Lenders Encouraged to Closely Monitor Lumber Market Borrowers in 2024

In this article, we take a look at recent lumber market developments and suggested actions for lenders with portfolio exposure to minimize the potential for downside risk in the year ahead.

Housing Overview

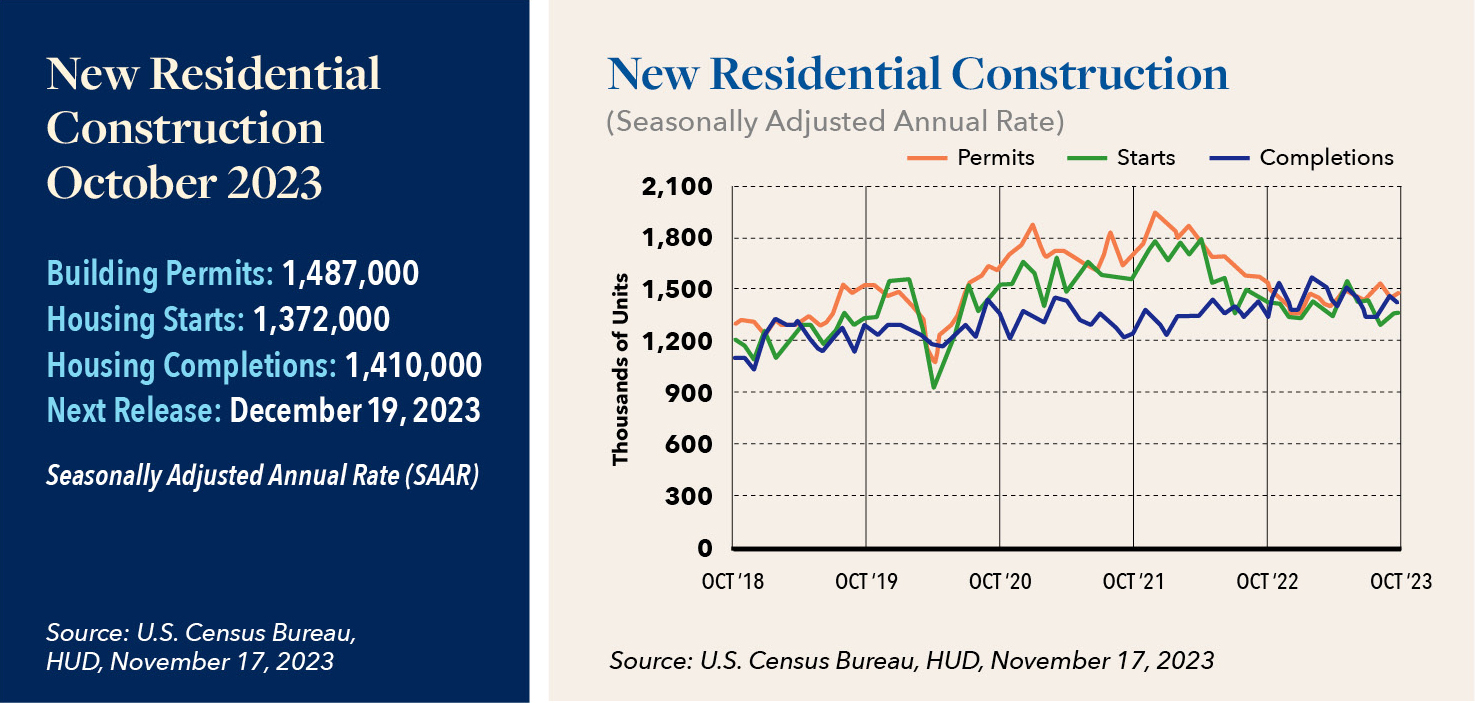

October saw a 1.9% overall increase in housing starts, reaching a seasonally adjusted annual rate of 1.37 million units. Despite the rise in interest rates during the month, the demand for new construction remained strong due to a shortage of existing home inventory. Combined single-family and multifamily starts experienced decreases of 22% in the Northeast, 11.2% in the Midwest, 7.8% in the South, and 15.3% in the West. In October, overall permits increased 1.1%, reaching a 1.49 million unit annualized rate. Single-family permits experienced a 0.5% uptick, reaching a rate of 968,000 units, but year-to-date they are down 10.6%. Multifamily permits increased by 2.2% to an annualized rate of 519,000. Permits declined 19.5% in the Northeast, 16.7% in the Midwest, 11.3% in the South, and 15.8% in the West.

