Will Impending Interest Rate Cuts Drive a Debt Capital Markets Boom in 2025 and Beyond?

As we cross the mid-year mark and look to 2025, the likelihood of interest rate cuts later this year raises the question of whether we will see a boom in debt capital markets. To explore this possibility, we need to consider how interest rates impact debt capital markets, examine historical precedents, and assess current economic conditions.

How Much Do Interest Rates Drive Debt Capital Markets?

Interest rates significantly influence debt capital markets. When rates rise, borrowing becomes more expensive, leading companies to defer raising debt capital. It’s only logical that refinancing existing low-cost debt with higher-cost debt is financially unwise. Higher interest rates mean increased debt service payments, straining a company’s cash flow. Importantly, however, some companies may find themselves needing to refinance maturing debt despite higher rates. In these cases, banks and non-bank lenders often opt for amending and extending loan terms, especially for companies with performing loans. This arrangement benefits both parties. Companies maintain their existing debt facilities at the same rates, while lenders earn fees for the amendments and continue to receive interest income without deploying new, higher-cost capital. Additionally, performing loans require lower reserve requirements for banks, creating a win-win situation.

A Historical Perspective: The Post-Great Recession Era

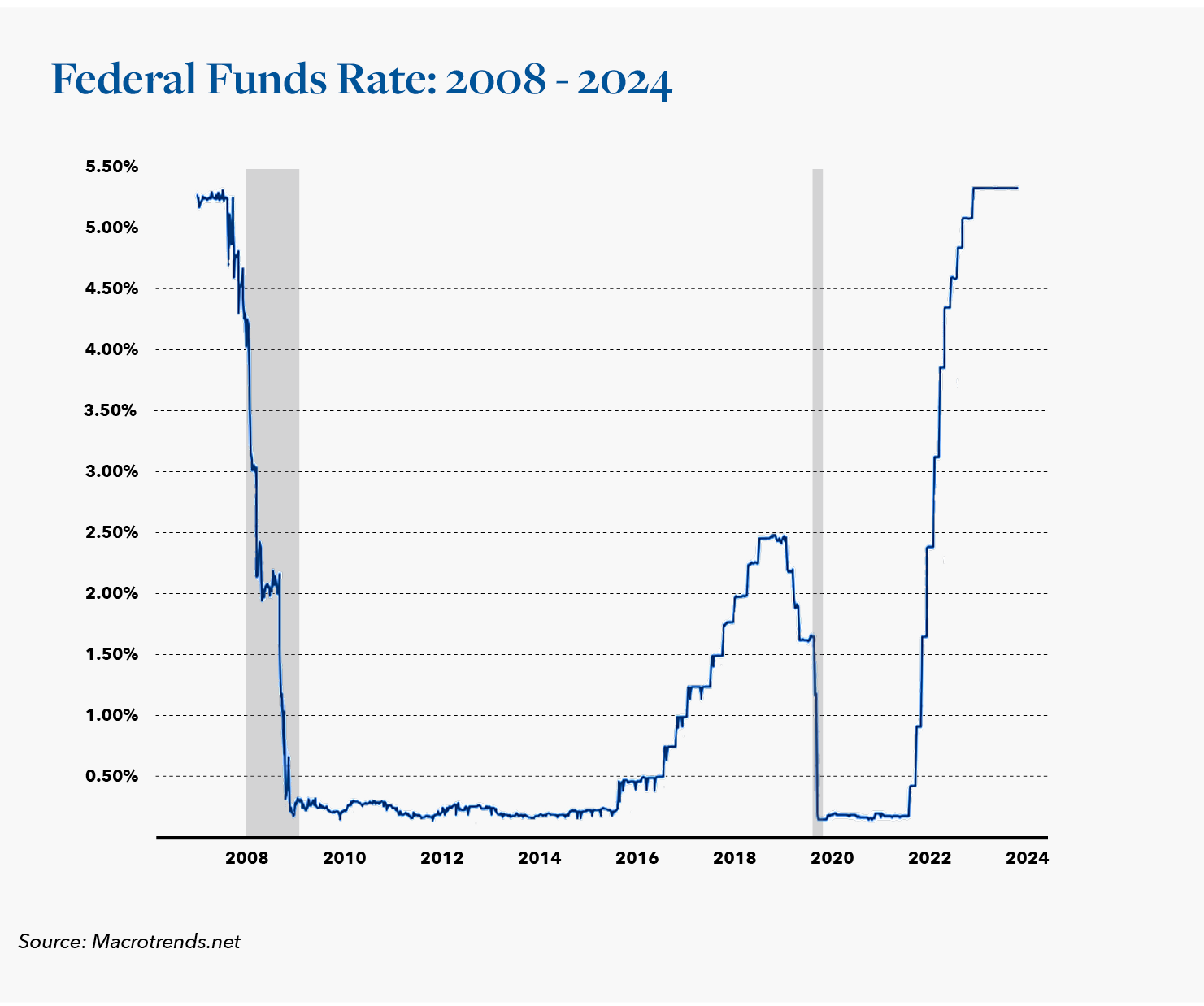

To understand how interest rates might impact future debt capital markets, it is helpful to look at recent events. Following the Great Recession of 2008-2009, for example, the U.S. economy was in turmoil due to massive losses in mortgage-backed securities. In response, the Federal Reserve slashed interest rates to near zero through unprecedented monetary policy measures, including ten rate cuts. However, the recovery was slow, and debt capital market activity was subdued. Regulated lenders, bolstered by funds from the Troubled Asset Relief Program (TARP), were hesitant to deploy capital. TARP aimed to stabilize the financial system and promote economic growth, but despite these efforts, lending remained cautious immediately following the crisis. The reluctance to lend during this period underscores how deep economic disruptions can overshadow low-interest rates in spurring debt capital market activity.

