Private Equity’s Impact on the Golf Landscape is Far from Par for the Course

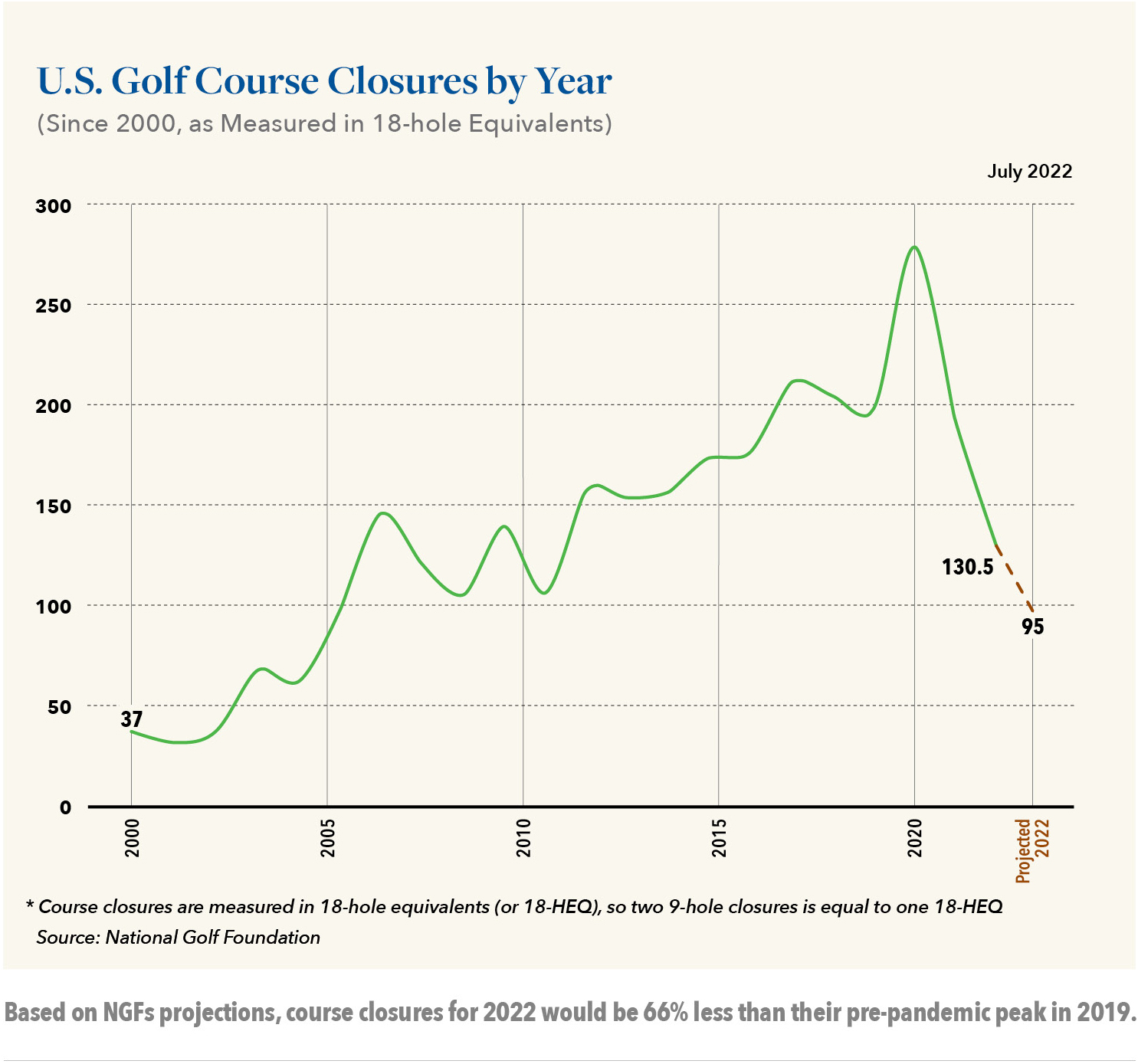

Due, in part, to the lasting effects of COVID, we are seeing a massive shift in commercial real estate. Remote working trends have placed office properties in a highly precarious position with record vacancies and the prospect of dramatically reduced renewal rates moving ahead. Multifamily/residential properties have seen markets shift, with some geographies flourishing while others languish. Even the seemingly nonstop growth across industrial space has finally tempered. Conversely, however, hospitality has bounced back with a vengeance, and the golf industry is a big part of that story.

Entering 2022, golf course and resort owners were focused primarily on maintenance, the number of rounds played and maintaining customers, particularly given widespread concern that some may have stepped away from the game due to COVID considerations and might not return. Prior to and during portions of the pandemic, course maintenance staff dwindled at many facilities, with key positions often requiring backfill. Additionally, many course restaurants, grills and halfway houses at the turn were running short-staffed. By mid-2022, however, it became clear that things were turning around with an increase in both rounds played as well as revenue for food and beverage.

