Beauty Remains a Challenging Beast

In this article we take a look at performance, trends, challenges and recommended actions for lenders with portfolio holdings across the beauty industry in the back half of 2023.

MARKET PERFORMANCE OVERVIEW

The beauty market continues to grow across all categories, displaying resilience in the current, turbulent worldwide economic environment. With a solid recovery since the peak of the COVID-19 pandemic, 2023 beauty care revenue now amounts to $579.20 billion, according to data from Statista, with more than $90 billion of that being generated from the U.S. market specifically. The market is expected to grow annually by 3.53% (CAGR 2023 – 2028). It is estimated that 27.5% of total beauty revenue will be generated through online sales in 2023.

Market growth through the remainder of this decade is expected to be driven largely by the expanding premium beauty tier and by younger consumers, who are actively embracing sustainability, self-care, and products promoted by an increasing number of online influencers. According to data from the NPD Group, U.S. Prestige beauty industry sales revenue grew by an impressive 15%, year over year, in 2022 to reach $27.1 billion. Within U.S. Prestige Beauty, the makeup, skincare and fragrance categories rose 18%, 12% and 11% respectively during the same period. Lip products was makeup’s fastest-growing segment achieving double-digit sales gains over pre-pandemic levels. Growth in the fragrance market was largely attributable to parfums, eau de parfums and higher-end artisanal fragrance juices. Skincare revenue growth increased by 12%, with body products growing at 3x over facial products. Hair, which is Prestige Beauty’s smallest category, grew fastest of all at an impressive 22% in 2022. Its performance in the mass channel, however, was characterized by notable declines among products including shampoo, conditioner and hair color.

ONLINE & BRICK AND MORTAR CHALLENGES

E-commerce has played a significant role in beauty’s overall growth, nearly quadrupling from the period 2015 through 2022, with substantial continued expansion potential. As the beauty landscape becomes increasingly competitive with independent brands and new challengers entering the market— many through the online channels —established brands are being challenged like never before to adapt.

As brands pivot to focus on delivering profitability, some in the DTC space are struggling to acquire customers based on the rising acquisition cost associated with executing via methods including influencers and instructional videos on Meta and other social platforms. Simultaneously, many of these and other brands are also struggling to navigate a balance between cost control and the expense of store build-outs. This is occurring as they seek to establish (or re-establish) a brick and mortar presence amid what seems to be a growing realization that physical locations matter more to beauty customers than some may have thought.

Driving foot traffic at brick and mortar has always been of paramount importance to retailers. Among other efforts, Sephora is addressing that challenge through a bit of a twist on the pandemic-popularized “buy online/pickup in store” (BOPIS) strategy — which typically has focused on enabling consumers to order an item online from their home for pickup in-store.

Now, when a product is out of stock or not available at a physical Sephora location, a shopper can access an in-store terminal to order it directly and then return to the store on a selected date to pick it up. This approach is not only bringing customers back into stores to drive another purchase opportunity, but is also freeing up store associates to assist other customers and drive the sale of currently in-stock merchandise.

In much the same fashion, brick and mortar operators are utilizing other digital in store enticements such as virtual makeup and hair experiences, to drive foot traffic. AI developed by Chanel can even identify a precise shade of lipstick from a photo on a customer’s smart phone. Membership rewards also continue to play an important part in attracting and retaining DTC and in-person customers. Ulta and others expertly leverage the cadence and tailored offerings associated with their programs to entice customers to expand their purchasing behaviors into higher-end, higher margin products which help boost overall basket value.

Scaling remains a challenge for many brands, necessitating a focus on omnichannel expansion and internationalization. As indicated via the chart highlighting activity this year, M&A will continue to play a significant role in the industry, with a shift in focus towards brands with innovative product pipelines and sustainable growth. Overall, the beauty industry offers numerous opportunities for growth if brands tailor their strategies to reflect the changing global consumer landscape and evolving channel preferences. Case in point — as the potential for continued aggressive growth in China, and even here in the U.S., begins to slow, diversification strategies are becoming critical in geographies such as India and the Middle East, which offer access to a new and expanding global customer base.