With data from the U.S. Census Bureau indicating that nearly 40% of homes in the U.S. are now owned free and clear, the vast majority of existing mortgages at rates well below current levels, and the all-in cost to purchase a new home remaining high, there is not much incentive right now for existing home owners to entertain a move. Cash transaction relocations, particularly to favorable climate regions and tax-advantaged states, however, have been a notable exception to this scenario over the past 18 months.

For the week ended December 8, 2023, the average 30-year fixed mortgage rate was 7.41%, down from 7.57% the previous week and 7.87% the month prior. The national 15-year fixed rate was 6.66, down from 6.84 the previous week.

Lumber Markets

Framing Lumber

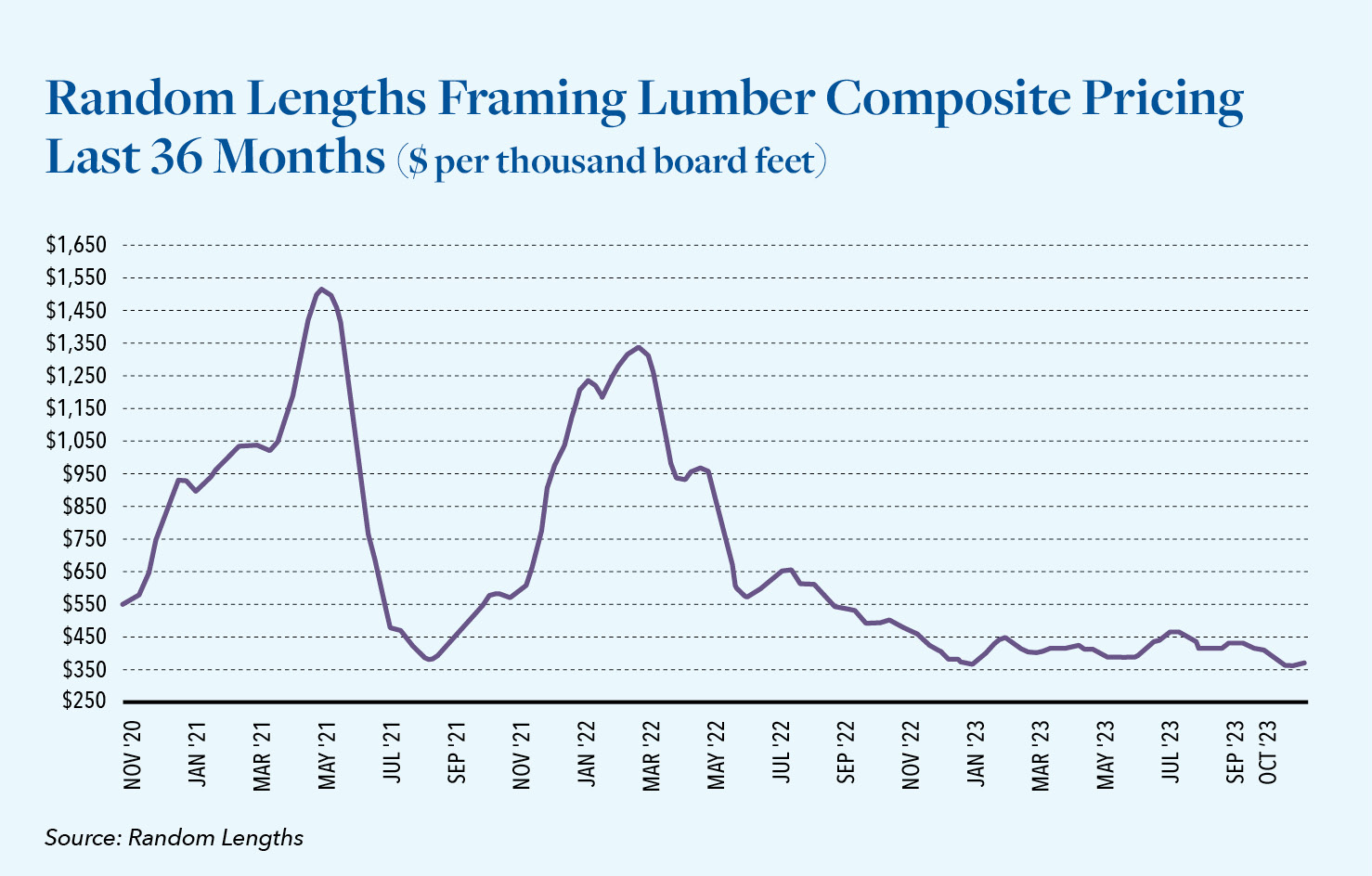

As we approach year-end, sales in the existing home market remain largely stalled based in great part to the factors outlined above. With few looking to buy and much of the construction-oriented home improvement activity for those who are staying put already having taken place, we have seen both temporary and permanent shutdowns at Canadian sawmills. This can also be attributed to their higher labor and freight cost, as compared with U.S. counterparts. Combined with ongoing pressure from Canadian environmental concerns and the recent catastrophic wildfires in areas across that country, this has collectively resulted in a number of mills shuttering during 2023. Framing lumber composite pricing was down 27% year-over-year in October 2023 to $376 from $497 the previous year.

