Manufacturer “Productivity Improvements” Translate to “Plant Closures”

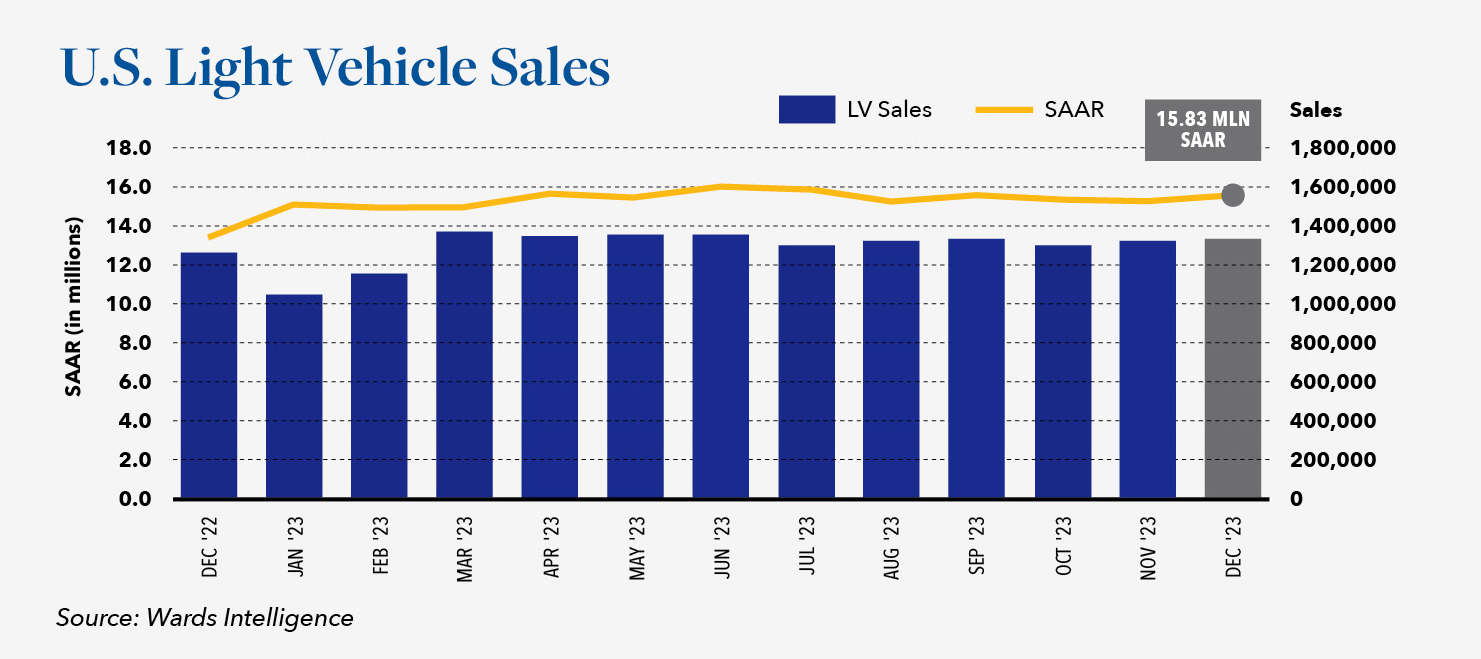

In 2022, a seasonally adjusted annualized rate (SAAR) of 15 million for U.S. light-duty vehicles was a threshold the industry only managed to exceed on two occasions. Conversely, that same 15 million figure was a floor the industry only managed to fall below on two occasions in 2023. According to Wards Intelligence, the industry actually flirted with a SAAR of 16 million units on several occasions last year, but never managed to break that mark. Ultimately, U.S. light vehicle sales totaled 15.6 million units for all of 2023, an increase of 13% from 2022. Current forecasts for 2024 are between 15.5 million and 16.0 million vehicles.

When the UAW initially went on strike last September, the impact was not immediately felt due to the inventory of new cars being at its highest point in more than two years. Over the course of the six-week strike, the companies had to cut production by about 200,000 vehicles. The cuts could have been much worse if the union had resorted to a general strike across all assembly plants. Ford, General Motors (GM), and Stellantis (Chrysler) estimate the lost production cost them $1.7 billion; $1.1 billion, and $795 million, respectively. That does not include the impact of the various wage and benefit improvements that the union was able to secure for its members. Ford and General Motors estimate that the new contract will cost them $8.8 billion and $9.3 billion over the course of the agreement, respectively. By the end of the agreement, the incremental cost will add $900 to the cost of every Ford built in America and $595 to every GM vehicle. Both Ford and GM are confident that they can offset the costs of the agreements with productivity improvements, but there is no denying that this development comes at a bad time for an industry that is trying to pivot to electric vehicles. The introduction of those vehicles has resulted in significant investment in new assembly capacity such that overall plant utilization has now dropped below 70%. Put in that context, “improved productivity” is just another way for manufacturers to say “plant closures”.

The effects have also been felt beyond the traditional Detroit “Big Three” manufacturers. Not long after the agreements were signed with the UAW, Toyota, Honda, Nissan, and VW all announced immediate pay increases in the neighborhood of 10 percent. With all of the manufacturers about to report record level profitability, the UAW felt this was the time to announce its intentions to launch a fresh push to organize labor at 13 automakers with non-union U.S. assembly plants. The business case for “near shoring” just got stronger. For foreign companies wishing to compete in the North American economy while reducing their dependence on China, near shoring production to Mexico reduced order lead times and cut transportation costs while preserving most of the labor savings. The Mexican National Institute of Statistics and Geography recently reported that capacity utilization at the automotive manufacturers operating in Mexico was nearly 100%. In other words, if there was more plant capacity, manufacturers would use it. To that end, foreign direct investment (FDI) in Mexico totaled $32.2 billion for the first nine months of 2023, nearly as much as the total FDI reported for 2022. Tesla’s has announced plans to build the world’s biggest factory for electric vehicles in Nuevo Leon, which has approved more than $100 million in incentives for the company to undertake those efforts.