Challenges Persist in the Chemical Industry: How Did We Get Here and What Now?

It’s understandable if some decision makers in the chemical industry just want to cry uncle. Economic volatility, supply chain unpredictability and global upheaval are making 2022 another challenging year on the heels of two years that brought unprecedented obstacles. This article explores the bumpy road traveled to date, and some of the potential forks in the road ahead for the chemical industry.

HOW DID WE GET HERE?

Looking back on it now, the challenges of navigating the ups and downs of the chemical industry prior to 2020 seem relatively tame when compared with what market conditions have thrown our way since. The disruptions have been unprecedented, with many industry leaders in crisis mode for the better part of two years running; sometimes on a day-to-day or even hour-to-hour basis. Taking stock of the havoc helps put the future in some context.

The COVID-19 Pandemic was a first-ever challenge for the modern-day chemical industry. There is nothing to compare it to, and the turmoil it caused was monumental. While some opportunities Challenges Persist in the Chemical Industry: How Did We Get Here and What Now? By Kevin Duffy SMARTER PERSPECTIVE: CHEMICAL INDUSTRY arose from the pandemic, it took time for even the nimblest players in all sectors of the economy to adjust to the new landscape.

Early in the pandemic when demand for transportation fuels fell drastically and refineries closed or ran at reduced rates, the supplies of feedstocks like Naptha and Propylene decreased significantly. The chemical industry found itself in short supply of key inputs and unclear about how demand for industry staples might evolve. After the initial shock of the lock downs and economic downturn, a few bright spots revealed themselves, namely the elevated demand for plastics and packaging for the food and health care sectors. From takeout containers to Personal Protective Equipment (PPE), that strong demand did a lot to help buoy the chemical industry in the short-term.

Then came the weather. The 2020 hurricane season had a “recordbreaking 30 named storms and 11 landfalling storms in the United States,” according to the National Oceanic and Atmospheric Administration (NOAA). While an average season has three major hurricanes, 2020 had seven. Because a significant portion of U.S. chemical production is concentrated in the Gulf Coast, many chemical plants are in the direct path of Atlantic hurricanes. When Hurricane Laura approached the Gulf Coast in August 2020, there were widespread plant shut-downs. Though stock prices of U.S. chemical companies surged in anticipation of the short supply and high demand, the storm’s impact on critical infrastructure was, fortunately, less significant than that of Hurricane Harvey in 2017.

Hurricane season was followed by a deep freeze in 2021, including a storm much of the southern U.S. was ill-prepared to weather. Power outages and shutdowns there had a negative impact on chemical production capacity once again. In fact, 100% of capacity for certain chemicals such as Butadiene (BD) and Polycarbonate (PC) was offline for a time. According to industry publication Hydrocarbon Processing, in March 2021 the storm outages, “coincided with domestic consumption that remained robust,” and prices for chemical inputs surged. The weather continued to menace the industry with more Gulf Coast hurricanes in 2021. According to NOAA, 2021 was “the third most active year on record and the sixth consecutive above-normal Atlantic hurricane season.”

While the weather was wild, the global supply chain proved to be perhaps the most formidable foe for the chemical industry, and for essentially every other industry on both a domestic and global level. In fact, we have reached the point where “Supply Chain Issues” might be a legitimate response for why everything is taking longer than normal to be manufactured, transported and delivered to market. Shipping container shortages, too few truck drivers, and overall labor shortages across multiple industries have all contributed to skyrocketing shipping rates, recordbreaking commodity prices and extensive shipping and transportation delays. The chemical industry is no exception.

Global chemical supply chains have been under immense pressure. Normal flows of products have been delayed and often canceled due to lack of capacity. Prices, in turn, have spiked to unsustainable levels. There are too few new ships nearing completion, and there has been too little capital investment in shipyards for a robust or rapid turnaround. These factors have contributed to fears that the system may not rebalance for years. Prior to 2020, the shipping sector had been unprofitable for an extended period and the number of shipyards globally was declining. Even in areas where investment in shipyards is currently active, we expect it will be some time before the benefits from those capital improvements on the part of shipyards are realized. Needless to say, strain on the global chemical supply chain due to the shipping crisis is likely with us for the foreseeable future.

