Weighing Retail Inventory Monetization Options is Critical as COVID-19 Persists

Retail and CPG manufacturers have been devastatingly hard-hit by the COVID-19 crisis. Since March, significant sales declines have occurred across the apparel sector, with emphasis on dresswear, formalwear, workwear, footwear, jewelry, and travel-related goods. As large inventories of seasonal spring and summer merchandise have languished in warehouses and on retail floors, even some of the most upscale retailers are implementing significant discounts designed to move inventories quickly in an effort to generate liquidity and floorspace for next season’s goods. Nowhere is this more evident than retail apparel where spring and summer styles are 40% off or more. For example, at Neiman Marcus, which is historically pointed and discreet with their discounting, customers are experiencing unprecedented sales throughout departments. As COVID-19 continues and immense uncertainty remains, retailers and manufacturers alike will be continuously challenged with maintaining enough liquidity to operate while ensuring the right inventory is in the right place at the right time. To be successful in this environment, a deep understanding of consumer trends, inventory values, and available solutions to balance inventory with liquidity is essential.

Market Uncertainty

Retailers and manufacturers are juggling a brew of competing economic indicators and data to plan for the balance of 2020. In the short term, retail sales numbers have been particularly encouraging, pushing management teams to ensure they have enough relevant goods for consumers to drive engagement in the back half of the year. According to the National Retail Federation’s Chief Economist Jack Kleinhenz, June’s numbers showed retail spending was ‘Fueling the economic recovery.” The U.S. Census Bureau reported that overall retail sales during June rose 7.5 percent on a seasonally adjusted basis from May and 1.1 percent year-over-year. This after a record drop of 14.7 percent in April, during the first complete month of store closures related to COVID-19. However, the extent to which this trend will continue is in question. Congress has failed to extend benefits that have spurred consumer spending over this period – $1,200 stimulus checks and an extra $600 in weekly unemployment benefits, to name two widely cited factors. Without a vaccine or therapeutic treatments, it is possible (if not likely) that as colder months approach, cofnsumers will retreat to the safety of their homes to avoid the virus, either by government mandate or personal choice.

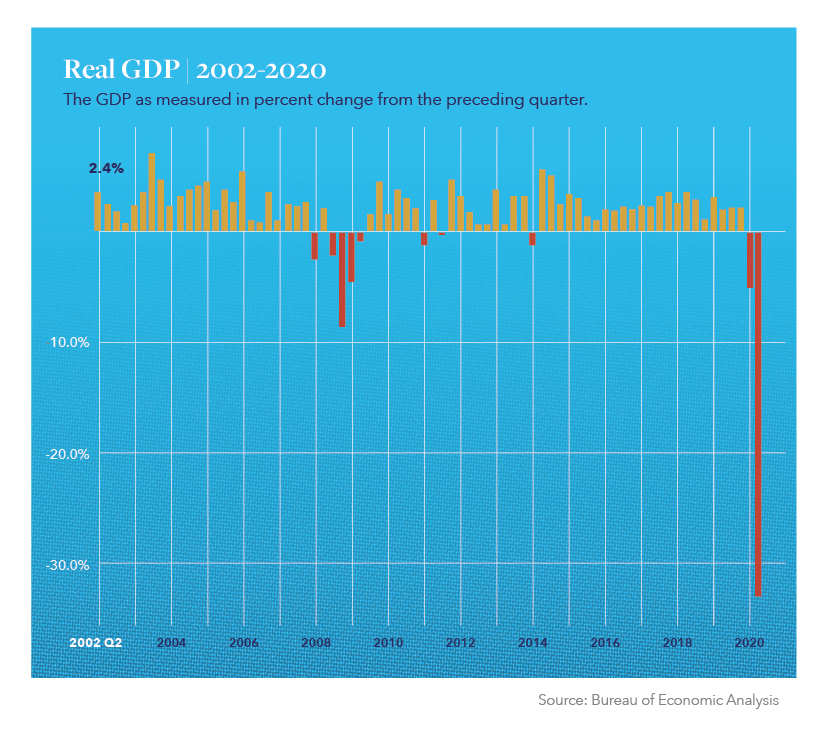

Despite some encouraging retail sales numbers, examining data against the greater macroeconomic backdrop is important. Q2 GDP data released in late July shows that the U.S. economy experienced a record-setting drop and is struggling to rebound as consumer spending fell at 34.6%, annualized, in the wake of layoffs, limited travel and the shutdown/restrictions at restaurants, bars and retail locations across the country. Though the number of people filing for unemployment has been decreasing, over a million people have continued to file per week well into August.

Predicting outcomes for 2020Q3, 2020Q4, and early 2021 is a moving target. To make the best business decisions, retailers and manufacturers can (and should) lean on professionals that maintain an industry-wide and real-time perspective, and that can access the capital and connections necessary help effectuate strategic initiatives which will determine short- and long-term success.

