Online Sales Momentum Foretells Further Challenges for Automotive Aftermarket Industry in Post-Pandemic Environment

In this article we take a look at ecommerce and its impact on both consumer purchasing behaviors and brick and mortar businesses, with an eye toward what the future after COVID-19 may hold for those competing

in the Automotive Aftermarket.

In March of 2019, the Commerce Department reported that for the first time in history, ecommerce retailers had achieved a higher market share than general merchandise stores. The latter does not include grocery stores, liquor stores, and drug stores but it does include department stores, warehouse clubs, and supercenters. At the time, seasonally adjusted sales by ecommerce retailers totaled $61.0 billion, or 11.9% of total U.S. retail sales. By December of that year, seasonally adjusted sales by ecommerce retailers had grown to $66.8 billion, or 12.6% of total U.S. retail sales. During that time frame, the market share related to traditional general merchandise stores shrank from 11.7% to 11.3%. The trend and its potential implications for general merchandise stores are clearly undeniable. But what is the impact from ecommerce on specialty retailers like car dealers, parts stores, and tire shops?

Traditional Automotive Aftermarket

The automotive aftermarket industry includes original equipment parts, aftermarket replacement parts, vehicle service, and collision repair. The Hilco Parts Index (HPI) is comprised of six publicly traded companies that distribute aftermarket replacement parts and is published quarterly after all financial results are available. Net sales for the companies that comprise the HPI totaled $64.1 billion for the third quarter of 2019, a 5.7% increase from one year earlier. Aided by a steady increase in both the number of vehicles registered and the average age of these vehicles, the industry can generally depend on underlying organic growth in the range of 1% to 5% where organic growth is defined as sales reported from stores open for at least one year. According to the U.S. Department of Transportation, there were only 213 million vehicles registered in the United States at the turn of the century (the year 2000) and the average age was only 8.9 years. Currently, there are more than 275 million vehicles in operation in the United States, and the average age of light-duty cars and trucks is 11.3 years. It follows that more vehicles and older vehicles gives rise to more demand for replacement parts. Prior to COVID-19, the 2020 automotive aftermarket was forecast to exceed $700 billion in sales worldwide, including $300 billion in the United States. All else being equal, the outlook was good for traditional retailers of aftermarket replacement parts. So, why the angst?

Market Disrupters

Not long ago, car shoppers had limited alternatives to the dreaded trip to their local dealership and the prospect of haggling with a salesperson. Yet today, that type of buyer experience runs the risk of disappearing in the proverbial rear-view mirror. With increasing frequency, consumers are relying upon online information as opposed to traditional newspapers for their car shopping needs. In addition, car buying services such as Carvana have created compelling offerings that are enabling consumers to buy, receive and trade-in cars without ever visiting a dealership. Sales by companies like Carvana are still relatively small but the availability, and the utilization of online information, is widespread. According to digital marketing agency Adtaxi, approximately 86% of car shoppers conduct online research before visiting a local dealership.

A similar transformation is taking a firm hold in the automotive aftermarket industry, driven by a host of players led by Amazon. Amazon, for its part has repeatedly demonstrated its prowess in orchestrating the disruption of numerous consumer categories over the past several years. With robust networks touting same-day delivery, many industry analysts and insiders foresee a similar outcome in this space. And, while the market share of these third-party fulfillment companies is still relatively small in terms of total aftermarket sales and service, their presence has not gone unnoticed by traditional retailers like Advance Auto Parts, AutoZone, Genuine Parts (NAPA), LKQ, O’Reilly Auto Parts, and Uni-Select. In response, the traditional retailers have worked to develop their own online presence, complete with comprehensive product catalogues, streamlined ordering, and integrated customer service. The traditional retailers report that ecommerce sales are one of their fastest growing segments and represent one of their best opportunities for growth short of acquisitions.Nonetheless, ecommerce sales remain a relatively small proportion of total sales for the traditional retailers.

Amazon has clearly had the greatest impact on retail sales, enjoying tremendous success in its strategic targeting and disruption of numerous niche industries.According to some estimates, half of all ecommerce sales in the United States are fulfilled by Amazon. From bookstores and department stores to grocers, pharmacies and a host of others, Amazon has changed the game for traditional sellers. Unencumbered by the costly real estate and supply chain inefficiencies of the brick and mortar businesses it competes with, Amazon’s momentum is driven by an unrelenting strategic and financial commitment to collecting and perfecting its data collection and analytic capabilities. It has been no surprise, therefore, that both are having a notable impact on the auto parts business as well. According to research conducted by Altos Digital, 70% of all car parts sold via ecommerce in the United States are sold on Amazon or eBay.

