Pandemic Continues to Shape the Course of Forestry Markets

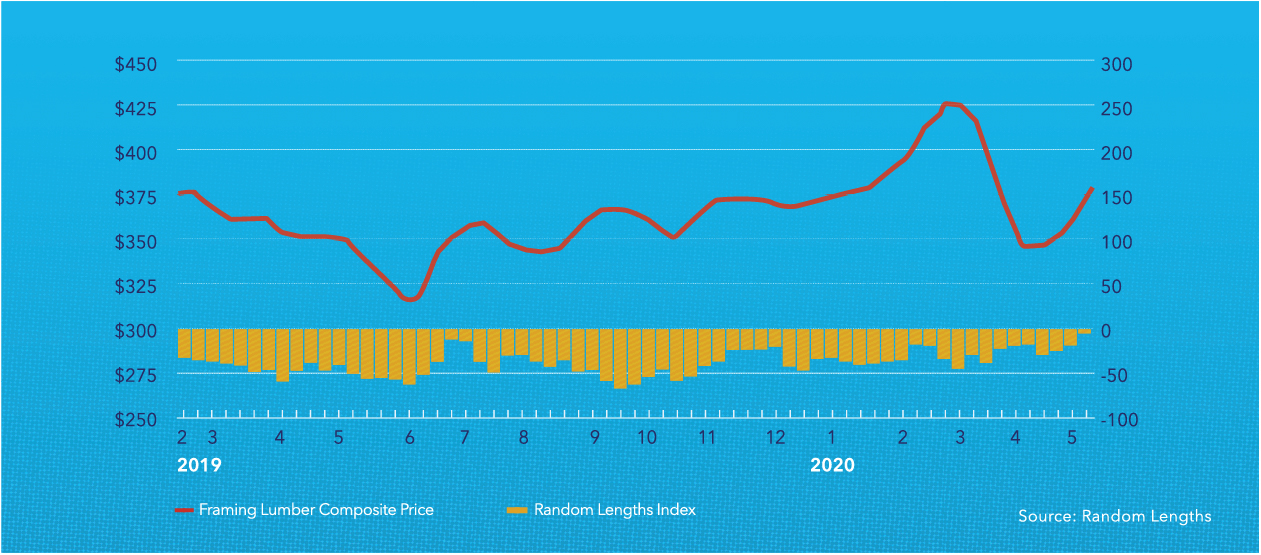

With construction designated as an essential service across much of the country since the start of COVID-19, continued, though somewhat diminished, new construction and remodeling demand has helped to sustain U.S. lumber markets. Pricing levels have also been bolstered by downtime taken at some western Canadian sawmills as a consequence of the pandemic and a lack of source fiber due to ongoing government limitations on cutting.

Demand from toilet paper manufacturers, in particular, helped to bolster pulp prices over the past few months. While away-from-home demand dropped dramatically as business closed, at-home demand, which comprises approximately two-thirds of the market, thrived as consumers frenetically stockpiled their favorite brands. Containerboard also saw solid demand based on the hoarding phenomenon, as consumers took to purchasing a variety of products online, which were subsequently delivered in boxes made from containerboard. While this has resulted in increased OCC residential curbside volumes, those cannot adequately counter the greater level of lost recoveries at the commercial, industrial and institutional level.

The toilet paper phenomenon and online ordering overall appear to have now peaked, as evidenced by actions being taken at some U.S. mills. Case in point- based on forecast demand for its Toledo, Ohio mill’s containerboard which is used in the manufacture of packaging boxes, Georgia-Pacific shut down production and sent most of its hourly workers home for a week-long layoff in mid-May.

