Your Business Needs Actionable Data Now

In this article we discuss how many companies, both large and small, are missing out on critical insights that can be used to drive operational decision making and result in greater profitability.

What if you’re making production, capital investment and other decisions predicated on the fact that you believe your business has healthy margins, but it really doesn’t? How much would that information be worth to you?

To make our point, let’s start with an illustrative example based upon some of our recent turnaround and restructuring work at Getzler Henrich. A $300 million manufacturing company prices its bestselling product at $10 per unit and its second and third best-selling products at $12 and $14 dollars each. The company selects these price points because a) there seems to be little if any price resistance at those levels, b) because customers and their own store checks tell them time and again that those products fly off the shelves, and c) because their margins are highly favorable at those price levels.

Upon closer examination, it turns out that the business has a problem. It is bleeding cash. That best-selling product priced at $10 that flies off the shelf is, in fact, not yielding a healthy margin. Rather than making $4 per unit as believed, the company is actually losing $1.90 on each item sold. Unfortunately, the same is true of its second and third best selling items. How can this be?

Herein lies the core issue. Diligence finds that the company has an outdated enterprise system which is not providing wholly accurate information. Furthermore, it turns out that management relies upon monthly reports generated by sales, finance and operations. These departments are each highly siloed, conduct their own ad hoc queries, and report in a varied manner. While the reporting from each tells a different story, none of the information is necessarily incorrect or being manipulated. Unlike the raw source data located on the back end of the company’s system, however, different variables are being introduced and considered by each of these departments in their analysis and reporting. As a result, the data presented has misled management to make a number of strategic decisions over the years based upon a wide range of false or unaligned assumptions.

While the need for companies to continuously update systems and improve reporting is fundamental and widely embraced as an important business principle, the point that has been once again driven home for us during the COVID-19 crisis is the unexpectedly high percentage of sizable businesses we see, both healthy and in distress, that have failed to do so over a prolonged period. Some Management teams can be surprisingly blind to the impact that their own lack of action has had on their businesses over time.

Logic would seem to dictate that when you believe you have margins in the range of 40% but are bleeding cash, there are underlying factors contributing to that disparity that need to be identified and addressed. The path carved by logic, however, can be expensive and resource-draining, or is often perceived to be and therefore not taken. But “what if” these assumptions, much like the others addressed above, were also inaccurate? That was the first in a series of questions that we asked and answered for ourselves, followed by a series of others: What if your business doesn’t have $4 or $5 million to invest in a new enterprise system? What if your present situation doesn’t afford you the time needed to build and deploy that type of system? And what if you don’t have the internal resources that would be required to shorten the runway even if you could make the capital investment? Lastly, we asked… What if an alternative solution existed? Now it does.

“This ability to turn a bunch of numbers into actionable data insights for businesses, and to do so dynamically, is truly distinctive because it creates control where control did not previously exist.”

