Cased Wine Trends and Key Considerations for the Asset Based Financial Professional

This second installment in our wine market series discusses general guidelines for lenders when evaluating a prospective borrower or an existing portfolio account in the cased wine industry.

INDUSTRY OVERVIEW

Cased wine, also referred to as case goods, is finished, bottled wine that is ready to sell. Case goods are generally referred to in case quantities, which includes 12 standard 750-milliliter bottles, also referred to as nine-liter equivalent (9LE). Although not all wine is sold in case quantities, this is a general industry term that includes finished, bottled wine ready for consumption.

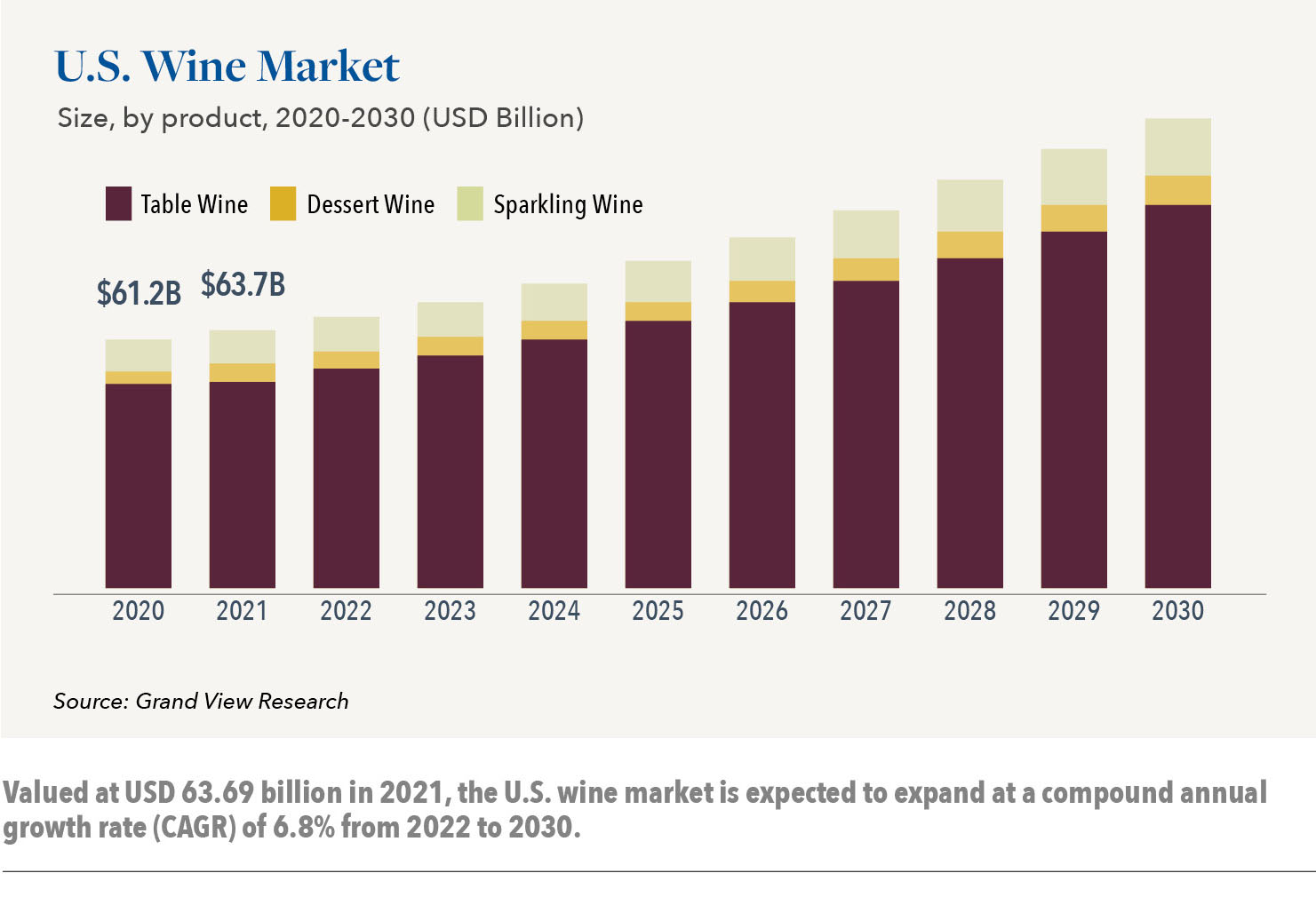

The U.S. wine industry comprises the sale of bottled wine through various channels including, but not limited to, distributors, retail stores, online, tasting rooms, restaurants, and bars. Wine consumption in the U.S. was estimated at 3.18 gallons in 2021, up from 2.72 gallons a decade prior in 2011. Although this trend has increased year over year in recent years, the rate of increase is not expected to continue.

