A Cigarette & Tobacco Market Overview for Asset Based Lenders

In this, the first article in our three part series on tobacco, vaping and cannabis, we provide a detailed overview and insights for lenders with current or potential portfolio exposure in the cigarette & tobacco market.

Consumption Trends in the U.S.

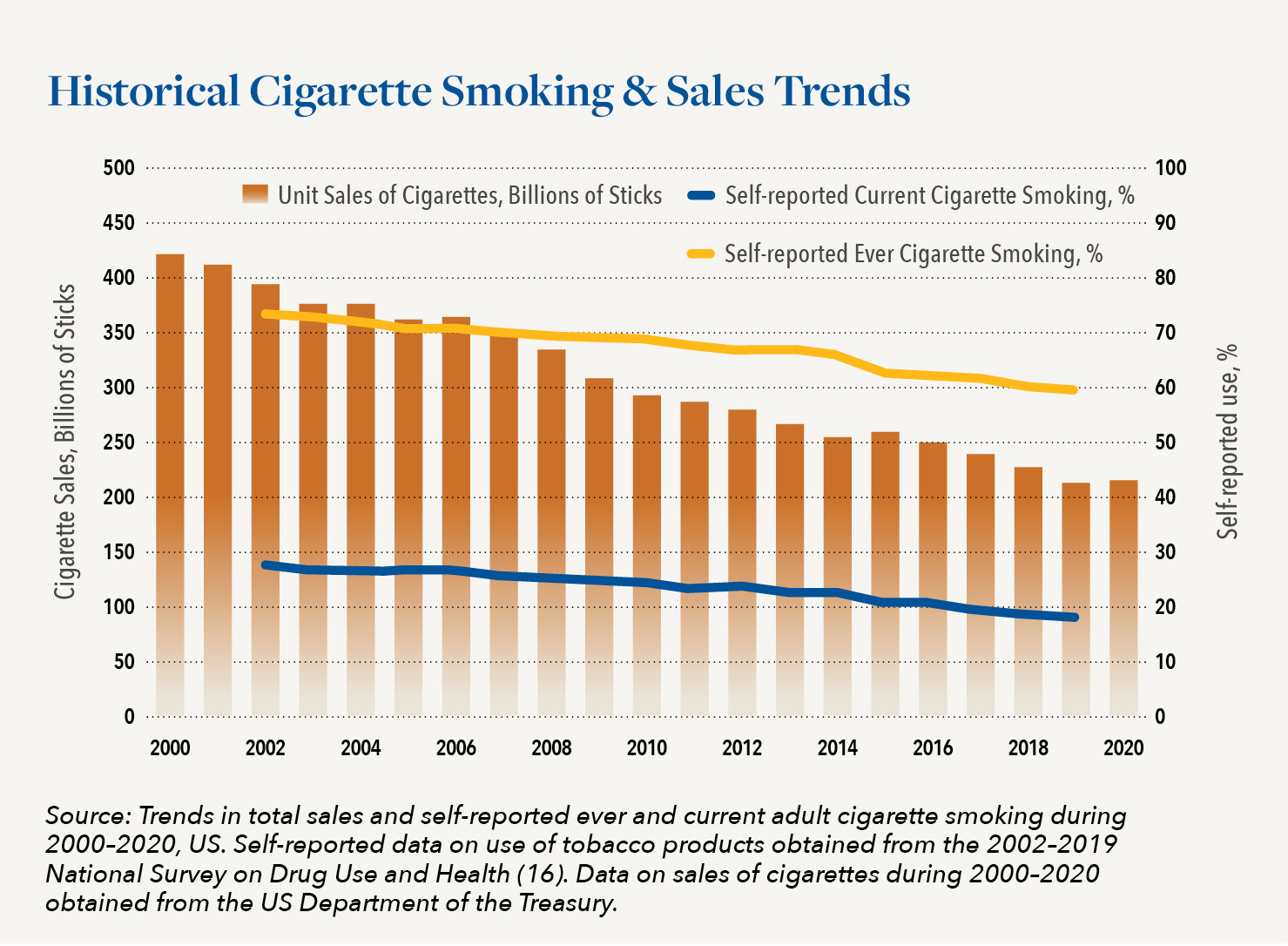

11.5% (28.3 million) U.S. adults aged 18 years or older smoked cigarettes in 2021. While that may seem like a fairly high percentage given current medical knowledge, smoking education efforts and Americans’ increasingly healthy mindset, the figure represents a substantial decrease from a whopping 20.9% as recently as 2005. In fact, sales for the cigarette and tobacco products wholesaling industry have shrunk notably over the past five years as wholesalers have contended with expanding regulatory and economic challenges, as well as shifts in consumer preferences.

