Transportation Market Update – Q4 2023

In this article, we review the state of the class 8 transportation market pertaining to trucks and trailers, touch on the recent Yellow bankruptcy, provide a brief recap on our time spent in Chattanooga at this year’s Future of Freight Festival, and discuss what is in store for 2024 pertaining to commercial transportation assets in North America. We will also provide a brief reminder of the prevailing factors that affect value no matter where we are in a market cycle.

CURRENT MARKET REVIEW

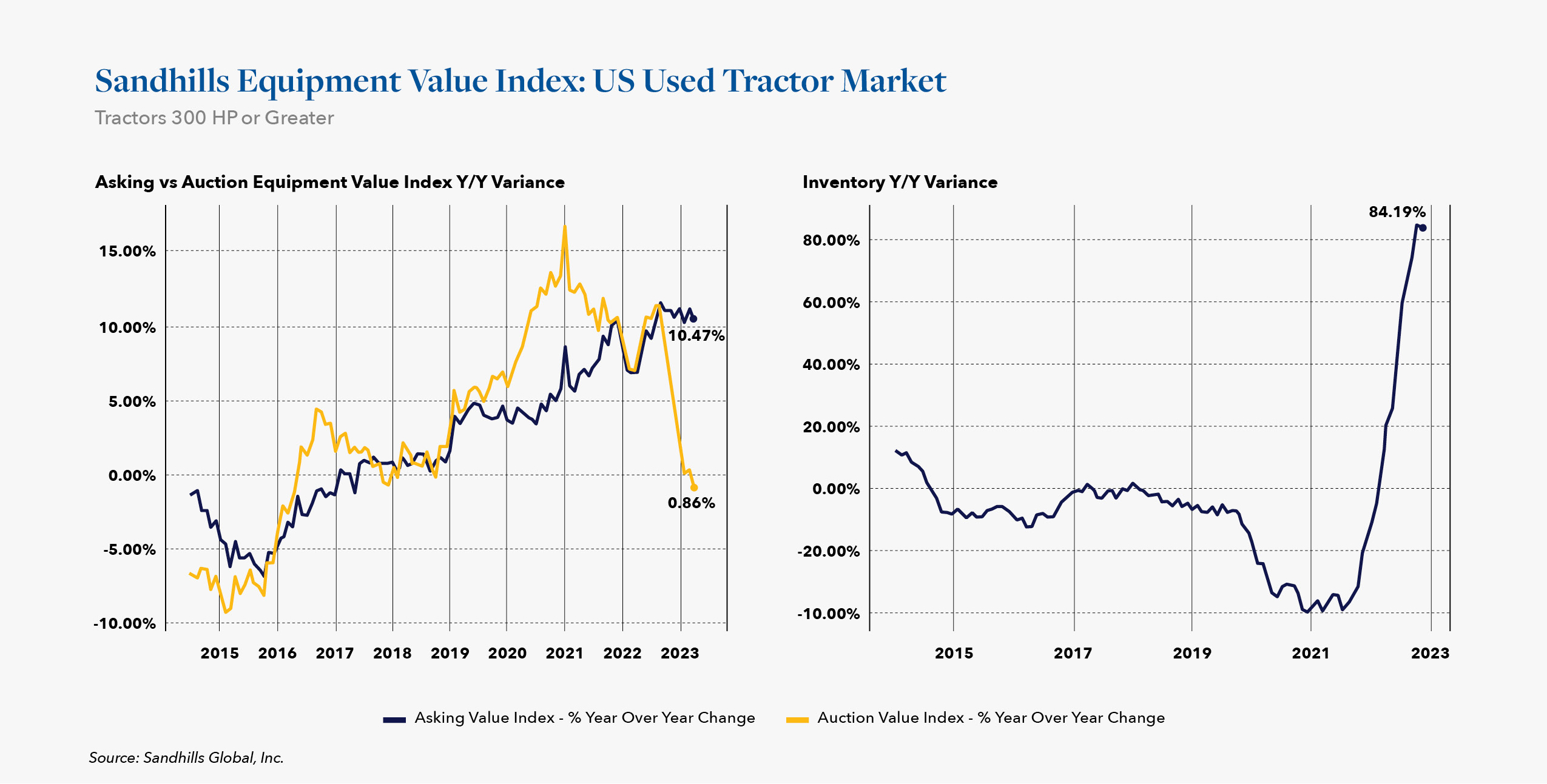

On a macro level, the sales volume of class 8 trucks across retail, wholesale and auction platforms in 2023, based on data available through September, is up over the year prior. Retail accounts for a 2% increase year over year while Auction and Wholesale are up 74% and 43%, respectively. For comparison, through September of 2022, 53,801 class 8 trucks had been transacted. This year that number has risen to 67,811 units through the same month, representing a 26% volume increase in asset sales.