Altos Digital is a digital marketing service specializing in ecommerce solutions for auto dealers. In November 2019, Altos Digital announced they were now a member of the CDK Global Partner Program ready to assist dealerships selling parts online. CDK Global happens to be a leading provider of integrated information technology to the automotive retail industry (i.e., car dealerships). Altos Digital published the accompanying infographic listing five reasons dealers should consider selling auto parts on Amazon. Put another way, these are five very good reasons – perhaps more relevant today, in light of COVID-19 than ever before – for traditional aftermarket retailers to worry about Amazon’s intentions. Or maybe, these are five reasons for traditional aftermarket retailers to worry about the original equipment manufacturers.

Original Equipment Manufacturers

Historically, the original equipment manufacturers (OEMs) like Ford, General Motors, and Toyota have struggled to maintain a relationship with their customers once the vehicle was out of warranty. In the past, the OEMs fought to retain these customers by trying to develop a product offering of less expensive aftermarket parts that could compete with the traditional aftermarket retailers and their supporting cast of independent installers (i.e., repair shops). Until now their efforts have never met with much success. However, the advent of the information age may have swung the momentum in favor of the original equipment manufacturers.

It was no surprise that at CES 2020 this past January, tech companies were out in force showcasing their data analytics and related technologies to attendees which increasingly includes representatives from automotive and automotive-related industries. Anyone who wonders why attendance at traditional auto shows has been on the decline has never been to the CES convention. Everyone is in a rush to demonstrate their ability to provide technology to the automotive industry in order to improve vehicle performance and enhance the customer experience. Today’s vehicles are laden with microphones, microprocessors, cameras, global positioning systems (GPS), cellular connectivity, and all sorts of other technology capable of collecting and storing a wide array of information about their operators; and that data is a valuable and sought-after commodity capable of driving sales for numerous industries, not the least of which is the automotive parts and service industry. This is not lost on the original equipment manufacturers. They are currently re-allocating their resources partly to retain control of, and reap the financial rewards associated with, the valuable data their vehicles can collect.

Barriers to Entry

So, what do those within the industry have to say on the topic? We inquired to gain the distributor, retailer and collision repair perspective from three notable insiders:

Ken Clinchy is Vice President of Pricing & Category Management for FleetPride, Inc. (FleetPride), the largest U.S. distributor of heavy-duty aftermarket replacement parts. Mr. Clinchy indicates that while his company has experimented with third-party online platforms, buyers don’t generally go to these platforms for hard parts. He adds that some third-party websites have had some success with hard-to-find parts if they provide for more detailed product descriptions but, that in general, “third-party websites have only found success with consumables.” Clinchy indicates that, when it comes to the heavy-duty segment of aftermarket parts, there are three natural barriers to entry for third-party ecommerce players. First, there is the “data piece” related to the vocational nature of the applications, which allows customers to specify any number of components such as engines, transmissions, rear-ends; Second, there are “supply chain implications,” which are a function of how big and heavy the components are (an average brake drum weighs over 100 lbs. while a fifth wheel can weigh more than 400 lbs.); and finally there is the “forward deployment of inventory” critical to the just-in-time nature of their business. According to Clinchy, “every day a commercial truck spends in a repair bay represents an average of $1,000 of lost revenue.”

FleetPride accepts that these are barriers to entry today, but may not be tomorrow. After a considerable investment of time and capital, FleetPride is on the verge of launching a new ecommerce platform that will better codify the company’s browser taxonomy, will utilize the latest innovations in consumer interface, and provide enhanced product information (photos, diagrams, and specifications). Ken cites market research by Mackay & Company that indicates ecommerce is still only 15% of the market and most of it is done by larger fleets with the necessary sophistication. However, he acknowledges that the percentage of people researching online before they buy continues to increase, and he sees the company’s new software as a helpful tool for those people.

Rob Milstead is Senior Vice President for Digital at Genuine Parts Company (NAPA), one of the five largest retailers of aftermarket replacement parts in North America and a component of the Hilco Parts Index. According to Mr. Milstead, third-party platforms have had some success with categories like accessories and shop supplies (i.e., towels and chemicals) that do not involve a vehicle that is out of service. But most of the industry’s sales are to repair shops that depend on writing shop orders for vehicles that are out of service, for which the time to repair is critical. The catalogue of parts for such repairs is extensive and unless those parts are readily available same day, the repair shop will likely lose the work order to someone that can deliver them in that time frame. “This complexity and breadth of the catalogue is one of the issues that the third-party sites like Amazon have not been able to crack,” says Milstead. Put another way, “in this business, it is very easy to order the wrong part unless you know what you are looking for.”

Nonetheless, Milstead admits “Amazon took advantage of a clean sheet approach to the problem of order fulfillment to develop and install a very sophisticated, efficient supply chain solution. In contrast, the aftermarket industry has evolved over a much longer period of time and from an environment that was entirely manual”. No doubt there are lessons to be learned, and as part of an effort to speed the company up the learning curve, Genuine Parts Company recently acquired Sparesbox, the largest ecommerce pure play in Australia. The market in Australia is a popular environment for developing and proving a product on a smaller scale before taking it to the big show. On a recent investor call, the Sparesbox acquisition was referred to as the disruptor that houses “68 team members who live, breathe, eat, and sleep digital innovation.”

