Market for Replacement Parts Remains Optimistic

September 19, 2023 – The purchase of all the issued and outstanding shares of Uni-Select by LKQ, another component of the Hilco Part Index (HPI), has now been completed. Uni-Select has been delisted from all public exchanges and will no longer be reported as a component of the HPI. This marks the end of the road for Uni-Select as an independent distributor and serves as yet another important milestone in the consolidation of the industry. What started in 1968 as a purchasing group for 12 Québec wholesaler distributors, ultimately grew to be one of the major distributors of replacement parts in North America. Uni-Select had only enjoyed its seat at the head table for ten years before receiving an offer it could not refuse from Icahn Enterprises in 2015 for all of its U.S. assets. Ichan’s experiment in the replacement parts market, however, has since declared bankruptcy and the assets sold at auction. LKQ is now obligated to sell Uni-Select’s UK operations, named “The Parts Alliance” for anti-trust reasons, and will, no doubt, be looking for someone to buy Uni-Select’s Canadian Automotive Group. LKQ’s interest in Uni-Select will be FinishMaster US, a distributor of automotive paint and related products which complements LKQ’s extensive line of collision parts.

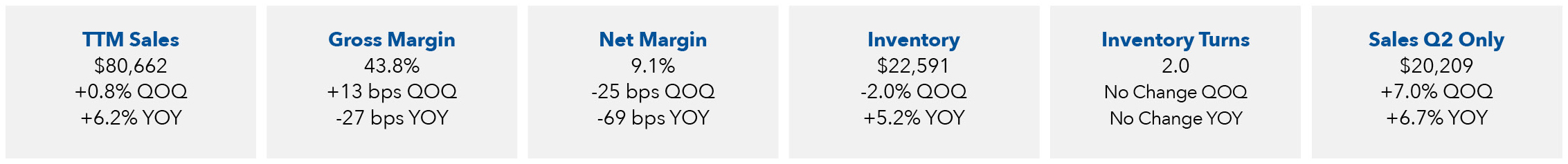

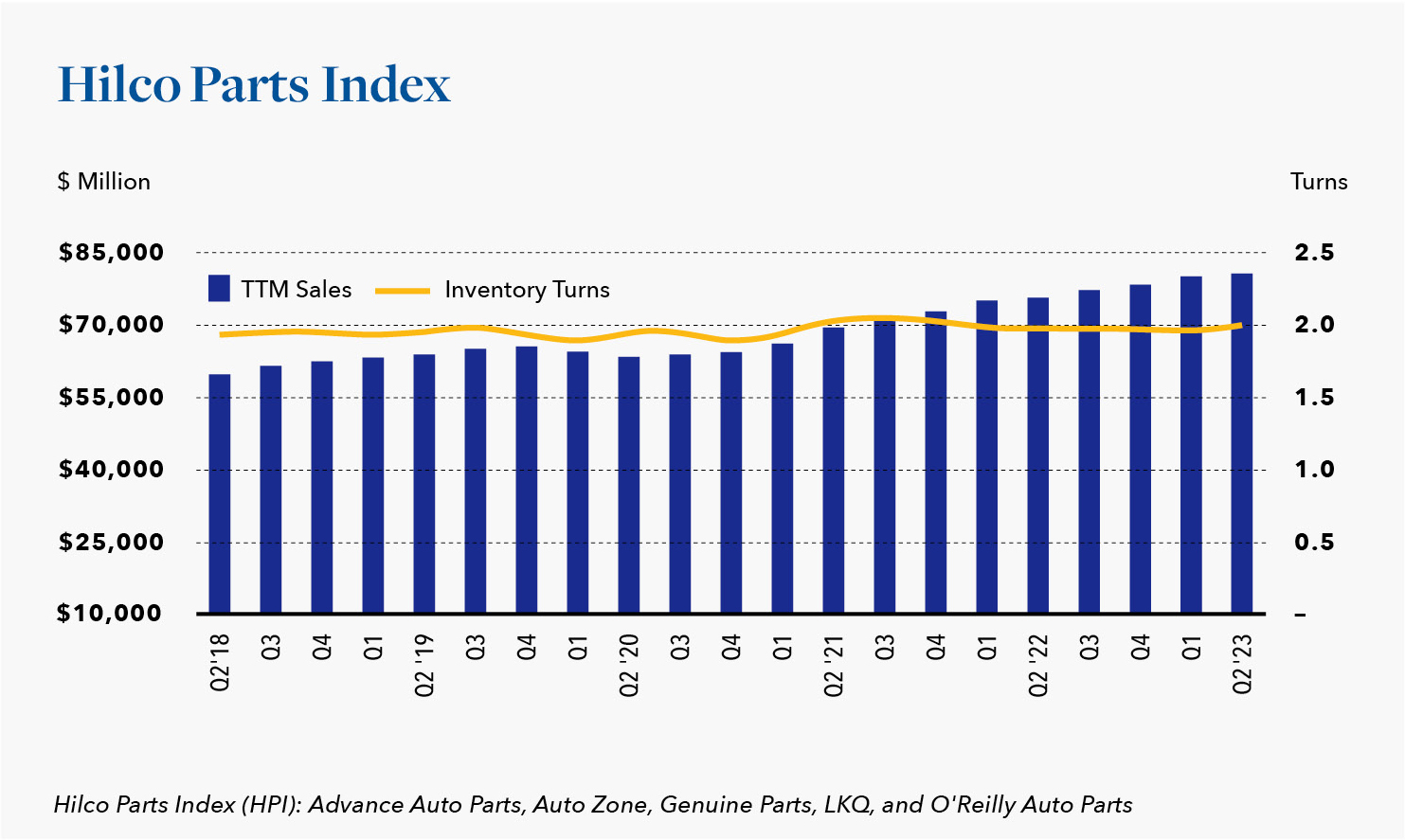

For the five remaining public companies that comprise the HPI, net sales for the second quarter were $20.2 billion, an increase of 6.7% as compared to the second quarter of 2022. All but Advance Auto Parts (Advance) were pleased with their results for the quarter. Advance has been struggling for the better part of 12 months, prompting the board of directors to make a change. Advance’s new president and CEO, Shane O’Kelly, brings 30 years of supply chain experience that, no doubt, would have been very helpful over the last 36 months. In