Smart Alert!! Sawmill Distress on the Rise

Periodically, when we identify industry market developments that warrant quick notification to our business and lending constituents, we will now be issuing timely Smart Alerts to convey that important information. The below Smart Alert is a supplement to Hilco Valuation’s recent Q1 Forestry Market Update.

We are now seeing notable indications of distress among Sawmills. Key observations and ramifications as of 2/26/24 include the following:

- The pain has not been spread equally across regions. Lumber production in the Pacific Northwest and western Canada (British Columbia primarily) has been impacted the most due to a reduction in the annual allowable cut (AAC) in B.C. Higher costs (log costs, labor, freight) and, to a lesser extent, wildfires have also contributed to the decrease.

- In British Columbia, for example, the annual allowable cut fell approximately 20% from 2021 through 2023 as a result of provincial government-imposed limitations on the cutting of old growth forests. This has led to a significant number of closures among the province’s sawmills. Case in point, West Fraser just closed its Fraser Lake sawmill, citing an “inability to access economically viable fiber in the region.” Numerous other closures have occurred across the province over the last few years and Western Canada production of lumber, overall, dropped from 6.25 billion board feet in 2022 to 5.176 billion board feet

in 2023. - Similar policies are also impacting mills in the Pacific Northwest. Hampton Lumber recently shut down an Oregon sawmill that had been in operation since 1961 due to a proposed habitat conservation policy that would cut harvests in state forests by up to 34%. Western U.S. production of lumber, overall, dropped from 14.021 billion board feet in 2022 to 13.712 billion board feet in 2023.

