Mid-Year Sustainability Update: Regulatory, Consolidation and Cash Flow Concerns Build

Our sustainability updates include insights and data from the Hilco Valuation Services team, pertaining to the plastics and chemicals Industries, and are applicable to a host of businesses operating in various sectors and other industries around the world.

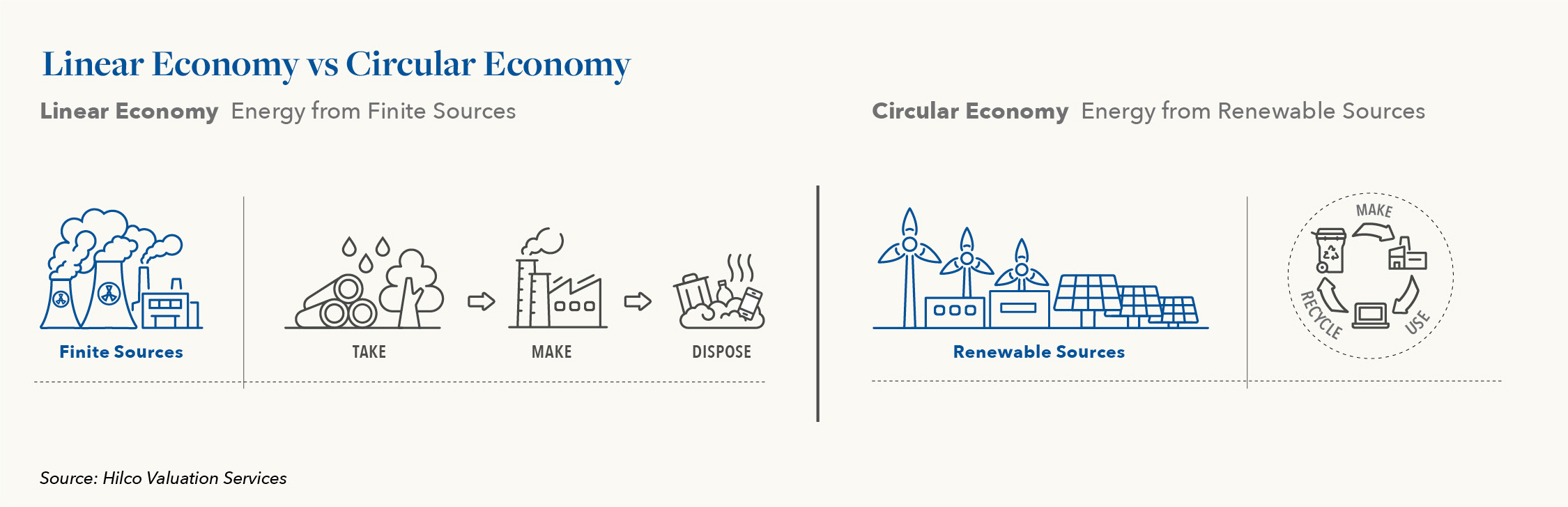

Sustainability efforts continue to play a vital role in improving the environment in 2023. By adopting eco-friendly practices and responsible production methods, many companies are reducing their environmental impact and contributing to a more sustainable future. We are seeing more and more manufacturers optimizing their usage of energy, water, and raw materials, to minimize waste and lower greenhouse gas emissions. They also continue to actively embrace waste reduction and recycling, diverting materials from landfills to further advance the “circular economy.”

As sustainable manufacturers prioritize energy efficiency through adoption of cleaner technologies and utilization of renewable energy sources in powering operations, they also reduce harmful emissions and air pollution. An important part of these efforts is responsible sourcing, which is also leading to broader utilization of materials with a lower environmental impact.

Across product design, sustainability is also a key consideration. Manufacturers are bringing more products to market with durability and recyclability top of mind, which ultimately should result in longer product lifespans and reduced waste generation. We are also seeing more products being introduced that can be disassembled, repaired, and recycled.

By integrating sustainability into their practices, we expect that more manufacturers will make substantial strides toward conserving natural resources, reducing pollution, and complying with environmental regulations this year. In the details below, we highlight some of the current market challenges, risks and noteworthy efforts taking pace toward that end.

Green Guides

A debate is now raging among some of the U.S.’ consumer goods behemoths about how to address the threat of potentially tighter controls on recyclables labeling. The issue centers on the FTC’s “Green Guides” which were established to prevent companies from making misleading environmental marketing claims about their products. In December, FTC Chair Lina Khan stated that, “For the average consumer, it’s impossible to verify these claims.” The changes would be the first update of those guidelines since 2012. According to NielsenIQ, the sale of consumer packaged goods in North America that includes sustainability labeling rose by an estimated $21 billion between 2021 and 2022. The guides have been updated at 10 years intervals since being introduced in the early 1990s. Because the guides are intended to protect not just consumers but companies, themselves, from accusations of “greenwashing” many companies have called for more frequent updates to create federal standard that is clear and precise for all to follow.

Consolidation Risk

Unlike their counterparts in the petrochemical industry, many companies in the recycling chain do not have the ample cash reserves needed to feed operations and pay expenses when times get tough. Many small and mid-sized players, in fact, are barely able to keep the lights on month to month. This along with the tight margins currently being experienced across non-packaging grades and previous investments many players made in areas such as sorting technology, flexibles recycling and flake to preform plants is adding momentum to the potential for increased bankruptcies, acquisitions and mergers during 2023; something many in the industry have been warning about since late 2022.

The Cost of Sustainability

Meanwhile, companies such as LyondellBasell (LYB), the world’s largest producer of polymer compounds, are striving to forge new sustainability pathways. The company has set an aggressive goal of producing and marketing at least 2 million metric tons (MMT) of polymers, derived from recycled or renewable sources, annually by 2030. With operating costs inflated right now and low demand for its some of its end products such as construction materials, however, the road could be difficult. Adding to these complexities, feedstock providers and others in the recycled products supply chain needed to support the growth of forward thinking companies like LYB in their efforts, are strapped for cash themselves right now. Their and others’ inability to make the necessary investments needed to help grow the supply chain during this period could stand in the way of polymer production expansion.

The Bottom Line

While steady strides are clearly taking place, a number of challenges and opportunities – well beyond those outlined here – persist for chemicals and plastic manufacturers, investors and lenders in the market this year. The diligence and valuations we are performing on behalf of a number of these business right now provides us with unique insight into the market. We welcome the opportunity to share this perspective, and assist you in leveraging the power of our proprietary industry data, to benefit your business or a business in your portfolio. We are here to help.

Hilco Valuation Services is the leader in valuation for the chemical industry with hundreds of highly accurate appraisals delivered on asset values ranging from $10 million to over $1 billion. Hilco Valuation frequently works hand-in-hand with other Hilco operating companies including Hilco Performance Solutions (HPS) to provide cross-functional Manufacturing Operations, Supply Chain, People, Mergers & Acquisitions, and Commercial expertise to the chemical and other industries. By teaming highly regarded industry veterans with advisory experts, we are uniquely positioned to deliver optimal solutions that assist businesses to achieve favorable outcomes under a wide range of market conditions and circumstances.