MEETING EVOLVING NEEDS & EXPECTATIONS

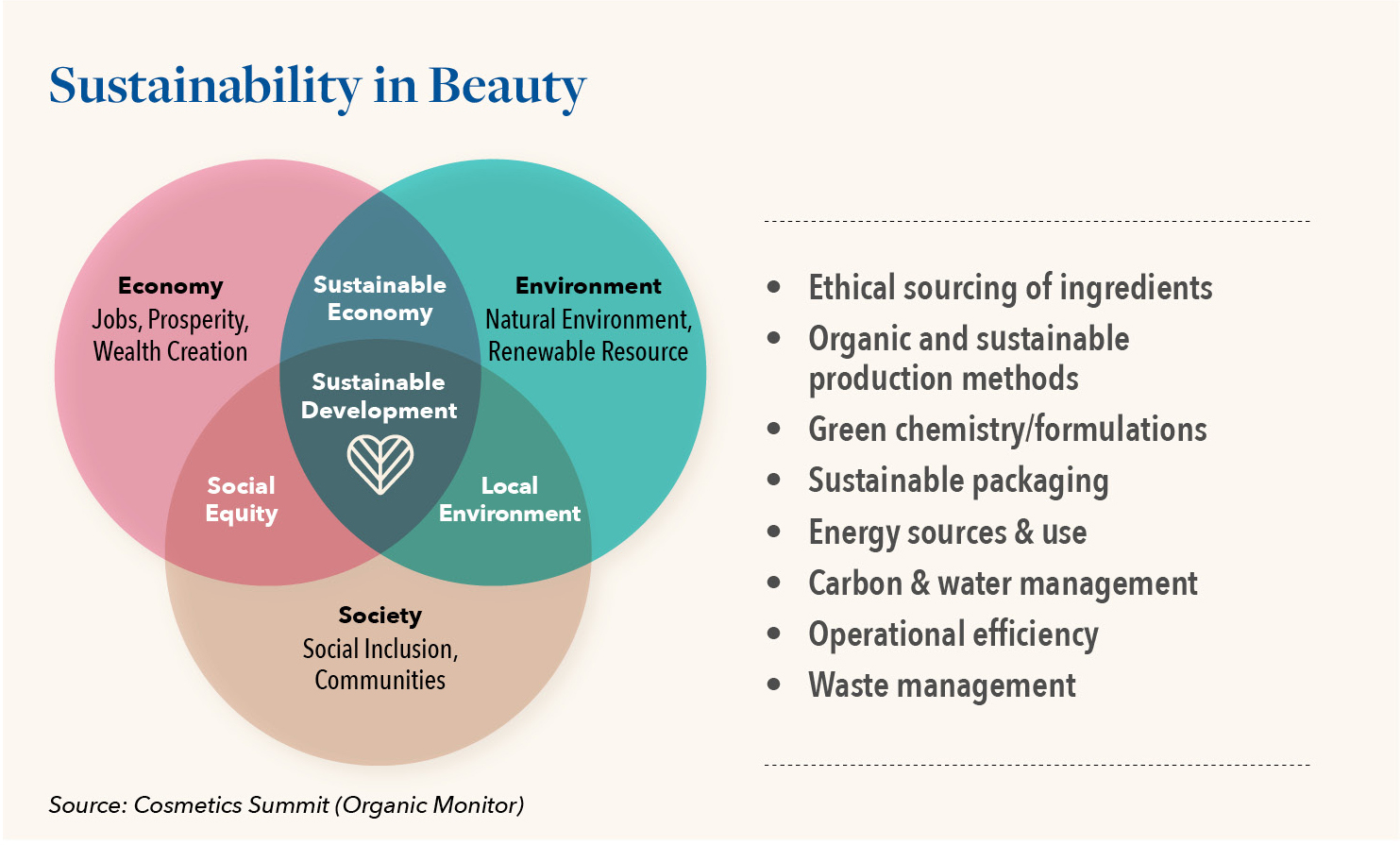

The in-cosmetics Global trade show in Barcelona, Spain this past March featured a number of new focus areas for the industry. Among these were Sustainability, Greener Processes and Circularity, as well as focus on Senescence (the deterioration of cells with age). Skin Immunity/Immunology, Anti-inflammation and Beauty as Therapy were also highlighted. An interesting trend on display at the show, and gaining traction among celebrities and consumers, is skin care as makeup. The idea is that fresh skin, benefiting from masks and various treatments, actually becomes a no-makeup version of makeup.

The influence of younger consumers continues to play an influential role in reshaping beauty norms, by demanding authenticity, sustainability, gender inclusivity and diversity from brands. We discussed some of these developments in our previous perspective last year. Now, as the beauty industry continues to actively strive toward development of more and more ethnically diverse products, we are seeing further momentum and a range of steps being taken across the enterprise. These include investing in comprehensive R&D to better understand the unique needs of consumers across a range of diverse ethnicities and develop more effective product formulations.

