Q1 ’24 Chemical Market Update: Modest Growth and a Continued Focus on Sustainability Ahead

2023 in Review

While a modest rebound for the chemical industry’s production output was forecast in 2023, producers revised expectations downward mid-year. A number of varying factors, including the recession in Europe, continued inflation in the U.S. market, and slower-than-expected recovery in Chinese demand contributed to an overall drop in chemical demand globally. To make matters worse, over-ordering during both 2021 and 2022 contributed to elevated inventory levels, resulting in the need for destocking. The result through most of the first three quarters of 2023 was minimal chemical output growth, which resulted in most companies focusing on how to capitalize on efficiencies and reduce cost to address the challenges of output declines.

Hilco saw the impact of lower sales driven by both inventory destocking and soft market dynamics universally in inventory valuations of plastics and chemical companies. We observed, in most cases, companies doing an effective job of reducing inventory levels in line with lower demand. The destocking environment can often put negative pressure on inventory recovery rates as slower moving inventory can become a larger portion of the inventory mix.

The soft market conditions were particularly challenging for manufactures of commodity chemicals which are being hit with pressure on margins due to lower operating rates, coupled with downward pressure on selling pricing. Hilco performs inventory valuations for TiO2 manufactures, some of which have been working through the challenging margin environment. Selling margins play a large factor in the valuation of finished goods inventory.

Outlook

While fears of a U.S. recession or notable economic downturn have eased in the U.S., it is anticipated that overall economic growth will slow. This has prompted expectations of only a modest rebound in chemical production in 2024. While a shift from destocking to restocking is anticipated for many chemicals, it is likely that underlying demand weaknesses and overcapacity among some products may linger. For chemical companies, this will necessitate striking a somewhat tricky balance between short-term necessities and long-term goals.

Competitive Landscape

The chemical industry is contending with a complex and seemingly ever-shifting competitive landscape influenced by stakeholder pressure and government policies advocating investment in the energy transition. These shifts have led to a convergence of sectors related to the energy transition. Oil and gas companies, for example, are diversifying into critical minerals mining, agriculture, and chemicals, while some chemical companies are now involved with processing lithium, manufacturing batteries and producing clean ammonia as a means of remaining competitive in the face of both traditional counterparts and sectors which boast plentiful cash flows.

Challenges and Opportunities in 2024

As 2024 unfolds, the chemical industry finds itself at a critical crossroad. The call for sustainability from regulators and consumers around the world is in direct conflict with the need to safeguard profits during the current period of highly unpredictable energy cost fluctuation. For these businesses, the need to determine which strategic moves to make it 2024 should be guided and tempered by the many lessons learned during a challenging 2023.

In the face of developments such as the EU’s ban on seaborne crude oil and refined oil imports from Russia, chemical companies are moving to production methods that embrace greater use of alternative resources. This green energy initiative-oriented prioritization is becoming more prevalent and utilizes a range of low-impact materials, bio-based chemicals, lower-emission electricity, and renewable energy. These developments promote the phase-out of dangerous chemicals, the practice of responsible chemical management, and a transition to eco-friendly alternatives — all in line with the direction of legislative actions being taken in both the U.S. and the EU.