Peter Fortner is Vice President of Sales & Marketing at LKQ, which represents another aspect of the aftermarket parts market distinct from both FleetPride and NAPA. Although a great over-simplification, while FleetPride trades in the heavy-duty truck market and NAPA trades primarily in the light-duty car and truck market, LKQ is focused on the collision repair market, offering a unique blend of recycled parts and aftermarket parts. LKQ has a national network of recycling yards that harvests usable parts such as fenders, hoods, headlamps, and grilles from damaged vehicles that meet insurance company quality standards for collision repairs. LKQ augments their product offering with a full range of new aftermarket equivalents.

Fortner explains that LKQ wholesale customers can place electronic orders using orderkeystone.com and retail customers can use lkqonline.com but is quick to add that, “the typical LKQ customer is a body shop that still phones, emails, or faxes that order.” For this segment of the business (i.e., collision repair), he points out that it may be the insurance companies that are the true market catalyst. Increasingly, insurance companies are recommending their customers to repair shops that utilize one of the industry standard software tools for preparing and submitting insurance estimates. CCC ONE, Mitchell Estimating, and Audatex are a few of the more widely used software solutions. These are very sophisticated applications that include electronic links to preferred vendors like LKQ, which then provide part quotes and submit electronic purchase orders. Right now, says Fortner, “One of the only things limiting more ecommerce in this space is the repair shop’s preferred mode for ordering parts.”

Click and Mortar

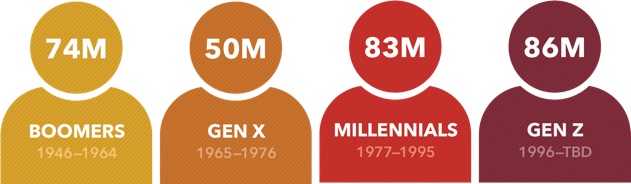

Just to complicate matters even further — some who study and forecast the purchasing behaviors of the generational segments had indicated prior to the current crisis that Gen Z, which now comprises nearly 30% of the U.S. population, is likely to spark a return to brick-and-mortar retail spaces due to their interest in experience-based shopping. This based, of course, on the analysis of collected data up to that time which points to the segment’s desire for a best of both worlds scenario; a seamless “click and mortar” shopping experience, where they can research and compare online, but fulfill that same order in-store. Whether this will hold true in the new post-pandemic reality remains to be seen.

Comprising nearly 30% of the population, Gen Z’s preferences and buying habits may well dictate the future composition of omnichannel sales in the auto aftermarket.

Ecommerce retailers like Amazon and eBay have the online system to collect data and the logistical system to deliver the product but they do not have the brick and mortar that customers still desire. The original equipment manufacturers have the brick and mortar and the data but not the systems to utilize it or the aftermarket product customers are looking for. The traditional aftermarket retailers have the brick and mortar and the product but not the systems and the information. Resources are limited. No doubt, the solution will involve alliances and leverage much of the ingenuity and creativity that seems to have been sparked by necessity through the events of the current crisis.

The Tipping Point

In summary, a significant investment has been committed by the Automotive Aftermarket to make ecommerce work. For most in the space, ecommerce sales represent the fastest growing segment of their business. Upon closer inspection, the increases are coming off a very low base and the adoption of ecommerce platforms remains stubbornly low as a percentage of total sales.

According to market intelligence firm GlobalData, impact from the COVID-19 pandemic is expected to reduce the rate of replacement for vehicles currently in use, which in turn should generate greater demand for repair and maintenance parts. As this occurs, those across the automotive aftermarket and their OEM counterparts will likely be paying close attention to determine whether adoption of more frequent online purchasing behaviors during the mandated stay-at-home period will translate to an increase in aftermarket ecommerce traffic and sales. This information may well drive the future of not only aftermarket parts and consumables, but also of how dealers and new/used car buyers do business in the years ahead.

In his book The Tipping Point, Malcolm Gladwell identifies three factors that must be present before an idea can become widely accepted. One of the factors is referred to as the “Power of Context,” which is the notion that the environment is right for the idea. Clearly, in the throes of COVID-19 and the calls for social distancing, the environment is right for ecommerce. As long as the other two factors identified by Gladwell are also in place, namely The Law of the Few and The Stickiness Factor, it is possible that we have reached the tipping point for ecommerce in the Automotive Aftermarket. Time will tell.

ABLs and manufacturers alike have achieved a high level of success across numerous industries in partnership with Hilco Valuation Services based upon our disciplined process, industry-leading bench strength, systematic and collaborative approach. This success is a testament to our commitment to excellence. By understanding past cycles and performance, documenting historical data points across the sectors and industries, and continuously exploring and assessing the path that is being paved ahead, Hilco Valuation Services consistently delivers reliable, accurate, and actionable valuations for our valued customers.