Long perceived as primarily an “old boys club,” golf and its related activities have recently experienced a resurgence into the mainstream as the sport became popularized across social and streaming platforms as well as on cable TV. Dozens of influencers across these social networks have come to enjoy significant follower numbers while promoting a bevy of golf industry products and services. Recent television shows such as The Golf Channel’s The Big Break, the Netflix documentary Full Swing and numerous other programs have further popularized and generated interest in the game and its various new derivations. As a result of these and other developments, there is significant momentum in the market right now for golf course transactions driven by parties on both the buy- and sell-sides of the equation.

One of the biggest perceived drawbacks of golf, among both those who play and those who have considered taking up the sport, has always been the time investment involved in not just in learning the game but in simply playing a full round of 18 holes. Over the years, many facilities have added par 3 or “short” courses in addition to their traditional offerings. Some free-standing par 3 course facilities have gained notoriety as well. Included among these are the short course on the RTJ Golf Trail’s Grand National property in Auburn, Alabama and the Palm Beach par 3 course in Florida. Recently, several other par 3 course options have emerged, most notably The Cradle at Pinehurst, Bandon Preserve at Bandon Dunes and The Sandbox at Sand Valley.

Challenging and aesthetically attractive nine-hole courses, which enable golfers to play a mix of par 3, par 4 and par 5 holes, just as they would on both the front and back nine of a traditional 18-hole course, are now becoming more prolific across the U.S. Various architects and golf proponents are also focused on building alternative golf layouts, mostly of a shorter configuration. Six-hole courses are becoming more popular as are 12-hole layouts, like those that were played in the earliest days of golf in Scotland. Heightened consumer and investor interest in these various course configuration options, each requiring less land than full 18-hole layouts (particularly those with practice facilities), stands to benefit sellers of existing courses as well as landowners with acreage to support development of such facilities in the future.

Impressively, 41.1 million Americans aged six and over, played golf during 2022. This total includes 25.6 million people who played on a golf course and another 15.5 million who participated exclusively in off-course golf activity at locations such as driving ranges, indoor golf simulators or golf entertainment venues such as Topgolf and Drive Shack. The below chart provides added detail on other growth statistics surrounding mounting interest and participation in, and adoption of, the sport and culture of golf across the U.S.

Private Equity is In the Game

Topping the Leaderboard

Private equity (PE) has clearly taken note of golf’s return to popularity, stepping up its stake in the market with voracity. We are now seeing some of the “smartest money” funding significant investments in golf. This, in turn, is creating a potentially optimal opportunity for course owners who have long been seeking an exit strategy. Among PE firms, the so called “Green Grass Big 3” – which consists of Apollo, TPG and LNC Partners – have been highly active in the space.

Apollo Global Management, which paid $2.2 billion dollars to acquire the publicly-held, private golf club operator ClubCorp prior to the pandemic in 2017, announced its rebranding of the entity to “Invited” in early 2022. The move is widely believed to be a precursor to an upcoming IPO for the company. In 2021, ClubCorp acquired The National and The Deuce in Kansas City, MO, as well as Engineers Country Club in Roslyn NY. Since its rebranding, Invited also acquired The Haven Country Club in Boylston, MA.

In 2021, TPG Capital, the private equity platform of alternative asset firm, TPG, made a significant investment in Troon, the leader in golf and club-related leisure and hospitality services. TPG was joined by Symphony Ventures, the investment fund of professional golfer, Rory McIlroy.

LNC Partners’ Kemper Sports Management, a leading provider of management, marketing and brand activation services to golf courses, resorts, major sports leagues and Fortune 500 companies, acquired Streamsong Resort in 2023. Streamsong, a premiere golf destination in central Florida, was previously held by The Mosaic Company alongside three of the top 100 courses in the country.

Other Veteran Players in the Field

Other “Green Grass” major movers have made notable investments as well. In 2020, KSL Capital Partners, the Denver-based investment firm, acquired Heritage Golf group from Tower Three Partners. At the time of the transaction, the Heritage Golf Group portfolio included three resort-style properties. Demonstrating expansive growth over a relatively brief period, Heritage reported 30 total courses under its purview in April of this year.

In 2022, Concert Golf Partners received strategic investments from both Clearlake Capital (Q2) and Centroid Investment Partners (Q3), the latter being the owner of leading golf products manufacturer, TaylorMade Golf Company. Since the infusion from Clearlake, Concert Golf has added several new private clubs to its portfolio. At the end of 2022, Concert Golf operations included a total of 27 private golf and country clubs nationally.

Beyond the Course

Combine golf with the broad consumer draw of entertainment, and what do you get? “golf-tainment.” This burgeoning niche has been building significant momentum right alongside the resurgence in course play.

In 2021, Callaway Golf followed up its initial investment in golf-tainment company, Topgolf International, by acquiring the remaining 85.7% stake. At the time of the transaction, Topgolf had reported revenues of $1.1 billion, an operating loss of $74.2 million and a net loss of $114.9 million for the year. By the time of its fiscal year-end in 2022, Callaway, had changed its corporate name to Topgolf Callaway Brands Corporation, and reported revenues totaling $3.995 billion. To illustrate the burgeoning relevance and potential profitability of the golf-tainment business, $1.5 billion (an impressive 39% of those revenues) were attributable specifically to the Topgolf segment.