While these types of efforts take place largely behind the scenes, the shift in marketing and branding that is taking place is occurring front and center, for consumers to see firsthand. The clearly apparent and increasing emphasis on inclusivity and representation in marketing and branding efforts features the use a wide range of models with various ethnic backgrounds. As part of this strategy, industry players are actively collaborating with experts and influencers from various ethnicities to gain valuable insights and promote authentic diversity. Additionally, more than ever before, companies are requesting and using actionable feedback from their customers to improve existing products and create new ones that address unmet needs. As a result, we expect this year and next to be characterized by further acceleration in the number and range of products beauty companies introduce to meet the needs and expectations of previously underserved ethnicities.

TECHNOLOGY & BEAUTY

McKinsey research has indicated that 71% of consumers today now expect to receive a personalized experience when they shop and more that 75% get frustrated when this does not occur. In the cosmetics industry, this preference for customization is particularly pronounced with 58% of shoppers stating that they are more likely to buy from a business which solicits their input via a quiz to recommend tailored products, and 45% stating that a company’s use of AI or virtual reality which enables them sample a product online increases their likelihood of buying from that business.

Not surprisingly, more cosmetics, skin care and fragrance companies than ever before are investing in, and taking steps to leverage, technology and data to create hyper-personalized customer experiences for their brands.

Artificial intelligence (AI) and machine learning algorithms — many customized — are allowing these businesses to analyze vast amounts of customer data, including purchase history, preferences, and online interactions. Regulators and lawmakers are following this and other technologies carefully across industries and markets to help ensure that they are not utilized in ways that unduly manipulate or confuse consumer purchase decisions. A lawsuit filed by the FTC in June against Amazon, for example, claims that the online retailer used “dark patterns” and deceptive web designs to manipulate consumers into enrolling in recurring Prime subscriptions.

On a more positive note, the use of this AI-driven data-driven approach in beauty is leading to a deeper understanding of individual preferences and needs. When paired with an omnichannel consumer experience, this insight can enable synchronized delivery of tailored recommendations online and in-store or through any channel individually, thereby increasing the potential for customer satisfaction, loyalty and increased conversion.

