Generating Liquidity Through Real Estate in an Economic Downturn

In this article, we discuss how, during times of financial tightening and uncertainty, real estate owners and occupiers often need to broaden their traditional sources of financing to create liquidity and stay afloat.

Over the course of the past year, there has been persistent talk of an impending recession in the U.S. Various factors have been cited as potential triggers, including rising interest rates, high inflation, an inverted yield curve and the recent unexpected banking crisis. In the real estate world, the signs of financial difficulty associated with the economic downturn have become more and more evident over the past 18 months.

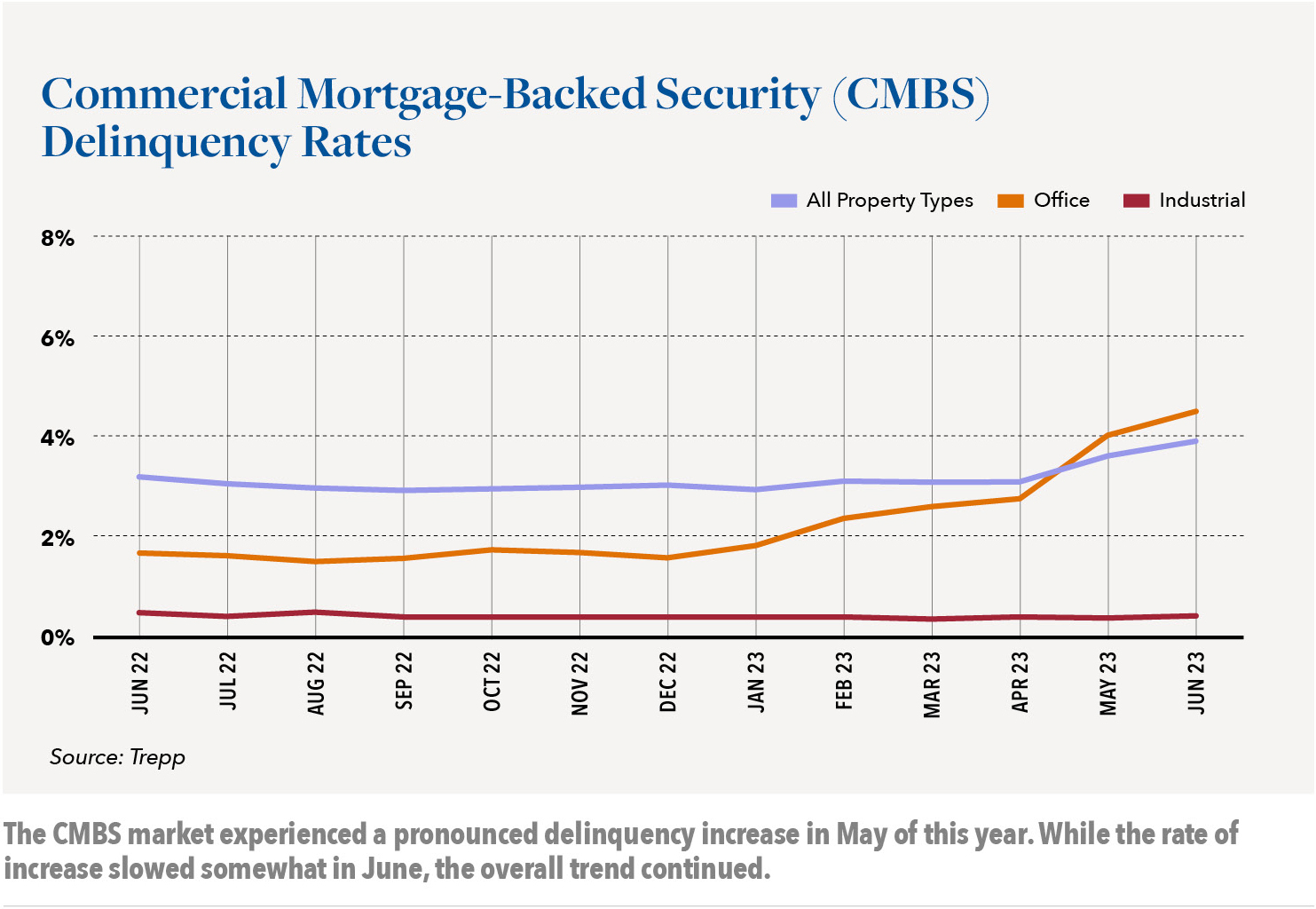

Recent examples of this shift include Brookfield Properties losing its anchor tenant, Macy’s, at the iconic Chicago Water Tower Place. This ultimately resulted in Brookfield turning over the keys to its lender, a unit of MetLife, just a year later in April 2022. Late last year, we saw GFP Real Estate default on its $103 million mortgage-backed securities loan at 515 Madison Avenue in Manhattan.

