The Upside of Monetizing Aging Retail Inventory Now Versus Down the Road

In this article we explore retailers’ rising inventory levels and discuss an optimal strategy for finishing the year strong and starting on solid ground in 2023.

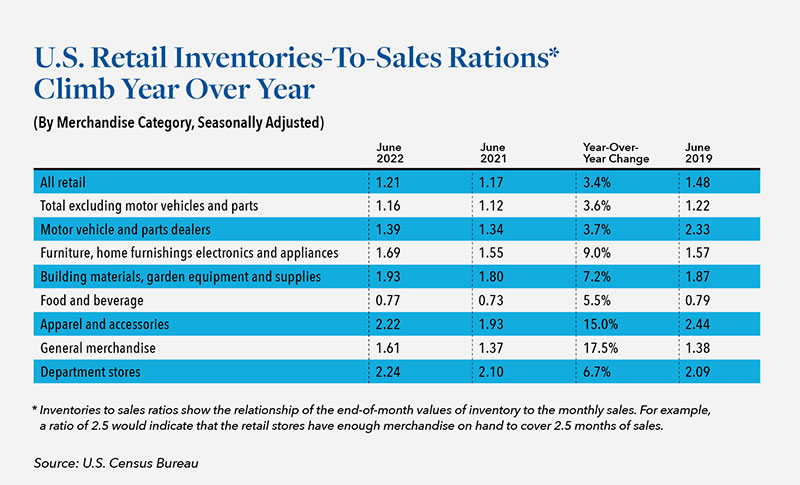

The retail outlook for the fourth quarter of 2022 is uncertain, with multiple headwinds confronting retailers including historically high inventory levels. According to the U.S. Census Bureau’s Monthly Advance Economic Indicators Report for August, “Retail inventories for August, adjusted for seasonal variations and trading day differences, but not for price changes…were up 21.6 percent (±0.7%) from August 2021.”

As retailers evaluate their options, they also must contend with consumer behavior that has not been easy to predict. Going back to 2020, the extent of the retail rebound took most by surprise when stimulus money landed in consumers’ checking accounts combined with the savings from lack of travel and entertainment. To their credit, operators responded by beefing up online offerings, providing curbside pick-up, and employing other creative solutions to maximize their sales. Many also took the step of bringing orders forward, increasing inventory by 1.5 to 3 months, to address a constricted supply chain. On NPR’s Marketplace show, Stephen Bethel, head of Frazier Capital recently commented, “A lot of the companies we work with have seen inventories rise by about 25 to 30 percent over the past four months.”

Beginning in 2022, however, the world reopened and discretionary spending reallocated to include experiential purchases. Shortly thereafter, rapid inflation pressured household budgets as we have seen since May ’22. The result has been a glut of inventory across retailers, and in many cases, the wrong inventory. Orders pulled forward to fill athleisure demand are sitting idle, overtaken by categories like occasion dresses. Laden with dated, off-trend, and out of season merchandise, this inventory is not only aging, but also occupying valuable space in DCs and depreciating.

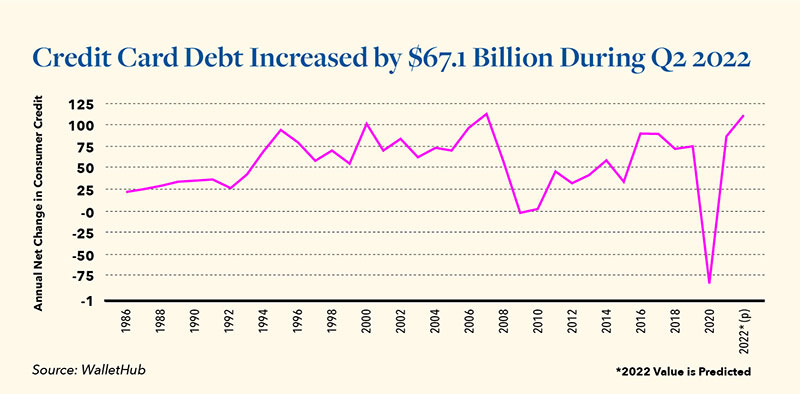

Adding insult to injury, unprecedented consumer debt has now reached all-time highs, looming over the fourth quarter as the proverbial canary in the coalmine, questioning just how resilient the U.S. consumer really is. In Q2 of this year alone, U.S. consumers took on a record-setting $67.1 billion in new credit card debt as compared with $86.2 billion for all of 2021. With inflation, mounting debt, OPECdriven fuel increases and the potential global ramifications of further escalations in Russia’s war with Ukraine collectively putting pressure on consumers, retailers must contemplate the best way to resolve their bloated inventory levels.

MOVING THE GOODS

Over the past 20 years, the team at Hilco has seen retail cycles with similar characteristics. The temptation for operators is to defer action, hoping to salvage and sell inventory at full margin down the road. While this is an easier pill to swallow than taking the margin hit and selling the inventory today, Hilco’s experience has been that in most instances the best operators do leverage action today and focus on real dollars rather than margin percentages.

