California Bulk Wine Q1 ’24 Market Developments and Lender Considerations

This article discusses developments and observations pertaining to the current state of the California bulk wine market, including wines in the category that are recently produced, those that are just beginning their aging process and those that are ready for bottling.

Inventory and Pricing Insights

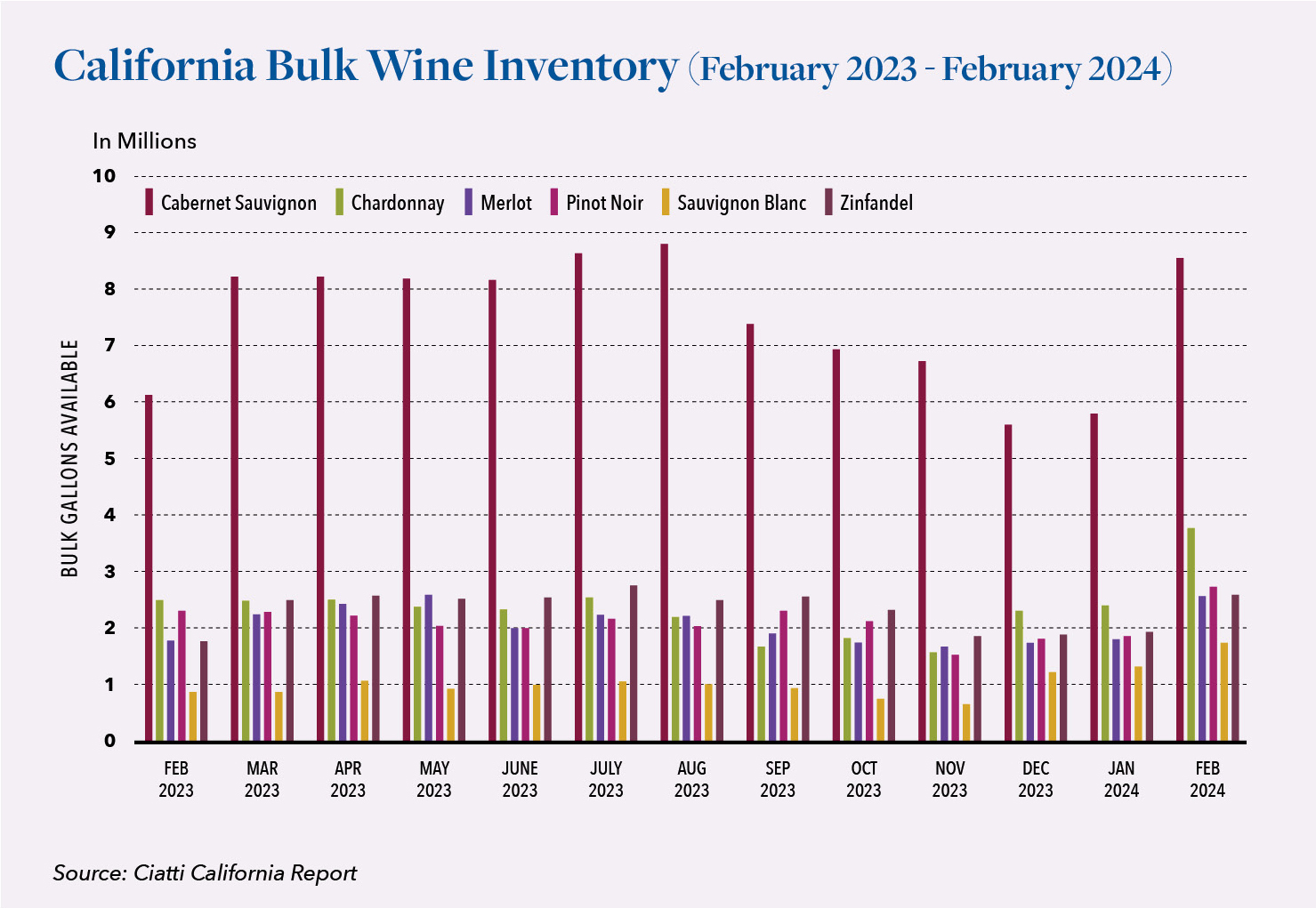

The bulk wine market has continued to struggle since our previous article on the topic was published last year. Since then, bulk wine actively for sale has continued to increase across all regions. While Turrentine Brokerage was actively selling 19 million gallons statewide at the end of the second quarter last year, as of February 2024, this number has increased to 24 million active bulk gallons. This increase is attributed to the amount of older vintage bulk wine still available given the lack of demand.

Ciatti Global Wine and Grape Brokers have indicated that the limited buying activity that has occurred has primarily been focused on 2023 white varietals, with Sonoma County or Russian River Chardonnay and North Coast Sauvignon Blanc leading the limited coastal activity. Pointing out that the pool of buyers is sensitive to price and not very deep, Ciatti notes that, “Inquiries have been made into Napa Cabernet, but mostly at pricing lower than where the market currently sits. Sellers are, however, showing flexibility in accommodating interest.”

