Utilizing Dynamic Advance Rates in a Specialty Finance Setting

While the focus of this article pertains to lenders to commercial and consumer finance companies, the principles described can be ascribed to trade receivables as well, particularly in seasonal businesses with dating terms or complex payment arrangements.

The utilization of dynamic advance rates structured around trailing dilution and loss ratios is commonly seen within securitization and asset backed lending transactions. This practice, however, is less commonly applied in specialty finance settings, where lenders to finance companies more commonly adopt a static advance rate to the portfolio or utilize dynamic rates from an ABL setting utilizing historic default and charge-off percentages as an indicator of performance. This can provide a level of confidence to their credit teams around a product or collateral which may be less familiar.

As field examiners, we have seen a mindset shift regarding field exams. Once considered a check box exercise at the tail-end of an underwriting process used to confirm existing assumptions, these exams have now become an integral part of the decision-making process itself, alongside a lender’s own credit team practices.

When engaged for a survey transaction, our specialty finance team at Hilco Diligence Services (HDS) works with the prospective borrower to establish several outputs evidencing portfolio performance. Collectively, these assist the lender in determining how best to structure their advance rate position where the analysis used replaces the more traditional approach of dilution rates and turnover days.

Creating a reliable and robust rollforward of receivables is a critical first step in understanding the cyclical nature of the portfolio. While this is common for most lenders, borrowers within specialty finance environments often do not have the capabilities or willingness to create this output from scratch and need some guidance through this process.

Here, also, it is important to consider nuances specific to the borrower. For example: Consumer lenders may monitor receivables at a gross level, inclusive or exclusive of interest receivable. Healthcare AR would need to be stated net of contractual allowances, payor reductions and lease payment streams which, in particular, can become complex as the implied interest rate of the lease can be restated with any modifications– making a principal-only rollforward a challenging prospect.