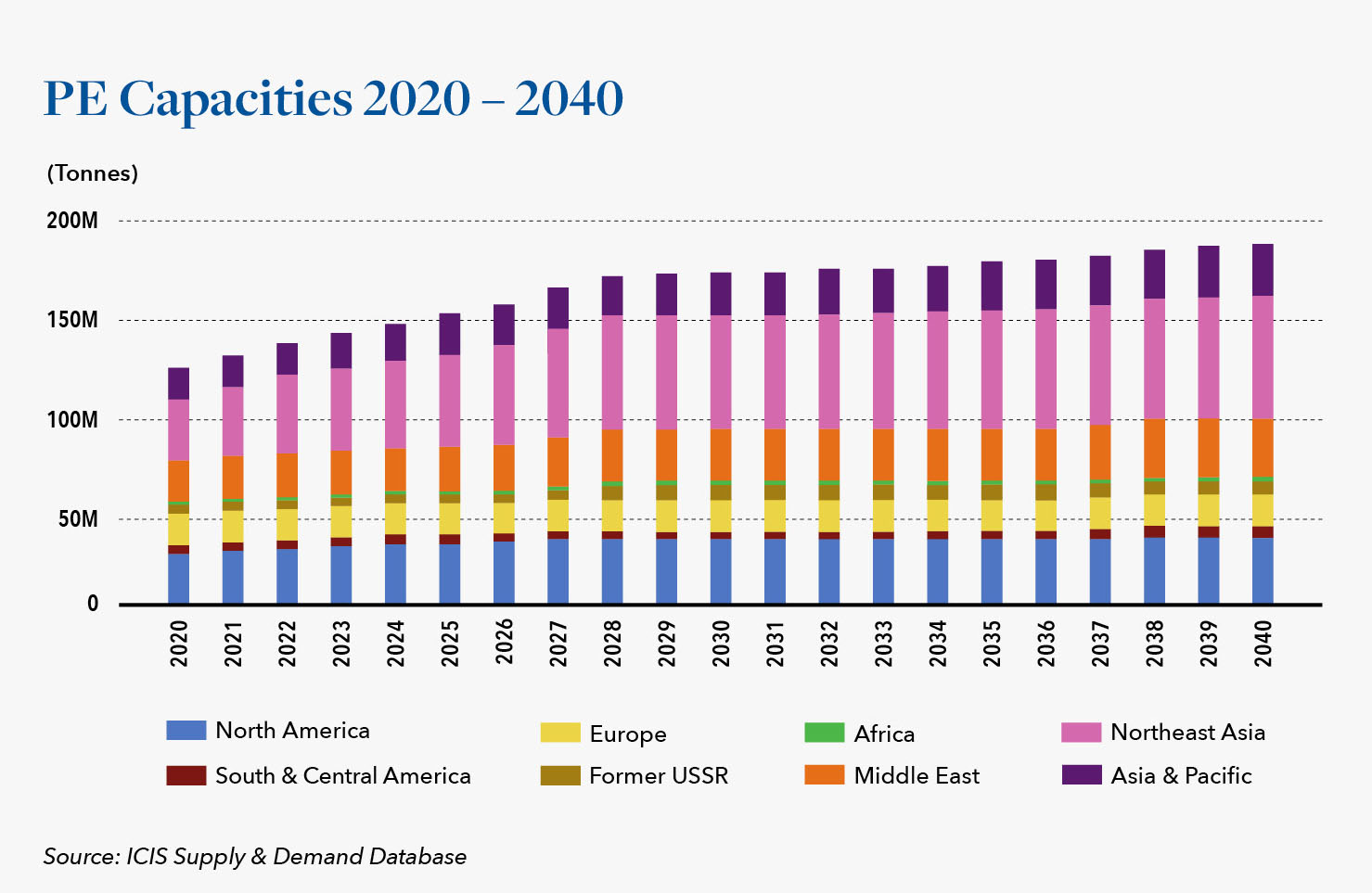

Additionally, the buildup of capacities geared at the production of both polyethylene (PE) and polypropylene (PP) remain a concerning focal point as China demand for imports of these major polymers wanes and, in some cases, the cost of oil-based feedstock remain high.

