Change and Opportunity Are the Only Constants Surrounding the Still Nascent Cannabis Industry for 2023

This article explores the current state of the cannabis industry with an eye toward where the biggest disruptions may occur in the near-term, as well as how regulatory and economic conditions will impact the value of assets and the scope of the market opportunity during the next phase of the industry’s evolution.

The path that the cannabis industry has followed looks more like something on a treasure map than a roadmap. Figuring out how to invest in and manage the business is challenging to say the least. And it’s not entirely clear what is around the corner for this nascent industry. Put plainly by Paul Demko of Politico earlier this fall, “It’s not easy selling weed.”

The industry is beset by numerous challenges related to the fact that it is still illegal to cultivate and sell cannabis under federal law. A patchwork of state and municipal laws has led to a different set of rules from one town to the next. The cost of entry has been kept high because traditional capital sources are not accessible, and the investment environment has been characterized as uncertain, volatile and promising all in one breath.

Not all the news is bad, however, because the revenue generated by the industry is significant, and state laws are advancing despite stagnation at the federal level. Total revenue from the cannabis industry in 2022 is projected to reach $32 billion and then double again in the next 5-6 years. And there are some key states — New York and New Jersey in particular — about to legalize recreational use, which will help fuel that growth. Many others have some form of legalization on their ballots in November. At present, according to Flowhub, medical cannabis is legal in 37 states, recreational cannabis is legal in 18 states, and 44% of US adults live in states with access to legal recreational cannabis. Those stats will increase, by how much is not known, but the numbers will rise in 2023.

Within a couple of years, it is very likely that half of the states in the US will have some form of legalized recreational cannabis law. For many of the states that are poised to transition from legal medical use to legal medical and recreational use, the assets, even land or warehouse space for cultivation, are already in place and the momentum is there to support significant recreational industry growth. The data shows that as the industry evolves, the time from when medical use is legalized to when the first recreational sale happens is shrinking dramatically.

REGULATIONS AND ROADBLOCKS

There is ongoing lobbying at the federal level to create a regulatory framework that will eliminate, or at least alleviate, some of the most onerous roadblocks for cannabis cultivators, processors and sellers. Although most industry leaders have lost hope that the current Congress will pass key legislation related to the tax code, there is momentum to accomplish that goal long-term, and it will be a game changer. As Jen Drake, co-chief operating officer at Ayr Wellness also stated in Politico earlier this fall, “If you’re able to generate cash flow with all of these headwinds, when these headwinds start to be removed, it’s going to be an incredibly, incredibly good business model.” Many in the industry believe it is just a matter of time, but each extension to the timeline will impact how many companies can hang on, as well as how much capital flows into the industry, at least in the short-term.

EVERY STATE FOR ITSELF

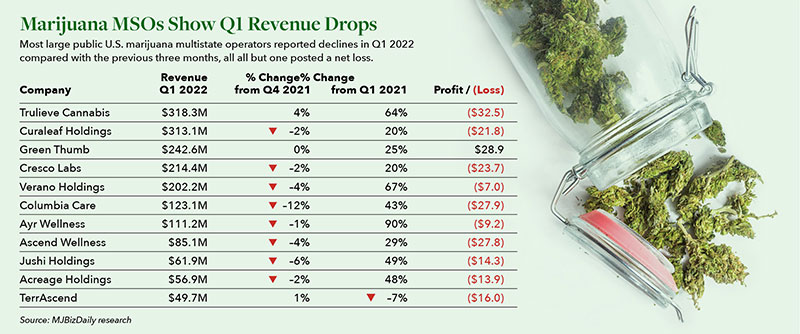

As a result of the regulatory variation, states that welcome and issue licenses to companies from outside their borders have attracted multi-state operators (MSOs) that are vertically integrated, well established, technologically sophisticated, and in most instances have access to more capital than local start-ups. A number of the MSOs have gotten a foot-hold in multiple states and are growing into regional and national power houses with brand recognition. Despite being hamstrung by some regulatory roadblocks like restrictions on products crossing state lines, MSO’s have invested in and positioned themselves well for growth in emerging markets. Their presence in multiple states will have a significant impact on the growth and character of the industry going forward.

NO CRYSTAL BALL IN CANNABIS

It’s safe to say that the roller coaster ride is not over for the cannabis industry. In addition to the regulatory differences from state to state, there are some economic influences like inflation and an economic downturn to contend with in the near-term. Interestingly, the more mature markets, like those in Washington state and Colorado, are probably in a better position to survive the inflation crisis and economic downturn than the nascent markets in states with recently passed legalization. Because the emerging markets’ infrastructure is immature, those states may be less resilient and have a harder time surviving economic upheaval. The legacy states also face less competition and a greater guaranteed share of the market, despite the economic headwinds.

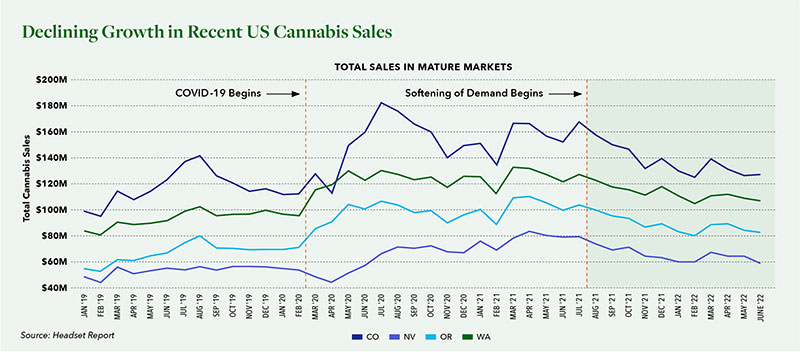

Yet, the legacy markets have their own challenges. The supercharged sales experienced during the pandemic were simply not sustainable. The pandemic was an anomaly, as noted in a recent report by Headset titled, “An analysis of declining growth in recent US cannabis sales.” The authors said, “In the data, we find that the sales growth during the pandemic was exceptional and that the softening of demand [in legacy markets in particular] in recent months may be a correction to a pre-pandemic normal.”