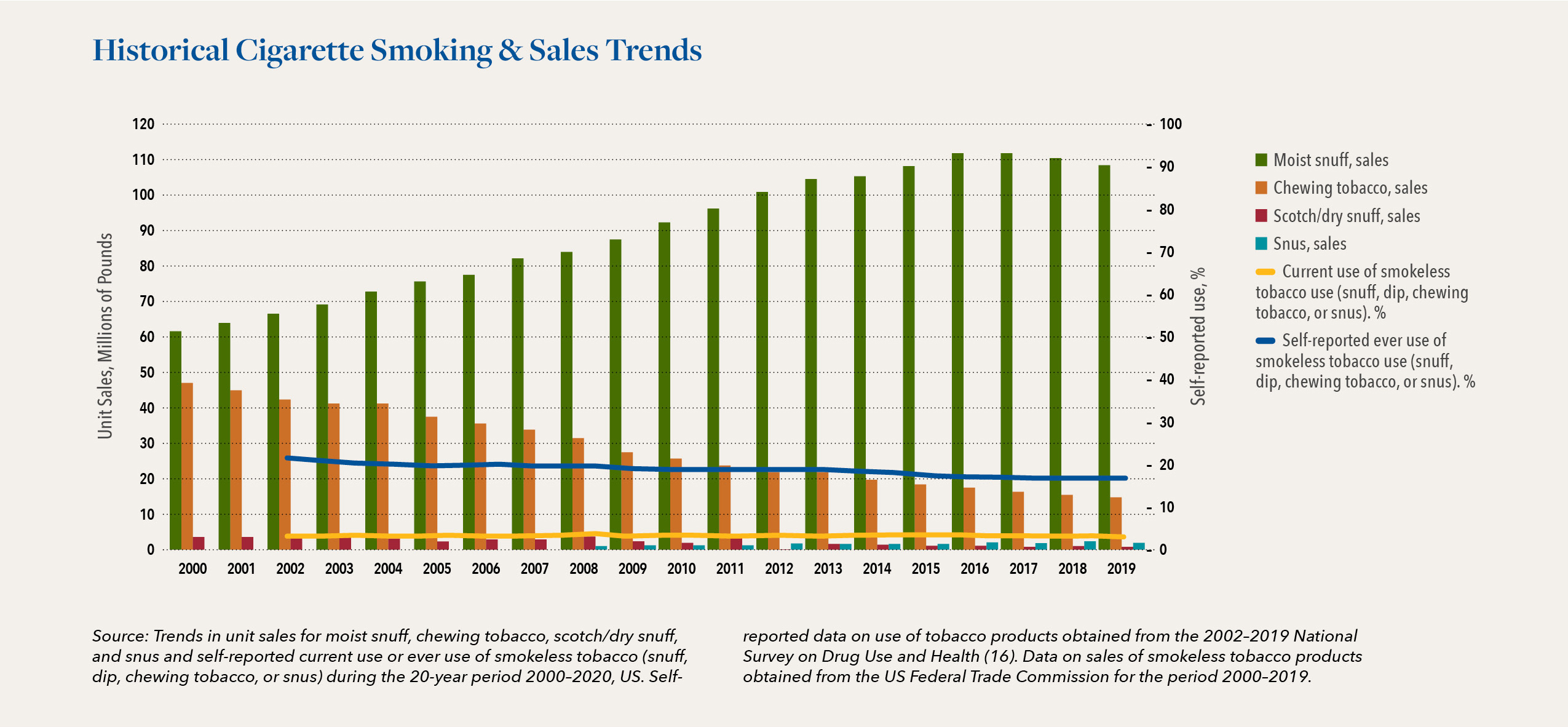

Wholesalers have expanded their product portfolios to capitalize on the continuing popularity of e-cigarettes. This has partially offset declines experienced by the industry within their cigarette and other tobacco product lines. Although smoking rates overall have plummeted, e-cigarette use has helped to maintain steady sales overall. Demand for other non-cigarette tobacco products such as premium cigars, cigarillos and snuff has also been persistent. That said, revenue for the cigarette and tobacco products wholesaling industry has declined at a compound annual growth rate of 1.0% over the past five years, hitting an estimated $149.2 billion in 2023. It is expected that given factors associated with inflation, 2023 alone will see a revenue decrease in the range of 1.6%.

Regulatory Environment & Transition to E-Cigarettes

Regulations related to cigarette and tobacco products continue to grow across the nation, primarily at the state level. For instance, in early 2022, Massachusetts implemented a ban on all flavored tobacco products, including menthol cigarettes. Other locales and municipalities have imposed severe restrictions on where smoking is allowed, including many outdoor and public venues. It’s safe to say, the pressure continues to mount across the country on anything tobacco related. This is one of the reasons consumers have transitioned to e-cigarettes, or vaping, which is considered by some to be less harmful, but also to wean off traditional cigarettes. I will cover vaping and e-cigarettes further in part two of this series of industry perspectives.

Regulatory rules pertaining to the use of e-cigarettes are still a work in progress, with the U.S. Food and Drug Administration first assuming authority over these products relatively recently, in 2016. The five-years leading up to that time saw exponential growth in the production and popularity of e-cigarettes. In fact, according to the Center for Disease Control, a 122.2% increase in the sale of those products took place in the span from 2014 to 2020. While this proliferation of e-cigarettes helped to significantly boost wholesaler profits during that time, the stringent regulatory environment that has now taken hold, combined with the continued, social stigma against smoking and tobacco use overall is widely expected to further the reduction of traditional tobacco product consumption over the next five years.

