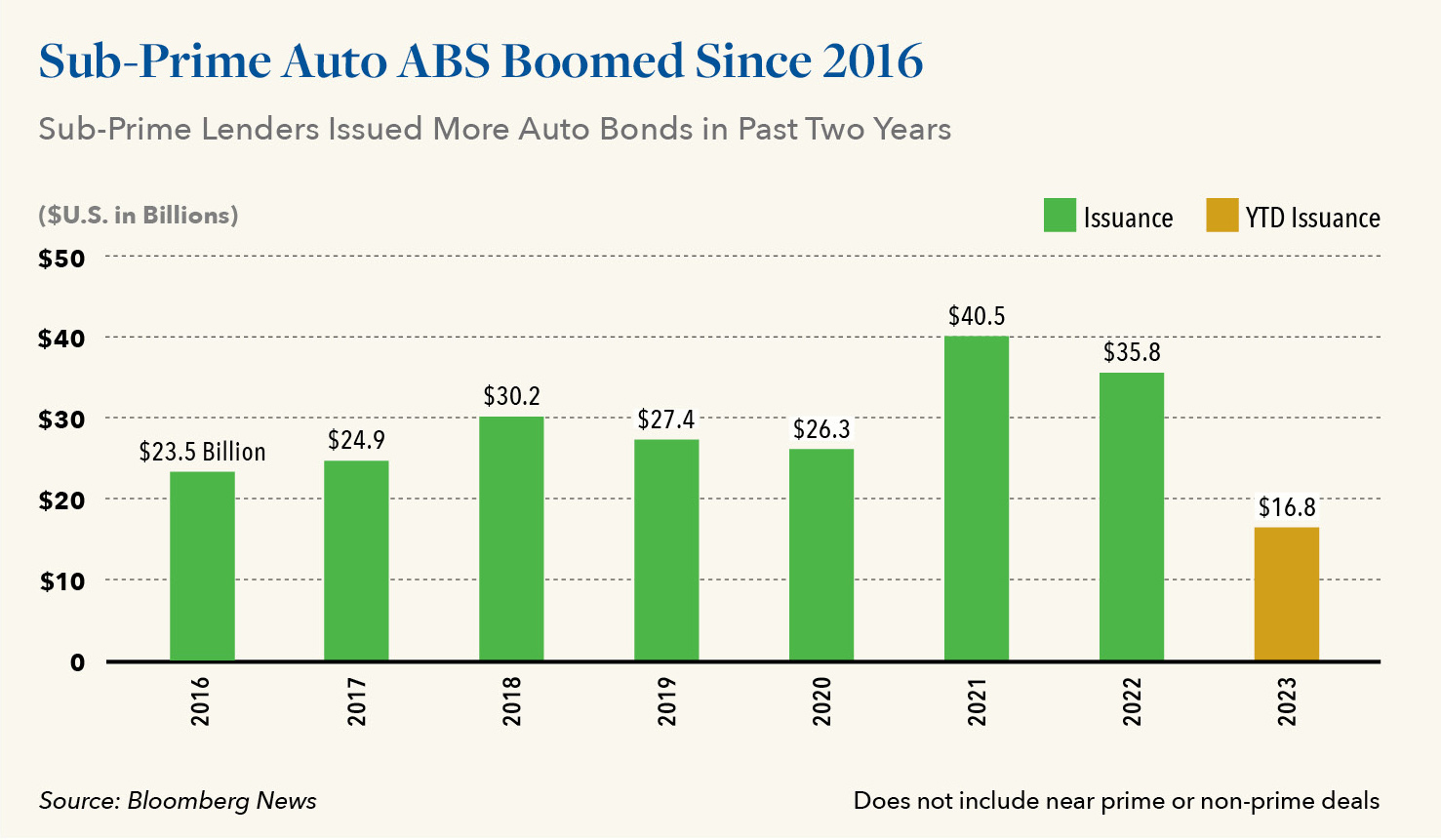

According to Bloomberg News, issuance in the subprime auto ABS market grew more than 70% in the five years leading up to, and through, 2021. But now, as more lenders associated with those loans stand to fail, concerns are elevating in regard to ensuring that borrowers pay back the money they owe; particularly given now higher interest rate levels, the increased cost of goods, and dwindling consumer savings.

A big part of the problem in situations such as these is that when a lender does fail, there is often a loss in continuity for borrowers that can make it more difficult to collect monthly loan or lease installments. Historically, we have observed that as lenders become distressed, their normal channels of communication and follow through with borrowers frequently suffer. To make matters worse, customer service, accounts receivable and other personnel may be reduced based on cash flow during such periods of distress, further disrupting billing and other processes.

If a physical monthly bill fails to arrive by mail, a borrower may forget about the payment or decide to wait until another arrives. Hearing about the failure of its lender, a borrower may simply decide not to pay. Or, the borrower may actually want to pay but not know where to send that payment without a physical bill for guidance. It is also important to note that in the current environment, we are seeing this same scenario occurring across a variety of transportation portfolios, including both consumer borrowers (auto loans/leases) and commercial borrowers (commercial vehicle and truck fleet loans/leases). Overall, the longer that this continuity disconnect continues, the more difficult it can become for creditors to collect these monthly payments, particularly from portfolios of sub-prime borrowers.

In much the same way that a consumer who borrowed money to purchase his or her vehicle expects to receive a bill every month, bondholders expect those in charge of managing billing, accounting and other processes associated with the collection of those payments, to perform their duties under all conditions. When they do not, bondholders can be put in a compromising position because their indicators of such problematic issues often lag those of a borrower.

Early identification of these situations and quick action by creditors is critical to ensure continued performance of these portfolios during periods of distress. The timely assignment of a substitute “Servicer” into the loan structure can help ensure that consistent and ethical business practices are followed in both collecting borrower payments and administrating the overall loan process over a given period moving forward. These third-party servicers are rated by a rating agency to ensure that all practices are conducted in accordance with the structure and contractual obligations of a loan.

In light of the above market conditions, at Hilco Receivables, we are already seeing a notable increase in demand for our extensive, proven, and fully compliant national servicing capabilities.

As a recognized leader in the collections industry with over 40 years of experience working on behalf of companies and their performing retail and non-performing commercial debt portfolios, our team is differentiated not only by its experience, but by a track record of implementing innovative and successful recovery solutions across all sectors and industries.

Our capabilities include distressed debt monetization and valuation services across both commercial and consumer accounts receivable and loan portfolios. We painstakingly evaluate the net realizable value of a company’s receivables and develop innovative and customized collections techniques tailored to maximize return for each individual client.

Unlike many other providers, Hilco Receivables is able to outright purchase receivables, purchase with an upside share, or operate on a fee basis. This provides an enhanced level of optionality and reassurance for our clients based on time sensitivity, cash flow and other considerations.

Advisory services are also available under a structure contingency fee transaction basis that enables clients to maximize value while also best serving business objectives. And, as a Hilco Global company, we are able to leverage an extensive range of complementary advisory and other related services to assist well beyond the servicing of loan portfolios, in ways that others in the industry simply cannot. We encourage you to reach out to our Receivables team today to discuss any situations you are dealing with that could currently benefit from, or are likely to soon require, experienced servicer intervention. We are here to help.