Retail Perspective

Retailers and manufacturers are facing a confluence of factors hitting all at once. In addition to the economic uncertainty, closures forced many retailers to cancel summer and fall orders with insufficient outlets to sell existing goods, resulting in a backlog of unseasonable inventory on store floors and warehouses. Canceled orders have backed up the supply chain and, in many cases, are still sitting with the manufacturer or have been abandoned at ports. Solutions to these problems have varied by circumstance, omnichannel capability, and cash position.

Well before the COVID-19 crisis struck, it was evident that long-established manufacturers and retailers had to make critical changes to keep up with significant e-commerce growth. Now, the realities of the pandemic have forced industry stalwarts to accelerate significant e-comm and omnichannel investments to remain competitive and help address inventory backlogs.

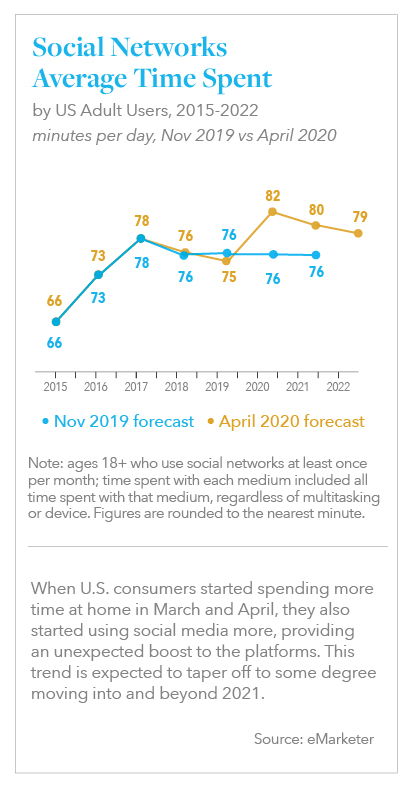

As part of the shift toward e-commerce, retailers are now shipping higher quantities of merchandise directly from their stores than ever before. Some have also turned to store staff to serve as online customer service representatives and social media liaisons to help facilitate more considerable numbers of e-commerce transactions and ensure customer satisfaction. Those with a built-out omnichannel infrastructure have fared far better than those without, illustrating its critical nature.

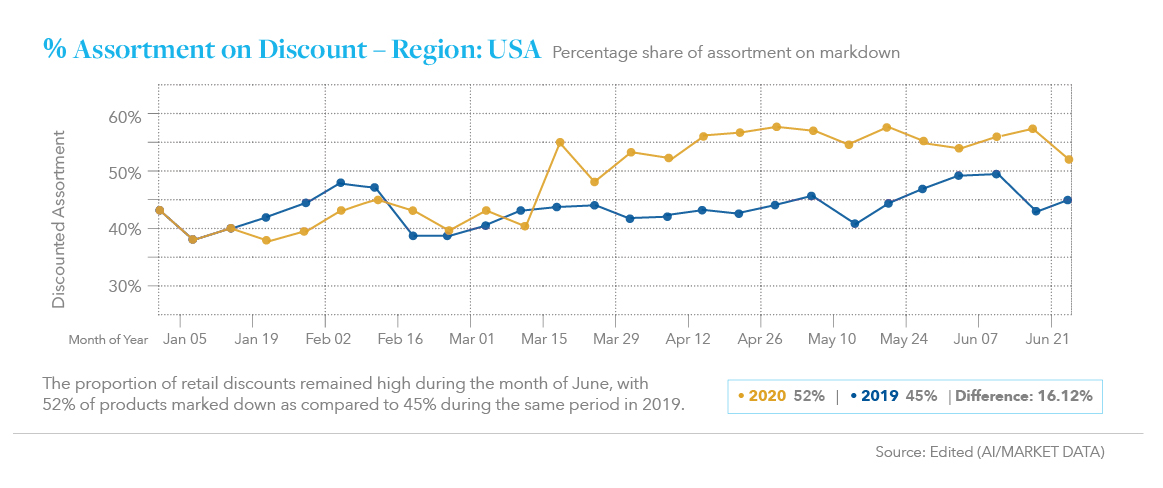

E-commerce sites heavily utilized the ability to dramatically discount merchandise online during the early months of the crisis. As stores have reopened, those discounts have translated to store markdowns across a broad assortment of merchandise.

Others, such as Levi’s, have taken a different approach. Citing the classic, non-seasonal nature of its core denim jeans, company CEO Chip Bergh told analysts early on in the pandemic during its Q1 earnings call that it would be holding some inventory for later as it is ”core replenishment which can be carried over to future seasons.” This inventory can be carried over through the “pack away” method as described below.

Capri Holdings, owners of Michael Kors, Versace, and Jimmy Choo have indicated a similar approach as they plan to repurpose this summer’s seasonal inventory for sale in spring 2021. Given that much of the merchandise never even made it to stores or the consumer, it will still be fresh next year and retailers may not need to deeply discount. Of course, only certain types of inventory can be packed away in this manner. And, even when inventory can be packed away, the retailer’s cash position may make such

a solution impractical.

