A Return to More Normal Market Growth is a Window for Change

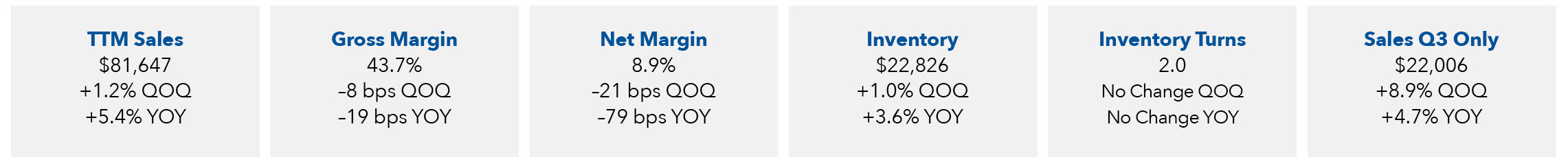

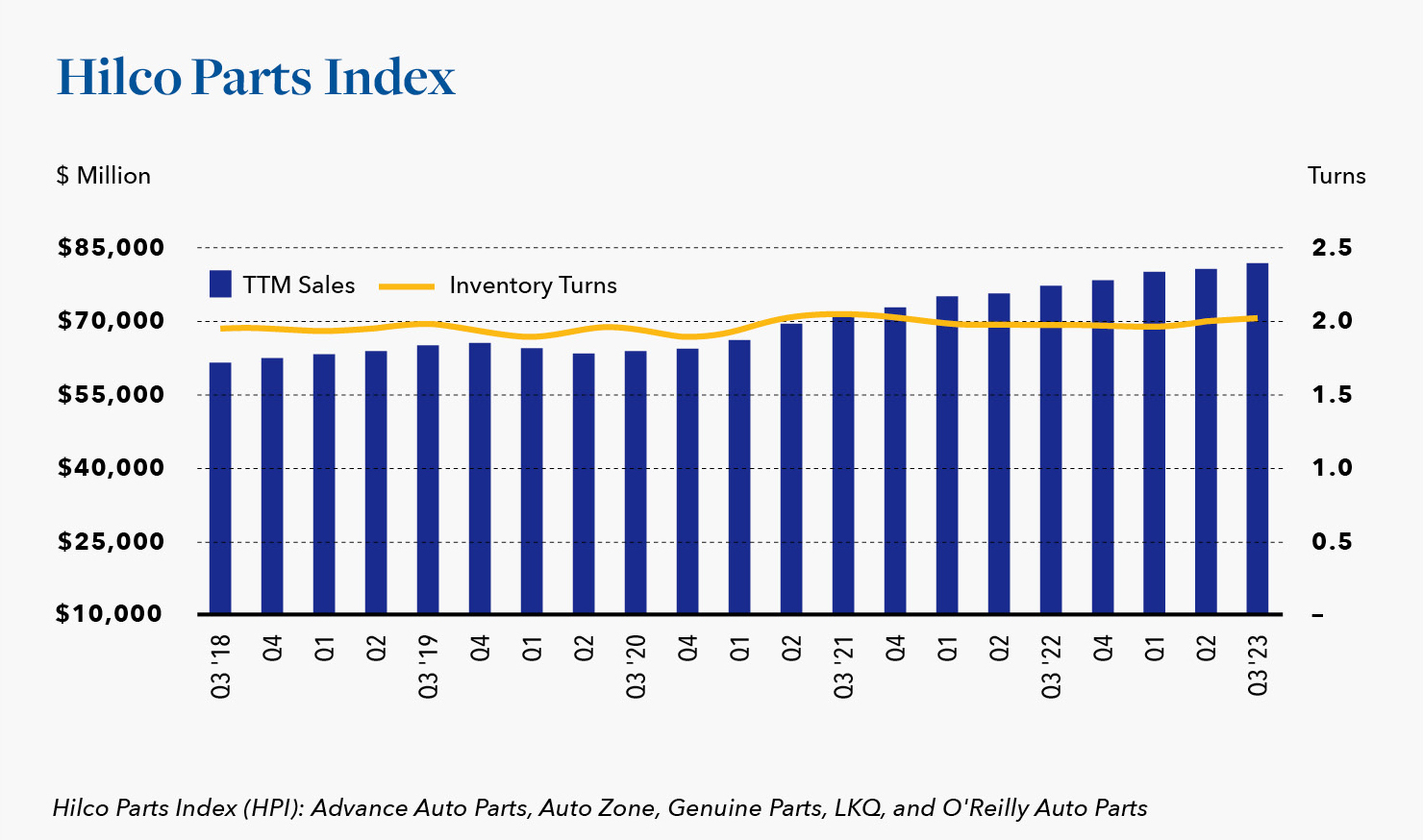

For the five companies that comprise the Hilco Parts Index (HPI or the Index) net sales for Q3 2023 were $22.0 billion, an increase of 4.7% from Q3 2022. On a similar basis, sales for the trailing twelve month (TTM) were $81.6 billion, an increase of 5.4% from the TTM sales ending with Q3 2022. At the outset, industry sales responded favorably to the arrival of hot July temperatures that triggered various heat-related failures related to cars’ electrical and cooling systems. As the quarter progressed the heat abated and the prior year comparisons were increasingly difficult to offset. Except for one company, same store sales were up only low single digits for the quarter. The notable exception was O’Reilly which continues to capitalize on its strong position in the commercial segment of the market.

Same store sales in the second half of 2022 benefited from extreme weather conditions and improving inventory positions. The sales momentum carried over into 2023 but the prospect of difficult year-over-year comparisons loomed large on the horizon. As difficult as the comparison was to Q3 of 2022, all of the companies forewarned that Q4 of 2022 would be the toughest comparison of the year. However, the unusual reporting practices of some of the companies in the Index afford an advance look into results for the fourth quarter. Not many public companies employ a fiscal calendar based on three 12-week quarters followed by one supersized 16-week quarter but two of the five companies in the Index, AutoZone and Advance, do. AutoZone was the first to report earnings on September 19th and Advance was the last to report on November 15th. The other three reported in the third week of November, like most other public companies. AutoZone has now also reported results for the next quarter as well. The company’s domestic same-store sales were up 1.2% for the 12 weeks ended November 17, 2023 compared to 1.7% for the prior quarter and 5.6% one year earlier. While slightly below its expectations, these results lend some evidence that the industry is retaining its characteristic resilience amid uncertain markets.

The global pandemic and the ensuing upheaval in the supply chain was no time to be making strategic changes. Investments were put on hold to conserve capital, product launches were delayed to conserve budgets, and leadership changes were overlooked in favor of a steady, familiar hand on the tiller. But the apparent lull in the market, a return to more normal year-over-year growth, has provided a window for change. Over the past 12 months, all five companies in the Index have either made changes, or announced their intentions to make changes, to the composition of their C-suites. New leadership at Advance has already announced some bold moves necessitated by their historic under-performance. The other companies, however, are not subject to the same market scrutiny and will no doubt wait for additional signs on the direction of the economy.

About the Index: The Hilco Parts Index is comprised of five publicly traded companies that distribute aftermarket parts, namely Advance Auto Parts (Advance), AutoZone, Genuine Parts

(NAPA), LKQ, and O’Reilly Auto Parts (O’Reilly). Advance, AutoZone, NAPA, and O’Reilly are the four traditional parts distributors in North America with strong commercial (do-it-for-me or DIFM) and retail (do-it-yourself or DIY) programs. LKQ is largely a distributor of recycled (used) parts, as opposed to new parts.