A lender should be aware of the changing consumer landscape and regulatory environment when considering an engagement with a traditional tobacco distributor or manufacturer. These ever-present, everchanging risks related to regulation and consumption alternatives add to the uncertainty of a declining industry and should be monitored closely by any potential lender. With these thoughts in mind, we present the following diligence insights.

Recommended Due Diligence Discussion Topics

Nature of the Business:

Understanding the specific nature of the operations of a tobacco consumer products company as early as possible in the due diligence process is key to a successful inventory appraisal outcome. It’s critical to understand if the company is primarily a manufacturer of items such as cigarettes or chewing tobacco, or are they mainly a distributor? Do they produce or distribute a variety of products or accessories such as lighters, or are the solely a cigarette maker? Who are their customers? Do they sell to distributors who in turn sell into the convenience stores and gas stations marketplace, which most tobacco manufacturers refer to as the “measure market”? Or perhaps, they are a smaller, regional company that sells directly to such retailers? It’s critical for a lender to fully understand the landscape, channels of distribution and footprint of operations of any given company in this space, as this can have a direct impact on the inventory valuation.

Key Products, Trends and Expirations:

The most known forms of chewing tobacco are Moist Snuff Tobacco (MST, or “Dip”), often in a variety of flavors and packaged in hockey-puck-like plastic container, and loose-leaf chewing tobacco, which consists of shredded tobacco leaf, usually sweetened, sometimes flavored, and mainly sold in a sealed pouch. Also, there are typically 20 cigarettes per pack and approximately 25 brands of U.S. cigarettes sold across the country. Recent trends suggest that consumers will begin to trade down from premium loose-leave chew, MST and premium cigarettes, to discount brands, mainly due to worsening macroeconomic conditions and a potential recession. As a result, discount product segments are poised to reap the rewards of this growing prospect in the coming quarters. lenders must also understand potential issues associated with product expiration across the variety of product offerings. Typically, Looseleaf chew expires after 12 months post-production, while moist snuff tobacco and cigarettes have expiration dates of 6 months and 24 months respectively. Lenders must be aware that inventory expired or nearing expiration may require significant discounting, and may be subject to limited distribution channels in a liquidation.