The COVID-19 Years and the Aftermath

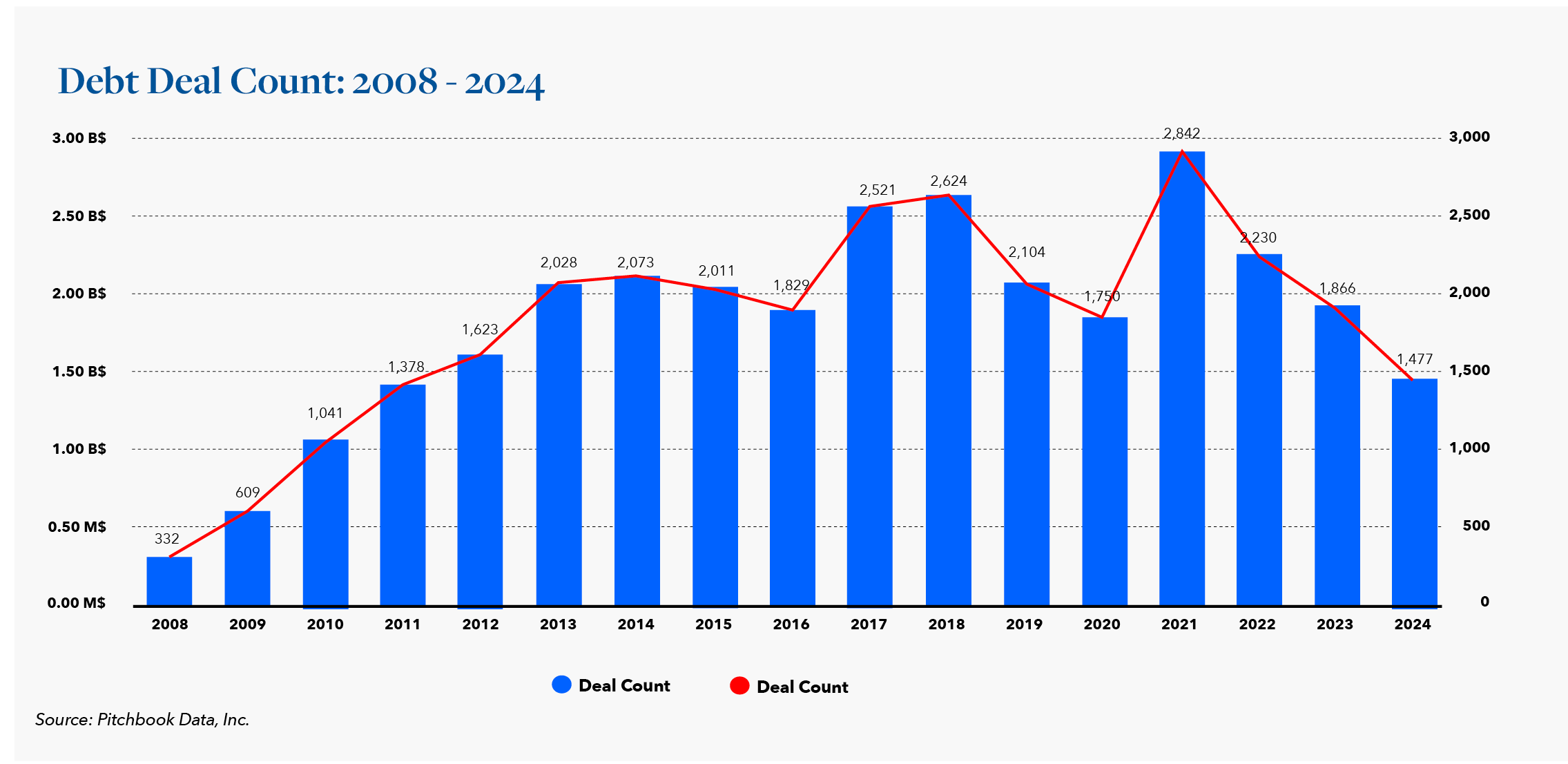

The COVID-19 pandemic in 2020 dramatically disrupted global financial markets. Equity markets plummeted but rebounded quickly, yet deal activity came to a halt during the lockdowns. As the world adjusted to the new normal with vaccines and government stimulus, the Federal Reserve continued to cut rates to nearly zero, igniting a surge in deal volume during 2021. This was driven by pent-up demand from 2020, increased consumer goods spending from home (with access to travel and events limited), and a wave of refinancings. Company valuations soared during this period, and the low-interest environment spurred mergers and acquisitions (M&A), resulting in a true boom in deal activity. This recovery, however, faced challenges including supply chain issues, labor market tightness driven by the “Great Resignation,” and inflationary pressures. The Federal Reserve responded with a series of interest rate hikes from late 2022 through 2023 that were intended to combat inflation. A byproduct of those actions was the resulting cooling off in deal activity.