So which year is the outlier when it comes to transactional volume trends in this space? The tentative answer is 2022; the lowest volume of transactions in the space through three quarters in a single year since 2017 when 47,158 trucks were sold. And with the rapid pace of global business and economic change, it is worth noting that looking back any further than around 2017 to compare sales volumes may not be relevant other than comparing year over year percentage variances. While transactions in the transportation space occur in abundance outside of retail, wholesale and auction, these volumes are most quantifiable and indicative of transactional behaviors.

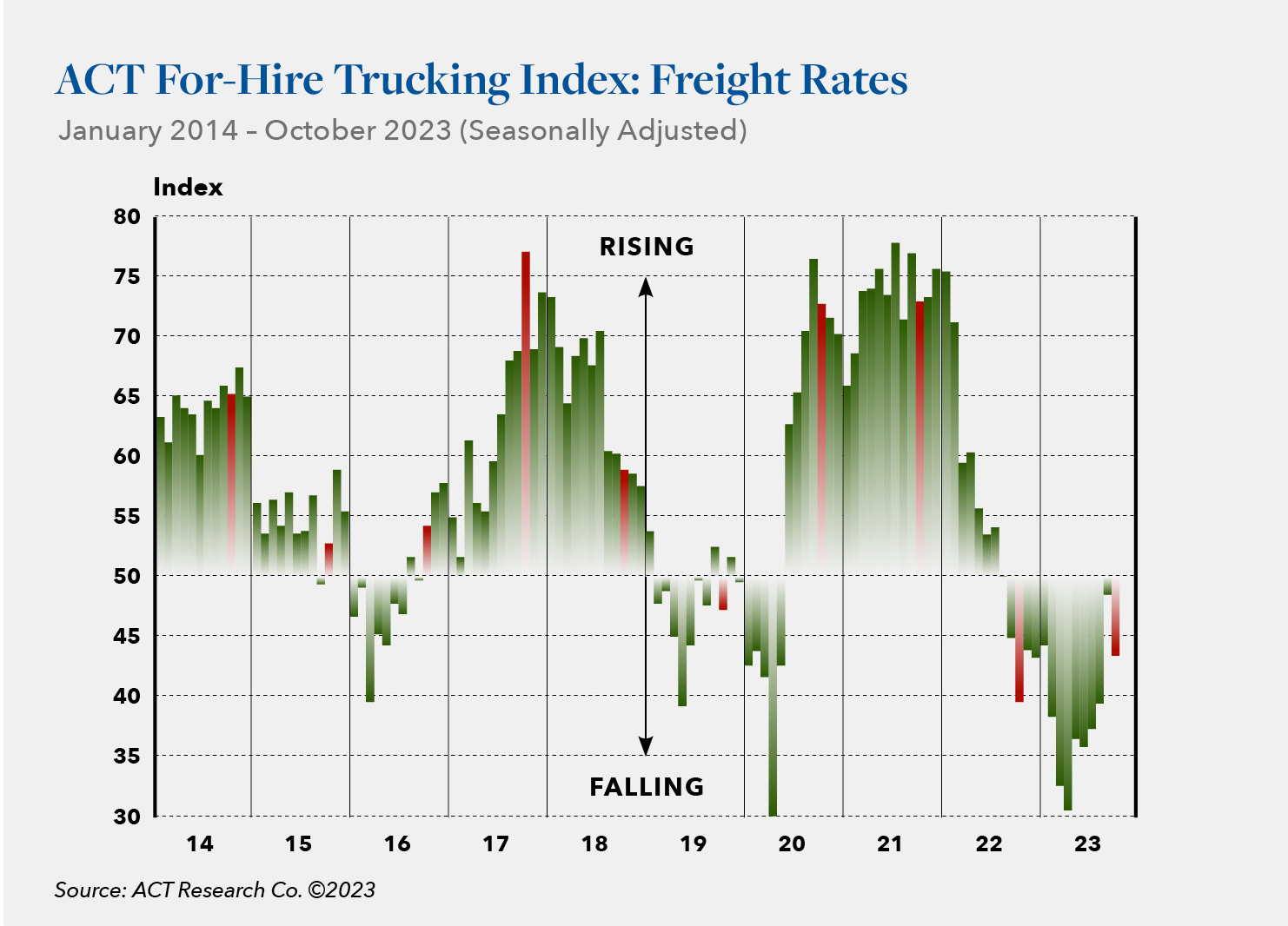

While many tend to feel that volume trending is far less important than transaction value, both are, of course, interconnected. Through September 2023 values are down 32% compared with 2022. Those figures continue to make sense and track in parallel with market corrections that Hilco has predicted and observed over the past 12 – 15 months. Still, the figures are worth noting because the year over year change is so dramatic. Since the pandemic pricing bubble began in May of 2020 the trucking market did not experience a negative year-over-year month split until September 2021 vs September 2022. In other words, September of last year was the first time since April of 2020 that there was a negative year-over-year split for any given month.

There are no two ways to say it, the rapid market correction came swiftly and dramatically. However there is a silver lining in this value trend. The worst is in the rearview mirror. In fact, the value correction we saw occur in Q1 has now been replaced by stabilization. Since March of this year average truck sales values have only decreased by 4%. This is representative of a stable market and normalized depreciation. Manufacturers have not backed down their premium new pricing and it is causing a cascading effect that is beneficial to the used market place. New trucks are more expensive than ever and purchasing good used equipment is a highly attractive alternative to purchasing new. For these and other factors, overall, the class 8 truck market has proven to be relatively resilient in 2023.

