Storm Clouds Gather Over the Auto Industry

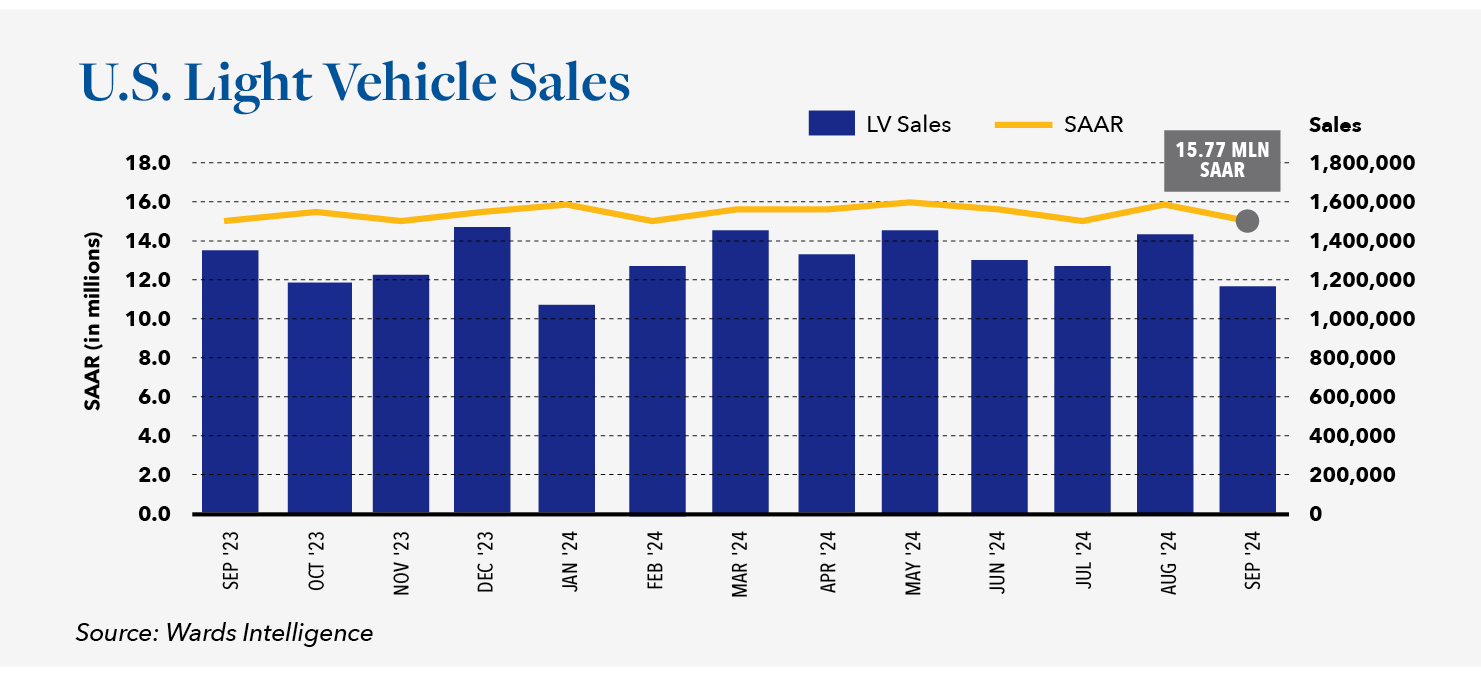

October 22, 2024 – Third–quarter sales of U.S. light-duty vehicles decreased by 1.8% compared to the third quarter of 2023. This was the second straight quarter of year–over–year sales declines following an increase of 5.6% in the first quarter. July was the only month where the seasonally adjusted, annualized rate (SAAR) of sales exceeded 16 million vehicles. In terms of cadence, the first quarter SAAR was 15.4 million vehicles, the second quarter was 15.6 million vehicles, and the third quarter was 15.7 million vehicles. Instead of a fourth–quarter surprise, most industry analysts are expecting more of the same. Elevated new-vehicle pricing and higher borrowing costs continue to temper retail demand, leaving manufacturers increasingly reliant on low-margin fleet deliveries to offset weak retail demand. Industry forecasts for the full year remain between 15.5 million and 16.0 million vehicles.

Not long ago, when vehicle production was constrained by COVID-19 pandemic restrictions and the microchip shortage that followed, vehicle manufacturers struggled to maintain dealer inventory above 1.0 million vehicles. Consumers got used to waiting weeks to have their vehicles built to order, and those who couldn’t wait were prepared to pay above the manufacturer’s suggested retail price. As a result, the average transaction price of a new vehicle increased from about $38,000 thousand in September 2019 to more than $48,000 in September 2024. Under more normal circumstances, when faced with “ticket price shock”, some potential new car buyers might have opted for a late-model used vehicle. Unfortunately, at the same time, inventory was tightening for new vehicles, and inventory was tightening for used cars as consumers and rental car companies tended to hold onto their vehicles longer. As a result, the price of late-model used cars increased even faster than new cars, which only exacerbated the situation further.

It took some time for the global supply chain, particularly for microchips, to repair itself sufficiently to support increased vehicle production levels. Beginning in 2022, daily vehicle production finally recovered to levels that allowed the manufacturers to begin to build some inventory. Unfortunately, just as industry productivity began to recover, the Federal Reserve began to increase interest rates to slow the economy to avoid runaway inflation. It appears the Federal Reserve may have succeeded in engineering that “soft landing” they had promised, but the impact on the auto industry has been significant. Although the Federal Reserve has begun to ease interest rates, potential new vehicle buyers report that they are deferring purchases for now, hoping things will improve in the future.

The industry has responded with additional sales incentives to improve affordability, but inventory levels continue to climb. New vehicle inventory now stands at nearly 3 million vehicles, an 88-day supply at current sales levels. If not for a series of unfortunate events like hurricanes, striking dock workers, and a cyber-attack, inventory levels would likely have exceeded three million vehicles. The pandemic demonstrated that manufacturers and dealers can remain very profitable while selling fewer vehicles as long as inventory does not get out of control. However, inventory levels may be reaching that tipping point where the industry plunges into a downward spiral of increasing incentives, decreasing prices, increasing financing costs, and decreasing profitability. Toyota has survived very nicely for many years on less than half of the inventory of most other manufacturers. I sense that any more than two million vehicles on dealer lots is evidence the manufacturers are building vehicles that consumers don’t want. Carlos Tavares, Stellantis CEO, senses that a significant auto-industry storm he’s been warning about for several years has arrived, that it could last several years, and it could cause some automakers to fail.