Slow U.S. Housing Market and Delayed Asian Industrial Recovery Weigh on Lumber Markets

In this article, we take a look at mid-year developments in the lumber markets and suggested actions that can be taken by those with portfolio exposure to minimize the potential for downside risk.

Housing Overview

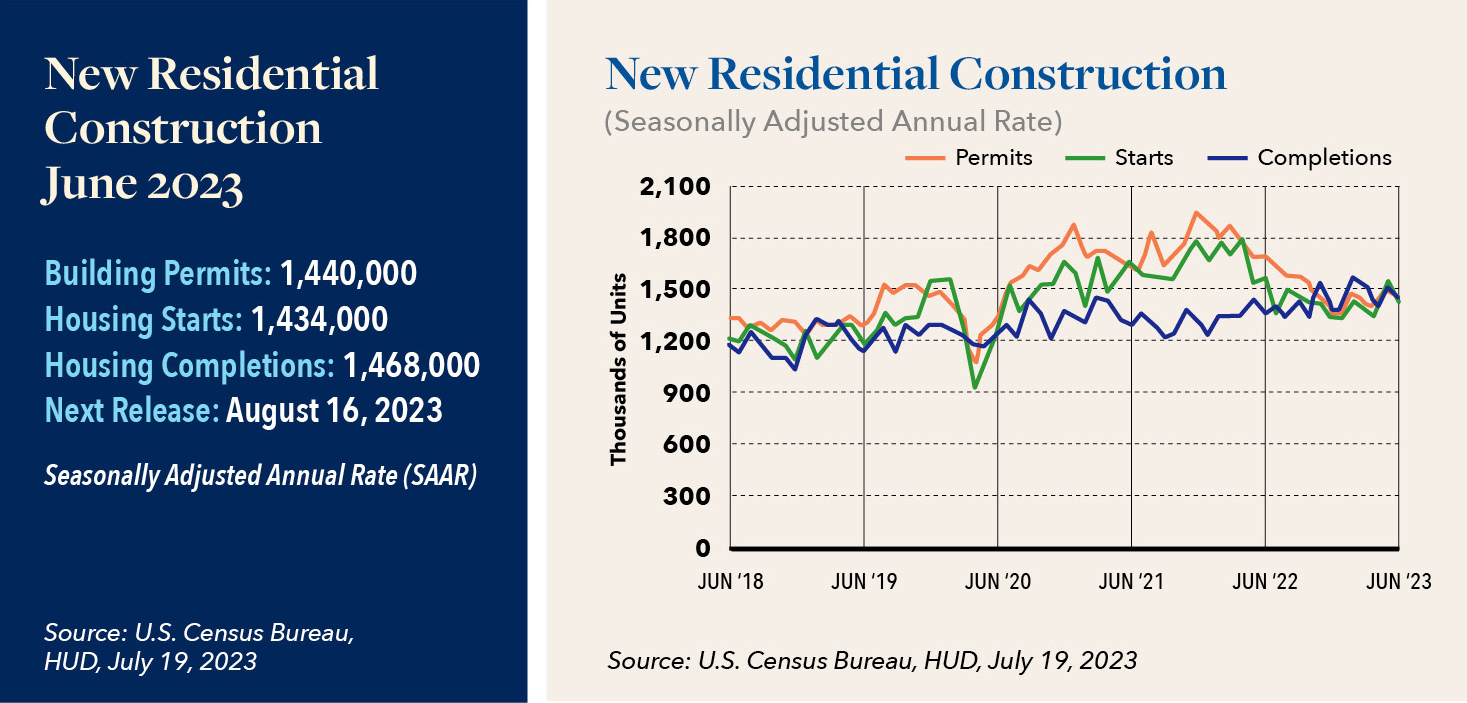

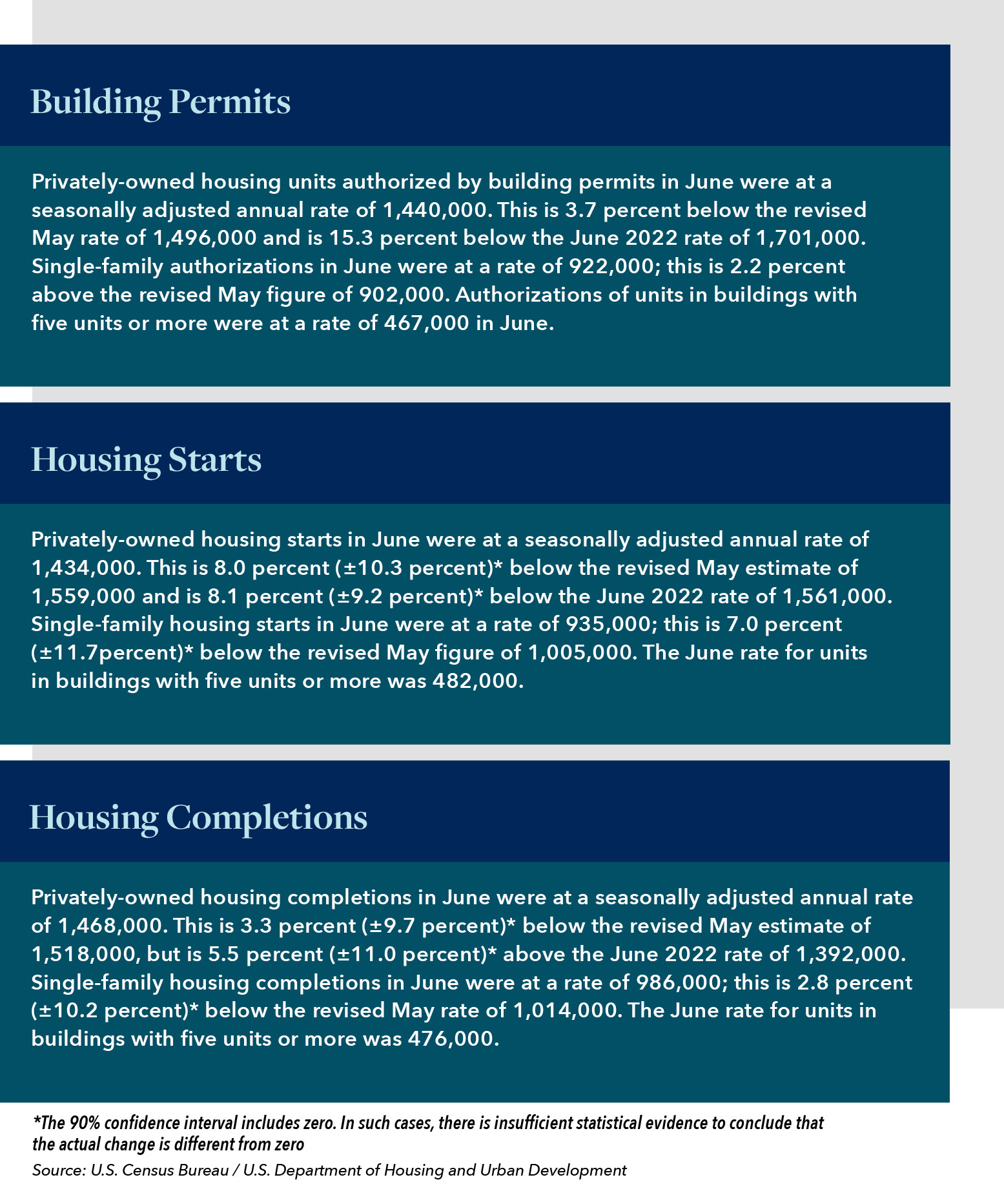

Housing starts in June were down 8.1% from the prior year, dropping below economists’ expectations to a seasonally adjusted annual rate of 1.43 million. The decline followed a significant 18.7% surge in housing starts in the month of May. Permits issued for future construction rose to a 12-month high on the weakness of the existing home sales market. Notably in June, a total of only 600,000 existing homes were listed for sale across the U.S. While June data for new home sales was not yet available at the time of this publication, details for the previous month are provided in the charts below.