Printing & Writing Papers

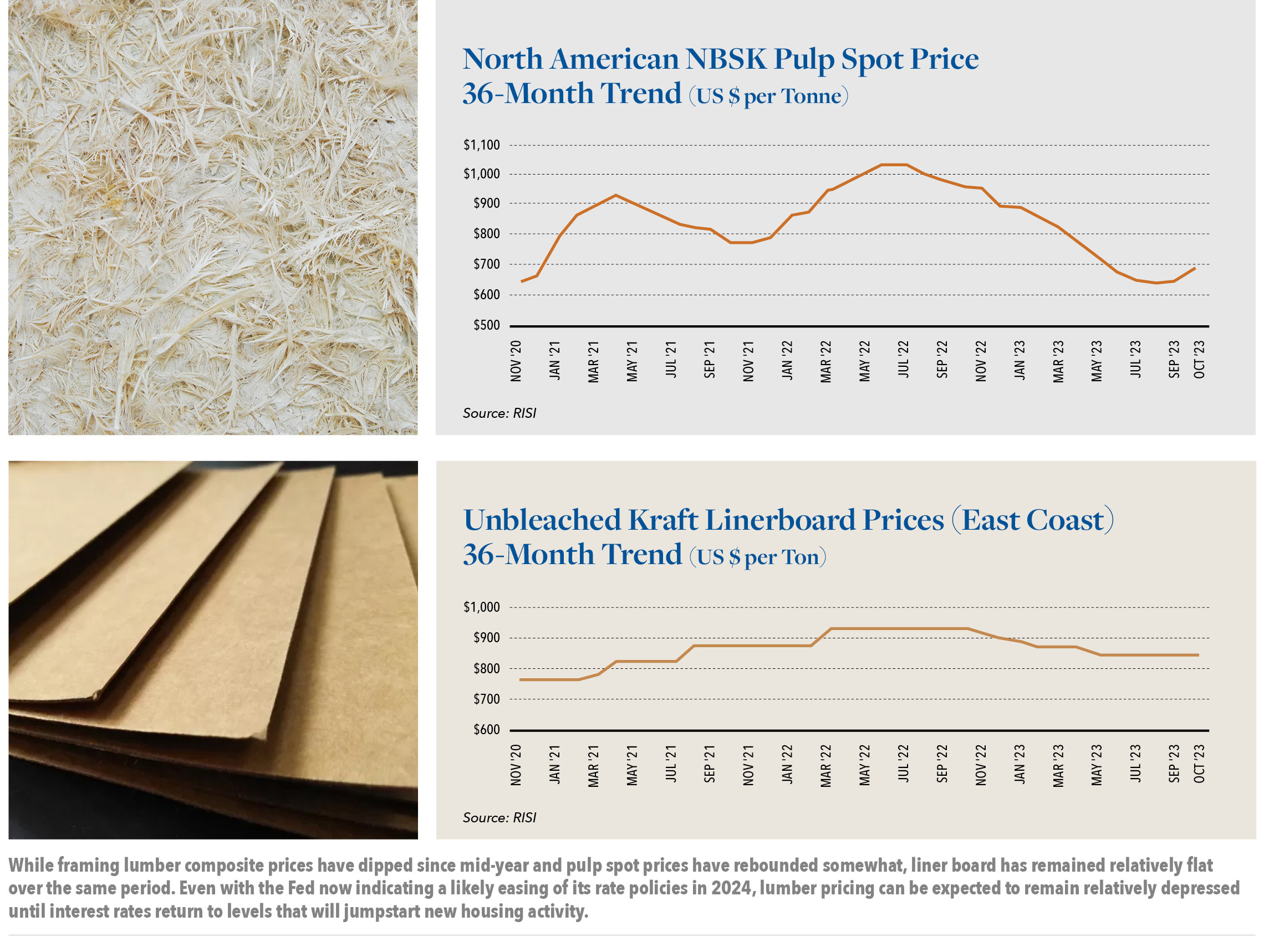

Total printing-writing paper shipments were down 15% in October compared to October 2022. And U.S. purchases of total printing-writing papers decreased 30% in September compared to the same month last year. Total printing-writing paper inventory levels decreased 2% when compared to September 2023.

Containerboard

Total Containerboard production in the third quarter of 2023 was down 1% when compared to Q3 2022 levels and was down 8% compared to the same 9 months last year.

Conclusions

With the U.S. economy remaining sluggish, questions over a potential recession still looming, and interest rates not likely to return to a level conducive to robust new housing starts for quite some time– lumber pricing remains depressed. This even as Canadian production and resulting supply has dwindled as a result of its government’s stringent forest policies, the effects of the mountain pine beetle epidemic, other invasive beetle species and the depletion of natural resources caused by the country’s recent pervasive forest fires. Demand, quite simply, is not there.

In the current economic and industry climate, we encourage lenders with borrowers in the lumber market to ensure that they have a firm grasp of those businesses and any distinct operational challenges they may now face. These may include business performance, competitive threats, or data-driven forecasting accuracy that could contribute to potential distress in 2024. For these and other reasons, we advise regular intervals of valuation monitoring during this period and welcome the opportunity to assist in those efforts or answer any questions you may have pertaining to exposure within your portfolio. We are here to help during these complex times.

Hilco Valuation Services is the leader in valuation for the forestry and lumber industry, having delivered more than 500 forestry and lumber appraisals, with asset values ranging from $500 thousand to $1 billion. As one of the world’s largest and most diversified business asset appraisers and valuation advisors, we serve as a trusted resource to companies, lenders and professional service advisors, providing value opinions across virtually every asset category. Hilco Valuation Services has the ability to affirm asset values via proprietary market data and direct worldwide asset disposition and acquisition experiences. Access to this real-time information, in contrast with the aged data relied upon by others, ensures clients of more reliable valuations, which is crucial when financial and strategic decisions are being made.