The impact of the COVID-19 pandemic on wine sales and consumption has been widely analyzed. In the spring of 2020, the on-premise wine market collapsed as lockdowns limited people from dining in restaurants and bars. By contrast, e-commerce wine sales grew exponentially that year. Interestingly, the overall profile of wines sold during this time changed. Given that high-end wines are historically consumed predominantly in restaurants and tasting rooms, or during celebrations such as events and weddings, the COVID-19 lockdowns caused a significant decrease in high-end wine sales for many brands. Entry-level, mid-range, and bag-in-box wines became preferred items for consumers as they dined, tasted, and celebrated more at home. Low-end wines sold online or at retail experienced an increase in many cases, and this trend appears to be continuing. Yet, while the mix of off-premise and on-premise sales has somewhat normalized, Silicon Valley Bank’s Peer Group Analysis (PGA) Database shows a 2022 nine-month year-to-date sales growth rate of only 9.6 percent for premium wines, down from growth of 18.2 percent in 2021.

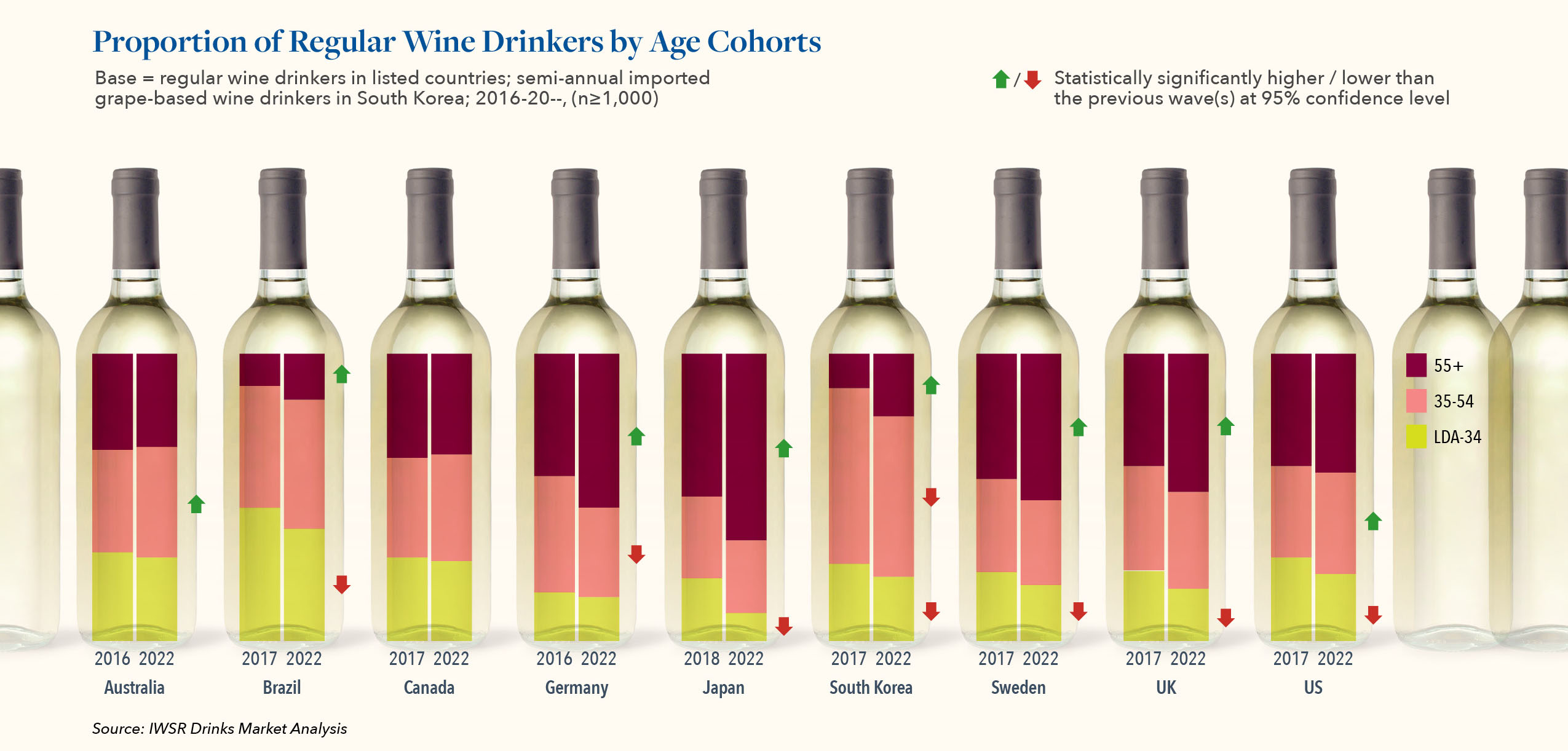

Baby boomers, with an age range from 58 to 76, are the top consumers of wine but are trending off in numbers, along with the mature generation, age 77 and up. Consumers over age 60 account for most of the growth in still wine (wines that have been obtained through the natural alcoholic fermentation of grapes) over the past 25 years, and their share of spending continues to grow. The median boomers are now on the other side of their normal retirement age of 66, and the spending in this group is widely expected to begin its decline. As consumers, boomers are being replaced by younger buyers at a rate of 10,000 per day. Importantly, each of those replacements comes with a different set of tastes, values, and desires than the older generation. One of the things that distinguishes boomers from all other generational groups is their affinity for wine consumption. Industry data reflects that those younger than 60 are simply less fond of wine than those older than 60. This is a significant and concerning fact for the industry because it means that consumers who are more committed to the category and who spend more on wine today, are being replaced with consumers who drink more across all the alcohol beverage categories but are less committed to wine.

Add to that trend the growing number of wine consumers trying to reduce consumption for any number of health reasons, and it is clear why the wine industry is anticipating the shift and strategizing to minimize the impact of a further reduction in growth going forward.