Present Day Forward

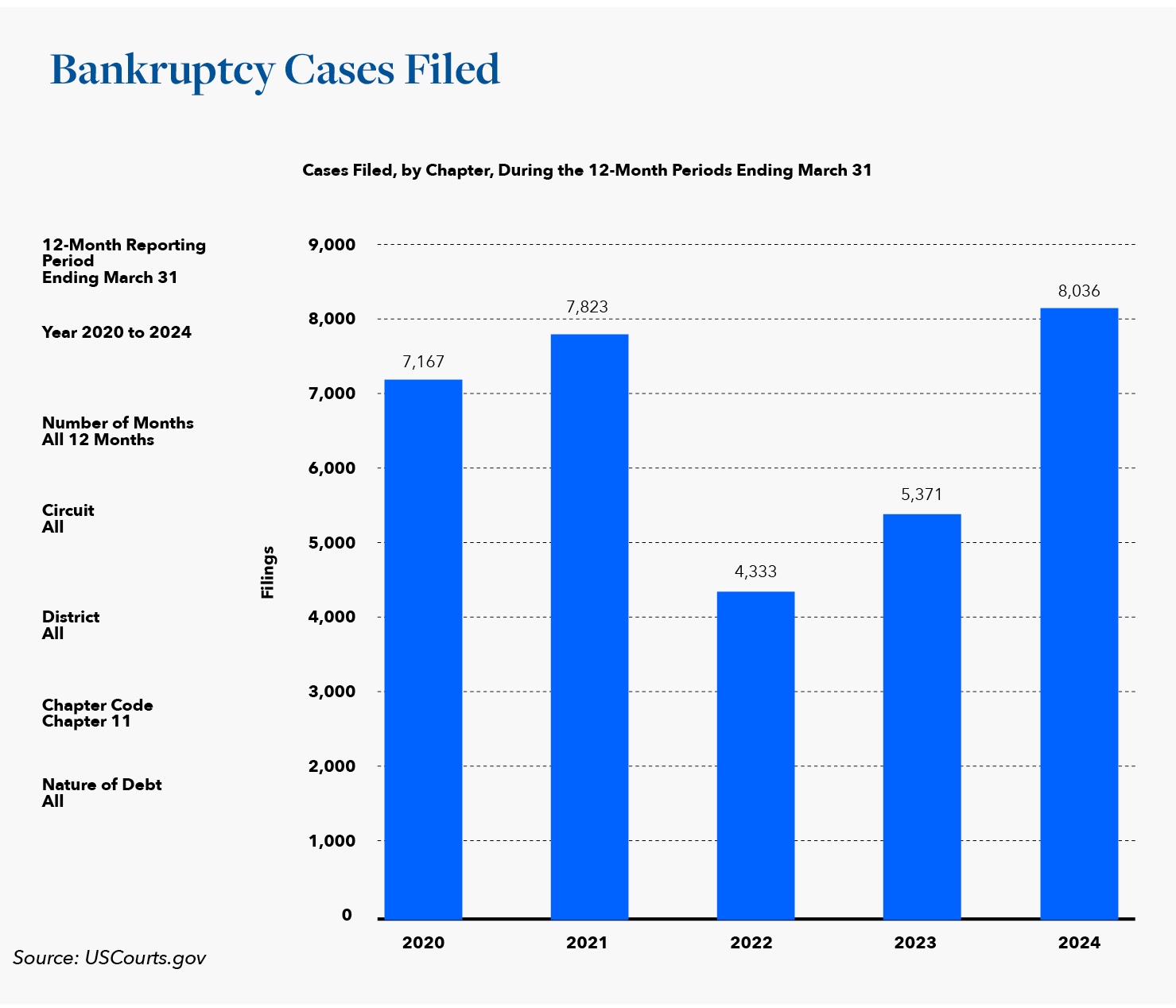

As of mid-2024, the Federal Reserve has held rates steady but hinted at potential cuts in the near future. Multiple rate cuts had been originally expected to begin in the first half of 2024. With inflation remaining above the Fed’s 2% target, those anticipated cuts will likely occur in the latter half of 2024 instead. This leaves many companies in a dilemma right now. Those needing capital are being forced to navigate a high-interest environment while others wait on the sidelines. Banks continue to amend and extend loans for performing borrowers, but non-performing loans are seeing increased restructurings and bankruptcy filings, particularly in consumer discretionary sectors like restaurants and retail. On the Private Equity side, firms are being forced to hold investments longer than intended, as they are challenged to exit at favorable valuations right now amid high debt costs.

Looking ahead, if the Fed begins cutting rates meaningfully, we might witness a gradual uptick in deal activity. Companies that postponed raising debt capital will likely re-enter the market as borrowing becomes more affordable and less burdensome on liquidity. However, the extent of this potential boom will depend on various factors beyond interest rates, including political stability, international relations, and broader economic conditions.