In regard to trailers, carriers are continuing to increase their ratio of trailers to trucks with the goal of increasing fuel efficiency and less dead head runs. That said the correction in value that we are observing is in line with stated overcapacity. In 2020 the price of trailers increased by roughly 50%, most relevantly in van and reefer trailer categories and less dramatically in flat beds. This was confirmed at the National Trailer Dealers Association earlier this year. While trailer prices decreased during the recent correction, new inventory has only slightly decreased and manufacturers are not likely to provide pricing breaks in 2024. Similarly to truck OEMs, trailer brands are working to maintain premium new pricing no matter the market for used equipment. Manufacturers captured unprecedented values for new product during the pandemic pricing bubble and are doing everything they can to keep that pricing elevated.

Reefer values and demand are closely tied to produce markets. 2023 was a challenging year and contributed to more dramatic declines in value. We also expect reefers to be effected by the oncoming 2027 EPA regulations. Factors including alternative fuels, increased efficiency and EPA compliance will result in new, increased cost. These rising new costs can be expected to push more buyers to the secondary market in 2024 and lead to stability in used values.

Flatbed has flown under the radar and less impacted by overcapacity and increased production. Though flatbeds are a much smaller slice of the pie as compared to refer and dry van, values have been generally less impacted and are forecasted to follow more normalized depreciation.

YELLOW CORPORATION (YELL)

Yellow Corporation was an American transportation holding company headquartered in Overland Park, Kansas. As of July 2023 the company ceased all operations, and entered into bankruptcy. The closure left 30,000 employees without jobs, roughly 22,000 of which were teamsters. Originally founded in 1929 and trading on the NASDAQ under the ticker symbol YELL, the company and its subsidiaries were a highly recognizable brand throughout the United States for anyone who has frequented America’s roadways over the past century.

Yellow took on a $700 million federal loan in 2020 intended to prop up the business in the face of challenges brought on by the COVID-19 pandemic. But Yellow had already lost $104 million the previous year (2019). The money for the loan came from a fund established solely for companies deemed essential to national security. The Trump administration pushed the loan through on the basis of Yellow’s status as a transportation partner for the Department of Defense and the Department of Homeland Security, even though at the time the Justice Department was investigating allegations that Yellow had intentionally inflated its shipment weights in order to overcharge the government. The company ultimately settled that case for $6.85 million in March of 2022.