Late in 2021 the American Chemistry Council (ACC) surveyed chemical manufacturers doing business in the U.S. In the ACC’s January 2022 Survey Report: Supply Chain and Freight Transportation Constraints for Chemical Manufacturers, the Council noted that of the 67 corporate respondents 93% reported, “costs into the several millions of dollars,” due to supply chain and freight transportation disruptions. In the past year alone, two thirds reported lost production and over 90% reported shipping delays and increased transportation costs. Although the delays and price increases may have been most acute in the shipping arena, the impacts were felt across the railroad and trucking sectors as well. Not surprisingly, those respondents also indicated that relationships with customers have been strained, and in several instances, customers had to shut down their production entirely due to delays and uncertainty. As one respondent shared in the general comments section of the survey, “This situation is unsustainable.”

Unfortunately, as the second quarter of 2022 begins, most of Asia is experiencing a COVID-19 surge from the Omicron variant. China’s zero-COVID policy has led to lockdowns in several major cities and subsequent labor shortages and work stoppages at key shipping ports. The policy is proving difficult to sustain, so China is tweaking its approach, but it will be a bit before the resulting supply chain impacts abate.

Of course, we cannot forget inflation. The economic community’s position on pandemic induced inflation has evolved in the past year. The debate about whether the inflation was transitory versus systemic played out for some time with most economists arguing it was a temporary result of the large economic stimulus to combat the pandemic. Since inflation did not ease as the economic recovery continued through 2021, however, the conversation began to shift more toward the systemic causes and the longer-term impacts of inflation. By the first quarter of 2022, it became clear that the Federal Reserve would act by raising interest rates.

On March 16, 2022, the Fed raised rates by a quarter of a point to .25%. It was the first-rate increase since 2018. The expectation is that rates will be raised incrementally through the remainder of the year, with the year-end target rate approaching 2%. Interestingly, the 2% year-end projection is a full point higher than the estimate Federal Reserve Board members and bank presidents backed only a few months ago in December 2021. As Al Greenwood Hilco Global is the Chemical Industry Smarter partner for your business. pointed out in his piece, “US Fed raises interest rates, cuts GDP forecast, sees more increases,” on the Independent Chemical & Energy Market Intelligence (ICIS) web site on March 16, 2022, the Fed Board members and bank presidents also reduced their 2022 GDP growth projection from 4.0% to 2.8%. Greenwood also quoted ICIS senior economist Kevin Swift, who keeps a model tracking the risk of recession. Swift said, “Threats to the economy are building up. The risks are high.” The model rose to 36% the week of March 14th, up from 26% in January.

The table at right shows how Federal Reserve board members and bank presidents have updated their Dec 2021 forecasts of key economic indicators (as of March 16, 2022).

Inflation and supply chain constraints have both contributed to rising fuel prices. As if both of those major factors were not enough to manage, the war in Ukraine brings a new challenge that throws an even bigger wrench into the global economy and the chemical industry. Ironically, it’s not that long ago that some in the chemical industry were talking about the downside impacts of falling crude oil prices (back when no one was flying or driving much). Change is constant and now the pendulum swings in the other direction, with crude oil prices skyrocketing.

The European Union is heavily reliant on both Ukrainian and Russian gas and oil. The energy challenges facing the EU are immense, and there is no quick fix. As the war drags on, disruptions in supply are going to be acutely felt by Europeans. The price of natural gas has risen sharply enough that some chemical producers will likely suspend their production operations for a period of time. According to Aura Sabadus at ICIS, “Elevated oil prices also dent downstream consumer confidence and spending.” In her piece from March 21, 2022 about Ukraine, she continued, “Margins for naphtha-based ethylene producers in Europe have turned negative for the first time since the ICIS records began. They had been falling since the start of the year, as producers struggled to pass on increasing naphtha feedstock and energy costs.”

