Q1 Transportation Market Update

In this article we observe early returns for 2024 related to the class 8 used truck market. We also provide commentary on freight rates, market volatility, the potential for negative equity in operator fleets, and spotlight current and future EPA standards.

With an election year looming and inflation still a major issue, the Cass Transportation Index for January ’24 indicates that the average cost of a shipment was down -2.6% m/m and 18% y/y in the 10th consecutive month of double digit y/y decreases. While trucking demand remains soft overall, rising import and intermodal trends are key leading indicators of a potential recovery in trucking this year. Backing up this notion, ACT Research has reported that January preliminary North America Class 8 net orders were 27,000 units, up 600 units from December and 45% from a year ago. These statistics seem to suggest that freight is headed towards a potential recovery.

However, for as long as our transportation team at Hilco Global has been following production volume and pricing trends over the years, we have found that OEM behavior in this area rarely has a direct correlation with what is happening in the used space in real time. Frequently, publications like ACT research express optimism for the truck market that is mostly seen through the prism of OEM order trends and production volume. Importantly, though, what is typically most relevant to both our clientele and ABL lenders are today’s values for predominantly used fleet.

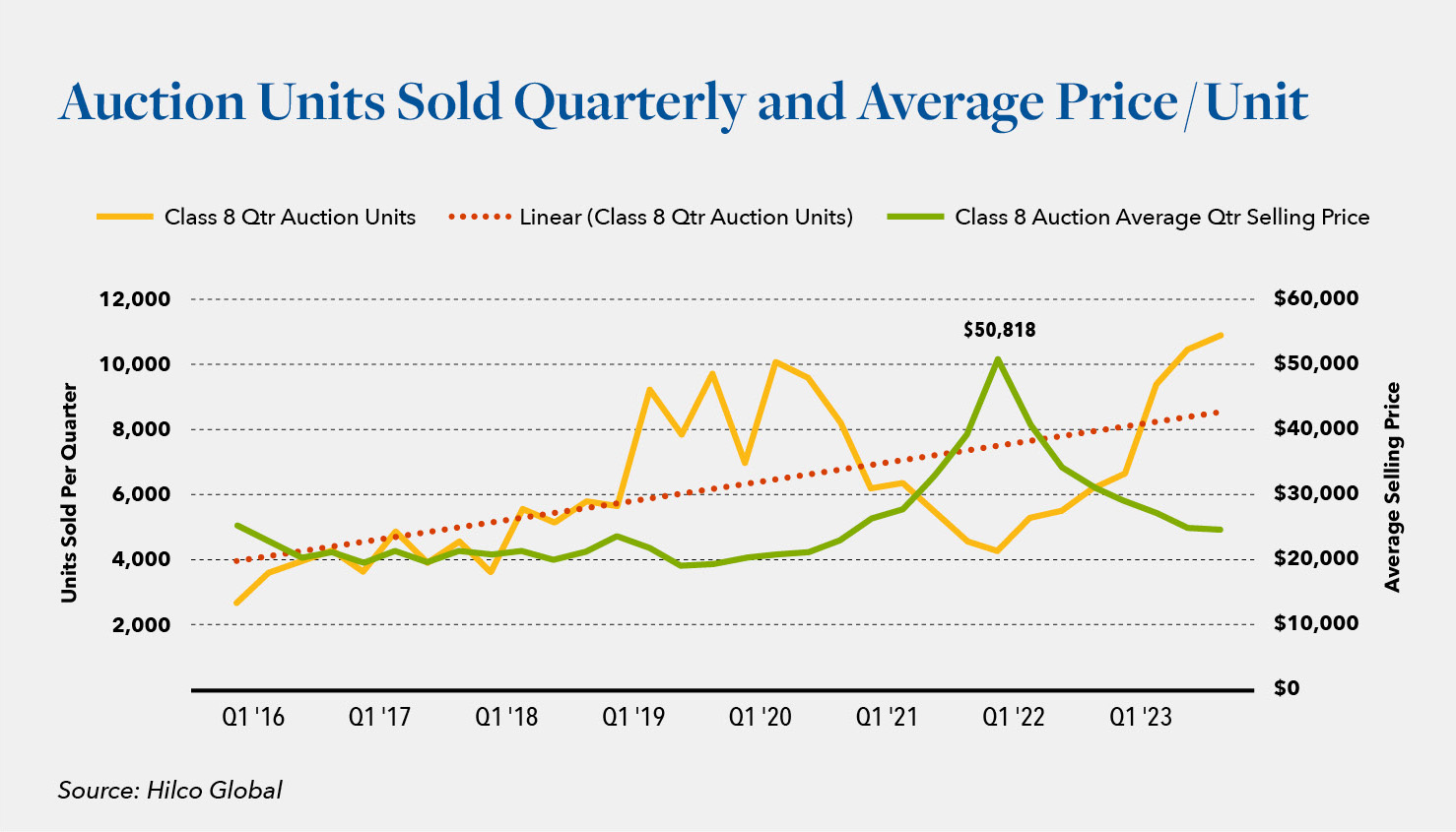

In regard to the used market, while the largest correction in class 8 used trucking occurred from the second half of 2022 through Q1 2023, a steady rate of depreciation still continued through the end of 2023. What is somewhat surprising is that early returns in the auction space since the beginning of 2024 are suggesting that the market is continuing to soften. August 2023 sales were only 1% lower than August 2022 sales, but September sales were 3.2% lower than September 2022. October was 6.3% lower, and then dropped 17.5% lower in November. December 2023 sales were 19.9% lower than December of 2022.