High profile defaults early in 2023 included both a $270 million Blackstone CMBS loan on a Manhattan multifamily portfolio sent to special servicing and Brookfield’s default on $784 million in loans associated with two prominent skyscrapers in Los Angeles. Most recently, RXR defaulted on a $240 million loan for 61 Broadway. Park Hotels and Resorts stopped making payments on $725 million in debt associated with the Hilton San Francisco Union Square and Parc 55 hotels, handing the keys to those properties over to lender, J.P. Morgan Chase.

Current conditions clearly indicate a high probability of increased distress moving ahead, with some experts suggesting that levels could exceed those experienced during the financial crisis and Great Recession. The New York Fed’s Recession Probability Indicator has added weight to these concerns, as it currently suggests a 68.2% chance of a U.S. recession within the next 12 months. Notably, this reading is higher than at any time over the past 40 years. Despite these potential triggers and indicators, the U.S. labor market remains robust, with strong employment figures and a healthy job market. This has led to a division among economists regarding whether a recession is inevitable in this unique economic environment.

Staying well informed, advised and proactive in the face of such potential adversity can empower property owners and occupants of leased spaces to face the challenge of maintaining their financial stability and minimize downside risks. In such situations, there are specific approaches that can be utilized to monetize real estate assets effectively and efficiently, to provide needed liquidity and/or minimize mounting costs.

While it may seem somewhat counterintuitive, from a historic perspective, recessions have frequently presented opportunities for savvy, long-term real estate investors. This is great news for investors with ready money that can be put to work in value-add opportunities. And for those occupants struggling with liquidity issues, who need to evaluate other potential sources of funding, the investors looking for deals can provide a potential liquidity source.

The information below outlines three effective methods that property owners and tenants of leased spaces can leverage to both protect their interests and continue to capitalize on their investments during times of turbulence.

SALE-LEASEBACK

Sale-leaseback is a strategy in which a property owner sells an asset to a buyer and simultaneously leases it back from that buyer. This strategy is often deployed on behalf of clients

as it provides several advantages in a recessionary environment, including the delivery of an immediate, and often urgent, capital infusion. Selling a property unlocks its value, providing the original owner with access to substantial liquidity that can then be used to bolster its financial position, repay debts, invest in other areas or simply provide cushion during an economic downturn. While sale-leasebacks have become more prevalent in strong economic times due to cap rate compression and investors paying top dollar for strong credit tenants, they can be even more important in a high interest rate environment where this strategy often provides capital at a lower rate than simply borrowing it.

Sellers in a sale-leaseback scenario also unlock the full value of their property as opposed to only 60-70% in a traditional financing scenario. Additionally, the seller will set the terms of the lease

and unlock all that capital with no loan covenants. This strategy can also provide added operational flexibility by enabling an original property owner to continue to operate without interruption in the facilities as its tenant. The leases are traditionally structured as “triple net,” meaning the tenant remains responsible for the operational costs of the property. These costs retained by the lessee, such as taxes and maintenance, are often tax-deductible expenses. Transferring ownership to a new buyer also mitigates an original owner’s future risks associated with property value fluctuations and potential market downturns, providing an added degree of stability during uncertain economic times.

Two recent, but very different, examples illustrate how sale-leaseback is being used in the current market environment:

- Late last year, Oak Street Real Estate Capital concluded a $200 million purchase of the former 30-acre Chicago Tribune Publishing center as part of its sale-leaseback transaction with Bally’s. As a result, Bally’s is now constructing a $1.7 billion hotel, casino and entertainment complex on the site.

- Earlier this year, an affiliate of PSP Partners spent $19.5 million to purchase a 173,000-square-foot industrial plant in Waukegan, Illinois. Thermoflex, an automotive accessories manufacturer had owned and operated the plant for over 60 years. Under the deal terms, the company gained needed access to liquid capital, which it is now using, in part, to pay rent to the PSP affiliate on a new, long-term lease.

- HRE’s work with Service King, the premier collision repair provider of choice in the U.S. with over 330 locations across 24 states, involved an assessment of the company’s

37 owned properties. Based on HRE’s portfolio analysis, 21 of the owned properties were marketed to a targeted, qualified group of investors as a sale-leaseback opportunity. In less than 60 days, HRE coordinated full due diligence on each site, marketed the portfolio, generated offers from six groups, conducted a best and final round and closed on the portfolio with a major institutional buyer for proceeds in excess of $66M, with Service King retaining possession of the properties on a long term lease. These results far exceeded the Seller and Sponsor’s expectations, and supported Service King’s financial objectives and ongoing business operations.