– Robert Gorin

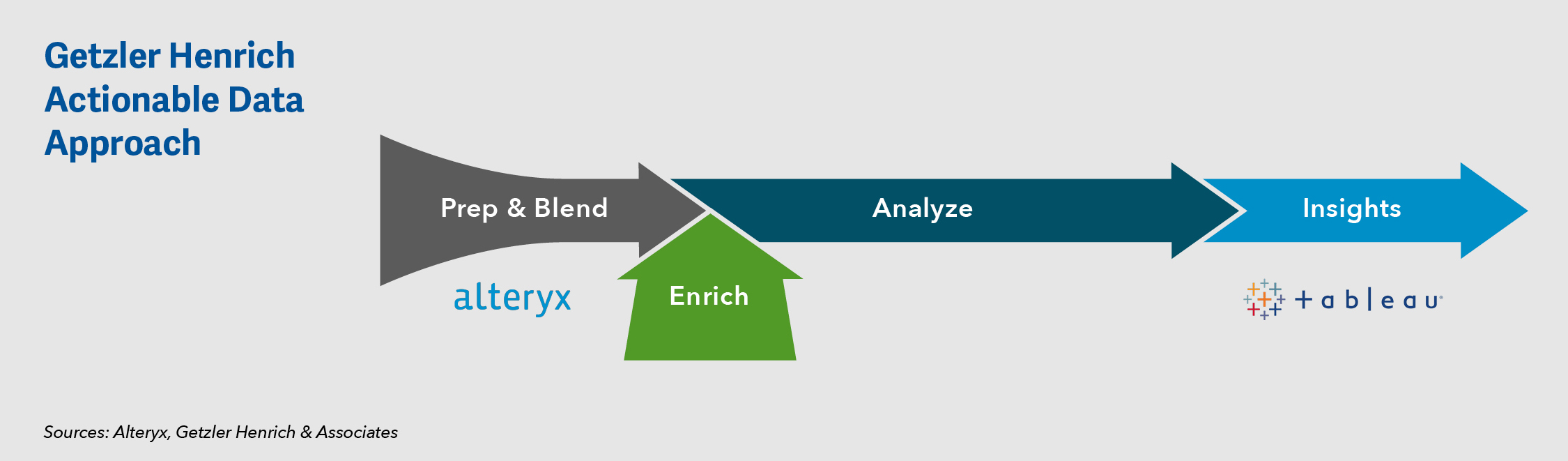

Leveraging both our firm’s and our own collective expertise, gained across decades of complex engagements involving process improvement, supply chain strategy, sales and marketing consulting, technology systems assistance and transaction advisory services, we have been able to build a truly dynamic and customizable solution capable of providing a company with a broad range of insights based on actionable data derived from the back end of its own business systems. Built on the Alteryx automation platform and integrating our own proprietary algorithms and AI, this is far more than a reporting tool. The solution can be customized to deliver dynamic financial information, inform marketing campaign targeting efforts, aid sales teams by providing real-time company and competitor insights during the customer negotiation process, and provide precision pricing guidance.

This ability to turn a bunch of numbers into actionable data insights for businesses, and to do so dynamically, is truly distinctive because it creates control where control did not previously exist. By tapping into invoice level data from the back end of their own systems, we have, for example, enabled our clients to shift from setting prices based on stale, 12-24-month-old data to doing so based on real-time inputs. We have empowered their product development and field teams to track the performance of dozens of SKUs, drill down to reveal even greater detail regarding high or low performing items and take steps to eliminate or augment portfolios of products as a result. Not only can profitless production items be weeded out in this manner, but the associated shelf space cost can be saved. A company can even use insights driven by the data to reallocate interchangeable WIP inventory toward its most profitable SKUs.

Raw material, production, labor, and shipping costs incurred by a business sourcing product either domestically or overseas can be easily analyzed. With a single keystroke, each of those costs can be converted from their associated local currency – such as the Japanese Yen, Vietnamese Dong, or South Korean Won, for product/services sourced from Asia for example – into a single report automatically reflecting their U.S. dollar value, saving laborious and costly manual effort and eliminating the potential for inaccurate results.

Importantly, because it can be fully customized to a user’s specifications and needs, this type of solution can accomplish virtually any task that involves leveraging data to optimize efficiency and profitability. It can be utilized just as effectively by a consumer goods company as it can by companies across any number of specialized commercial industries. From simply closing monthly books more quickly and providing lenders with timely reports, to forecasting product sales 2-3 years into the future, or even screening sources to compile aggregated market data when shopping for used industrial equipment, the adaptability of the built-in proprietary algorithm and AI interface can drive those kinds of outputs.

Even if all you and your business seek to accomplish right now is to better understand what it truly costs to deliver a product and price it accordingly, or how much each company division truly made or lost over the past 12 or 24 business or financial cycles, consider this. In less than 30 days and for well under $100k, our team has been able to deliver capabilities approximating the functionality of a new enterprise system that would take the better part of a year to build at 10 to 40x the investment. For individual business, these builds have included analysis of five+ years of invoices, millions of lines of data, the linking of customer invoices to those from vendors and the customization of interactive tableau-based dashboards that provide up-to-the-minute views of profitability by product line, item, customer, geography and more, in a format that delivers much more than just a look at numbers in columns.