RECOMMENDED DUE DILIGENCE DISCUSSION TOPICS

The topics below are given as general discussion points only and are not absolute as there are various other rules and regulations which could impact each example.

- SKU Level Analysis: A traditional SKU-level analysis is typically not performed on case goods. Many wineries offer the same type of wine, year after year, as the new vintage becomes available; with each new vintage year, a new SKU number is created. As such, a SKU-level analysis often will not reflect the true turnover, as many wineries will sell through one vintage year before offering the next one to customers. Hilco would recommend a higher-level analysis of the cased wine in order to capture the sales from one vintage year to the next. Wineries generally have a label code or other ways of categorizing the cased wine as an alternative to the SKU number. For example, a 2023 chardonnay will replace the 2022 chardonnay as soon as the 2022 vintage is sold out. For this reason, the winery would track this at the chardonnay level, rather than SKU level.

- Federal Excise Tax: Excise tax is determined based on the alcohol content of the wine and whether it is still or sparkling. In the event of a liquidation, excise tax would need to be paid on any bonded case goods that were sold to a customer. To properly account for excise tax that may be due in a liquidation, the lender may want to consider a reserve for excise tax payments on the borrowing base, or deducting the estimated excise tax as a liquidation expense when calculating a net orderly liquidation value.

- Shiners: Shiners are finished bottles of wine that are not yet labeled. Wine is required to be labeled with an approved label when it is removed from bond (a bonded facility), as that is the time of tax determination. If wine is removed from bond without a label, it may be deemed to be mislabeled and could be subject to seizure. In the event of a liquidation, all shiners would need to remain in bond and would need to be sold into another bonded facility unless they were appropriately labeled.

- Seasonality: Wineries typically see a traditional seasonal pattern in cased wine and will often bottle bulk wine in the spring to make room for the upcoming harvest period. Given this typical cycle, a lender may expect to see an increase in the amount of cased wine available for sale in late spring. However, high-volume, lower-end wines may not see a significant impact due to seasonality because aging times are less and bottling is generally year-round.

