Sometimes Less is More

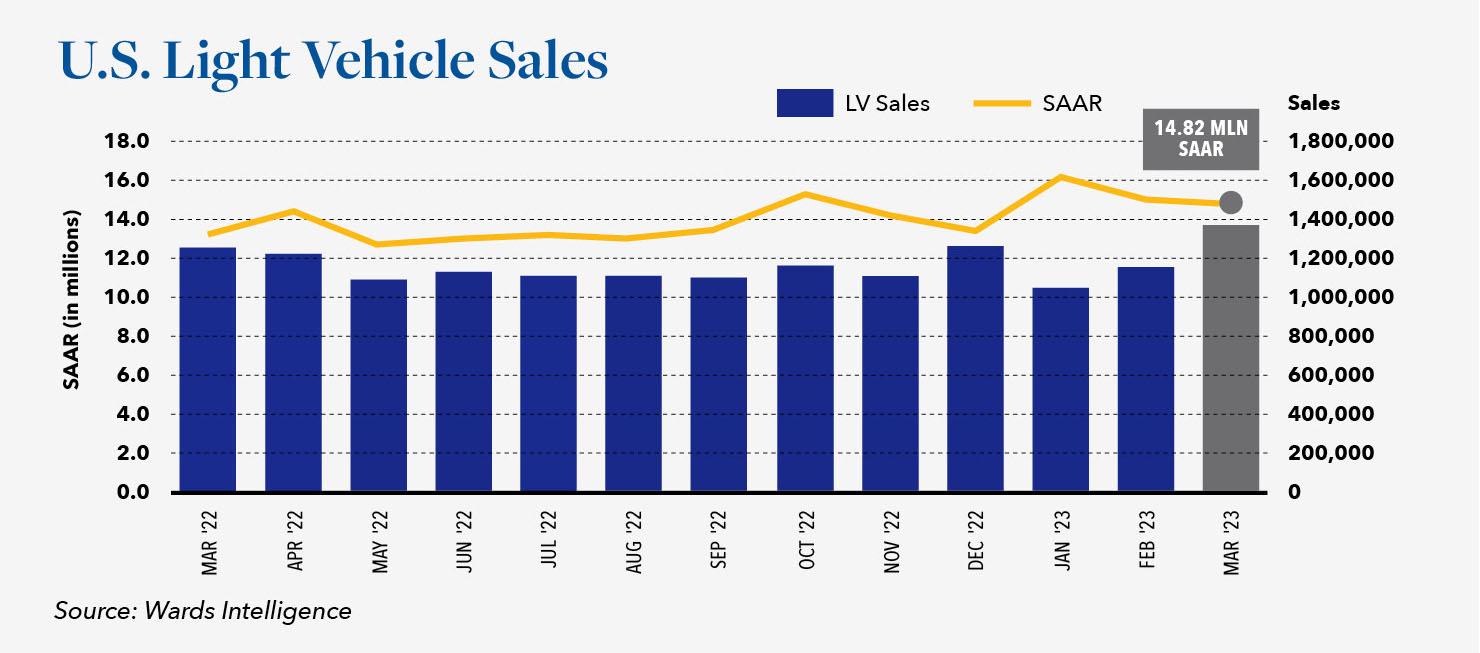

April 20, 2023 – For the third month in a row, March 2023 showed the seasonally adjusted annualized rate (SAAR) for U.S. light duty vehicles at, or near 15 million units. First quarter results have been at the upper end of most industry forecasts, but industry analysts still remember what happened in 2022 and are not prepared to upgrade their forecasts just yet. After posting an SAAR of 15.2 million in January 2022, some industry forecasters were projecting 2022 sales approaching 16.0 million units. Unfortunately, after peaking in January, the SAAR promptly declined to 14 million in February and then 13 million in March, not reaching 15 million again until October of that year. Full-year 2022 sales of light-duty vehicles ended at 13.9 million units, down 8% from 2021. That was the lowest level seen since 2011.

The lack of semiconductors is no longer the constraint that it was in the past, which is enabling vehicle manufacturers to slowly rebuild retail inventories.

The total U.S. supply of new vehicles, including vehicles in transit, was nearly 2 million units, a 56-day supply at current sales levels. For perspective, retail inventory was nearly double prior to the pandemic, a 94-day supply based on stronger sales at the time. At current sales volumes, pre-pandemic inventory would represent a 112-day supply which would be nearly twice the level considered by the industry to be normal and ideal. Unless sales completely collapse, the road to full recovery is still relatively far away because the industry will continue to be dogged by a shortage or semiconductors for at least another year. AutoForecast Solutions estimates that the global market has already lost 980 thousand units of production to the shortage this year and projects that it will grow to 2.8 million lost units of production for the full year. This time last year, AutoForecast Solutions estimated that the global market had lost 1.6 million units of production and that it would grow to 2.4 million for the full year. In the end, the global automotive industry lost 4.6 million units of production due to the shortage of semiconductors.

Assuming the North American automotive industry has the ability to produce 23.4 million vehicles annually, manufacturing plants in North America are currently operating only at 65% of capacity. In the past, low capacity utilization was a green light for manufacturing to increase production. That resulted in excess inventory which empowered sales teams to increase retail incentives and, in turn, eroded residual values and undermined profitability. That is an over-simplification of a very complex problem that characterizes a paradigm the industry has been locked into for the past 50 years, and a vicious cycle which the industry is likely to repeat. However, with the huge investment needed to transition to alternative fuels, the industry cannot afford to retreat into this profit-eating syndrome of over-producing. Unable to turn-up production for lack of semiconductors, the industry has witnessed that LESS PRODUCTION, LEADING TO LESS INVENTORY, CAN RESULT IN MORE PROFIT. Accordingly, it might actually be a good thing if the semi-conductor shortage continues to linger for a while, since the automotive industry is now learning that Sometimes Less is More.

For further information, please contact Keith Spacapan at 847-313-4722 or kspacapan@hilcoglobal.com.