Successful Execution of Steel & Non-Ferrous Plant Closures Require a True Turnkey Buyer/Partner

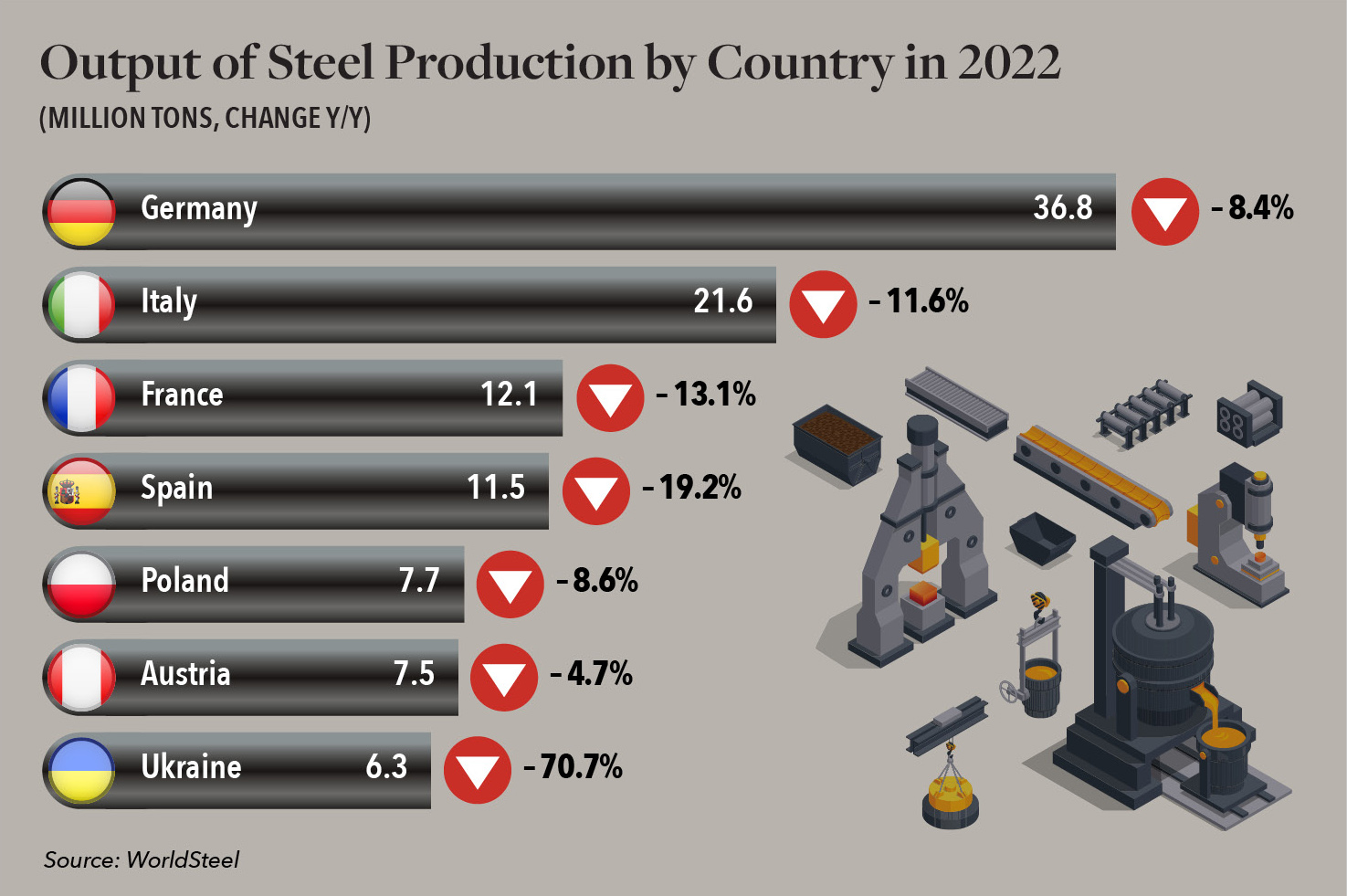

In this article we discuss how high energy costs have been forcing steel makers to cut output across Europe, threatening mass plant shutdowns and placing the viability of steelmaking — which contributes tens of billions of euros to the region — at significant risk.

Elevated energy costs have forced steel makers across Europe to cut output. Some producers report that recent monthly energy costs to power their facilities have amounted to nearly as much as what they previously paid to do so over the course of an entire year. These developments are concerning on numerous levels, particularly given that the sector employs more than 300,000 workers and contributes tens of billions of euros to the region’s economy annually.

A number of emergency measures and policy options have been proposed to alleviate the burden of high energy prices for those across the steel industry, as well as for a range of other businesses, public services and consumers. Practical solutions, however, have been slow in coming.

The European Union (EU) steel sector produces more than 150 million metric tons of steel annually at approximately 500 sites. But EU steel demand is now anticipated to dip 3% in 2023, according to the European Steel Association (Eurofer). If that occurs, it would be the fourth decline to take place over the past five years. And while total steel imports dropped by 28% in Q1 of 2023 as compared to the same period in the previous year, the share of imports when compared to consumption was 22%, which is considered high in relation to historical trends.

This is due in part to the fact that producers in some other regions enjoy a competitive market advantage because they are not subject to the restrictive, environmentally-focused policies and thresholds that EU industrials face. Some also had continued their energy relationships with Russia after the start of the war in Ukraine, until such time as they were able to find other sources.

As a result of these and other events, a number of high profile plants across the Steel and Non-Ferrous Industries have shuttered over the course of the last two years. Because of our experience and reputation across the region, Hilco Industrial Acquisitions (HIA) has been selected as a buyer and/or turnkey partner by the owners/operators of many of these facilities including those detailed below:

Over the past 24 months, HIA has sold almost 100,000 tons of equipment. In January 2023 HIA achieved dual ISO Certification (ISO 9001 and ISO 45001), thereby ensuring essential Quality and Safety delivery for our clients.

Our experienced project management and sales teams have handled highly diverse and complex engagements in many different industries and markets around the world, leveraging a proprietary database to track and benchmark the sale price of machinery and equipment across virtually every industry and sector. HIA both invests our own capital to acquire assets upfront and project manages deals directly, with a focus on private treaty sales to industry-specific end users vs. auctions to sell acquired assets.

Having bought and sold thousands of plant assets around the world we already know your industry, speak your language and understand your challenges. This serves to ensure accuracy, efficiency and delivery of maximum monetization value for you and your organization. If your company or a company within your investment portfolio is currently involved in steps toward a Steel or Non-Ferrous plant closure, or is embarking on any other type of transaction involving disposition of industrial plants or their assets, we encourage you to reach out to our team to discuss how we can assist. We are here to help.