ALL Bets May Finally Be Off for Corporate Restructurings in 2023

In this article, we consider whether recent signs of financial distress in the US portend a surge in restructuring and special situations activity in the next several months and, if so, which industries seem to be most at risk.

At a TMA Distressed Investing conference that I attended in Las Vegas, industry professionals were lamenting the dearth of restructuring activity, while offering a hopeful prediction for the future. “We’re slow now,” one said, “But six months from now… all bets are off.” That conference was in early 2009. Yet the same comments have been heard at nearly every restructuring industry conference since, with the exception of only a few, relatively short intervals — most notably, the early days of COVID-19 in 2020.

There is no shortage of theories as to why restructuring up-cycles have been fewer and of shorter duration since the Great Recession of 2008: unprecedented levels of market liquidity, the distortion of market conditions caused by artificially suppressed interest rates, even the prohibitive cost of protracted chapter 11 reorganizations, which have been supplanted by out-of-court restructurings or expedited, pre negotiated chapter 11 cases. Whatever the merits of these explanations, it finally does seem that, over the next six months, all bets may at last be off. So, what is different this time and where might we be headed?

WHAT HAS CHANGED?

For over a decade, credit market conditions have enabled a range of otherwise underperforming businesses to remain afloat despite sector downturns, poor management, and other challenging business conditions. The abundance of relatively inexpensive capital, with lenient or non-existent covenant structures, has allowed public and private borrowers since the Great Recession to “extend their runways” longer than they ever had previously — and left creditors with weakened protections, reduced leverage, and fewer viable options.

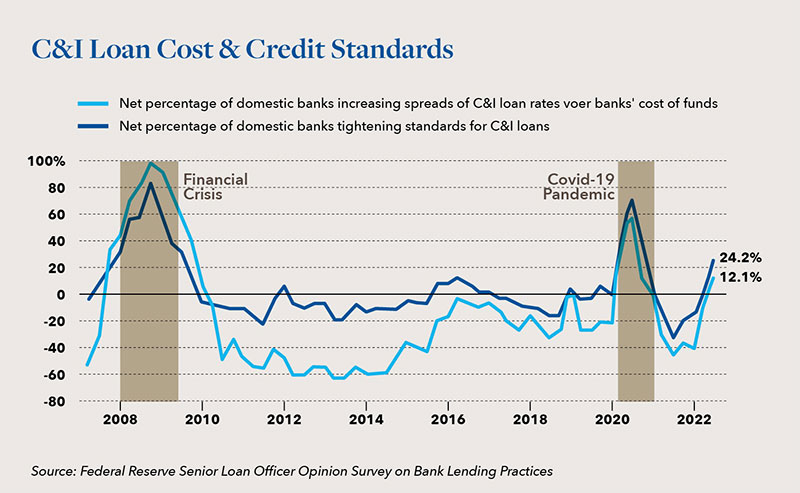

Over the past several months, the tide finally seems to be turning. Perhaps in response to rampant inflation, lingering supply chain disruptions, or just lenders whose patience has reached its limit, the availability of cheap and easy credit has abated. The increasing cost and tightened credit standards for C&I loans can be seen in the following chart.

Not surprisingly, leading indicators of distress such as default rates and distressed debt volume have spiked this year. As of August 1, 2022, for example, leveraged loan default rates in the US had nearly doubled since their pandemic trough in mid-2021 — both in terms of volume of debt and number of issuers.¹ Likewise, distressed loan volume has steadily increased throughout 2022, reaching over $40Bn — a nearly 4x increase from mid-2021.²

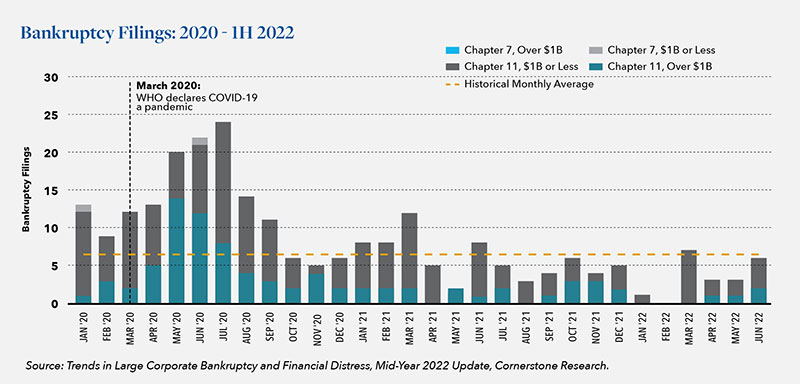

The number of bankruptcy filings has lagged these leading indicators. After a spike caused by the initial shock of COVID-19, bankruptcy filings for the period 2H 2021-1H 2022 were well below historical levels. Reduced filing activity can be seen both in “mega” cases (defined as debtors with over $1Bn in reported assets) as well as all cases involving debtors with over $100M in reported assets. For the period 2H 2021- 1H 2022, a total of 21 mega cases were filed, just short of the historical average of 22 mega cases/year.³ Likewise, for this period, all cases involving debtors with more than $100M of reported assets numbered 47, significantly lower than the historical average of 75 cases/year.4

It remains to be seen whether the below-average number of chapter 11 filings over the past 12 months is due to the normal lag time following a surge in default rates or a more systemic shift away from utilizing chapter 11 as the vehicle for effectuating a corporate restructuring.

