The Benefits of Conducting Operational Due Diligence

In this article we discuss the value created by operational due diligence and how such an analysis can reduce CapEx and significantly improve EBITDA.

The term “operational due diligence” can mean different things depending on the context in which it is used, even within the world of M&A transactions. The term can, for example, apply to the financial operations of the target company or even to the financial condition of the investing company. In this article, we will discuss its application to the actual operations of a target company and a range of functional capabilities including manufacturing, product development, warehouse logistics, supply chain and procurement.

Why Conduct Operational Due Diligence?

Operational due diligence (ODD) helps investors understand and quantify the risks associate with a proposed acquisition. In much the same way that PE firms engage accounting companies to verify a business’ financial statements, there is proven value in engaging experts to assess the operations of a target company. Performing operational due diligence also is a way to validate the “trust” being placed in a management team. This is particularly important because typically, a PE firm’s own operating partners do not have direct, hands-on operations experience– having managed operations vs. actually performing day-to-day operations tasks. Proper due diligence of this type identifies upside potential, as well as likely downside scenarios associated with, and extending beyond, a company’s management ranks.

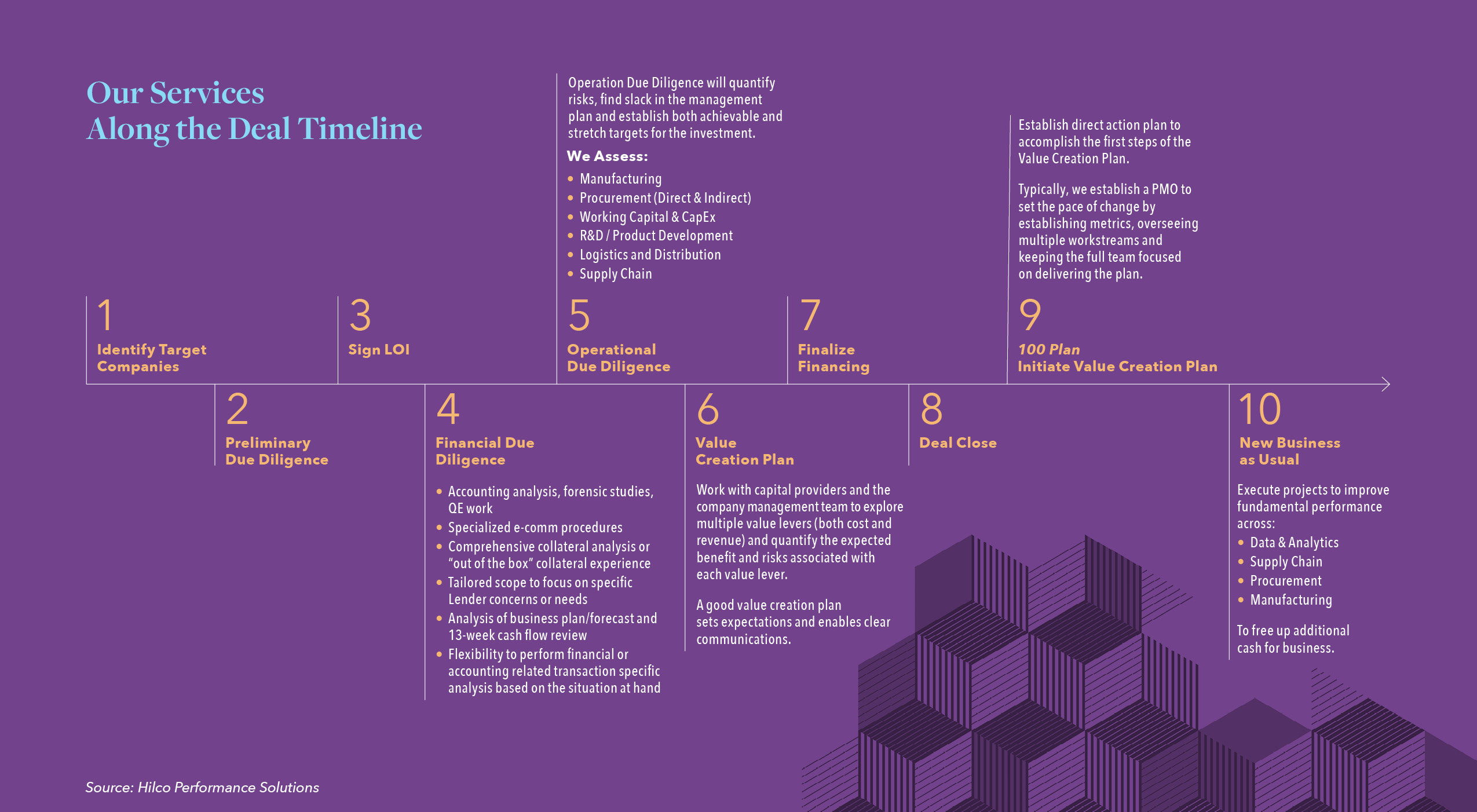

How Does it Fit Into the Transaction Cycle?

Operational due diligence comes later in the transaction cycle, typically after a letter of intent (LOI) is signed and once financial due diligence has been completed. Since this type of diligence typically requires external resources, PE firms tend to wait until after a deal passes their internal investment committee review. If the deal is approved, then operational due diligence is conducted to verify the assumptions and capabilities modelled into the value creation plan. When conducted effectively it will quantify risks, find slack in the management plan and establish both achievable and stretch targets for the investment.

What Does it Assess?

While every operational due diligence effort is unique, all follow a rigorous process. Each starts with qualitative assessments of opportunities and risks based on information located and available in the data room and the existing value creation/value improvement plan.

Qualitative assessment of opportunities and risks:

- Comparisons to industry benchmarks where feasible

- Site visits and visit summaries

- Develop operating cost baseline with variances for risks & opportunities

- Detailed review of multiple functions

- Broadly speaking, we review a few key functional areas

Functions for Which Capabilities, Opportunities and Risks are Captured:

- Manufacturing

- Working capital & CapEx

- Supply Chain

- Procurement (direct & indirect)

- Logistics & distribution

- R&D / Product development

- Selling, general, and administrative expenses (SG&A)

Summary

The key objective of an operational due diligence effort is to validate or disprove a buyer’s investment hypothesis, and identify potential opportunities as well as risks across procurement, manufacturing, engineering/product development, sales & service and G&A functions. When conducted in a timely manner by an experienced team of professionals, leveraging best practices and industry knowledge, the actionable insights gained through the process are numerous and highly beneficial in guiding the course of an ultimate investment decision.

Hilco Performance Solutions focuses on operationalizing business strategy through action, working in the trenches alongside our clients, and translating strategy into actual results. We encourage you to reach out to our team to confidentially discuss the potential of integrating operational due diligence into a current or upcoming investment opportunity. We are here to help.