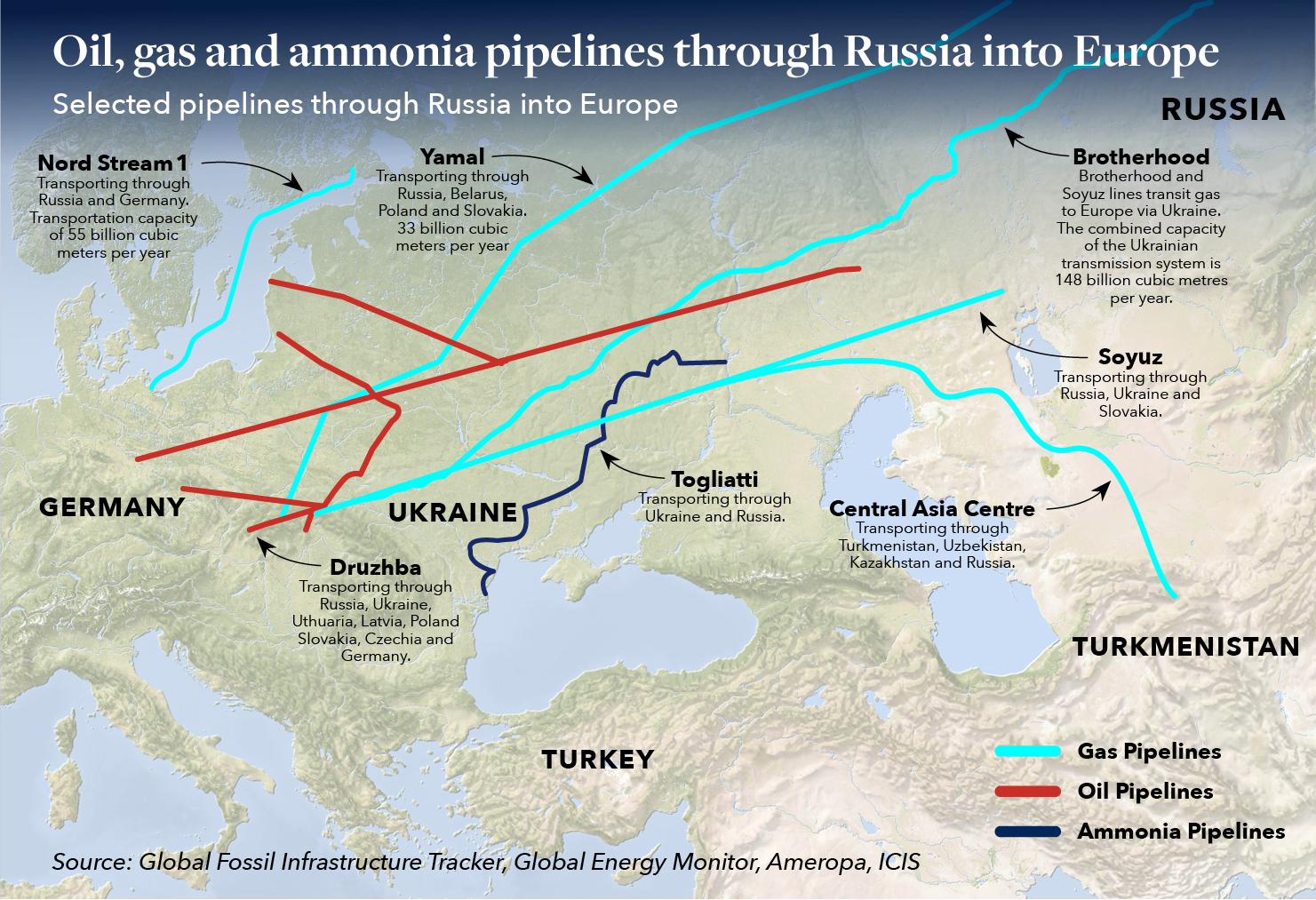

As the map below illustrates, several key pipelines move oil, gas and ammonia from Russia into Europe. According to the ICIS Supply & Demand database, “… the countries [the] Druzhba [pipeline] runs through, except for Germany, are reliant on Russian crude oil for more than half of their imports. In turn, the chemical production downstream will be negatively affected.” The consensus right now among industry watchers is that chemical production in the EU will not be maintained at normal rates without alternative sources of crude for European producers.

WHAT NOW?

Outside of the acute downturn at the beginning of the pandemic, the consistent and strong demand for chemical industry products has been a bright light for the industry. Data from ACC’s “Weekly Chemistry and Economic Trends,” for the week ending March 18, 2022, indicates that producer prices increased for a 21st consecutive month in February, up by 1.0%. Year-over-year prices were up 21.5% with double-digit gains across all major segments other than consumer products. While the gains are positive, there is certainly a tipping point. It remains to be seen if a prolonged war in Ukraine will propel us there. In the near-term, we expect to see continued bottlenecks across the supply chain. Global producers that can leverage multiple production facilities as well as multiple transportation methods for their products will, no doubt, be at an advantage.

Lobbyists and legislators continue in their efforts to address supply chain challenges. Some progress has been made via implementation of extended service hours at ports, as well as truck driver recruitment and certification programming. The chemical and other industries are working together to promote policy changes that will reform ocean shipping rules, gross vehicle weight regulations and more competitive and reliable freight rail service rules.

If the war drags on, we may see signs of belt tightening. General weariness and uncertainty about how long the war will last likely has chemical industry scenario builders preparing for a worst case scenario, i.e., recession, and a less worst-case scenario, i.e., moderate downward pressure on demand.