PORTFOLIO OPTIMIZATION AND LEASE RESTRUCTURING

Portfolio optimization and lease restructuring involve analyzing an existing leasehold portfolio and making strategic adjustments to maximize value and mitigate risks. This approach can be particularly valuable leading into and during a recession as it provides rental income stability and greater flexibility in the face of potential adversity. Lessees often benefit by working with a qualified third-party to assist in objectively reviewing lease agreements, analyzing the applicable marketplace and identifying opportunities. Resulting efforts may include lease extensions, rent reductions or adjusting lease terms via temporary abatement or other methods to retain tenants during challenging economic periods. HRE specializes in such scenarios as a third-party provider, which helps reduce lease exposure to tenants in both good economic times and periods where holding onto cash may be a priority.

Through detailed assessment of lease portfolio composition, HRE has enabled property occupants to identify assets that may be more vulnerable to recessionary impacts and strategically diversify a portfolio by reallocating resources and acquiring properties tailored to different sectors or geographic locations which have shown historic resilience during economic downturns. HRE’s work with Southeast Grocers, for example, involved a portfolio-wide lease review and subsequent lease repositioning project to support the company’s restructuring. These efforts resulted in $70 million+ in lease savings and millions more in value to the company from HRE’s concurrent marketing of over 100+ leasehold assets for sale/assignment.

Tenants can also benefit from careful scrutinization of their operating expenses and implementation of cost-cutting measures and operational inefficiencies. This may involve renegotiating service contracts, streamlining operational processes or optimizing energy consumption. Reducing these types of costs can help improve profitability and financial stability during a recession.

SURPLUS REAL ESTATE SALES

During an impending recession, property owners may have surplus real estate assets that are underutilized or no longer aligned with their strategic objectives. Selling these surplus properties, can generate immediate liquidity that can be used to strengthen the financial position of the property owner. A subsequent cash infusion can then be reinvested in more profitable ventures or used to reduce debts. HRE’s work with IDI Logistics, which had accumulated numerous one-off land parcels in major metro areas, is a prime example. While these assets had been marketed, no sales resulted. To “clean up” IDI’s balance sheet and generate proceeds from non-performing assets, the HRE team implemented a date-certain program culminating in an online auction. Utilizing a multi-channel marketing strategy to elicit interest from local markets as well as national industrial players, HRE received over 160 inquiries for these properties. The combined results from the auction and negotiated post-auction sales culminated in the successful sale of sixteen of the twenty parcels in less than six months.

Divesting surplus real estate can also enable property owners to redirect resources and attention towards core assets that are more critical to their business operations. Efforts in this area allow for greater concentration on strengthening the performance and value of key properties within a portfolio. Additionally, it is important to recognize that some real estate assets have a greater likelihood of becoming liabilities during a recession. Those with high, ongoing maintenance expenses, excessive property taxes and other burdensome operational costs should be considered as prime targets for sale when seeking to reduce cost and mitigate unwarranted risk associated with holding underperforming properties during an economic downturn.

SUMMARY

Under any circumstances, seeking proven advisory guidance is highly advisable when undertaking the complex steps associated with monetizing real estate through strategies such as sale-leaseback, portfolio optimization, lease restructuring and the disposition of surplus real estate. The current market environment and recessionary threat only heighten the need for such specialized expertise.

Real estate transactions can be highly intricate and involve various legal, financial and market considerations. Therefore, property owners and portfolio holders should focus on engaging an advisory team with deep expertise and a proven track record of navigating complex real estate markets, transaction structures, legal requirements and utilizing industry best practices.

An understanding of the nuances involved in each strategy provides valuable insights and guidance to maximize return, limit downside risk, provide access to added resources, address regulatory compliance issues and execute/close deals in a timely and efficient manner. If your business, or a business in your portfolio is a property owner or tenant of leased space seeking to protect its interests and capitalize on its investments during times of turbulence, we encourage you to reach out to our team today for a discussion. We are here to help.

ABOUT HILCO REAL ESTATE

Successfully positioning the real estate holdings within a company’s portfolio is a material component of establishing and maintaining a strong financial foundation for long-term success. Hilco Real Estate (HRE) advises and executes strategies to assist clients seeking to optimize their real estate assets, improve cash flow, maximize asset value and minimize liabilities and portfolio risk. We help clients traverse complex transactions and transitions, coordinating with internal and external networks and constituents to navigate ever-challenging market environment.