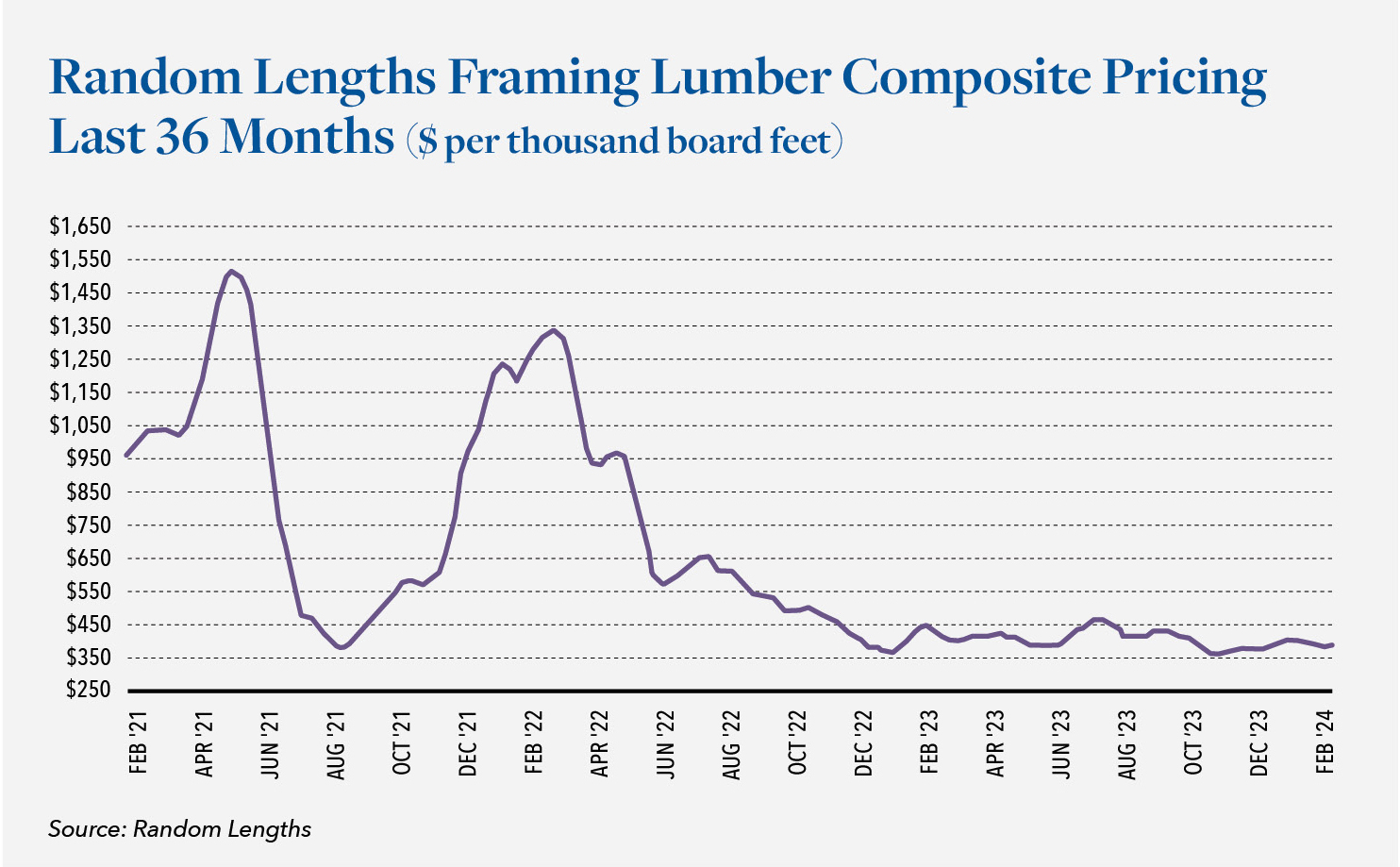

While framing lumber composite pricing has remained essentially unchanged (as reflected in the chart above) since our Q1 Forestry Market Update back in January, the key observations above warrant further discussion of more detailed considerations pertaining to the realizable liquidation value of sawmill assets in the current market environment:

- Although more hardwood production facilities/sawmills have been shutting down in the Pacific Northwest, very few have gone to liquidation in the last year. Our perspective is that most are temporarily shutting down operations with hopes that prices will come down, enabling the restart of production. If these shutdowns result in piecemeal liquidation, we would expect to see an overflooding of equipment in the used market which would be difficult to absorb, leading to discounted prices.

- A big portion of value in sawmills is in material handling. This requires heavy duty equipment including Log Loaders, Front Loaders, Material Handlers, Skid Steers and Large Capacity Forklift Trucks (20,000 – 75,000+ -Lb. Capacity). Each of these are utilized in various industries and would have a large buying audience in the event of liquidation. Importantly, however, they see quite a bit of wear and tear in sawmill operations and end users would most certainly factor that condition into their bids. Our historic data indicates although sawmill material handling equipment older than 10 years experiences a significant drop in value as compared with new, it still has a distinct and active buying audience at liquidation.

- Newer computerized/optimized sawmill equipment is more sought after and will have more of an audience at liquidation as the industry’s tight margin environment requires the latest optimization practices to reduce waste and increase production rates. With the current rate of technology improvement, older software (anything over 15 years) is considered obsolete.

- At present, older manual sawmill machinery is selling at or near scrap. Buyers now tend to obtain

these machines very inexpensively and then rebuild them to either sell in the used market or use in their own facilities. - Assets that are proving particularly difficult to liquidate currently include: wood fired boilers, dust collection systems, lumber sorting systems and dry kilns. These assets have a high cost of removal which, depending on age and condition, may outweigh the value of the systems themselves. Dry kilns with masonry walls, for example, have essentially no value, although their dryer controls and fans may be salvageable components.

- Late model (7 years and newer) well-known industry name brand debarkers, band saws, canters, gang rip saws, edgers and planers would see good demand at liquidation.

- Support equipment such as log deck conveyors, chain conveyors, roll case conveyors and transfer belts are not selling for much. Buyers most frequently obtain these types of assets to salvage their component chain/belts and drives, as frames are typically fabricated in-house. Vibratory conveyors, however, hold more value as they are sold in sections, are easier to integrate into existing systems and are very expensive to buy new.

- Chippers, chip screeners, and wood waste grinders are utilized in various wood related industries other than sawmills and will have a larger audience at liquidation. These are easy to remove and fit on a flatbed trailer.

Lenders with borrowers in the forestry/lumber market, and particularly those with sawmills within their portfolios, should ensure that they have a firm grasp of those businesses and any distinct operational challenges they may now be facing. Beyond business performance, these may include competitive threats or data-driven forecasting accuracy that could contribute to potential distress in 2024. We now advise more frequent intervals of valuation monitoring during this period and welcome the opportunity to assist in those efforts or answer any questions you may have pertaining to exposure within your portfolio. We are here to help.