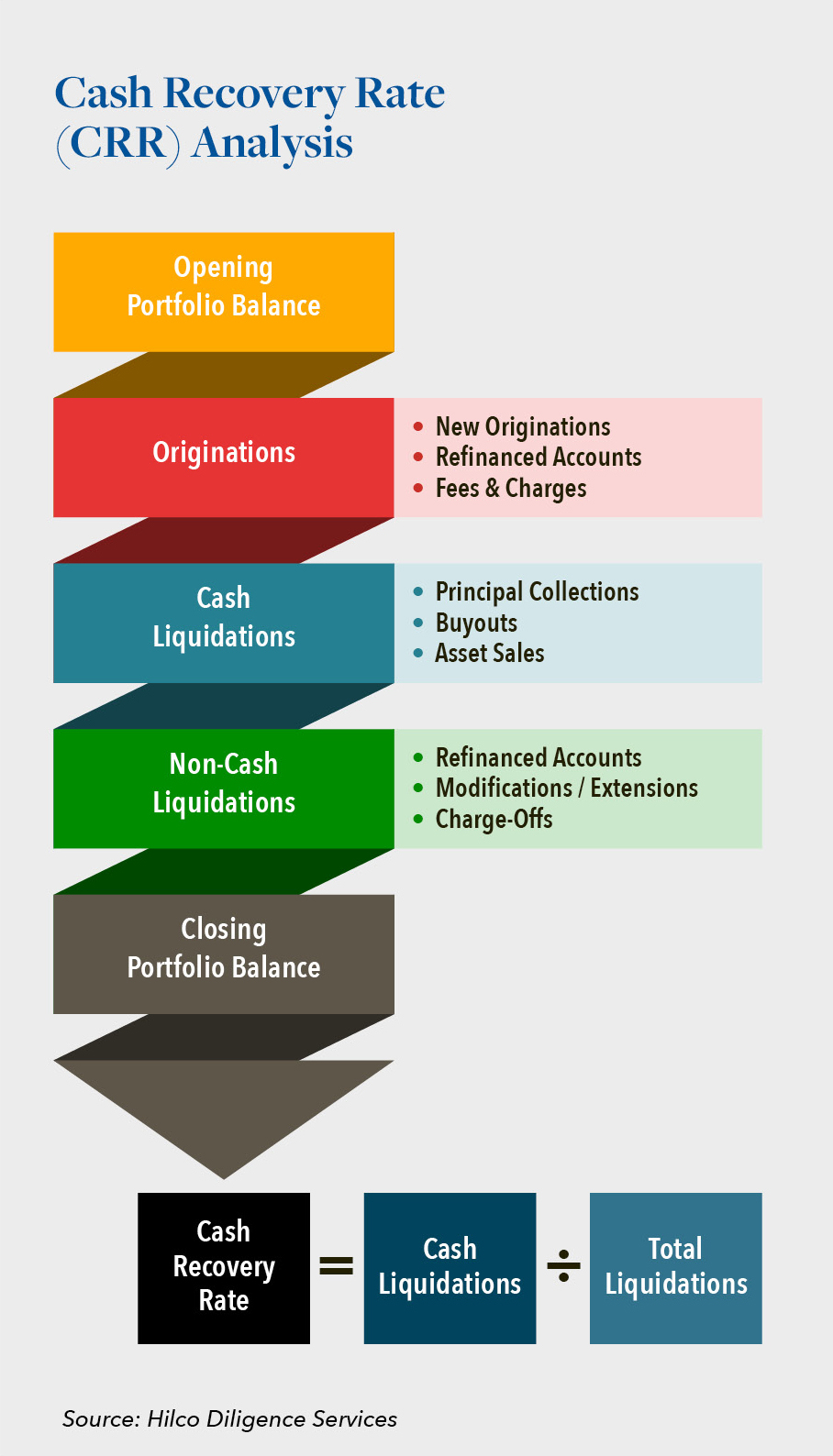

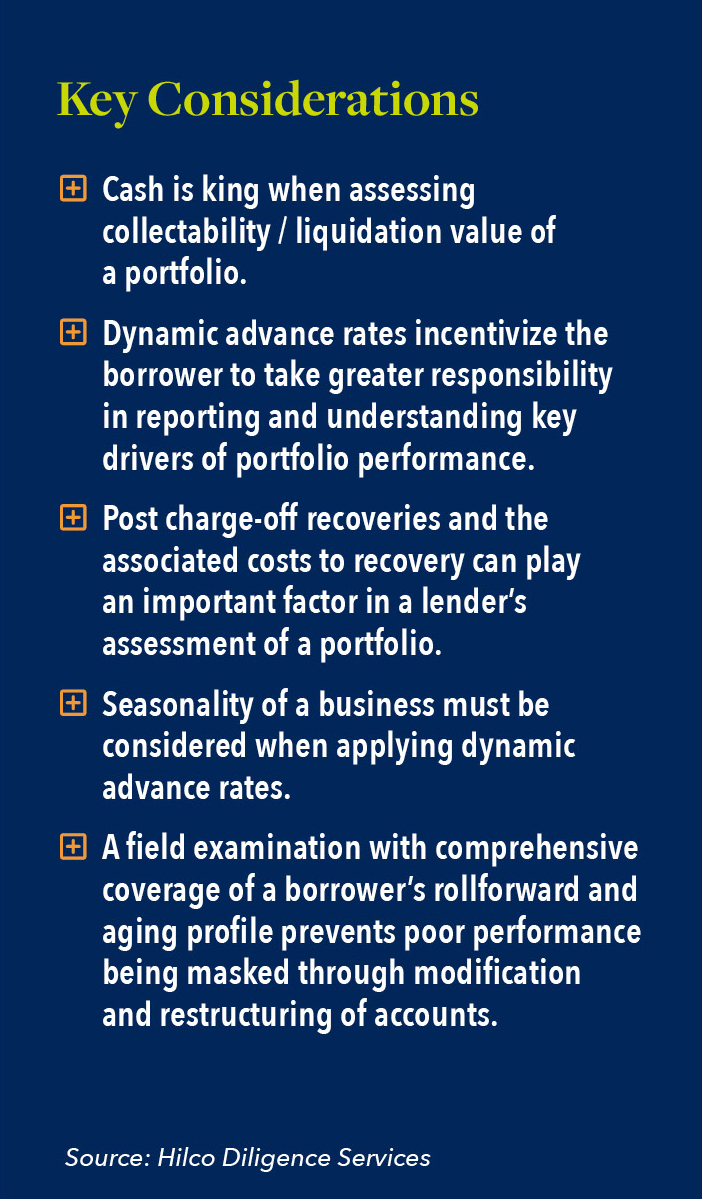

Once a rollforward is created, this allows a cash recovery rate (CRR) analysis – also commonly referred to as it’s inverse, a loss to liquidation (LTL) ratio. The CRR/LTL used today for Specialty Finance portfolios date back to the mid-1990’s with lenders coming to understand the benefits of an approach focused on cash over a delinquency-based approach that can be more easily manipulated within the borrower’s aging.

A CRR is based on the liquidations out of the portfolio. It calculates the percentage of receivables exiting the pool during the period which are settled in cash, relative to all liquidations. The result can be extrapolated forward to provide an orderly liquidation value (OLV) for the pool, assuming the material components of that pool remain consistent over time and incorporated into an advance rate calculation which can be restated each reporting period.

- Using a trailing 12-month average helps to adjust for seasonality in the borrower’s business, while a shorter time horizon can allow deteriorating performance to be captured sooner. A cautious approach can take the lower of a trailing 3- or 12-month CRR. In practice, the advance rate will likely incorporate both a discount to the reported CRR to create an additional buffer for the lender and a ceiling to the overall advance rate. In this dynamic approach, which can be recalculated monthly or quarterly, responsibility is placed squarely upon the borrower to monitor receivables performance and enhance its own credit decisioning profile. By doing so, the borrower can improve availability and best align to the risk profile of the lender based upon the agreed borrowing base structure.

