2024 Threats Facing Manufacturing and Industrial Businesses Warrant Lender Caution

How will reduced consumer spending and increased leverage cost stress manufacturing & industrial companies in the year ahead?

Manufacturing & industrial companies are precariously balanced right now. On the one hand, sales remain strong and these businesses have, at last, been able to hire more of the right talent, albeit at a higher cost than a couple of years ago. This, however, is occurring within an environment of significantly increased cost of debt, where OEM customers are applying pressure and leverage to secure increasingly painful cost reductions from their suppliers.

With this landscape in mind, the below outlines what we view as the primary threats to manufacturing and industrial businesses as well as their lenders with exposure in these areas. The information provided also addresses important considerations and proactive steps for these companies to take that can help them minimize future downside risk. Lenders should look out for portfolio companies that are still struggling with legacy challenges from 2020; e.g. trouble getting parts on time, supply chain challenges, finding and hiring good people, and getting equipment serviced (on-site technicians & parts).

Leading Threats

Something Sudden

The U.S. industrial industry has taken lessons from the pandemic and tariffs to diversify their supply chains. Companies have implemented near shoring and redundant suppliers to reduce their exposure to these risks.

Ultimately, the real risk every year is something unexpected. The top of the list of hypothetical concerns include: cyberattacks and the resulting data breach and escalating global conflict.

Consumer Spending Collapse

Even with recent U.S. government data indicating a notable surge in consumer spending, factors including rising credit card balances and the recent resumption of the student loan repayment burden for millions across the country, place a continued high level of consumer spending during 2024 in question. Notably current data shows a consumer spend slowdown. Keep in mind consumer spend approximates 60% of GDP. Consumer behavior matters.

Fed Rate Hikes

The Federal Reserve decided this November to maintain interest rates at a target range of 5.25 to 5.5%. This marks the third instance in the last four meetings where the Fed has opted to keep rates steady. While this cautionary stance has prompted speculation about whether the Fed may now have concluded its series of rate increases, uncertainty remains as to whether new developments could lead to further, potentially aggressive, increases and its impact on cash interest expense.

High Cost of Doing Business

The inflationary environment has notably added expense, ranging from costlier insurance, healthcare and utilities to anything dependent upon oil production, including transportation cost, plastics and resin-based manufacturing.

Lack of Capital

The Fed continues to pull liquidity from the system and lenders are under pressure to strengthen and diversify their balance sheets, as a result, industrial and manufacturing businesses will see restricted access to capital. The lack of access to capital could impact business growth and hiring plans.

The Ever-Coming Recession Arrives

While the economy seems to have avoided a recession in 2023, there is speculation that if real GDP growth remains modest on a prolonged basis, we could see what some have termed a “growth recession” characterized by a sluggish economy but very little impact on the employment market.

Election Cycle, Legislative and Administrative Policies

The uncertainty that accompanies any pre-election period in combination with ongoing instability in the House of Representatives, the specter of another government shutdown and the U.S.’s unavoidable and polarizing connection with the ongoing conflict in Gaza, could lead to economic fallout and reverberating supply chain and other repercussions both domestically and globally.

2024 Tailwinds

- GDP growth continues in 2024 to a consensus estimate of 1.7% with ranges from 1% to 2.5%. This is less than the 2.1% growth for 2023.

- Inflation has slowed significantly since its peak of 9% in June 2022, dropping to 3.2% in November 2023. While labor and material costs have increased significantly since 2020, companies have been able to price for these increases and profit margins are generally higher today than in 2020.

- Private Debt is available to fuel corporate growth, albeit at higher rates than from regulated bank commercial lenders. High leverage is putting strain on companies who borrow as they grapple with higher rates, decelerating free cash flow growth and the current multitude of economic challenges.

- Labor Participation Rates continue to improve from the 2020 lows of 60% to the current levels of 62%. The trend is continuing to improve towards the recent average of 63% (recent average 2013 to 2020).

- Federal Spending Implications of The CHIPS and Infrastructure Investment Acts will continue to flood the economy with cash. The infrastructure projects will receive significant funding throughout 2024.

Middle Market Considerations

We are seeing middle market industrial and manufacturing companies remain generally optimistic about 2024 as a performance year, and continuing to make capital and talent investments. This is not to say that there are not strong headwinds to navigate, including a continued, tight labor market – complicated by a vast percentage of baby boomers now reaching retirement age – and the ongoing unknowns surrounding interest rates, inflation and the potential for recession. While this has resulted in a bit of a “push forward while simultaneously waiting for the other shoe to drop” scenario, it should also be considered that the U.S. remains one of the safest places in the world to store capital right now, and continued global unrest is highly likely to result in an even greater level of capital influx from international markets in the coming years.