There are some bigger picture issues to consider as well. Deloitte published its “2022 Chemical Industry Outlook” in January. While the war was not factored into the company’s predictions, the outlook did state that sustainability and decarbonization is likely to be one of the top five critical areas of focus for most U.S. chemical companies this year. Sustainability is certain to be an issue that will long outlive the pandemic, the war and inflation. Accordingly, as the Deloitte study points out, most chemical companies plan to increase their investment in research and development that leverages advances in decarbonization, renewables, recycling and circular economy technologies.

As the war drags on, disruptions in supply are going to be acutely felt by Europeans.

This energy transition will take time, but there are real opportunities for the chemical industry to play a pivotal role in these areas. There is speculation—and hope—that while making themselves greener, the chemical industry will play a role in fostering collaboration across and among industries, sectors and countries. That collaboration, in turn, might just lead to new businesses, products, and partnerships while having a positive impact on the environment overall.

So many factors affecting the chemical industry during the current period are unpredictable. It remains to be seen if, in combination, these will put enough price pressure on markets to significantly dampen demand. The general expectation that economies around the globe will continue to recover from the pandemic in 2022 is now playing out with a new twist since the outbreak of the war in Ukraine, and global GDP and industrial production forecasts have been tempered as a result. It looks like the bumpy road continues for the foreseeable future.

At Hilco, the many conversations we have each week with our contacts across the chemical industry and the engagements we are continuing to move forward, provide us with valuable insight and perspective that we welcome the opportunity to share.

For ABLs with concerns pertaining to Chemical Industry exposure within their portfolio at this time, we are here to help and encourage you to reach out to us for guidance.

Hilco’s valuation team possesses extensive knowledge in all things apparel and accessories and has completed engagements in the emerging and more specialized areas of rental, secondhand, and vintage. As this corner of the market is sure to grow in the coming months and years, we encourage retailers/ resellers and lenders with portfolio exposure in these areas to leverage our team’s expertise in the space to better understand value and risk, as well as potential disposition strategies and channels. We are here to help.