Although housing prices have finally eased somewhat on an annual basis, many potential home buyers remain deterred by the continued low inventory of homes up for sale and high interest rates. Although 1.08 million were on the market at the end of June, that number is down more than 13% from the same period a year prior. This has resulted in bidding wars in some locations, with many homes selling above their list price.

Although housing prices have finally eased somewhat on an annual basis, many potential home buyers remain deterred by the continued low inventory of homes up for sale and high interest rates. Although 1.08 million were on the market at the end of June, that number is down more than 13% from the same period a year prior. This has resulted in bidding wars in some locations, with many homes selling above their list price.

On July 22, 2023, the average 30-year fixed mortgage interest rate was 7.24%, while the national 30-year fixed refinance rate was 7.38%. Both figures reflect an increase of 10 basis points over the week prior. The national 15-year refinance interest rate was 6.64%.

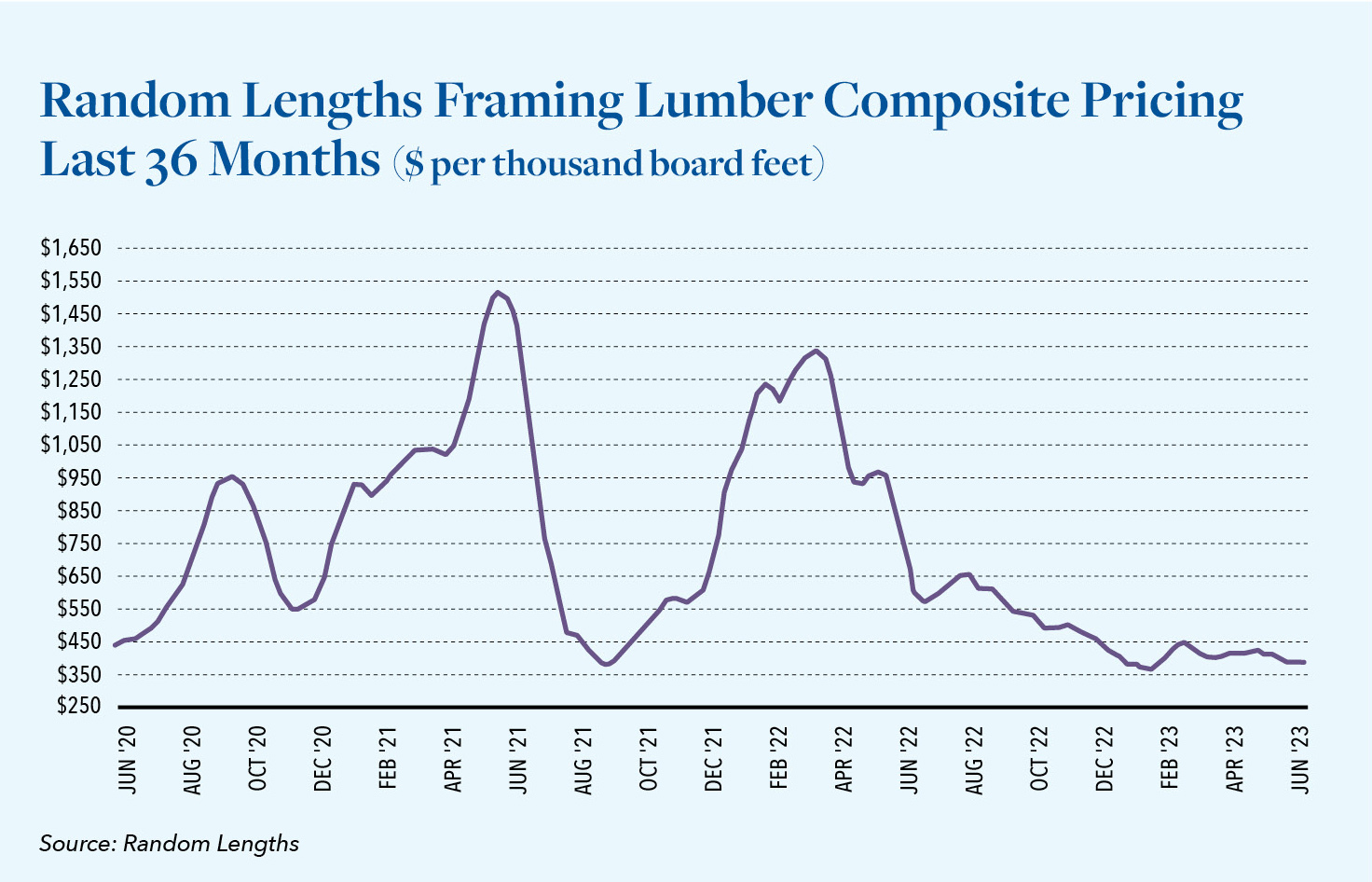

Lumber Markets

As we approach the midpoint of Q3, lumber rates have trended up slightly from their lows in January and May to back above the $500 mark per board feet, remaining on the high end of the historic range for the past two decades. Although we have seen some moderation in energy pricing, as referenced in our previous update, lumber prices are still not expected to get much lower unless we see a more significant shift. The other key factor that would bring down prices is the cost of labor, and that is not showing signs of reduction as workers are still demanding higher wages and lackluster interest in working within the lumber industry continues. The current moderation in trucking/transportation costs has, however, been a welcome development for the industry. With rates lingering just above the 500 mark, we have not seen much in the way of operational adjustments at the plants such as those needed to regulate production during periods of weakened demand.

Paper, pulp and liner board markets have been suffering. We have seen lackluster demand for pulp in Asia, where industrial activity, particularly disappointing in China, has still failed to return to anything approximating pre-pandemic levels. This, combined with slower industrial activity here in the U.S. and elsewhere, has weakened demand and pricing for paper and liner board as well, causing mills to take some downtime.