Implications for the 2025 Economy

Though the economy remains in a state of flux as of mid-2024, balancing between slowed but persistent inflation and the promise of lower interest rates, companies are cautiously optimistic but remain wary of immediate economic challenges. That said, historical precedent and current trends suggest that the following sectors may see deal activity increases in the months ahead:

Technology:

With cheaper access to capital, tech companies are likely to pursue acquisitions to accelerate innovation, expand market share, and integrate emerging technologies like artificial intelligence, cloud computing, and cybersecurity solutions. Historical precedents, such as the surge in tech deals post-2008 financial crisis when rates were near zero, suggest a similar trend could emerge in 2025.

Healthcare:

Lower interest rates reduce the cost of financing large acquisitions, enabling pharmaceutical companies and healthcare providers to pursue strategic deals aimed at expanding their product pipelines, improving service delivery, and achieving economies of scale. The COVID-19 pandemic underscored the importance of robust healthcare infrastructure, and companies are likely to continue consolidating to enhance their capabilities and resilience.

Consumer Goods:

Business in the sector have often utilized consolidation as a means of enhancing brand portfolios, expanding distribution networks, and leveraging synergies and efficiencies. In the aftermath of the Great Recession, for example, numerous consumer goods companies engaged in significant M&A to optimize their operations and capture new markets. With declining rates, companies may also focus on acquiring innovative, younger brands that appeal to evolving consumer preferences including sustainability and customization.

Industrials:

Cheaper capital can facilitate investments in advanced manufacturing technologies, sustainable practices, and expansion into new geographies. Industrial M&A activity tends to rise with lower interest rates as companies seek to enhance operational efficiencies and reduce costs through strategic acquisitions.

Private Equity:

A more conducive borrowing environment will enable PE firms to pursue larger and more numerous deals, focusing on businesses across sectors that demonstrate high growth potential and opportunities for operational improvement. While the private equity boom post-2008, driven by low interest rates and abundant capital, may be indicative of what we could start to see take place at some point in 2025 or 2026, this is a different market and time. Among other areas, we are likely to observe notable focus from PE firms on investment in businesses with proven traction in artificial intelligence development as on businesses now leveraging AI and machine learning technologies and those ripe for adopting these to gain competitive advantage.

Real Estate and REITs:

Lower interest rates reduce the cost of capital for acquisitions and development projects, making it an opportune time for consolidation in commercial and residential real estate. Historical trends post-recession suggest aggressive deal interest as companies seek to capitalize on lower financing costs to acquire appealing properties and portfolios. Commercial real estate deals are likely to be among those that will be most highly scrutinized as investors weigh the potential return on office properties relative to the likelihood of continued remote and hybrid work trends, as well as a property’s potential for office to residential conversion.

Concluding Thoughts

The charts herein support a correlation between debt deal activity and interest rates. Over the same historical period, we see an increase in the number of debt deals completed when interest rates are lower. Conversely, we see the number of debt deal activity decrease over time as interest rates rise. While other outside factors inevitably factor into deal activity levels, a strong correlation between interest rates and deal activity is unquestionably evident. It is, therefore, reasonable to expect that we will see deal activity pick up once the Fed’s expected rate cuts occur. As rates continue to decrease over time, we should also expect to see a greater increase in debt deal activity.

Lastly, it should be emphasized that the relationship between interest rates and debt capital markets is highly complex, influenced historically by myriad economic, geopolitical and other factors including increasingly larger debt funds that continue to achieve record-level fundraising dollars ready to finance M&A activity. While impending rate cuts could drive a potential boom in debt capital markets in 2025 and beyond, the impact that these factors might have on such a development remains uncertain. As companies and investors navigate the current economic landscape, they must remain agile, prepared to adapt to both opportunities and challenges that arise.

Our ongoing and historic Debt Capital Markets and M&A work involves a range of businesses across the sectors referenced in this article and provides us with a unique, informed perspective that could prove valuable to your business or a company in your portfolio as the interest rate landscape shifts in the months ahead. With this in mind, we encourage you to reach out to our team for a confidential discussion pertaining to either a current or anticipated need. We are here to help.

Hilco Corporate Finance, LLC is a registered broker-dealer and member FINRA and SIPC.