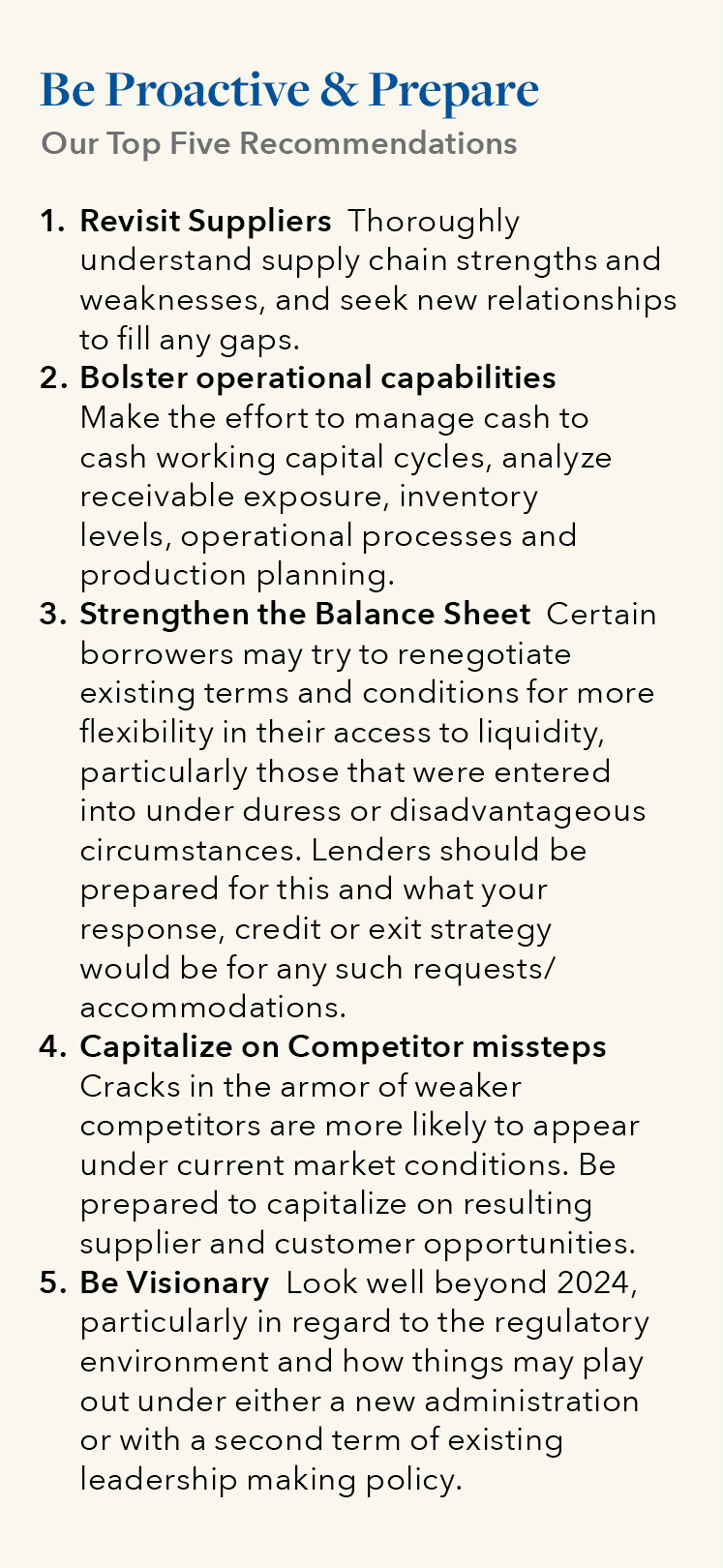

Factoring in each of these threats and considerations, our view is that middle market companies would be well advised to prepare now and proactively address the threats that stand to inhibit their growth or, worse yet, result in their distress in the coming year. And their lenders should be sensitive to these issues and monitor/be prepared to navigate these matters as they may relate to their borrower’s performance. Our top five recommendations on where to begin this process are indicated below:

Much of our own work with industrial and manufacturing clients in 2024 will be focused in these areas to help build in resilience for those businesses, enabling them to fend off these and other threats which present a high level risk and increase the potential for future distress.