Looking For a Few More Positive Signs

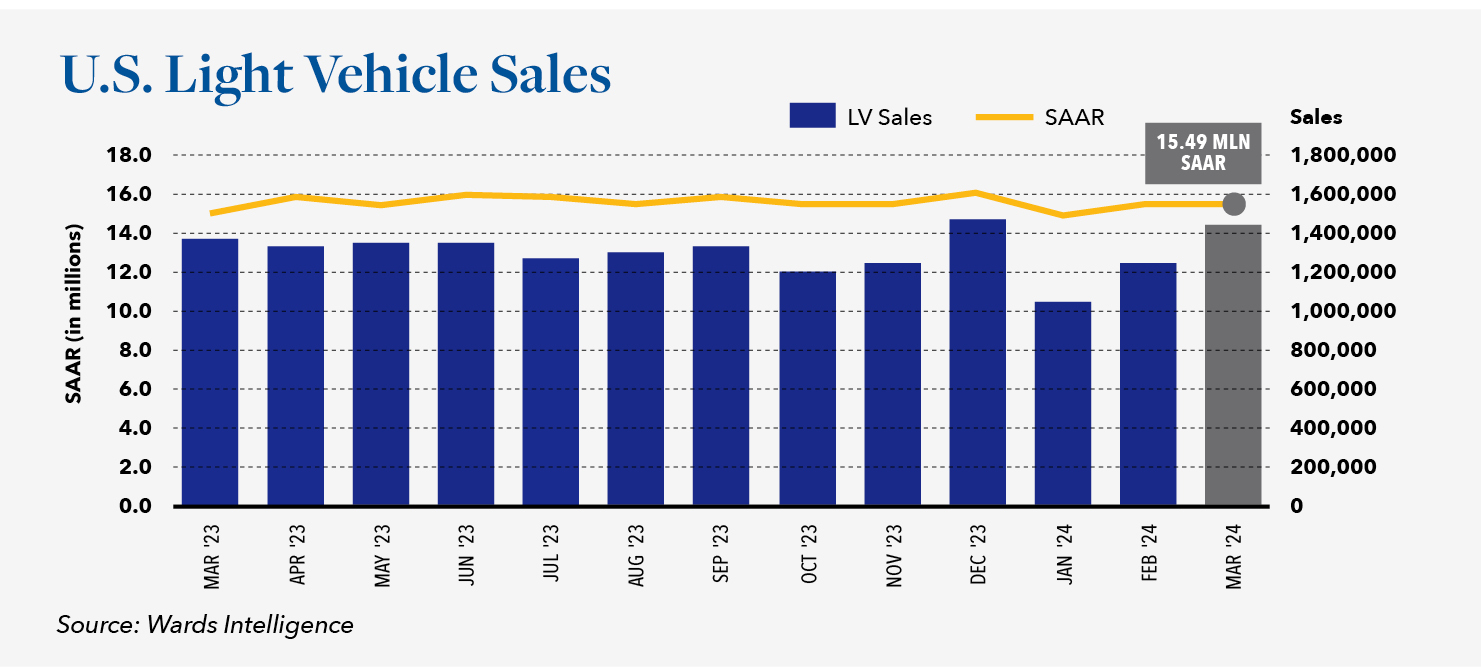

April 20, 2024 Sales volumes in January are always the lowest of the year, and the winter storms and freezing temperatures that blanketed much of the country this year were especially harsh. In response, the seasonally adjusted annualized rate (SAAR) of sales in January for U.S. light-duty vehicles failed to clear 15 million vehicles, the first time in nearly a year. After regaining some momentum in February and March, first-quarter sales managed to expand 5.6% from the first quarter of 2023. Industry economists were unmoved by the trend, believing the pent-up demand that fueled the 13% increase in 2023 has likely been sated, and the current forecasts for 2024 remains between 15.7 million and 16.1 million vehicles.

New car interest rates have remained above 7% for five consecutive quarters, and industry surveys confirm the uppermost concern on the minds of dealers is high-interest rates. The Federal Reserve has signaled that they plan to cut interest rates later this year, but the industry isn’t waiting. Even if the Federal Reserve were to cut rates three times in 2024 for a total of three-quarters of a percentage, interest rates would remain well above recent historical levels. To tempt would-be buyers, Ram and GMC offered an average of $7,500, or 10 percent, off select large pickups in certain markets. Not all incentives were this rich, but the overall average incentive is now $2,800 per vehicle, an increase of 67% from a year ago. It is also no longer the case that there isn’t sufficient inventory to support sales. By the end of March, total retail inventory was nearly 3 million vehicles, which represents a comfortable 72-day supply at current sales levels. The availability of inventory and the increase in sales incentives have lead to a decrease in the average transaction price of a vehicle for the first time in several years.

Sales are not responding as expected to the industry’s efforts to make the purchase of a vehicle more affordable, so some manufacturers are channeling more vehicles to less profitable fleet sales. Nissan, for one, sold nearly 40,000 vehicles, or 44 percent of its total volume, in February to daily rental companies. Balancing sales and production perfectly is an impossible task, so a certain level of consumer incentives, retail inventory, and fleet sales are an appropriate mechanism for compensating for some of the miscalculations. Unfortunately, the industry has a track record of over-relying on these mechanisms when it should have been cutting production. The downside is an erosion of profitability for both manufacturer and dealer, an erosion of the vehicle residual values, and an erosion of consumer equity. In the first quarter of this year, nearly 25% of all sales of new-vehicle involved trade-ins with negative equity with the average amount reaching an all-time high of $6,167 per vehicle.

Although manufacturers can adjust production at any time, the first week of July is the next logical opportunity. Most manufacturers will halt production the week of July 4th anyway, and extending the shutdown is one of the least disruptive ways for the industry to reduce production. Waiting until then will also give the industry a chance to assess how well the market responds during the all-important spring selling season. As for industry economists, they are waiting for a few more positive signs from the Federal Government, the American consumer, and vehicle manufacturers before they increase their forecasts.