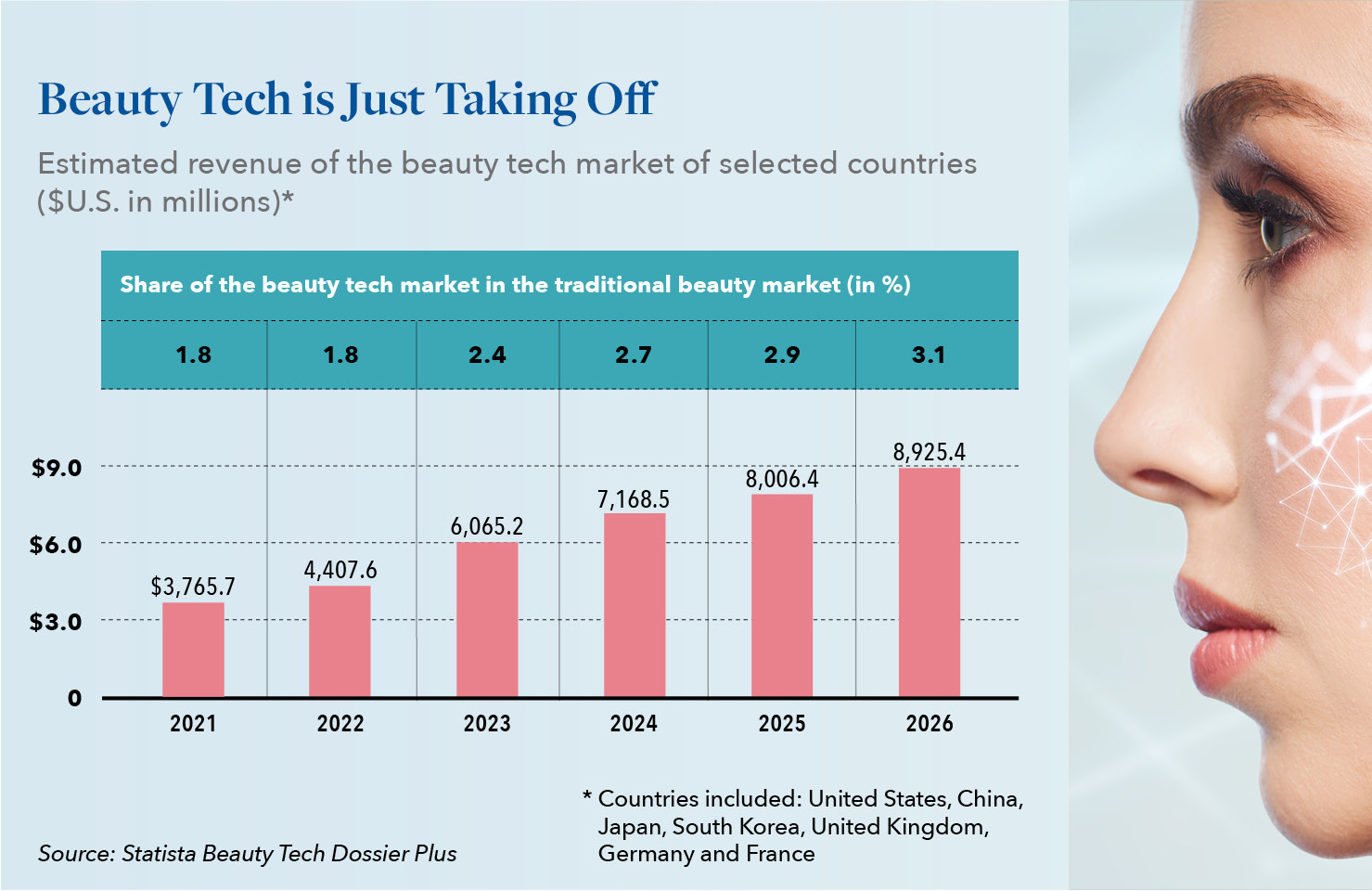

As technology has advanced and become more affordable, more companies across the industry have been able to implement augmented and virtual reality capabilities that enable customers to “sample” cosmetics and skincare products online. These engaging online experiences are part of a burgeoning beauty technology (Beauty Tech) industry which is evolving rapidly and includes startups that are marketing their SAS and other solutions to existing beauty companies as well as those who are leveraging that proprietary technologies to build their own DTC beauty businesses. Among other things, these technologies empower customers to preview how various beauty products could look or work on them, specifically. This helps drive more engagement and better-informed purchasing decisions. Some brands have taken these experiences a step further, in certain cases even offering customers the ability to create their own unique cosmetics shades and product formulations based on their skin type and priorities.

Skin analysis plays a crucial role in creating tailored beauty products by providing product developers with an in-depth understanding of individual skin conditions and needs. The use of artificial intelligence (AI) is being more widely adopted by beauty companies in 2023 to analyze various factors such as skin type, texture, tone, allowing development of more personalized skincare solutions. This data-driven approach enables the formulation of products with precise ingredient combinations that are able to address specific skin concerns and issues to help ensuring optimal results. We expect to see more of these companies integrate AI-driven skin analysis into their beauty apps or online platforms in the coming months, allowing remote buyers to receive even more personalized product recommendations based on their unique skin profiles, without ever visiting a physical store location.

It is logical to assume that these and other future personalized connections which beauty companies are able to forge with an increasingly diverse and individualized customers base will help to build greater preference and brand loyalty for their products.

SUGGESTED LENDER MONITORING

Lenders should continue to closely monitor their beauty portfolio company margins and product turnover rates. Understanding the nature and risk of investments that those businesses are now making or plan to make in equipment, facilities and technology to drive growth and profitability is critical in the current market. Equally important is ensuring up-to-date appraisal data on the realizable value of a firms intangible, as well as its tangible assets. In our experience, we often find that “hidden” assets, capable of providing needed cash flow with minimal or no operational impact, exist among a business’ existing intangible holdings. With this in mind, we encourage companies that have not conducted a comprehensive appraisal of these assets during the first half of 2023, to do so before the end of the year.

Hilco Valuation Services and Hilco Streambank can assist your businesses or a business in your portfolio in better understanding and addressing considerations pertaining to the strategic disposition, acquisition and maintenance of both tangible and intangible assets across the beauty industry. Whether you are simply seeking an added perspective or require more extensive guidance and/or assistance with a current undertaking, we encourage you to reach out to us during the back half of this challenging year. We are here to help!