- Distribution Channels: Distribution channels in the U.S. are determined by state, so the ability to sell wine into various channels must be followed at the state level. States such as California allow sales to all channels, meaning that wineries can sell wine directly to consumers, retailers, restaurants, and distributors, assuming they have the appropriate licenses and/or permits. States such as Utah, however, are “control” states, meaning manufacturers and suppliers may only supply alcohol products to the Utah Department of Alcoholic Beverage Services (DABS) or licensed beer wholesalers. DABS and the beer wholesalers then distribute alcohol products through the state’s liquor stores, package agencies, licensees, and permittees under applicable laws. States such as North Carolina offer a hybrid approach: the state controls wines with high alcohol content, but direct-to-consumer shipping may be allowed under applicable laws. Wineries nationwide with the appropriate licenses and permits in place can freely sell across all state lines, assuming all rules and regulations are followed. Understanding the already established distribution channels is critical to the success of a liquidation.

- Aging: Although wine generally will improve as it ages, this is not true over an extended period of time for all varietals. Red wines typically age the longest, with the highest-end wines aging for an average of 18 months in barrel. Many winemakers then bottle the wine and hold it in bottle for another one or two years before offering it for sale. White wines are typically not aged longer than nine to 12 months, with the exception of sparkling wines. White wines such as chardonnay and sauvignon blanc are generally meant to be consumed within one to two years from bottling and do not typically improve with age once bottled. Given the typical aging timeframes for the various varietals, cased white wine that is more than three years old is generally considered to be past its prime and could be difficult to sell.

- Library Wine: “Library wines” is a popular term in the wine industry that describes cased goods that have been reserved by the winemaker to be re-released or sold exclusively years after their initial debut. The name comes from wineries that would store these wines in their private cellars, which they refer to as “libraries.” Given this practice, it is common to find case goods with no sales, and these must be differentiated between wine that the winery has tried to sell but cannot, versus wine that has not yet been offered for sale. For premium brands, such wines would generate significant interest if offered in the marketplace, but this must be determined based on multiple factors. Library wine often requires a different liquidation strategy than current-vintage wines.

- Licenses and Permits: Selling wine requires specific licenses or permits, depending on the jurisdiction, ,operations of the company and distribution channels. The lender would want to ensure that the company had all necessary licenses or permits, as these would need to remain in place during the entire liquidation timeframe. Both Federal and State laws and regulations will need to be investigated and followed.

GLOSSARY OF TERMS

As with many industries, wineries have their own language. This glossary of terms is designed to provide a high-level overview of key terms that are likely to come up in conversations with a client.

- Case Goods: Also referred to as cased wine, case goods refers to finished, bottled wine that is ready to sell. Case goods are generally referred to in case quantities, which includes 12 standard 750-milliliter bottles, also referred to as nine-liter equivalent (9LE).

- Bonded Warehouse: A bonded warehouse is a storage facility that possesses a special designation from the Alcohol and Tobacco Tax and Trade Bureau (TTB.

- Off-Premise Channels: Off-premise channels refers to establishments that sell alcohol for off-site consumption, such as retail stores.

- On-Premise Channels: On-premise channels refer to establishments that sell alcohol for on-site consumption, such as bars, restaurants, hotels, and wineries.

- Silicon Valley Bank Peer Group Analysis (PGA) Database: This is a proprietary information set that includes both client and non-client financial statements and extends back to the early 1990s. The database is used for diagnosing industry and regional trends, as well as for providing anonymized comparisons to the bank’s winery client base.

- Varietal: Varietal refers to the type of grape that is used in making wine. Some of the most popular varietals of wine include cabernet sauvignon, chardonnay, merlot, pinot noir, and sauvignon blanc.

- Vintage: Vintage is defined as the year when a wine’s grapes were harvested.

At Hilco Valuation Services, we are currently engaged in multiple valuations and are having informative conversations with our industry contacts and partners across the cased wine industry on a regular basis. Whether you are working with a prospective wine industry borrower or have current industry exposure within your portfolio, the more you understand about those businesses, the better. This is particularly relevant in the current, uncertain climate. As information on a borrower is gathered, we recommend that lenders share these details with Hilco or the selected appraiser prior to a formal valuation engagement. Doing so will facilitate a more efficient and effective process in areas such as initial recovery guidance and general report setup recommendations. To learn more, we encourage you to reach out to our team at Hilco Valuation Services today. We are here to help!