For the vast majority of manufacturers and retailers currently sitting on significant volumes of seasonal or trend-based inventory, generating cash sooner rather than later will take precedence. For these companies, generating cash by moving that product into alternative channels, including off-price retailers, is worth the decreased margin associated with such a strategy. Ensuring the most profitable margin requires an understanding of how and where opportunities exist to move the merchandise quickly and in a way that yields the highest return possible. It is necessary to have all of this done while factoring in cash flow needs and other case-specific considerations. Accomplishing this is part art and part science, requiring real-time knowledge, insights, and strong ties to stakeholders across all consumer products. Additionally, such a solution should take into consideration vast historical pricing and trend data. Hilco, one of the premier retail and CPG practices globally, is in the unique position of maintaining such relationships and insights, as well as decades worth of valuation and disposition data. As a result, no firm is better equipped to help guide retailers and manufacturers through the process of responsibly generating the maximum amount of liquidity through inventory sales.

Strategic & Creative Considerations

Hilco’s industry relationships and reputation have provided numerous opportunities during the COVID-19 pandemic. Premier access to several non-productive or canceled inventories allows Hilco to produce timely insights for clients and capture premium merchandise that can be moved through the market independently or in conjunction with liquidation clients. Hilco has been involved with many of the largest and most high-profile liquidations of the past few decades and has applied this expertise to the COVID-19 pandemic. Hilco’s experience has enabled the development of distinct industry capabilities that have resulted in a proven record of delivering tremendous value to clients. These capabilities, through work in both augmentation and the off-price channel, include but are not limited to: utilization of equity agreements to deliver cash immediately to the seller, redirecting product into new channels in the most advantageous manner, utilizing strategic relationships with third-party logistics providers, and working to adjust the practice to the COVID pandemic.

Augmentation

Hilco’s “Augmentation” program enables retailers and manufacturers to sell their goods through another retailer’s Hilco-managed store closing event. Placing products in a controlled environment such as this serves to protect a seller’s brand. Doing so can often fetch a higher consumer purchase price, and provide predictable cash flow over a defined, short-term window. Additionally, Hilco’s extensive resources and understanding of market dynamics enable it to take equity positions, purchasing product for cash to create liquidity for the seller immediately. In recent years, equity positions have been increasing in frequency and importance for all parties involved. Hilco is seeing a strong demand during the current pandemic period for these deals. For Hilco’s liquidation clients, this supplements their existing inventories with a curated collection of merchandise, filling inventory gaps, and boosting overall recoveries—a true win-win scenario.

Off-Price Channel

In addition to purchasing and repurposing non-productive inventory from numerous sources, Hilco is actively involved in redirecting product into the off-price channel and to other discounters. When placing seller’s products into the off-price channel, Hilco develops customized strategies to protect clients from conflicts and internal restrictions. For example, Hilco has purchased branded merchandise from leading retailers and manufacturers under the condition to not sell into specific channels or types of locations that present either a competitive or perception issue. Lastly, Hilco can also place products outside the U.S. when needed or advantageous to do so for any reason.

While transitioning products to the off-price channel Hilco will, on occasion, take the step of black-lining or rebranding inventory to discourage and limit the potential for returns to the original retailer. Many restrictions during the early phases of COVID-19 prevented these usual measures from being implemented, however Hilco is seeing that recovery value associated with not conducting these activities is essentially offsetting the cost of any potential returns because the goods are worth more to a wholesaler with their labeling intact. The volume of inventories moving to alternative channels, potentially exposing customers to a brand for the first time, has been increasing during COVID-19, and more brands may recognize the value of this approach and thus adopt it as a regular part of their post-pandemic customer acquisition strategy.

Finally, Hilco maintains ongoing strategic relationships with third-party logistics providers (3PLs) on the East Coast, West Coast, and Midwest, creating a cost-effective distribution network. These relationships enable Hilco to efficiently pre-sort merchandise into curated and bundled collections. This distribution network also provides Hilco with the ability to repackage and de-brand merchandise as appropriate and with economic efficiency.

Conclusions

The environment of economic uncertainty is likely to persist and influence consumer spending for some time to come. As a conduit between multiple channels across the retail market, and the global leader in asset monetization solutions, Hilco often detects unique opportunities and holds pricing flexibilities that others in the industry do not. Hilco upholds other competitive industry advantages within many aspects of the market through decades of expertise, industry relations, and the ability to adapt to the COVID-19 pandemic. Currently, we are engaged in daily conversations across the industry and have several large retail liquidations and inventory acquisitions operating, with more expected during the months ahead. Hilco recognize that this is an unprecedented and trying time for many across manufacturing and retail, and we are here to help navigate and implement the most advantageous strategy moving forward.