IPv4 Addresses Often a Hidden ‘Asset’ with Significant Monetization Potential

In this article we explore the potential for corporations, universities and other organizations to achieve added liquidity by leveraging an often underutilized and misunderstood IP asset: IPv4 addresses blocks.

IPv4 is the fourth version (but the first version used outside of a lab) of the Internet’s principal set of rules for communications. Initially put in place in the early 1980s as part of the Advanced Research Projects Agency Network (ARPANET), IPv4 still addresses most of the Internet’s traffic today. Simply put, IPv4 addresses make it possible for computers to not only communicate within their own local area network (LAN), but to recognize when they are communicating with devices outside of their LAN and interact accordingly with a high level of efficiency.

Based on its 32-bit address space, IPv4 can accommodate 4.3 billion worldwide addresses, a quantity that no doubt seemed more than adequate to fulfil global demand for years to come when put in place some 40 years ago. Between 1995 and 2021, however, the number of Internet users worldwide grew from 16 million to 4.6 billion. Today, the connected nature of our personal and work lives, and an ever-expanding network of mobile devices and computers, has placed immense demand on IP address availability. In fact, IPv4 address space for allocation to regional registries was exhausted in 2011 and the American Registry for Internet Numbers (ARIN) had no choice but to start turning away requests for new blocks of IPv4 numbers beginning in 2015, after which a waiting list was established. While ARIN continues to make small quantities of address available to those on the list based on the limited number of returns, revocations and other allocations it receives for reissuance, obtaining those is a waiting game and far from a sure thing. Other registries have similarly limited potential supply.

When IPv4 address blocks were allocated initially back in the 1980s, the Department of Defense, the nation’s defense contractors, and supporting research institutions such as universities were among the largest recipients. Thousands of other large organizations also received blocks of 65,563 addresses to accommodate their user constituents. Over the years, these entities utilized portions of their allocated blocks, often assigning small bits throughout the larger blocks, in a non-sequential fashion, to devices across their internal networks.

It is important to note that at the time of their allocation, these numerical blocks were provided without cost and no true value was assigned to them. As a result, IPv4 recipients had no reason to classify them as assets on a balance sheet. Given, however, that no new IPv4 blocks will be allocated in the future and that official reissuance of small portions of recaptured blocks by ARIN is severely limited, a notable market now exists for these scarce addresses among entities which need more addresses than they currently possess. Furthermore, because they do not appear on the balance sheet, we have found that IPv4 addresses are largely an unknown entity among even the most seasoned senior corporate, university and organization leaders.

In many cases, most of the knowledge about their existence, functionality and utilization resides within the Information Technology (IT) area. Even companies and organizations with robust legal IP expertise are often unaware that their IPv4 blocks hold significant potential from a monetization perspective. In some cases, we find that registered holders of the address space do not even know they are the holder, particularly when these have been acquired as an essentially invisible asset as part of a merger or acquisition.

An IT team, for example, is likely to know that the organization possesses 10 blocks which it uses within the data center but is less likely to recognize that this would not necessarily preclude them from selling portions of those blocks. Furthermore, chances are they have not paid much attention over time to how assigning addresses within those blocks efficiently could enhance the ability to one day monetize those assets. In fact, when we meet with the heads of companies and organizations and their senior financial, technology and legal executives, they are often surprised to learn that a) these hidden assets exist within their organization; b) their present day market value can be quite significant and; c) regardless of how they have been managed in the past, there is an efficient, cost effective and defined process that can be implemented to renumber underutilized IPv4 address blocks of varying sizes and free them up for expedient monetization.

As the market leader in IPv4 auctions, Hilco Streambank has developed a diligence process to confirm that an organization is authorized to sell its IPv4 addresses. In addition, we can sponsor audits to identify unused or underutilized addresses to help address holders maximize the value of their space.

It is also important to mention here that while it is acknowledged that IPv6, with its 340 trillion trillion trillion (not a typo) address capacity will ultimately replace IPv4 as the de facto set of rules for internet communications, the timeframe of that transition is an unknown. Estimates for that transition currently range from between 5 and 20 years. Today, users can run both IPv4 and IPv6 on the same devices but if they are only running one, those devices cannot speak to those running the other. For this reason, essentially everything facing the Internet today is still running IPv4. That said, while the timeframe is unknown, there is certain to be a market peak for realizing maximum value on IPv4 assets. Accordingly, businesses and organizations currently in possession of underutilized blocks would be well advised to explore their sale sooner than later.