Aging and Storage of Raw Tobacco:

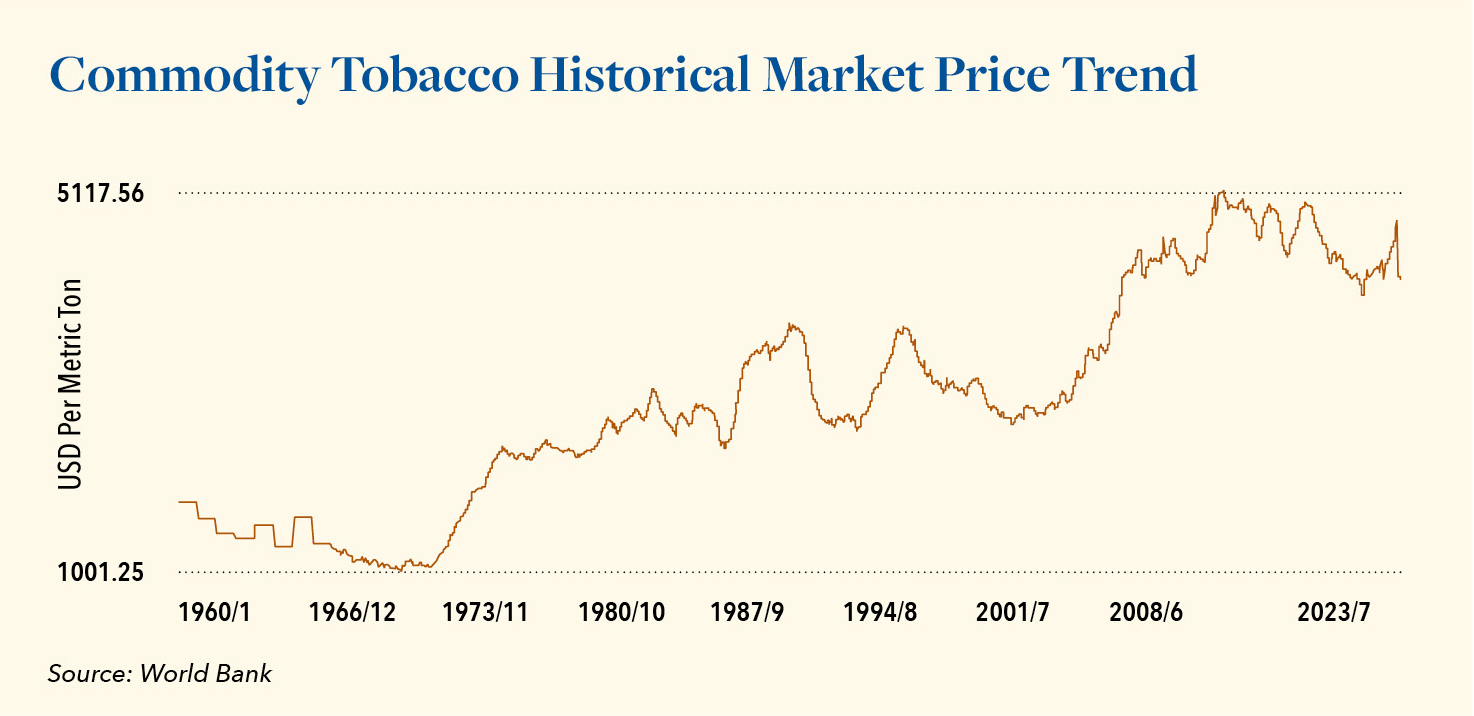

Raw materials tobacco is commodity-like in nature and requires what is referred to as a natural aging process that lasts between two and three years. During this aging process, tobacco undergoes two “sweating” processes, which typically occur in the spring and late summer/early fall. Curing and subsequent aging allow for the slow oxidation and degradation of carotenoids in the tobacco leaf. Tobacco is then typically stored in wooden barrels called “hogsheads”, to complete the aging process. It is important for potential lenders to understand where in the aging process the raw tobacco is during the diligence process to better understand the potential for sale in a liquidation. Tobacco that is not yet fully sweated, cured or aged may not be as sellable as that tobacco which has completed this process, which is what the true commodity designation insinuates.