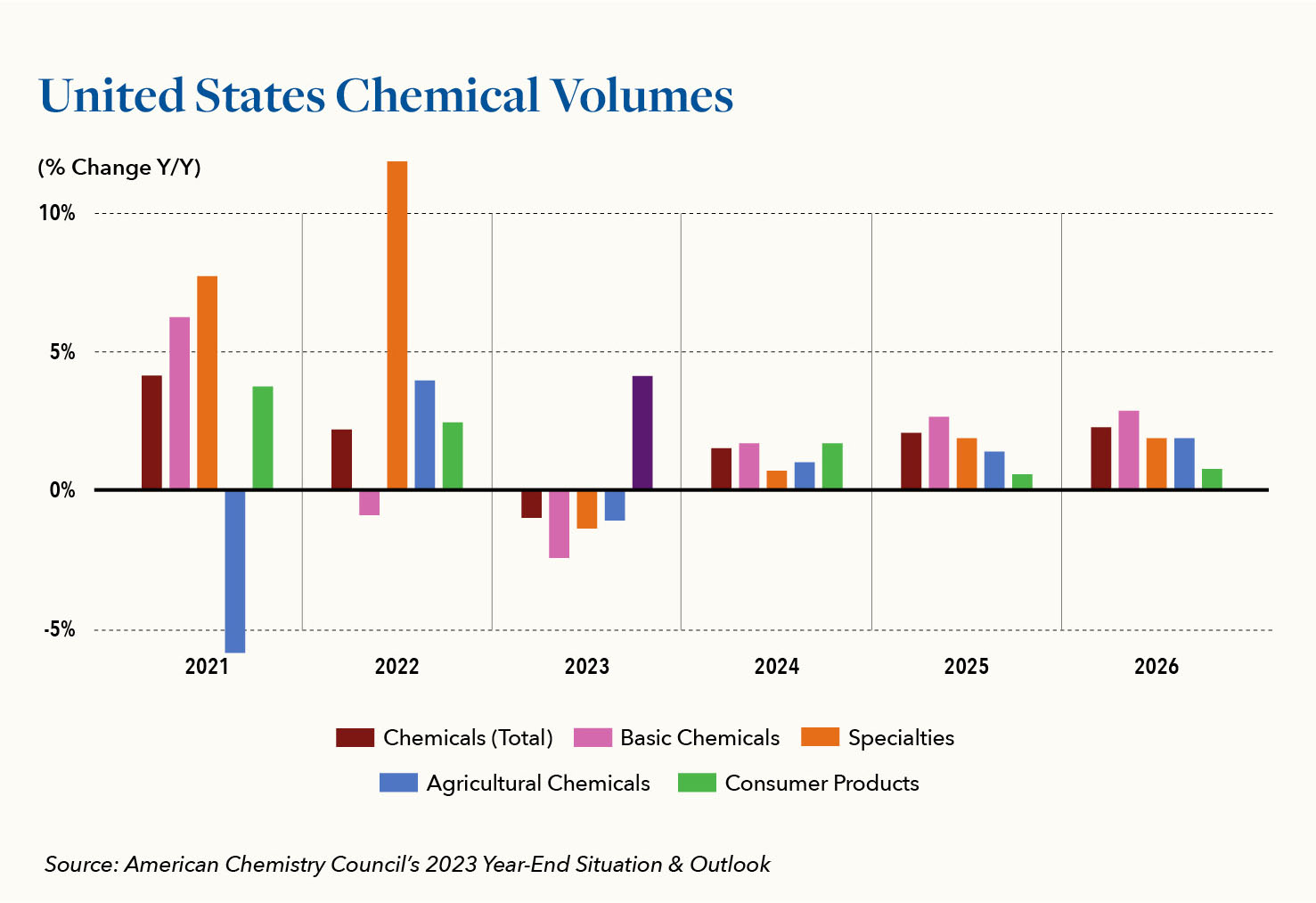

While overall demand for petroleum has slowed at a global level, U.S. chemical volumes are anticipated to rebound modestly during 2024 given current, low inventories and, as referenced earlier, the fact that destocking has largely ended across most value chains.