The most popular solution being deployed today is to pack and hold inventory. Target, Kohls, Gap, and many others have publicly announced pack and hold as a core solution to their excess inventory woes. Indeed, this strategy is sometimes successful for some retail concepts. Off-price, for example, leverages pack and hold to great effect. However, most retail does not rely on pack and hold unless there is a glut of excess inventory and the strategy is high-risk.

In these instances, for there to be a chance at success, only core categories in basic colors should be held. Straying too far from timeless and core categories invites the risk of changing consumer preferences. Case in point: the dramatic and abrupt shift away from athleisure. There are additional and common risks:

- Significant incremental cost is often incurred moving inventory from store to store, or from store back to DC. Each time inventory is touched it not only becomes less valuable but it can also become obscured within a retailer’s systems.

- Often times, despite the best of corporate intentions, eager buyers will buy over the same categories year over year, preventing pack away inventory from finding its way back onto store shelves.

- Instead, it lives in backrooms, or worse, in DCs where space is at a premium and there is a quantifiable cost to hold the inventory. In short, it is possible to successfully pack and hold inventory, but it is high-risk and often ends with additional costs that exceed the margin discount required to simply sell today.

So, what can retailers do? First, determine the buckets of excess. Second, sell it. As Jeff Bezos has famously said, “your margin is my opportunity.”

The best approach to monetizing inventory should also match current consumer trends. A McKinsey survey issued earlier this year found that 37% of consumers — more than at any time since the beginning of the pandemic — reported switching retailers in search of value. And, they are doing so in stores once again, with brick and mortar sales showing an increase of 8% YoY in the same survey. This trend is only accelerating as we begin to see a barbell effect with consumers: strength in the value and luxury segments, but softness in between.

At this time, retailers should consider three primary avenues of inventory monetization:

1.Selling inventory through stores they are closing, either in the normal course or as part of a strategic initiative.

2. Dedicated in-store clearance events designed to monetize defined buckets of excess while margin-protecting other core inventory

3. Leverage B2B sales and the off-price channel

Options 1 & 2

The first two options above offer the highest and best recovery possible on the merchandise, and monetizing it today will provide cash to redeploy into the most important parts of the business. Crucially, the consumer is hungry for deals and creating a dedicated promotional event is a much stronger way to generate consumer interest than taking inconspicuous markdowns in store. Give them deals and let them know!

Store closing and clearance events also serve to expand your customer base. Run correctly over a defined term with prescriptive and incremental markdowns, a promotional event can be divided into 3 broad phases targeting different customers in each.

1. The Core Customer: The first phase attracts the core customer that shops with you daily and is excited to find a deal at their favorite store.

2. The Aspirational Customer: The second phase attracts an aspirational customer who wishes they could shop your stores normally, and now can because the discounts have made the price points attainable.

3. The Value Customer: The third phase attracts the value-oriented customer who is always hunting for a deal.

In the case of the aspirational and value oriented customer, promotional events create an opportunity to gain customers and collect their primary information. This information can be used to engage with them in the future and build your customer database that can, over time, add notable IP value.

However, running these events is hard. Understanding the minimum discount required to sell goods in concert with a coordinated merchandising and marketing plan, and doing so in a brand protective manner, is part art and part science. Hilco has perfected that balance and relies on thousands of historical transactions to professionally manage such events in collaboration with its retail partners.

Option 3

If option 1 and 2 are not feasible, it is wise to contemplate monetizing their inventory via sale to a thirdparty disposition professional and utilizing the off-price channel. While off-price is often looked at as brand de-valuing, when used strategically it is a means to monetize inventory in a channel where it will be mixed in with hundreds of other brands rather than explicitly merchandised. Hilco has deep relationships and ready-buyers in off-price and has found success negotiating through this channel on behalf of retailers. Hilco also often serves as a direct buyer, since we are actively engaged in the sale of merchandise through retail closing events/liquidations throughout the year, through which others’ inventory can be effectively sold. Consumers view their “great finds” at store closing events as true “wow” moments that are viewed as lucky one-time opportunities, creating substantial brand protection.

If your retail operation, or a retailer in your portfolio is facing the types of issues raised in this article, we encourage you to reach out to our team. We have a wealth of experience in assisting our clients to monetize inventory to achieve maximum return, and are here to help.

Hilco’s Retail Group is a recognized authority in the global retail sector delivering expertise and solutions for complex business challenges. Over many years of working with healthy and distressed companies, Hilco has helped optimize inventory profiles through a variety of professionally managed strategies including clearance events and store closures. It has also leveraged its experience as a retail operator to develop and provide SaaS technology that helps retailers better manage their operations and key retailing aspects. Hilco is a capital provider and buyer of retail assets ranging from brands to inventory and real estate. It leverages its deep understanding of asset value to provide commercial finance and alternative investment solutions to retail and consumer companies, unlocking additional capital for inventory procurement, capex initiatives, expansion and turnaround initiatives, and debt refinancing. As the industry’s most respected and accomplished authority on retail and wholesale inventory monetization, HMR serves clients on five continents with customized solutions and transactional execution down to the smallest detail.