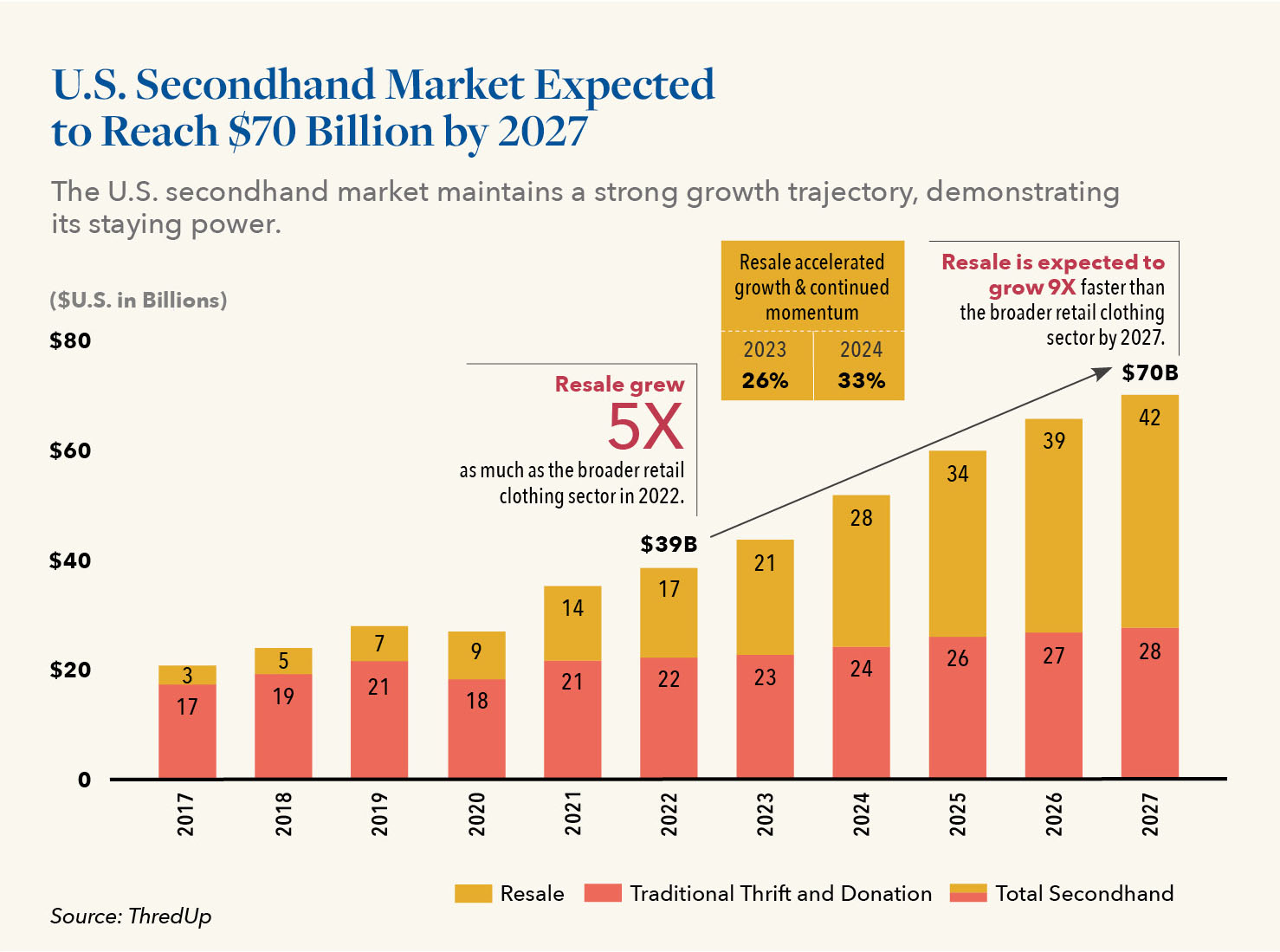

Resale Market Growth Accelerating Toward $70 Billion Mark by 2027

In this article we discuss key observations and data pertaining to the expansion and impact of the U.S. resale market.