The Yellow fleet was massive, comprised of 60,000+ individual pieces of equipment in addition to a vast volume of parts, inventory, and other ancillary service equipment inherently owned and utilized in a trucking operation of that magnitude. Within the fleet was a diversity of manufacturers and models of various ages. The huge volume of single axle day cab trucks and 28ft – 48ft van trailers was a clear sign of a company having primarily operated within the less-than-truckload (LTL) world. The average age of Class 8 tractors in the fleet was 2014, while the van trailers were an average vintage of 2009.

An important aspect of the Yellow asset liquidation that is important to be acknowledged is that the spec of Yellow’s trucks and trailers and their average age precluded the fleet from being universally appealing to the general trucking community at large. The overall truck and trailer fleet was old, comprised of single axle day cab trucks, and a large volume of less than optimal length van trailers. A high volume of Yellow’s trucks and trailers were beyond, or right on the cusp of going beyond, their remaining useful life. As a result, we expect that the actual downward price pressure associated with these excess assets entering into the U.S. marketplace will likely be far less than some have feared. Additionally, these assets are widely dispersed across the country at over 150 different locations. Ultimately it now appears that the fleet disposal will be spread throughout the market with a material portion going for either scrap or for use outside of the U.S. Like so many companies that go out of business, it seems these assets will be absorbed by the market and go quietly into the night. However, Yellow will continue to be part of the oversupply narrative during 2024. More than anything, Yellow represents the largest casualty of the roller coaster LTL freight world over the past 5 years. With the freight market constriction in 2023, Yellow’s exit is, in a manner of speaking, a major correction in the freight space in one single move. More to come on this topic during the new year as the situation further develops.

FUTURE OF FREIGHT… BROKERAGES?

Freight Waves is a prominent price reporting agency (PRA) focused on the global freight market, and a leading provider of high-frequency data for the global supply chain via its proprietary Sonar logistics platform. Hilco, which closely follows and works with many in the industry finds Freight Waves’ daily content highly relevant and digestible.

Freight Waves’ price, demand, and capacity data allow customers to benchmark, analyze, monitor, and forecast the global physical economy. Headquartered in Chattanooga, TN, the company put on its third annual “Future of Freight Festival” during the week of October 30th. Freight Waves’ products and festival are all geared towards the logistics community, anchored primarily by third-party logistics and tech driven freight brokerage firms that live every day in the spot rate market and, to a lesser extent, in the contract rate arena. Attendees of the festival were not truckers or companies that own and operate truck fleets, trailers, chassis or containers. Rather, they were entrepreneurial tech driven and non-specialized sales professionals who happen to have a focus on the freight space. In fact, the event may have been more aptly coined the “Future of Freight Brokerage Festival.”

For perspective, the brokerage space organically rose to material transactional involvement in the freight space during the period leading into the freight logistics bubble. Once 2021’s trucking market began booming in demand, a massive volume of small shops and private equity-type investment ventures flooded into the marketplace in an effort to gain market share within an industry that allowed a window for almost anyone to make a healthy profit. Fast forward to present day, November of 2023, and some of the largest firms in this arena have now collapsed due to the rapid correction occurring from the second half of 2022 into 2023. It is worth pointing out here that this happened during the same correction that Hilco first recognized through use of our own proprietary, hard asset value trends data. Many logistics companies have now declared bankruptcy and are gone. 2024 promises to force more brokerages out of business and those who remain in the space are facing the reality of automation and lower profit margins as a permanent aspect of the future of the freight brokerage space.

A great deal of the conference could be considered as an advertisement for Freight Waves and Sonar. Most presentations were done in a scripted “fireside chat” format that was predominantly hosted by Craig Fuller, the PRA firm’s CEO and Founder. Surprisingly, the sessions we attended lacked strong data or industry forecasting. Instead, conversations were filled with anecdotal references and a general expectation that 2024 will be extremely difficult for the industry; all without much specificity. That said, the production quality of the days-long event was highly professional and extremely well-orchestrated. Freight Waves also delivered a range of highly respected and intriguing industry figures as speakers / contributors.

In particular we found guest Alex Epstein and his position on the use of fossil fuels, now and into the future, most compelling. His insights on the realities of electric vehicles in consumer and commercial applications particularly resonates with experts who believe complete carbon neutrality and full adoption of EV technologies is currently unrealistic and disingenuous at best. JB Hunt and BNSF had a sponsored fireside chat that allowed both companies to present a united over-the-road & rail joint venture partnership called Quantum. This again was more of a broad sales pitch type presentation that lacked specifics. These type of presentations, with their lack of detail, were a message in and of themselves because the fact is that the logistics brokerage space is not doing well and there is little to no data that tells a promising story for the year ahead. Bottom line? The freight brokerage market itself is extremely tight and in order to make a profit right now, an operation will have to run with very high efficiently and maximum financial discipline.