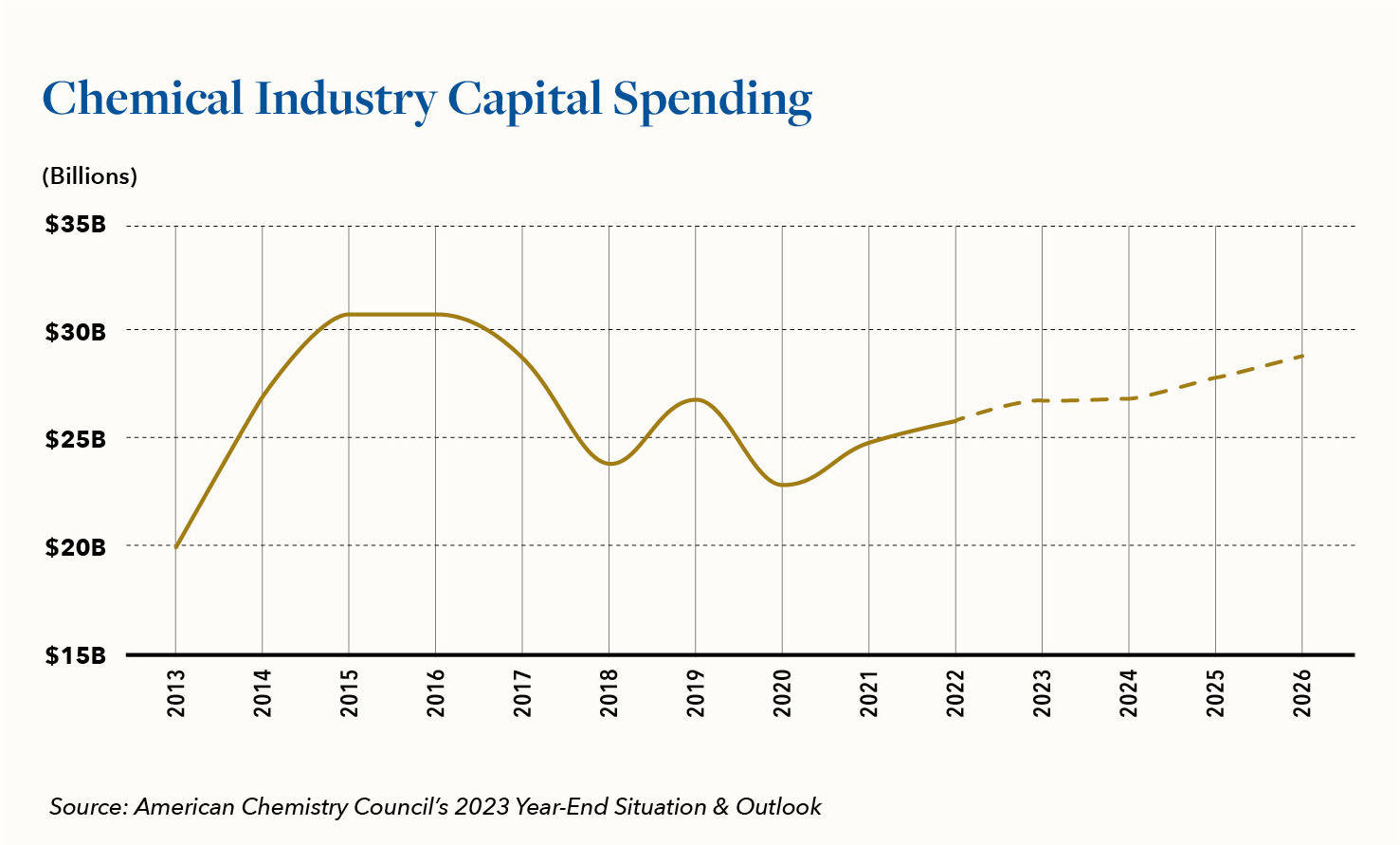

According to the American Chemistry Council (ACC) steady capital spending can be expected for the U.S. chemical industry this year, with chemical volumes rebounding 1.5% (after losing an estimated 1.0% last year) and growth in the 3% to 4% range expected during the upcoming period from 2025 through 2026. Strategic allocation of this capital will be pivotal in remaining competitive in the years ahead.

Growth moving forward will be greatly dependent upon chemical companies’ ability to strategically expand into emerging markets. While its high level of built-in demand for chemical products makes Asia a logical target for such efforts, capitalizing on the potential of that market will require companies make difficult decisions about right-sizing existing operations in other slow-growth and high-cost markets.

It is likely that we will also see chemical companies strategically shifting their models in the direction of increased Make to Order (MTO) and Configure to Order (CTO) production, as doing so better enables them to manage inventory levels based upon actual demand. We are already seeing greater emphasis and discipline from companies in regard to product auditing and distribution process improvement, which should enable right-fitting and cost savings.

Pricing Strategy & Management

The ability to evolve pricing strategies will play an increasingly important role in the evolution of businesses across the highly commoditized chemical supply chain. Companies that are able to correctly align their pricing approach with what they learn and understand about their customers’ and prospects’ needs stand to benefit by, among other things, delivering a range of value added services as part of their premium pricing. These may include offerings such as: enhanced customer support, extended packaging service capabilities and expedited or custom delivery options, among others.

Univar Solutions has been named on Newsweek’s America’s Most Responsible Companies list in 2024 for the third year in a row. The company’s accomplishments include reducing absolute Scopes 1 and 2 emissions by 16.31 percent from its baseline; reducing the global Total Case Incident Rate (TCIR) 30 percent to 0.33 in 2022, compared to a baseline1 of 0.47; strengthening its sourcing activities by rolling out a Supplier Code of Conduct to new suppliers and hundreds of legacy suppliers in the United States, covering over 32.5 percent of its product suppliers (measured by spend2); all while continuing to expand its sustainable product portfolio. Hilco and our valuation team have been fortunate enough to work with companies that are making important advancements in digitalization and are expanding their customer support-related offerings, while at the same time delivering meaningfully on efforts around sustainability and efficiency.

Lastly here, it is important to note that within the chemical industry we are seeing the positive impact associated with the broader use of accessible data, artificial intelligence (AI) and machine learning (ML) not only in determining and adjusting pricing to align with customer needs and sustainable markets, but in the optimization of resources, reduction of waste and ensuring both efficiency and safety across production lines.

The Bottom Line

As chemical companies navigate the intricacies of 2024, incorporating sustainability, exploring alternative markets, and adopting innovative pricing strategies become essential for success. The evolving competitive landscape demands strategic agility, and embracing digital transformation emerges as a key driver for efficiency and profitability. In a year of cautious optimism, chemical companies have the opportunity to make strategic moves informed by the lessons of the past, positioning themselves for sustainable growth in the years to come.

Our team performed diligence and valuations on behalf of a number of these business during 2023 and active engagements are already underway in 2024, providing us with unique and current insight into this complex market. We welcome the opportunity to share our perspective and assist you in leveraging the power of our proprietary industry data, to benefit your business or a business in your portfolio. We are here to help.