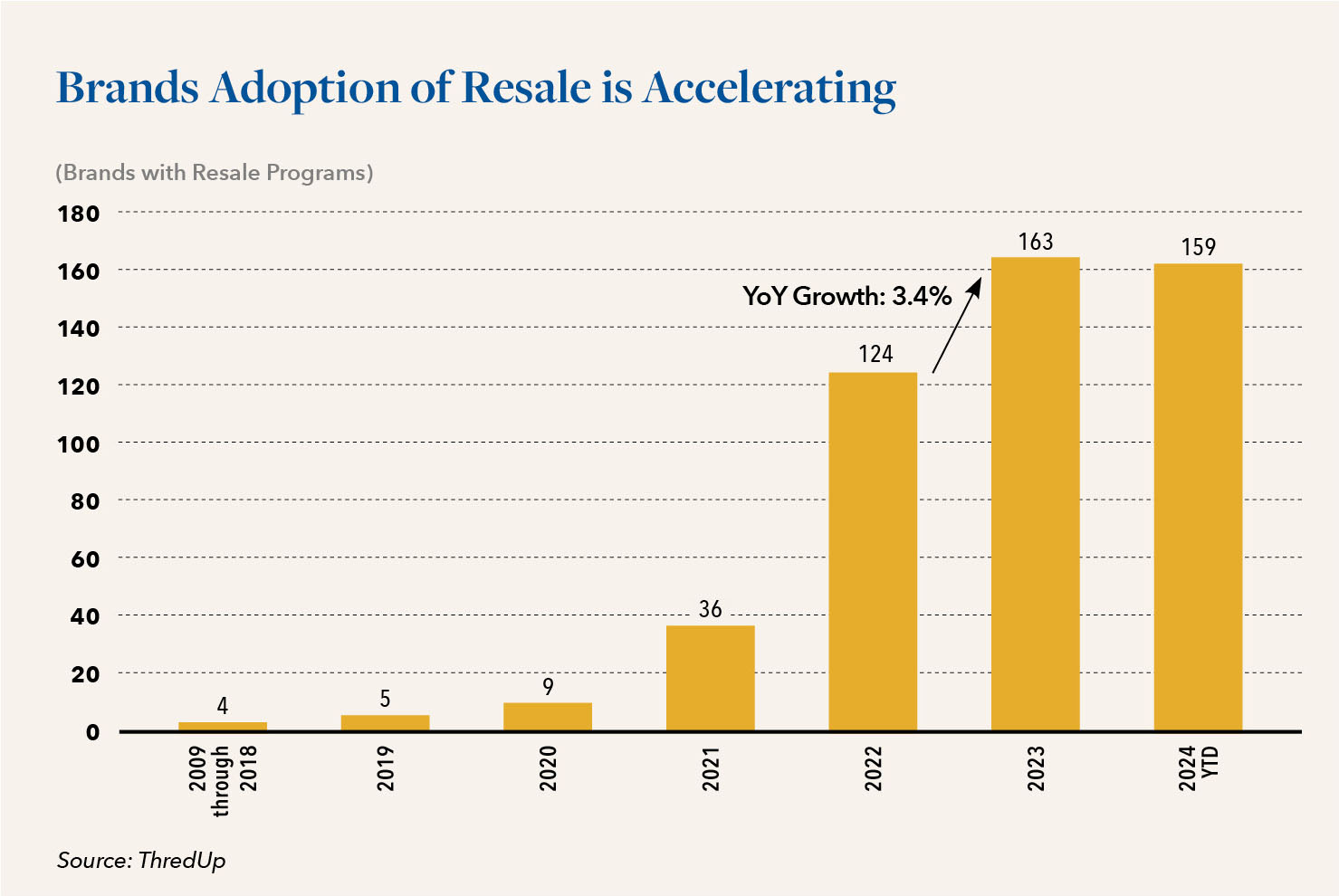

Approximately 80% of the resale programs now in existence were launched during the period from 2022 through 2023. According to the ThredUp Recommerce 100 report. Last year, alone, close to 40 brands introduced programs and those included some very familiar names such as Carhartt and H&M, among others. While impressive, that number was actually down from 88 new programs launched the prior year. Many industry insiders now speculate that 2024 may deliver even more growth overall than last, based on the fact that many brands which jumped into the market between 2021 and 2022 will likely be further expanding their resale program commitments, further adding to the expected growth from this year’s new market entries.