How do those involved in transportation feel about this? It depends on where they sit. For buyers who are well positioned to acquire additional fleet, this is an ideal scenario and a perfect time to obtain later model, lower mileage units at a reasonable price. For ABL lenders or operators who leveraged the market value of a fleet 2+ years ago for a generous borrowing base, it may now be advisable to take a serious look at the market and gauge exposure.

It is important to point out that the market correction didn’t just affect average pricing for used trucks and trailers. Nearly 88,000 trucking companies closed their doors in 2023 joined by 8,000 brokerages. If these seem like rather significant numbers, it’s because they are. And while many of those trucking entities were single owner operators or managed small fleets, the trend is clearly concerning.

With capacity still outpacing demand, larger regional and nationwide providers are certainly best positioned to handle the challenges of a constrained marketplace. Potential adversity, however, is around every corner for trucking companies, especially for owner operators and small fleets. The cost of operating a truck and/or a trucking company continues to be largely unsupported by the current freight environment. High fuel, insurance, parts and maintenance costs, truck purchase payments and the impact of increased regulation still linger from a premium market in ’20, ’21, and ’22. While each of these forces by itself would be significant, in combination they are conspiring to significantly limit carriers’ ability to turn a profit.

We are constantly reminded of the cyclical nature of the transportation industry. Inevitably, we reach the bottom of a cycle and that is precisely where we find ourselves today. So when will it get better, or is it actually likely to get worse before a state of better arrives?

As we bounce along the bottom, it is highly challenging to accurately forecast the path of freight recovery, particularly given the notable growth and strain that the industry has seen. When we look at the factors impacting carrier profitability, freight rates clearly stand out with many carriers feeling the pinch and wondering how much longer they can endure. Contract rates have been very competitive, and shippers have seemingly been in the driver’s seat when it comes to negotiation. That leverage is hedged by the spot rate market. Current spot rates are approximately 20% below fleet cost and the outlook for profitability any time soon is grim.

It now appears that, unfortunately, the only real way to expedite a recovery is to remove trucks from the market. The current state of over-capacity needs to be addressed and we expect to see more carriers continuing to release equipment into the used truck market, both strategically and by necessity. In tracking auction activity during the first quarter of 2024, we have noted an increase in volume and late model low mileage trucks. Importantly, because of the increase offerings entering the market, buyers can afford to be highly selective when it comes to make, model, usage, volume, and location.

Given current freight market volatility, location is important and should be carefully considered when deciding to buy or sell. Trucks, for example, that look essentially the same on paper are experiencing highly varied market returns from one auction to the next and from one region to another. Case in point, a 2019 Peterbilt 579 tandem axle truck tractor with standard miles might sell for $26K USD one day and $50K USD the next day at a different sale in a different region.

Carriers, of course, are very aware of, and burdened by, overcapacity and will actively be pushing aged and overutilized equipment into the market at least through the first half of ’24, in many cases by necessity. This increase in equipment for sale (via dealers and at auction) will continue to exacerbate pricing pressure, which we expect to result in increased defaults as the burden of negative equity trucks become unserviceable for carriers.

Just in case there wasn’t already enough uncertainty looming in the transportation space, enter “CARB 2024” and “EPA 2027.” CARB (California Air Resources Board) 2024 and EPA 2027 are the most recent and significant emissions regulations to impact diesel trucks in recent years. California typically tends to take the most aggressive approach to emissions standards and implementations of more specific controls to fleets and areas of operation. For example, CARB 2024 is implementing ZEV targets and phasing out aged heavy-duty trucks. The EPA 2027 mandate is requiring manufacturers to lower NOx and other air pollutants starting in model year 2027. Calling the new rules “the strongest-ever national clean air standards to cut smog- and soot-forming emissions from heavy-duty trucks,” the EPA claims that they are “80% stronger than current standards.”

There is no doubt that regulation will continue to be a theme in transportation for the foreseeable future and will ultimately impact fleet purchasing and de-fleeting decisions. While the specific implications of CARB and EPA 27 are nuanced and differ based on locale and fleet size, trucking companies will be forced to update equipment to meet the EPA regulations. These updates will come in the form of costly 2027 model year equipment — likely at a 10% – 20% cost increase. Costs to manufacturers to develop compliance technologies are extremely high and will, no doubt, be ultimately passed on to the consumer. As a result, we can expect to see significant prebuy activity in the industry starting as early as 2025 and continuing through 2026. In order for carriers to be compliant with upcoming regulations non-compliant equipment will be pushed into the secondary market on the heels of an already challenged used truck market.

From a CAPEX perspective, it is very important for operators and lenders with operators in their portfolios to be aware of average age of fleet and the cost of compliance. While the market remains soft now in early 2024, we expect to see that used trucking equipment which can still be operated with valid exemption status to the EPA 2027 requirements will be in demand in the midterm. More to come on this topic as we move closer to observing serious prebuy behavior over the next 2 – 3 years.

For now, we are keeping a close eye on today’s auction and wholesale value trends, in particular, to see whether a soft start to 2024 is more of a seasonal “hangover” or whether an inconsistent marketplace is likely here to stay for the remainder of the year.