Where the borrower has significant post-charge off recoveries due to a strict charge-off policy or an inherent part of its business model – for example: post charge-off repossessions for an auto dealer – credit can be assigned into the calculation for the additional recovery. Importantly, a lender should consider and monitor the costs associated with obtaining the recoveries. In a liquidation scenario, these legal or asset recovery costs would be borne by the lender, which can be significant at times. Therefore, treating recoveries on a net basis, including recovery costs, may be a more prudent approach where data is available to determine and then track on an ongoing basis.

With such a heavy reliance on the rollforward, part of the HDS field exam process is designed to validate the underlying data supporting the various rollforward categories. Without proper testing, reliance cannot be placed on the CRR/LTL as the output could be inflated for various reasons, including not charging off receivables within set timelines or netting dilutions within other rollforward line items for example.

Additionally, getting transaction-level detail pertaining to non-cash adjustments helps to ensure that the categories are being appropriately included or excluded from the calculations, and helps to inform eligibility considerations around restructured accounts. While these can be simple tests to perform, they require subject-matter expertise and are crucial in gaining greater clarity and confidence behind the CRR figures reported.

- These analytics ensure that issues within a portfolio are not hidden by the CRR calculation, which can occur where receivables are LIFO (“last-in-first-out”), thereby leaving the non-performing receivables propping up the collateral base but not liquidating. This is not an issue if the receivables age and are charged-off with expectations. Where restructuring of accounts through modifications or extensions takes place, however (which is particularly common with consumer borrowers and often utilized by borrowers as a collection tactic to encourage payment), it can keep non-performing receivables eligible within the portfolio when not identified and appropriate eligibility is not determined prior to origination of the transaction.

Static pools or the company’s loss reserve, as determined with a borrower’s external auditors (in accordance with current expected credit loss “CECL” requirements), can also be used as factors for evaluating portfolio performance and assessing expected collectability.

- Static pool analysis is most common in consumer lending portfolios, where underlying customers can be considered relatively homogenous and therefore ideal for cross analytics between origination tranches. This assists the borrower to dictate its future underwriting criteria or portfolio purchases, alongside charting expected collections over time.

In trade receivable situations where dating terms or complex payment arrangements exist, a static pool and CRR rollforward can shed light on how well these receivables actually collect and provide insight to the lender on collateral quality.

Building the above outlined analytics into borrowing base reporting packages and having a direct impact on the borrower’s advance rate brings enhanced visibility and ties AR portfolio changes to the borrowing base, hence reducing risk to the lender. Doing so, enables each party to identify deterioration of portfolio performance and allows for a more dynamic borrowing base approach rather than reactive decision making alongside other covenants and ratios imposed by the lender.

- HDS structured a dynamic advance rate for a portfolio of consumer loans for a retail business and continued to monitor through recurring field exams as Company performance began to decline, eventually filing for bankruptcy. A deteriorating CRR informed by the Company’s rollforward resulted in a falling advance rate and availability for that component of the transaction to limit the lender’s exposure. The deterioration was driven by a fall in sales which impacted the volume of collections from consumers that settle their outstanding balance in a short period. This inherently impacted the structure of the portfolio causing an aging receivable base with non-cash liquidations increasing as a percentage, given that total liquidations were falling.

- The dynamic rate allowed lenders to identify the issues and understand the underlying mechanics of the problem sooner, enabling them to begin working on resolutions. The alternative approach of a static rate would rely on monitoring for increases in the delinquency/default rates and breaching associated covenants, at which point the collectability of the remaining portfolio would have been significantly impaired relative to the historic norm for that business.

The above data points, when aggregated and verified from a field exam, allow the lender to take a quantifiable view on portfolio performance and expected recovery. Alongside macroeconomic considerations and qualitative risk factors, this data-driven perspective can be utilized in structuring a dynamic advance rate which incentivizes specialty finance borrowers, both small and large, to truly understand the causation for performance within their portfolio.

As the world’s preeminent authority on helping healthy and distressed companies and their stakeholders derive maximum value for their assets, our team at Hilco Diligence Services can act as a one-stop shop for field exam and appraisal services. We understand the value of due diligence and the impact it has on the outcome of a transaction. We are a true service provider, working in lockstep with our clients from beginning to end, and providing the clarity needed to approach transactions with 360-degree confidence.

With over a century of combined real market experience, including many former ABL professionals on staff, it would be difficult to name an industry that we have not served. In addition to our diligence capabilities, we offer clients a unique advisory and consultative approach. When our team is engaged clients receive bespoke, hands-on service tailored to their needs and access to the depth of knowledge and expertise found across the Hilco Global platform.