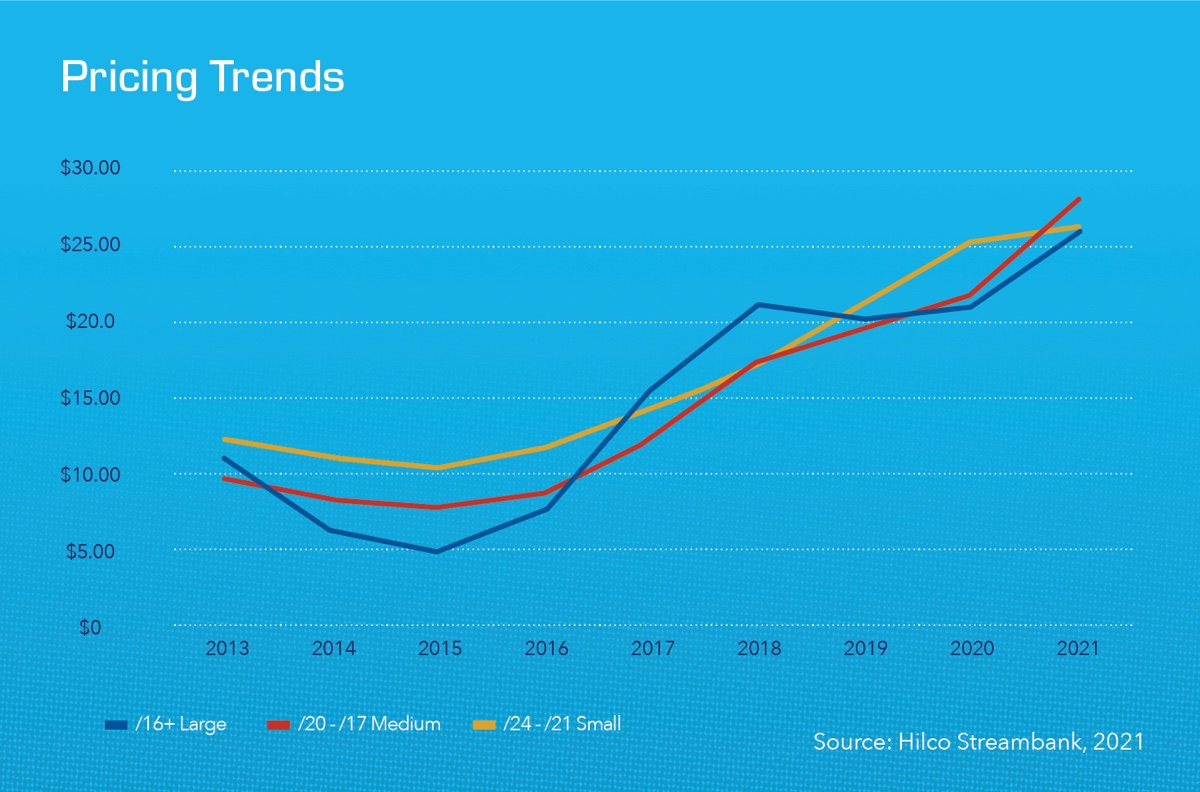

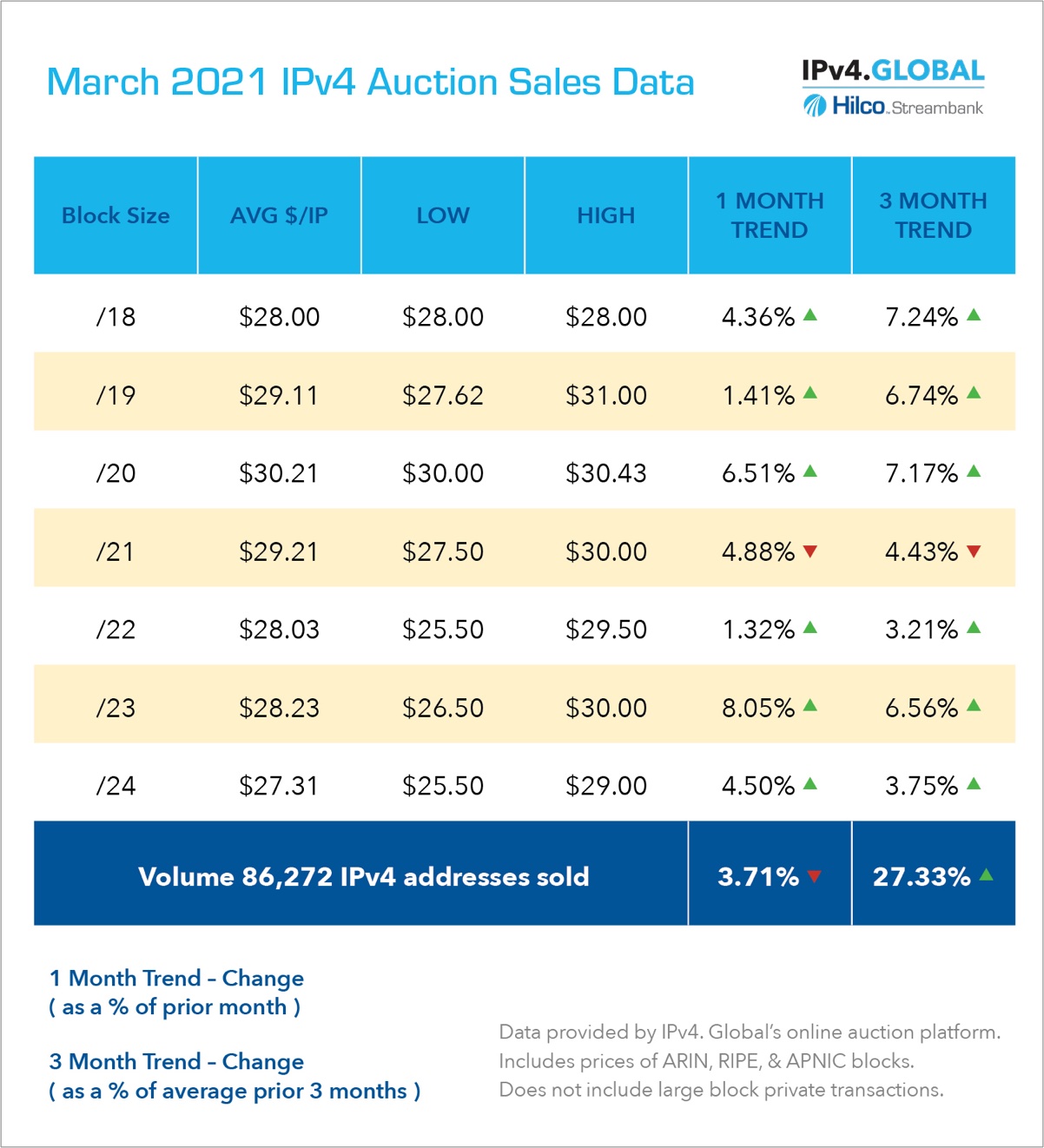

The impacts of COVID-19 on a wide range of businesses entities, many of which hold sizable allocation blocks of IPv4 addresses, have been far reaching and varied. If your company, university or organization is seeking to cover a budget shortfall, avoid layoffs, earmark funds for an upcoming capital project, corporate giving, scholarship or other efforts, we suggest you to check-in with your IT team to determine what it would actually cost to make addresses available. Armed with that knowledge, we then encourage you reach out to our team, as there are vast numbers of registered buyers on our auction site in need of the excess address capacity you possess. With current IPv4 address values in the $27-30 range based on expanding network needs, driven in large part by the pandemic, itself, the address blocks that we can work with you to make available hold significant market potential that can be monetized quickly and efficiently. We are here to help!

About IPv4.Global

IPv4.Global is a global leader in IPv4 transactions, representing clients from both the buy and sell side. IPv4.Global revolutionized the way companies buy and sell blocks of IPv4 addresses with the launch of our auction website in 2014. Since 2014, IPv4.Global has completed more than 2,000 transactions on the online marketplace and privately, generated nearly $500 million for its clients and brokered over 48 million addresses.

About Hilco Streambank

Hilco Streambank (www.Hilco Streambank (www.hilcostreambank.com) is one of the foremost authorities on intellectual property asset valuation and monetization. Acting as an agent or principal, Hilco Streambank advises upon and executes strategies for both healthy and distressed clients seeking to maximize the value of their intellectual property assets including brands, trademarks, domain names, patents, copyrights, IPv4 addresses, and customer lists.

Hilco Streambank has established itself as the premier intermediary in the consumer brand, internet and telecom communities with successes in publicly reported Chapter 11 bankruptcy cases, private transactions, and online sales through IPv4.Global. Hilco Streambank is part of Northbrook, Illinois-based Hilco Global (www.hilcoglobal.com), the world’s leading authority on maximizing the value of business assets by delivering valuation, monetization and advisory solutions to an international marketplace. Hilco Global operates more than twenty specialized business units offering services that include asset valuation and appraisal, retail and industrial inventory acquisition and disposition, real estate and strategic capital equity investments.