The current economic climate has most analysts anticipating some overall price decline as supply constraints ease and the MSOs exert their dominance across new markets, but they see bright spots for wholesale pricing in the less mature markets like Illinois and Massachusetts, where cultivators haven’t had the time to grow more supply than is demanded. And, as more states come online for adult recreational use, more consumers will get into the market and their preferences for certain brands and brand consistency will likely lead to the expansion of the MSOs.

Even with the declines in revenue that they are experiencing, the MSOs have an edge in raising capital as well, which means they will continue to innovate, introduce new technologies, gain efficiencies, and dominate the market. To date, the cost of capital has been kept artificially high due to the lack of traditional financing options available. As MSOs evolve, and as regulatory conditions do too, the flow of capital into the industry will likely diversify and expand. Some states that have already legalized cannabis have removed certain barriers, but it will take action at the federal level to make significant capital flow more readily into the industry.

Because change will come in fits and spurts during the next stage of the industry’s expansion, there is an expectation that both bankruptcies and merger and acquisition (M&A) activity will increase. Back in early 2021, the M&A activity was intense because the industry was growing quickly, and it attracted the attention of investors looking to get in on the action. And, as is still the case, the investment came from non-traditional sources, not banks. As 2022 has unfolded, however, the M&A activity is more strategic and more consolidation oriented, at least for now.

WHAT ABOUT THE REAL ESTATE?

Arguably the most valuable asset on the balance sheets of many cannabis companies is their real estate. Across any number of evolving industries historically, companies in possession of such desirable assets have been able to gain access to capital more readily when needed. In the cannabis industry, vast sums have been spent on the acquisition of real estate associated with cultivating, processing and distributing cannabis over the past decade — to a large extent as a means of preventing interference from, or restrictions being placed on those businesses by, landlords. Well-funded license applicants across states that have legalized cannabis, as well as those who were able to raise sizable sums once those licenses were granted, purchased big ticket parcels in prime urban and other locations often paying a significant premium over value for the privilege.

As many of these businesses began to take-in sizable amounts of cash, they were also challenged by an inability to bank funds due to federal restrictions. As a result, even greater investment has gone into the expansion of growing and dispensary operations, with MSOs and others competing head-to-head to add geographically desirable real estate, often at unprecedented purchase prices. In turn, these facilities have been filled with the requisite machinery and equipment (M&E) needed to ensure their success. Now, however, with fierce competition taking place in many states such as Michigan and Colorado, product margin has been driven down, profitability has been reduced and we are beginning to see more real estate and M&E associated with the industry coming up for sale. In many cases, operators are not looking to close locations but to raise capital through their sale, in the process seeking out buyers/new owners who will not restrict their activities or future potential at those locations.

This is an interesting dynamic because while the companies that choose to sell their real estate will gain access to needed funds for short-term strategic acquisitions, buildouts, or to feed their supply chain… they also may ultimately impact their own ability to raise capital. Investors are in a position to be selective and the scarcity of capital right now favors cannabis companies with strong balance sheets. While this disadvantages new market entrant, some states are addressing this disparity via programs targeted at helping smaller, local companies to get up and running since they cannot access capital like the MSOs. Even so, those smaller players are not likely to own, or be in a position to purchase, the real estate needed for cultivation, processing or selling. This, in turn, creates an opportunity for investors, many of whom are becoming interested in the space. As Michael Schwamm, a partner at law firm Duane Morris explained on wealthmanagement.com earlier this year, “Real estate investing (along with ancillary services) is often the entry point for many investors. As the industry continues to gain acceptance, more traditional real estate investors [are] taking a look at this market as they are able to get higher returns in the cannabis sector vs. other [real estate] markets.” And in cases where those in the industry may be looking to close one or more locations in a single or multiple geographies, particularly those located in well-trafficked urban and metro areas, the buying opportunity for well-funded retail, restaurant, banking and other operators can hold significant potential.

At Hilco Real Estate Appraisal, our team has experience with a wide range of complex real estate valuations and appraisals. We work directly with buyers, sellers and operators to conduct valuations and appraisals. Regardless of whether you are looking to evaluate a cannabis investment opportunity, attract a buyer for a going concern, find an acquisition opportunity, value your existing real estate or equipment, or reposition an existing asset, we are here to help. As the cannabis industry continues to evolve, we are poised to support a diverse set of clients to evaluate and engage in the opportunities the market presents.

HILCO REAL ESTATE APPRAISAL

Hilco Real Estate Appraisal provides fee-owned and leasehold valuation services and cost segregation analysis conducted by a seasoned staff of real estate analysts and appraisers. When/ where appropriate, our valuations are subjected to a reality test by Hilco Real Estate’s property disposition and acquisition experts, who review and assess valuations as if they were ultimately responsible for marketing the asset or considering its purchase.