LOOKING AHEAD TO 2024

2024 is looking like a market that is no longer primarily driven by the extemporaneous factor that dominated 2020 – 2023, the global pandemic. Unfortunately as we enter into more

“normalcy” we are at bottom-of-cycle levels when it comes to a lack of freight demand in a very manageable consumer goods inventory environment. This means a lack of demand for over the road freight and a continuance of the same theme of the past 18 months.

Going into the new year there is an overcapacity of trucks and trailer inventory. With some forecasting GDP growth of only 1-1.5% over the next year, it will feel much like a recessionary environment. This is especially likely given that 2024 is a major election year, which traditionally brings economic uncertainty and stagnant decision making when it comes to infrastructure related markets. A counter balance to these somewhat anemic factors is the anticipated 2027 EPA mandate ushering in the first major emissions standards regulations since 2007. The mandate is expected to drive a large prebuy of commercial vehicles that will be exempt from the emissions standards coming into effect in January of 2027. With new technologies and OEM costs, a 2027 EPA compliant tractor may cost somewhere between 10 and 12% more than its predecessors. Fleet operators will view purchasing pre-emissions units as a mandatory investment and that will drive purchasing during the years prior to required compliance. Navigating what is a soft economic environment while also looking to intelligently prepare and invest for anticipated EPA changes, however, is going to be tricky for companies of all sizes. This is particularly true for small to midsized operators, and 2024 is close enough to the EPA change deadline for prebuy activities to now be reflected in purchase order metrics.

Lastly here, Mexico has a strong currency and economy that is poised for growth. Mexican fleet operators are in dire need of updated trucks and trailers with the age of their commercial fleet assets being the oldest on average since 1990. This will have a positive impact on new demand from OEMs and used demand from the U.S. helping to clear the way for new inventory utilization in the USA. There are all sorts of opposing factors that suggest truck and trailer values will neither materially suffer nor benefit from prevailing conditions, making 2024 a somewhat stable, albeit challenging, year for the industry during this cyclical low.

FACTORS THAT AFFECT VALUE

Outside of prevailing macro-economic market conditions, many factors that affect fleet value seem to inevitably hold true. When looking to invest in the commercial transportation space, knowing your customer and understanding their fleet purchasing and acquisition practices, maintenance programs, safety record, and industry focus have major implications when it comes to collateral values. Is there continuity in the fleet? Operating a homogenous group of trucks and trailers creates cost savings and predictability when it comes to service and maintenance costs. It also streamlines third party support from dealers and parts suppliers. A company that has grown through acquisitions may experience challenges both short and long term if doing so leads to a hodgepodge of fleet assets from different years, makes, models, spec, maintenance histories or even differing cosmetic appearance. An operation may appear organized and buttoned up on a spreadsheet, but a physical inspection during an appraisal process can often be extraordinarily revealing and does affect value. Long haul freight operations rack up the miles, and in that industry segment mileage is the primary factor impacting asset values. Conversely, vocational-oriented businesses like recycling and waste disposal mean less miles incurred but also require operating in a corrosive and harsh environment where maintenance is crucial and appearance can and will be impacted by the areas they are operated in. Working with a trusted and experienced appraiser is crucial to understanding these nuances and their correlated impacts on appraisal values and monetization optionality.

STARTING WITH ACCURATE VALUES FROM DAY ONE IS A MUST

Hilco Valuation Services is one of the world’s largest and most diversified business asset appraisers, valuation advisors and the largest in the market-driven value space. We serve as a trusted resource to countless companies, their lenders and professional services advisors. Hilco provides value opinions across virtually every asset category imaginable, including extensive expertise across transportation, construction, material handling and related asset categories. Our proven track record in liquidation of fleet assets and direct investment in the ownership and operation of trucking and over the road fleet leasing companies makes Hilco uniquely adept at understanding current markets and how they affect asset value. Reach out to our team today to discuss your or a client’s business needs. We are here to help.