Shoppers are already beginning to see more secondhand and new items, both in store and online, being merchandised right alongside one another. Retailers see this blurring of the lines between the two as a means of creating a more seamless and buyer-centric shopping journey. Patagonia and REI are now actively engaged in these types of practices.

Resale, however, is still in its infancy in the broader retail world and to-date most early operators have either focused on 1) buying consumers’ used items in exchange for cash or store credit, or 2) providing a commission-based e-commerce platform through which sellers of goods and interested buyers can transact seamlessly. Now, however, we are beginning to see a hybrid model evolving where these buyback and peer-to-peer approaches are merging together. This more comprehensive approach to capturing resale share is likely to improve customer acquisition, stickiness and generate greater profitability long term.

We expect to soon see larger home furnishings items, including furniture and bedding and even bulky lifestyle items such as home workout equipment joining the resale mix as consumers have become more and more accustomed to obtaining items they need from these types of categories online via third party sites such as Craigslist, Facebook Marketplace and others. The ability to leverage a growing number of competitively priced site partner and independent moving business sources to have these items picked up and delivered directly into their homes, is making such purchases more effortless and appealing for buyers.

It is likely that traction will also be gained in the resale market this year and next via brands seeking to limit the impact of costly returns on damaged or flawed inventory on their businesses by remerchandising it through their own, or partner resale channels. According to the National Retail Federation, retail returns over the course of 2023 totaled over $740 Billion, a rate of 14.5% overall as a percentage of sales.

We are also seeing brands leveraging consumers’ affinity for businesses demonstrating a commitment to sustainability and partnering with other businesses that support the circular economy. A ThredUp partnership with luxury handbag reseller Rebag, for example, provides shopping credit on Rebag based on the value of items sold on the ThredUp platform. Both company’s websites provide interested consumer participants with easy access to the program. According to the 2023 ThredUp Resale Report, 47% of Gen Z refuses to buy from non-sustainable apparel brands/retailers, which increased from 36% in 2021.

While the integration of e-commerce into retailers’ omni-channel operations has been a focal point for many years, it now seems that almost every week we are hearing about another new brand entering the resale marketplace or integrating resale into its existing retail offering. With retail strapped by mounting people costs, investment dollars are limited for costly integration of e-commerce and other tools needed to drive revenue. New approaches to co-merchandising and partnerships, on the other hand, are likely to require less investment time and cost, while still yielding beneficial growth.

As large-scale peer-to-peer and consignment marketplaces continue to grow, brands are racing to establish their own resale programs to keep consumers within their own omni-channel ecosystems — just as retailers want to seamlessly integrate brick-and-mortar and e-commerce, resale is increasingly becoming part of that equation as well. Retail executives surveyed by ThredUp in its 2023 Resale Report about their circular fashion goals, revenue, sustainability, and brand loyalty overwhelmingly indicated that each improved incremental to expectations when resale programs were launched. In fact, among the variety of goals measured after the launch of resale marketplaces, improvement in brand loyalty outperformed expectations more so than any other metric.

And for some brands, concerned with how their products are showing up in the resale market, getting in on certifying and merchandising their own pre-owned products is better than the leaving that up to third parties. This is particularly true with luxury items where maintaining the value and a strong market preference for a brand’s own new products is inextricably linked to the pricing of its pre-owned merchandise. Rolex, for example, recently announced its own resale program to help ensure the authenticity of watches in the resale market and protect/maintain the value proposition attached to their new watch lines moving ahead.

Cuyana, a women’s luxury essentials brand whose tagline is “Fewer, better” — emphasizing simple everyday products designed with longevity in mind — has found benefits in the proprietary data it now can access via its resale platform. For example, the brand knows that certain retired styles and colors will sell out quickly once they are added to the site. This type of informed, data-driven knowledge can help influence future product development and production decisions.

A managed service model leveraging third parties such as ThredUP, Archive Resale, Recurate and Trove can assist brands looking to establish a recommerce program. In fact, nine of the top ten resale shops, measured by number of listings (items), use a managed service model according to the ThredUp 2023 Resale Report. Kate Spade, which leverages ThredUP for this purpose, has indicated that more than 90% of its secondhand shoppers are new to the brand.