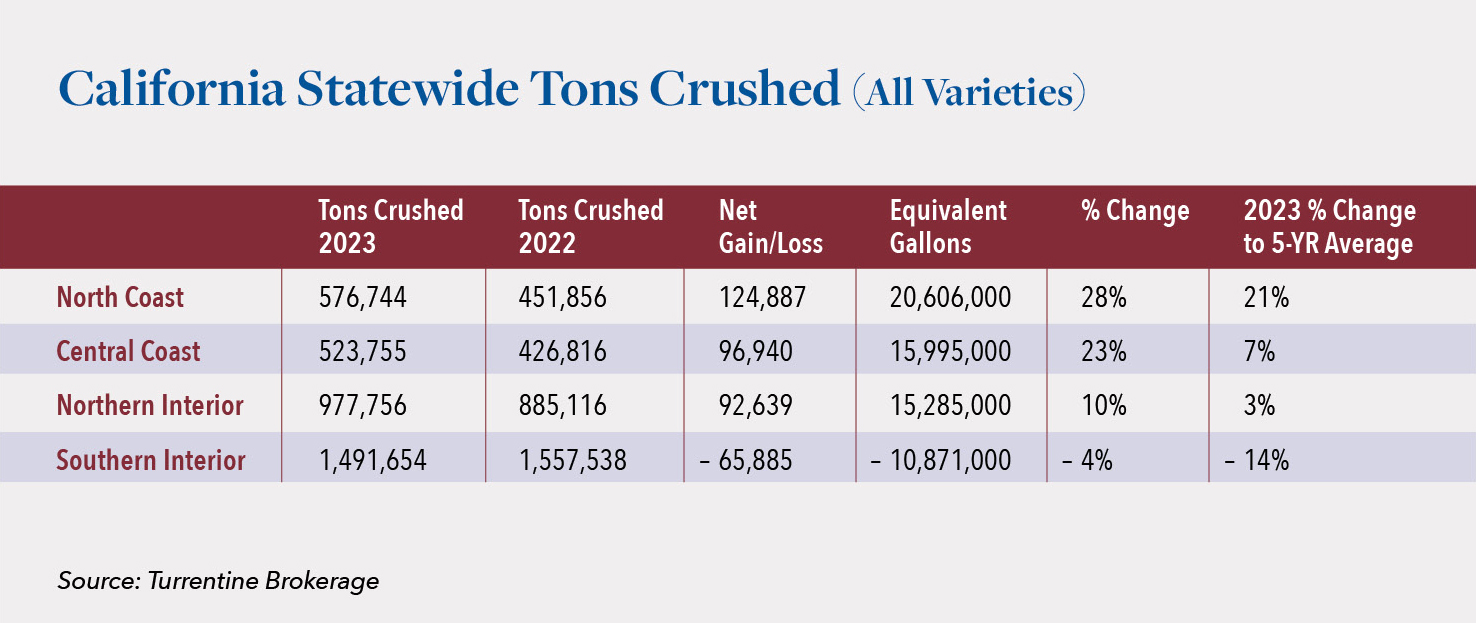

This increase in the availability of bulk wine can be expected to continue based, in large part, on the fact that the volume of grapes crushed has notably increased since 2022, although consumer demand has not increased at nearly the same rate. Specifically, the total 2023 crop was estimated to be 3.67 million tons, and if all grapes had been harvested, that total would have been at least four million tons. A comparison of the total tons crushed in California in 2022 vs. 2023 is illustrated in the chart to the right.

While grape prices in 2023 were reported to be at an all-time high, a portion of the crop went unharvested due to lack of demand. The elevated grape pricing that characterized the market during much of the year has been attributed to long-term grower contracts with built in annual increases, as it was reported that late season spot market prices for grapes were down significantly.

Broader Pacific Northwest and Global Developments

California is not the only area experiencing an increase in bulk wine supply with a decrease in demand. Washington state now also faces excess bulk inventories in early 2024 following a significant reduction in demand from the state’s largest winery. Oregon also has excess bulk wine, reportedly for the first time in three years.

Ste. Michelle Wine Estates (SMWE), the Northwest’s largest winery, informed growers that the company would be substantially reducing its fruit contracts. Specifically, SMWE plans to reduce its total anticipated grape supply by 40% over the next five years. This would mean that SMWE would go from using approximately 35,000 acres to potentially 18,000 acres in a period of less than 10 years, as the company was already gradually decreasing volume. It would also mean that SMWE went from using 70% of the state’s wine grape acreage to approximately 30%.

It is also important to point out that increased availability of bulk wine from Australia is now notably impacting the market in the Northwest, with winemakers there reporting that Australian wine has become available at pricing which is much lower than historic U.S. bulk wine prices. This development has added to the current decrease in the overall bulk wine market domestically and has been driven by a political disagreement between China and Australia dating back to 2020 which resulted in China implementing a tariff of over 100% on bulk wine imported from Australia. Previously, China had been Australia’s largest wine export market, estimated at approximately $790 million (AUS$1.2 billion) per year, and representing approximately 40% of Australia’s total wine exports. Just one year after the tariffs were imposed, however, sales to China fell to only $54 million annually. While there is some speculation that those tariffs could be lifted as soon as April 2024, there has been no confirmation of that potential development, and the speed and extent of its impact on the U.S. bulk wine market remains to be seen.

Lender Recommendations

Lenders with exposure to businesses within the bulk wine industry should be aware of the market’s decline and understand that bulk wine liquidations may now take longer than anticipated and may not yield the same returns as were possible even one year ago due to these conditions. In addition, lenders should closely monitor costing given that grape prices in California have been up, even though consumer demand is down. This, in turn, may lead to price reductions at retail, resulting in margin decreases which could also have a negative effect on cased wine values.