Conservative spending on goods by consumers this year is placing downward pressure on packaging demand, which has been worse than most large box makers had expected. With big box and other retailers buying less cardboard, indicating slower consumer spending, paper mills in the U.S. have scaled down production. Because cardboard boxes are involved in essentially each step of the journey that goods take through the supply chain, the performance of the paper industry can provide insight into consumer demand. With the U.S. corrugated products industry reporting slumping sales, well below those of last year, the outlook is less than stellar with mills running at approximately 70% of capacity.

According to the American Forest & Paper Association (AF&PA), 2023 total printing-writing paper shipments decreased 24% Y/Y in June. U.S. purchases of total printing-writing papers decreased 29% over the same period, while printing-writing paper inventory levels decreased 4% over the previous month, May 2023.

Conclusions

As Canada undergoes one of its most significant wildfire events in history, the country’s forestry industry has seen sawmills shuttered. This has driven lumber prices up marginally and is likely to impact production for months to come. Perhaps fortuitously, this has occurred at the same time that housing starts in the U.S. have stalled due to interest rate pressure and a tight labor market. These developments, combined with an anticipated, continuing low rate of consumer goods spending over the near term will define the course of the lumber market and pricing in the near term.

Lenders with borrowers in the lumber market should ensure they have a comprehensive understanding of those businesses and their operational challenges, including business performance, competitive factors, and the effectiveness of data-driven forecasting accuracy. Frequent valuation monitoring is highly advisable during this period and we welcome the opportunity to assist in those efforts and answer any other questions you may have pertaining to specific exposure within your portfolio. We are here to help during this volatile period.

Hilco Valuation Services is the leader in valuation for the forestry and lumber industry, having delivered more than 500 forestry and lumber appraisals, with asset values ranging from $500 thousand to $1 billion. As one of the world’s largest and most diversified business asset appraisers and valuation advisors, we serve as a trusted resource to companies, lenders and professional service advisors, providing value opinions across virtually every asset category. Hilco Valuation Services has the ability to affirm asset values via proprietary market data and direct worldwide asset disposition and acquisition experiences. Access to this real-time information, in contrast with the aged data relied upon by others, ensures clients of more reliable valuations, which is crucial when financial and strategic decisions are being made.