More than 50% of retailers engaged in resale programs indicate that those practices receive attention at the director and board levels, while 45% of executives say these programs are meeting the ESG expectations of investors. Additionally, about two third of retailers that currently offer resale anticipate that it will continue to be an essential part of their long-term growth strategy and expect to increase related investment in the next couple of years. Importantly, 82% of these retailers believe that resale will be able to generate a positive return on investment.

Concluding Thoughts

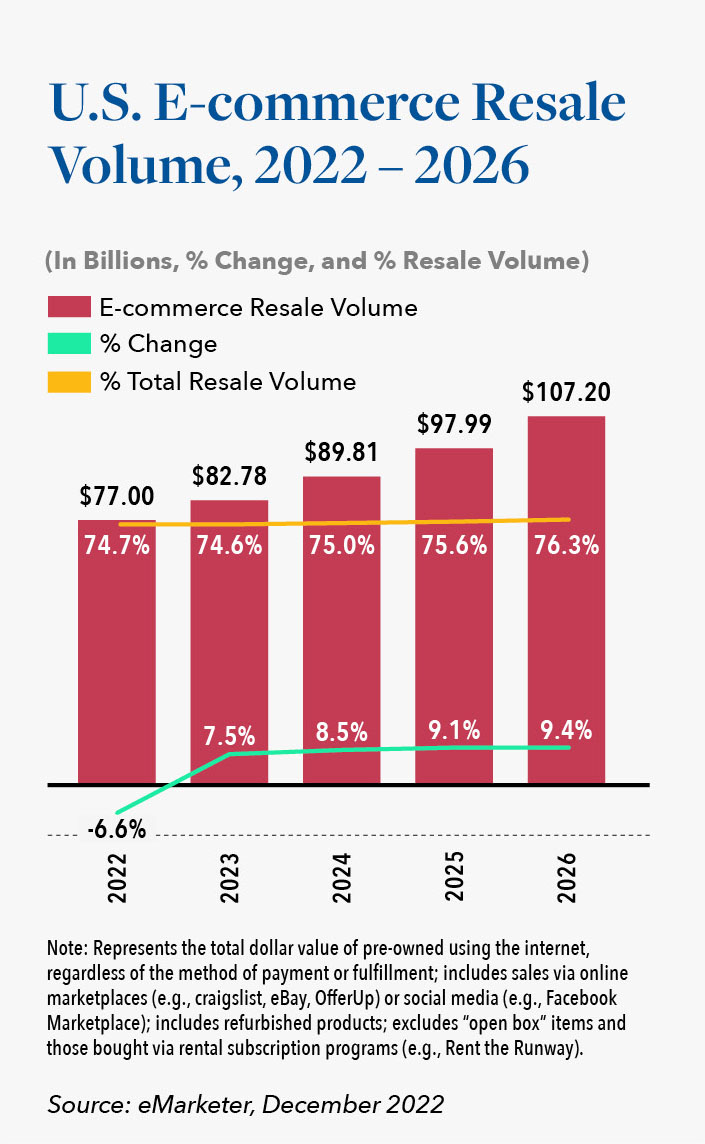

With the U.S. secondhand market projected to grow at an average rate of 21% per year during the course of the coming five years, online resale can be expected to drive much of that growth with younger shoppers embracing technologies such as AI and augmented reality to identify and experience merchandise in ways never before possible before visiting a physical store or making a purchase.

Even with all this positive momentum in the online channel, when it comes to inventory liquidity, brick and mortar still likely reigns as the most effective disposition channel overall for the resale market. Old habits die hard and many consumers still indicate (baby boomers and millennials included) that they simply will not consider buying items such as pre-owned clothing online, without seeing them in person first, particularly when stringent return policies are in force. This reality favors omni-channel retailers with physical storefronts where these assets can be effectively merchandised and sold to broadest range of buyers possible.

For a lender to include a business’ inventory as part of its borrowing base and credit facility, the business’ inventory must be of sufficient determined quality and/or salability. The eligibility of inventory is, understandably, of heightened concern when working with borrowers whose inventory includes substantial secondhand goods. At Hilco, our valuation team works side by side with experts in the areas of reverse logistics and liquidation augmentation, enabling us to assist lenders and their borrowers to more accurately determine the NOLV of these specialized inventory assets and limit downside risk.