1 LCD/S&P Leveraged Loan Index, August 1, 2022.

2 LCD/S&P Leveraged Loan Index, August 1, 2022.

3 Trends in Large Corporate Bankruptcy and Financial Distress, Mid-Year 2022 Update, Cornerstone Research.

4 Trends in Large Corporate Bankruptcy and Financial Distress, Mid-Year 2022 Update, Cornerstone Research.

WHERE ARE WE HEADED?

The above indicators suggest that predictions of a surge in restructuring activity may finally be more than wishful thinking on the part of restructuring professionals.

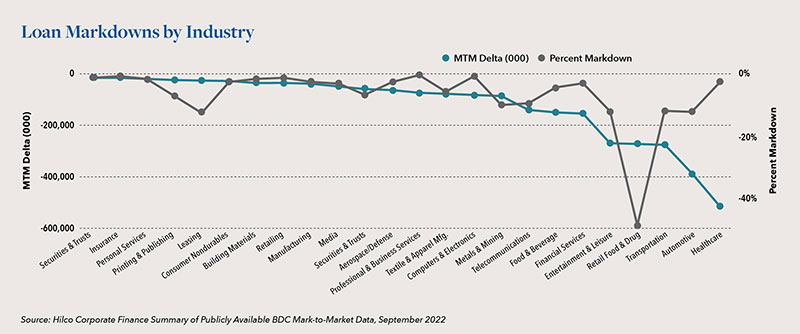

Hilco Corporate Finance has analyzed market data — particularly trends in Business Development Company (BDC) mark-to-market activity across several sectors. The results provide a glimpse into where the trouble ahead may lie.

The chart on the following page shows the aggregate BDC markdowns, by industry sector, both as a percentage of par value and in absolute dollars. The data show a dramatic discounting of BDC loans in the retail food and drug, entertainment/leisure, automotive, and healthcare sectors.

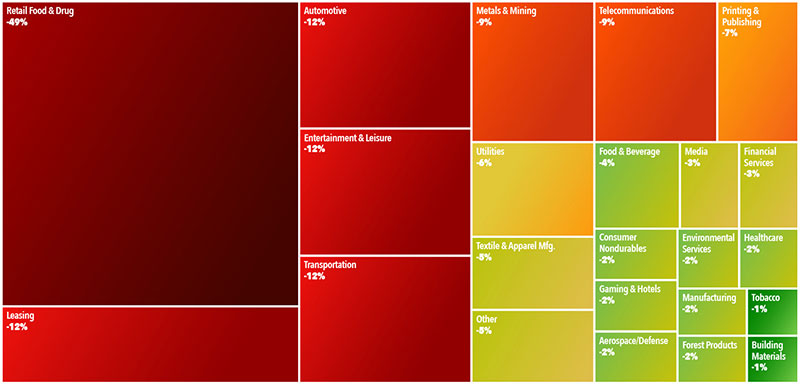

A heat-map5 of the above markdown data (on the following page) reveals the relative magnitude of distress in these industries and the sectors that are most likely to be at risk for the next wave of restructuring activity.

Thus, although signals of distress across broad markets could indicate a pervasive increase in restructurings, at a minimum the data suggests an accelerating level of distress in several large, consumer-oriented sectors that historically have generated significant restructuring activity.

CONCLUSIONS

In the nearly 15 years since the Great Recession, the US economy has managed to avoid a pervasive and sustained surge in corporate restructurings — with the notable exception of the initial wave of business failures resulting from COVID in 2020. The accumulation of adverse market data throughout 2022 suggests that this time, something is different.

Our recent interaction with clients — particularly in the retail/consumer, food, automotive/transportation, and other industrial sectors is consistent with these macro trends. Hilco Corporate Finance is currently advising businesses in each of the above industry sectors, and many report increasingly adverse market conditions — primarily because of persistent inflation, increasing cost of capital, and noticeably less willingness on the part of creditors to remain patient in the face of distress. Most important, many of these businesses expect that these challenges are likely to increase in 2023.

Hilco Corporate Finance has an experienced team of corporate finance professionals that provide M&A and Debt Advisory services as well as Special Situations and Restructuring advice across a broad range of industries. Our team is ready to assist you or your clients in navigating through these uncertain times.

5 ”Other” category includes Wholesale Trade, Retailing, Home Furnishings, Investment Funds, and Securities & Trusts. All are marked down by 1% or less. “Leasing” category includes leasing operators across various industries, including Advertising, Automotive, Industrial Services, Rent-to-own financing solutions, Crane Rental/Operators, Media, IT Services, Capital Equipment, and Aerospace and Defense.

Hilco Corporate Finance, a boutique investment banking advisor affiliated with Hilco Global, provides unmatched creativity and relentless support to the middle market. Our seasoned team of professionals specializes in the delivery of comprehensive advisory services including M&A Advisory, Private Capital Markets and Special Situations to private & public companies, private equity groups, family offices, and entrepreneurs. The deep experience of the senior teams we assign to each engagement, and their ability to understand the unique business goals and objectives of each transaction, enable us to develop customized and achievable solutions that exceed expectations.