other news, Greg Johnson, the CEO of O’Reilly Auto Parts (O’Reilly) has decided to retire effective January 1, 2024, after a 41-year career at the Company. His successor is Brad Beckham, who joined O’Reilly as a parts professional in 1996 and has held nearly every position within the organization on his way to the executive suite. This latest appointment is an example of the O’Reilly’s commitment to developing its leadership ranks and then honoring their commitment to promote from within.

With the exception of Advance Auto Parts, the leading retailers of replacement parts remain optimistic about the resiliency of the industry and are guiding full-year organic sales growth of somewhere between 4% and 8%. Genuine Parts Company (NAPA) believes the fundamentals of the replacement market remain favorable with increasing miles driven, an aging fleet, increasingly complex vehicles, rising interest rates, and continued high prices for new vehicles, all contributing to underlying demand. LKQ extolled the non-discretionary nature of the business and highlighted the ability to generate robust profitability during periods of challenging macroeconomic conditions. O’Reilly Auto Parts was pleased to be off to a strong start in the third quarter having seen the robust sales trends in the first half of the year continue with incremental strength from the extreme heat (which contributed to failure) in many markets in the first few weeks of July.

About the Index: The Hilco Parts Index is comprised of five publicly traded companies that distribute aftermarket parts, namely Advance Auto Parts (Advance), AutoZone, Genuine Parts (NAPA), LKQ, and O’Reilly Auto Parts (O’Reilly). Advance, AutoZone, NAPA, and O’Reilly are the four traditional parts distributors in North America with strong commercial (do-it-for-me or DIFM) and retail (do-it-yourself or DIY) programs. LKQ is largely a distributor of recycled (used) parts, as opposed to new parts.