Raw Tobacco Shelf-Life and Perishability:

Lenders should also be aware that commodity raw tobacco does not exhibit shelf-life aging concerns. Raw tobacco stored in hogsheads maintains a saleable integrity for 25 or 30 years. In fact, in some cases, aged tobacco may attract a higher price relative to market, particularly with respect to premium cigar tobacco, which requires a 5 to 7 year aging process.

Nature’s Threat:

One other lender consideration with respect to raw material tobacco aging and storage is understanding the potential harm caused by a pest named Lasioderma Serricorne, better known as the “Cigarette Beetle.” The Cigarette beetle is an ever-present concern facing tobacco storage facilities. These tiny critters, typically 2 to 3 mm long, can quickly infiltrate and cause significant damage to the crop if storage vendors do not take the proper precautions. Storage vendors must regularly fumigate warehouses proactively, and in some cases reactively, as it is a fine balance to prevent beetle infiltration. I recently visited one of the largest and best run tobacco aging and storage companies in Tennessee, and they walked me through their beetle risk mitigation process. I witnessed first-hand the kind of damage that such small insects can cause the tobacco in a relatively short amount of time.

Commodity Inventory & Market Pricing:

Any potential lender should monitor the commodity market price for tobacco on a regular basis, particularly if a given company is a manufacturer and carries or owns a significant amount of raw tobacco on-hand or being aged at a vendor. Secured lenders should understand what inventory categories are commodity-like within a tobacco producer’s overall product mix. Commodity-like inventory generally has a very large potential customer base in a liquidation scenario, and generally requires relatively minor levels of discounting below market price to incentivize purchasing. Conversely, rapid decreases in market prices for such a commodity can leave a company carrying inventory at a high cost basis relative to current market prices. Furthermore, although the commodity market price for tobacco has been relatively stable in recent years, a bad crop or certain adverse weather patterns may have a negative impact on the harvest and could lead to pricing volatility. It would also be wise for any commodity driven business to engage in some form of commodity futures hedging to mitigate the risk of pricing volatility. A lender would be advised to understand any hedging activity in a potential engagement.

Inventory Costing:

Inventory costing methodologies across segments, such as raw material, work-in-process and finished goods, should be thoroughly understood, including the impact related to ever-changing commodity input costs. Furthermore, understanding if inventory is costed at standard or some other method, and which components are included, such as labor, freight, overhead, federal excise taxes, and duty, would be critical in an appraisal. As information on a potential borrower is gathered, it is recommended that the lender share this information with the appraisal firm prior to appraisal engagement. Sharing this information lends to facilitating a more efficient process in areas such as initial recovery guidance and general report setup recommendations.

Assortment Mix:

The lender should monitor the inventory level mix frequently. Finished goods would recover at a higher rate than raw material tobacco in a sale, therefore, a shift in inventory mix from finished goods to raw materials would have a negative impact on the overall recovery values in a liquidation. However, in the tobacco industry, companies that carry significant amounts of raw, aged, and sweated tobacco, still maintain the potential for high inventory recovery on a blended basis, as this is a true commodity item. I recently valued a large, publicly traded tobacco consumer product manufacturer, and over 50% of their inventory was raw material tobacco. However, such commodities tend to recover much higher than non-commodity raw materials. Hilco would recommend that any lender establish separate advance rates for finished goods and raw materials, which would capture changes to inventory valuation due to inventory mix shifts.

Hilco Global, through its overall deal count volume and diversified platform of business verticals, conducts thousands of hours of senior executive conversations each month with borrowers. These management conversations provide a wealth of knowledge with up to the minute insights on the constantly changing market environment, which Hilco is then able to pass along to its clients. We are here to help our lending clients and borrowers leverage Hilco’s collective knowledge base to make critical and informed lending decisions.