In 2021, Apollo funded portfolio company ClubCorp (now rebranded as Invited), and VICI Properties announced their strategic arrangement to grow BigShots Golf with an infusion of up to $80 million in mortgage financing for construction of new golf-tainment facilities across the U.S.

Fortress Investment Group LLC was an early investor in Drive Shack. In March 2023 the company announced that it received a $26.5 million senior secured term loan facility to fund construction of its Puttery locations – immersive indoor mini golf and bar entertainment experience facilities – then under development.

The space is attracting star power as well. The outdoor high-tech putting golf-tainment company PopStroke added partner and investor Tiger Woods Ventures in 2019. With six existing locations and at least three more currently in development, TaylorMade has now also invested in the company, which now has a valuation of approximately $650 million.

The future certainly looks bright for golf-tainment investment, and for owners of land that is suitable or adaptable for development of these sprawling indoor and outdoor facilities.

What the Rangefinder Tells Us

In golf, experienced players know that the front nine is not always an accurate indication of what the back nine has in store. While many PE firms and their executive teams have a passion for the business categories in which they invest, it is also true that PE is first and foremost about profits, exit strategies and multiples. Running golf facilities with a corporate mindset can be precarious when achieving margin/return comes at the price of diminished quality or customer experience. This is particularly true when operating course-based facilities. Will members/customers continue to pay if quality declines? What is the threshold? How much cost can be trimmed out of greens and fairway maintenance, pro-shop merchandising and clubhouse grille operations, while still providing members and customers with the type of quality experience they have come to expect? And how will future market conditions affect this model? While high end membership clubs and elite public courses will likely not be notably impacted, it is a near certainty that midsize and lower end courses will be if a looming recession takes hold, significantly decreasing disposable income and, consequently, rounds played.

With traditional financing all but evaporated, we expect to see continued, aggressive PE backed course consolidation across the country, particularly following post-COVID population migrations to the Southeast, Texas, Utah and Colorado.

Certain strategies are likely to be more sustainable than others. The focus on private clubs remains strong, although in many cases, higher than average multiples that seem to neglect traditional PE norms are being paid to proactively snatch these ahead of competitors. This is particularly significant because golf courses take longer to turn around than traditional real estate assets and typically require far more capital resources to do so. Furthermore, it is important to consider that an increase in rounds (which is, of course the goal) will also result in more wear and tear on the course itself. As such, any investment should come with an expectation and expense allocation for increased facilities maintenance and an expected increase in the maintenance expense. While current accelerating demand may justify membership dues and fees increases, the question of whether those will be sustainable, or whether a deterioration of asset quality/customer experience could reduce future demand, should be very real concerns for PE investors as they explore the space.

A Split Fairway Ahead

With industry contraction focused primarily within the value-priced course segment (those with less than $40 greens fees), some developers and PE firms are eyeing investments geared at converting daily fee courses to private membership. While generally an advantageously cost-effective solution from an acquisition standpoint in today’s market, this strategy is typically also more capital intensive, as it requires more extensive course and facilities redevelopment to elevate the experience and justify the membership cost.

Many acquirers are focused on achieving differentiation by augmenting these traditional golf course offerings with amenities including simulators, putting and/or short courses, pools and fitness facilities, pickleball courts and higher-end food and beverage service. Others are looking to acquire struggling lower-end 18-hole courses and convert them to either residential communities featuring a nine-hole course or amenity-rich, non-golf residential living communities.

The popularity of destination golf is also broadening the scope of opportunities for buyers and sellers. Properties with proximity to other desirable neighborhoods, planned communities (membership-based or otherwise) and urban areas with restaurants and entertainment remain among the most desirable. Current owners of such facilities who are looking to exit, stand to optimize their return when these properties are properly marketed and deals are transacted through experienced real estate professionals. Acquirers can identify ideal targets and benefit by closing in a timely manner when equally well advised, but can likely expect to pay a hefty premium, given the market’s current momentum.

Overall, most PE buyers are proceeding with enthusiasm tempered by a healthy dose of caution and practicality. At Hilco Real Estate (HRE), we advise thorough diligence and look closely at data, both current and pre-COVID as part of our assessment of the existing market and facility performance. We also analyze factors such as potential deferred maintenance cost, property and other associated asset values to determine the most accurate value on behalf of our clients. This enables a well-educated and timely sales strategy to the ever-evolving market.

Our Golf Advisory team assists course and other property owners, as well as PE clients, to traverse challenging transitions, transactions, and navigate complex market environments. Successfully positioning these real estate holdings within a company’s portfolio is a material component of establishing and maintaining a strong financial foundation for long-term success. We expertly advise and execute strategies for clients seeking to optimize their real estate assets, improve cash flow, maximize asset value, and minimize liabilities and portfolio risk.

Our ongoing engagements and frequent interactions with industry partners and contacts provide us with invaluable insight into the industry that we welcome the opportunity to share with your organization. We encourage you to reach out to our experienced team today to discuss a current project or situation. We are here to help.