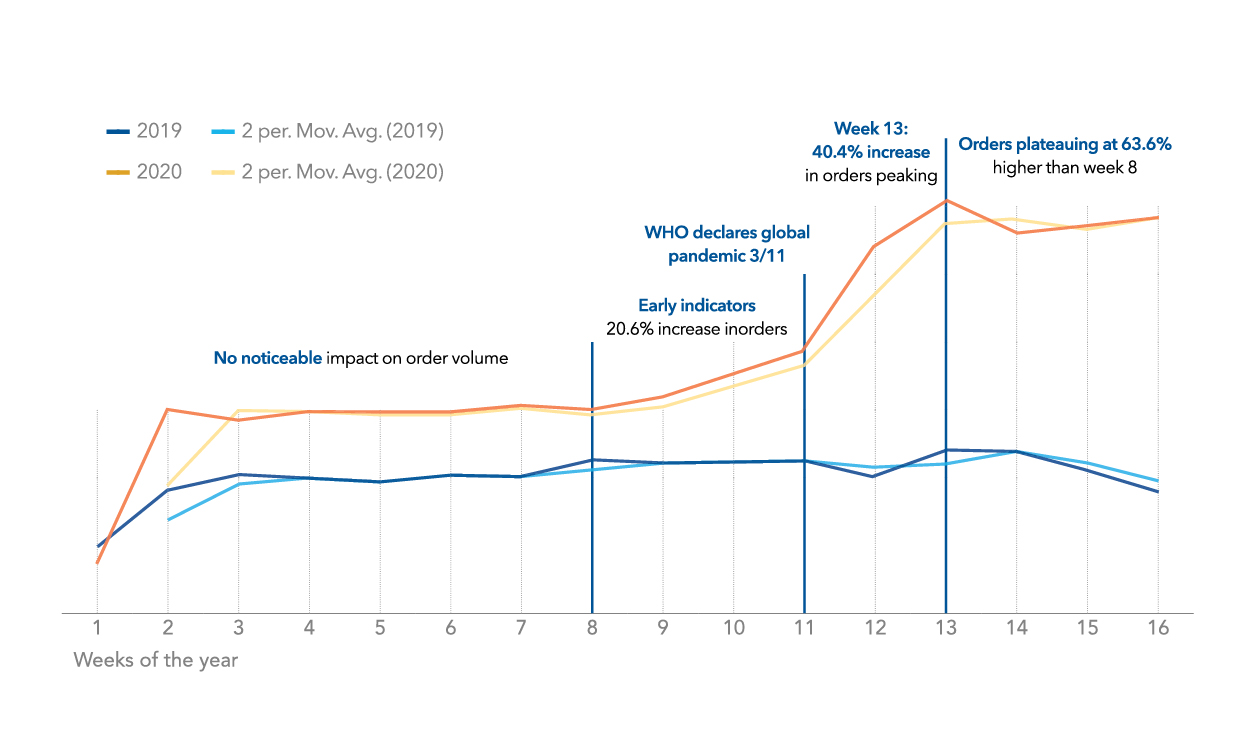

2019 vs. 2020 Impact of COVID-19 on e-commerce

SAP Commerce Cloud Customer Systems Insights

Week 13 saw the peak of online order volumes, after which purchasing has plateaued at a level 63.6% higher than at the start of the panic buying period in week 8.

With demand for printing and writing paper down significantly due to non-essential business closures, the demand for tissue had helped to bolster pricing overall. Data from the Pulp and Paper Products Council (PPPC) indicates that shipments of uncoated freesheet – one of four printing & writing grades – fell a substantial 33% in April, while total printing & writing paper shipments were down by 32% for the same period. Once tissue production catches up to waning demand from consumers, however, many of whom now have abundant reserves stacked in their bathroom cabinets, we expect to see increased downward price pressure. The speed with which businesses across the country reopen, employees return to office settings, and paper begins to flow through copiers, onto desks, and through the printing presses that deliver their advertising messages to buyers, will certainly have a marked impact those levels and their duration.

Recent protests and looting in urban centers across the country, have given rise to some speculation regarding a potential wave of urban flight and increased demand for new homes in suburban and rural areas. While only time will tell whether that comes to pass, the NAHB housing market index – an industry gauge on future home sales – increased 7 points in May to reach 37, still firmly in unfavorable territory and well below the 76 mark that it achieved in December 2019. Its accompanying sub-index for single family homes increased 6 points to reach a level of 42, approaching favorable outlook levels.

That said, May data released by the U.S. Census Bureau and HUD indicates significant declines in both new housing starts and permits for the month of April, although these were not as dramatic as had been expected by most across the industry. The reported April numbers represent a five-year low, with new housing starts falling to a seasonally adjusted annual rate of only 891,000 units. Building permits for upcoming construction also fell by 20.8% to 1.074 million units for the month, adding to widespread concerns regarding the potential severity of the ongoing Q2 economic contraction. Permits are recognized as the leading indicator for new home starts and a large source of demand for lumber.

Shortly before the COVID-19 crisis took hold in the U.S., Forest2Market – the wood and supply chain reporting service – issued its lumber demand forecast through 2023. Based on its trajectory model at the time, housing starts by 2023 were expected to average 1.262 million units, with remodeling increasing at an annual rate of 4.8 percent and annual demand for lumber increasing to just under 52 billion board feet (BBF). Based on anticipated capacity, this would result in a shortfall of between 1.0-1.5 BBF, equivalent to the production volume of approximately 6 or 7 mills. Recognizing the volatility of global markets, the service also developed “Optimistic” and “Dim” scenario forecasts, the latter of which may be most relevant based on recent events. In that forecast, housing starts of 1.25 million units and a remodeling rate of 2.5 percent would lead to oversupply of roughly 1BBF in capacity. As supply chain interruptions continue to subside and states across the country further ease restrictions enabling businesses to resume activity at more productive levels, Hilco expects to see a return to modest growth in lumber markets by Q1 2021. At this time, we continue to recommend normal levels of valuation monitoring. For ABLs with questions or concerns pertaining to specific exposure within their portfolio, we are here to help and encourage you to reach out to us for information or guidance. We have had numerous conversations with current clients and our many contacts across the industry over the past few months, and our team is well equipped to assist you in addressing any needs you may have during this crisis period and well beyond.